- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

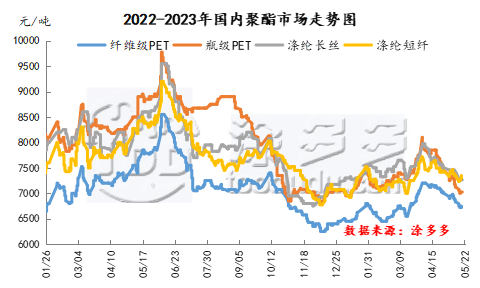

1. Market trend chart of polyester products

On May 22, the polyester chip market price index was 6775, up 50 from yesterday and 0.74% month-on-month.

On May 22, the market price index of polyester bottles and chips was 7000, down 25 from yesterday and 0.31% month-on-month.

2. Summary of market prices of polyester products

|

products |

specifications |

market |

2023.5.22 |

2023.5.19 |

rise and fall |

remarks |

|

polyester chip |

semi-optical sectioning |

East China |

6775 |

6725 |

+50 |

Ex-factory tax included, RMB/ton |

|

light slicing |

6750 |

6725 |

+25 |

Ex-factory tax included, RMB/ton |

||

|

products |

specifications |

market |

2023.5.22 |

2023.5.19 |

rise and fall |

remarks |

|

polyester bottle flakes |

Water Bottle (IV.= 0.8) |

East China |

7000 |

7025 |

-25 |

Ex-factory tax included, RMB/ton |

|

Oil bottle grade |

7000 |

7025 |

-25 |

Ex-factory tax included, RMB/ton |

||

|

hot canned grade |

7000 |

7025 |

-25 |

Ex-factory tax included, RMB/ton |

||

|

carbonic acid grade |

7100 |

7125 |

-25 |

Ex-factory tax included, RMB/ton |

||

|

Water Bottle (IV.= 0.8) |

South China |

7000 |

7025 |

-25 |

Ex-factory tax included, RMB/ton |

|

|

Oil bottle grade |

7000 |

7025 |

-25 |

Ex-factory tax included, RMB/ton |

||

|

hot canned grade |

7000 |

7025 |

-25 |

Ex-factory tax included, RMB/ton |

||

|

carbonic acid grade |

7100 |

7125 |

-25 |

Ex-factory tax included, RMB/ton |

||

|

Water Bottle (IV.= 0.8) |

North China |

7100 |

7125 |

-25 |

Ex-factory tax included, RMB/ton |

|

|

Oil bottle grade |

7100 |

7125 |

-25 |

Ex-factory tax included, RMB/ton |

||

|

hot canned grade |

7100 |

7125 |

-25 |

Ex-factory tax included, RMB/ton |

||

|

carbonic acid grade |

7200 |

7225 |

-25 |

Ex-factory tax included, RMB/ton |

||

|

products |

specifications |

market |

2023.5.22 |

2023.5.19 |

rise and fall |

remarks |

|

polyester filament |

Jiangsu and Zhejiang markets DTY 150D/48F |

East China |

8600 |

8600 |

0 |

Ex-factory tax included, RMB/ton |

|

Jiangsu and Zhejiang markets FDY 150D/96F |

7975 |

7950 |

+25 |

Ex-factory tax included, RMB/ton |

||

|

Jiangsu and Zhejiang market POY 150D/48F |

7300 |

7250 |

+50 |

Ex-factory tax included, RMB/ton |

||

|

Jiangsu and Zhejiang market POY 75D/72F |

7600 |

7550 |

+50 |

Ex-factory tax included, RMB/ton |

||

|

Fujian market POY 75D/72F |

7900 |

7900 |

0 |

Ex-factory tax included, RMB/ton |

||

|

products |

specifications |

market |

2023.5.22 |

2023.5.19 |

rise and fall |

remarks |

|

polyester staple yarn |

Semi-optical original white 1.56 * 38 |

Jiangsu |

7300 |

7350 |

-50 |

Ex-factory tax included, RMB/ton |

|

Semi-optical original white 1.56 * 38 |

Fujian |

7400 |

7450 |

-50 |

Ex-factory tax included, RMB/ton |

|

|

Semi-optical original white 1.56 * 38 |

Shandong |

7350 |

7350 |

0 |

Ex-factory tax included, RMB/ton |

|

|

Semi-optical original white 1.56 * 38 |

Zhejiang |

7300 |

7300 |

0 |

Ex-factory tax included, RMB/ton |

|

|

Semi-optical original white 1.56 * 38 |

Hebei |

7375 |

7375 |

0 |

Ex-factory tax included, RMB/ton |

3. Brief introduction to the polyester product market

polyester chip

Today, the polyester chip market is strong in finishing. Driven by costs last weekend, some slicing factories raised their offers slightly. However, today, due to the decline in raw material PTA, market growth was limited. Downstream demand is weak, and market production and sales are poor. It is expected that the market price of polyester chips may maintain a narrow range of fluctuations in the short term.

polyester bottle flakes

Today, the market focus of the polyester bottle chip market is narrowed. The raw material PTA market fell, cost support weakened, offers from mainstream bottle and tablet manufacturers were temporarily stable, and offers from dealers tended to low-end; downstream demand was weak, and the market was mainly cautious and wait-and-see. It is expected that the polyester bottle sheet market may adjust within a narrow range in the short term.

polyester filament

Today's polyester filament market has been narrowed. Volatility at the raw material side has increased, and low-end quotations of some polyester merchants have increased, and the focus of market transactions has increased slightly. Downstream demand weakened, and market production and sales weakened. It is expected that the filament market price may maintain the consolidation pattern in the short term.

polyester staple fiber

Today, the polyester staple fiber market remains consolidated. The decline in the raw material market suppressed, and the spot price in the staple fiber market corrected slightly. Downstream buying has slowed down, and market production and sales have been sluggish. It is expected that the short-term polyester staple fiber market price may fluctuate within a narrow range.

4. Polyester market production and sales data

|

products |

2023.5.22 |

2023.5.19 |

rise and fall |

units |

|

polyester chip |

60% |

110% |

-50% |

% |

|

polyester filament |

40% |

70% |

-30% |

% |

|

polyester staple fiber |

45% |

150% |

-105% |

% |

|

textile city |

839 |

1211 |

-372 |

ten thousand meters |

5. Polyester raw material market

|

products |

2023/5/22 |

2023/5/19 |

rise and fall |

units |

|

PTA Price Index |

5505 |

5575 |

-70 |

Yuan/ton |

|

PTA main contract settlement |

5318 |

5380 |

-64 |

Yuan/ton |

|

Ethylene glycol price index |

4118.84 |

4146.68 |

-27.84 |

Yuan/ton |

|

Ethylene glycol main contract settlement |

4200 |

4265 |

-65 |

Yuan/ton |

6. Future outlook forecast

The PTA market for polyester raw materials began to fall, and costs provided insufficient support for the market. The market is mainly cautious and wait-and-see, downstream demand is weak, and there is insufficient confidence in the future outlook. It is expected that the short-term polyester market price may maintain a narrow adjustment. Later, we will focus on changes in the raw material market and demand side.