- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

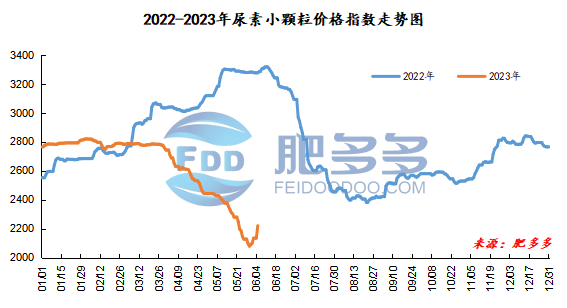

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on June 5 was 2,220.91, up 85.91 from last Friday, up 4.02% month-on-month, and down 32.21% year-on-year.

Urea futures market:

The market price of the urea UR2309 contract plunged today. The futures price peaked at 1819 immediately after the opening of early trading. After that, the futures price plunged and continued to fluctuate and fall. The afternoon futures price reached a lowest point of 1706, rebounded in a narrow range and fell, closing at 1716 in late trading. The opening price of the Urea UR2309 contract: 1803, the highest price: 1819, the lowest price: 1706, the settlement price: 1742, the closing price: 1716. The closing price dropped by 40, or 2.28% compared with the settlement price of the previous trading day. The daily fluctuation range is 1706-1819, and the spread is 113; the 09 contract has increased its position by 40644 lots today, and so far, it has held 378932 lots.

Spot market analysis:

Today, China's urea spot market prices have been comprehensively increased over the weekend, with price increases in all mainstream regions concentrated at 100-200 yuan/ton. Driven by futures sentiment in the morning, market trading was more enthusiastic, and factory prices continued to rise. Today, some installations in Shanxi and Hebei have been restored, and the industry started at around 81.42%. At present, China's Nissan is still relatively high. Although downstream demand has increased, it is unstable, and the market supply and demand relationship is tense. Specifically, prices in Northeast China have risen to 2,030 - 2,340 yuan/ton. Prices in North China rose to 2,170 - 2,300 yuan/ton. Prices in Northwest China rose to 2140 yuan/ton. Prices in Southwest China have risen to 2,050 - 2,500 yuan/ton. Prices in East China rose to 2,280 - 2,340 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,230 - 2,400 yuan/ton, and the price of large particles rose to 2,340 - 2,360 yuan/ton. Prices in South China rose to 2,190 - 2,250 yuan/ton.

Market outlook forecast:

In terms of futures, today's futures prices opened high and went low. They were good for spot goods in the morning and showed average performance in the afternoon. On the supply side, the cost of coal is low, and factories still have a strong willingness to produce. In the later period, new urea production capacity will be released, and supply may continue to grow. The urea industry is facing the problem of oversupply. On the demand side, it is currently the wheat harvest season, compound fertilizer production is still in progress, and appropriate replenishment is being made in agriculture and industry. Affected by the mentality of buying up but not buying down, market transactions are gradually improving. However, the current demand is not in a stable state. The spot price of urea can rise slightly in the short term, but in the long run, there is limited room for price rebound.