- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

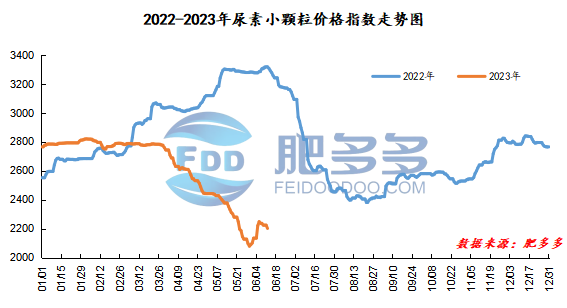

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on June 12 was 2,202.05, down 22.73 from yesterday, down 1.02% month-on-month, and down 33.62% year-on-year.

Urea futures market:

The futures price of the urea UR2309 contract fluctuated mainly downward today. At the beginning of early trading, the price first rose to the intraday high of 1672, and then the futures price fluctuated and fell. In the afternoon, the futures price still maintained a volatile downward trend, closing at 1631 at the end of the session. There were a large number of short orders in the session today. The opening price of the Urea UR2309 contract: 1667, the highest price: 1672, the lowest price: 1626, the settlement price: 1649, the closing price: 1631. The closing price dropped by 50, or 2.97% compared with the settlement price of the previous trading day. The fluctuation range throughout the day is 1626-1672, and the spread is 46; The 09 contract has increased its positions by 36621 lots today, and has held 453910 lots so far.

Spot market analysis:

China's urea spot market has performed mixed over the weekend. There are still increases in Northeast China and Inner Mongolia, with an increase of 40-160 yuan/ton. Prices in other regions have dropped widely, with declines ranging from 20-150 yuan/ton. Some factories are still tight in picking up goods, but the number of new orders has decreased. The factory owner issued orders received in advance last week and relied on the outgoing quotation to support it. At present, the country's wheat receiving area has exceeded 80%, and the downstream topdressing process has come to an end. Therefore, market demand is decreasing and favorable support is weakening. Specifically, prices in Northeast China have risen to 2,250 - 2,400 yuan/ton. Prices in North China fell to 1,950 - 2,300 yuan/ton. Prices in Northwest China fell to 2,260 - 2,270 yuan/ton. Prices in Southwest China are stable at 2,000 - 2,450 yuan/ton. Prices in East China fell to 2,130 - 2,200 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,030 - 2,400 yuan/ton, and the price of large particles stabilized at 2,350 - 2,370 yuan/ton. Prices in South China are stable at 2,150 - 2,230 yuan/ton.

Market outlook forecast:

In terms of futures, futures prices fell today, and long short positions increased significantly. In the later period, they may continue to weaken, which is difficult to provide good support for the spot. From a fundamental perspective, first of all, supply still remains high, with daily production of more than 170,000 tons in the short term. Although there was a certain amount of warehouse removal in the early stage, urea stocks are still at around 900,000 tons, which is still a high level in the same period in history. Therefore, the pressure of warehouse removal It is very high; and in terms of demand, urea topdressing has been obvious in the past few days, but as the process of compound fertilizer topdressing comes to an end, demand may drop significantly in the later stage, and it is still too early to wait for fertilization in autumn. In terms of cost, port coal prices rose and fell again, and urea cost support is still weakening. On the whole, the short-term benefits of the urea market are not obvious, and the spot market may start a new round of price declines.