- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

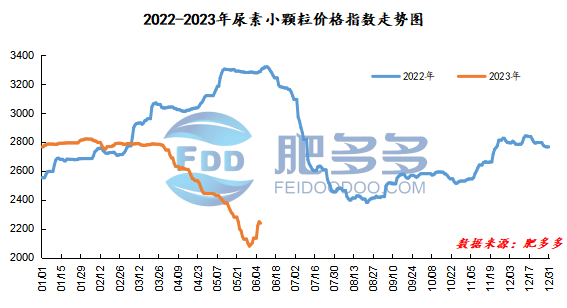

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on June 7 was 2,237.73, down 10.91 from yesterday, down 0.49% month-on-month, and down 31.98% year-on-year.

Urea futures market:

The price of the urea UR2309 contract fluctuated and fell after the opening of early trading today. In the afternoon, the intraday futures price continued to fluctuate within a narrow range, falling to the intraday low of 1658, and closed at 1664 at the end of the session. There were more intraday increases. The opening price of the Urea UR2309 contract: 1689, the highest price: 1706, the lowest price: 1658, the settlement price: 1679, the closing price fell by 45 compared with the settlement price of the previous trading day, a decrease of 2.63%. The daily fluctuation range is 1658-1706, and the spread is 48; The 09 contract increased its position by 22743 lots today, and the position held so far is 415907 lots.

Spot market analysis:

Today, the partial correction in China's urea spot market prices has mostly stabilized, with the reduction range ranging from 10 to 110 yuan/ton, and market trading is still acceptable. Downstream demand in some regions has begun to show resistance to the continued rise in the market, and is cautious in taking goods. Factories are forced to pull back their quotations due to inventory pressure. Fundamentally speaking, the early maintenance equipment will be put into production, and the daily output will soon be adjusted back to 170,000 tons. In terms of demand, there are still new orders sold today, but the volume has been significantly reduced. Specifically, prices in Northeast China have stabilized at 2,110 - 2,400 yuan/ton. Prices in North China have stabilized at 2,130 - 2,310 yuan/ton. Prices in the northwest region are stable at 2,300 - 2,310 yuan/ton. Prices in Southwest China are stable at 2,000 - 2,500 yuan/ton. Prices in East China have stabilized at 2,320 - 2,350 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,100 - 2,400 yuan/ton, and the price of large particles stabilized at 2,350 - 2,370 yuan/ton. Prices in South China fell to 2,180 - 2,280 yuan/ton.

Market outlook forecast:

In terms of futures, futures prices began to pull back this week. We should be cautious when entering the market. Short-term positions have increased significantly, and the instructions on the spot market are not strong. In terms of supply, as the early maintenance equipment was put into production, the market supply gradually rebounded to around 170,000 tons. In the long run, new urea production capacity will be released in the later period, and supply may continue to grow, and the urea industry is facing the problem of oversupply. On the demand side, downstream fertilizer preparations are concentrated and some of them need to be postponed. Therefore, at this stage, there are replenishment in agriculture and industry. At the same time, due to the mentality of buying up but not buying down, market demand is good in the short term. However, as the wheat harvest progresses, the enthusiasm for downstream production and terminal procurement will decrease, and now the downstream in some regions has begun to resist high-priced supplies, so it is difficult to maintain the rising market. On the whole, the spot price of urea will stabilize and wait and see in the short term. In the long run, the price will still fall, and then wait for a new market to emerge.