- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Core point of view this month

China's PP market has stopped falling and rising this month. As of June 29, the mainstream price of wire drawing is 7000-7250 yuan / ton, which is 40-7250 yuan / ton higher than at the beginning of the month. From the supply side, 400000 tons of Donghua Energy Maoming Phase I and 300000 tons of Anqing Petrochemical plants are planned to be put into production, while the early maintenance enterprises will resume starting in the middle and first ten days, and it is planned that the new parking device will only be overhauled at the beginning of this month, and the overall supply pressure in the market is gradually increasing. On the demand side, July is still in the demand off-season, throughout the past three years of historical data, downstream construction in July basically changed little compared with June. Market variables exist more in speculative demand, the current inventory in the middle and lower reaches is low, in the market signs of rising, do not rule out the need to enter the market to prepare goods. From the inventory point of view, in view of the current petrochemical grasp of market demand and the effective planning of production arrangements, the two oil inventories continue to operate at a low level in July, and the backing effect of the market will continue to play a role. The macro trend deserves everyone's attention. On July 28-30, China held a meeting of the political Bureau of the CPC Central Committee. The market will gamble on policy expectations before the meeting, especially the expectations and rumors of favorable policies will affect the trend of the futures market in stages. Overseas, the probability of the Fed raising interest rates in July is now more than 80%, and it continues to focus on the impact of inflation and employment data on monetary policy at a later stage. Under the comprehensive influence, the PP market is expected to run mainly in July, and the market volatility will increase under the macro-sensitive window period.

1.1 Analysis of the market trend of polypropylene in China

Table 1 & the change of drawing price in nbsp; polypropylene spot market

Unit: yuan / ton

|

Region |

June 1st |

June twenty _ ninth |

Rise and fall |

|

North China |

6960-7050 |

7000-7100 |

40/50 |

|

East China |

6950-7100 |

7050-7200 |

100/100 |

|

South China |

7050-7150 |

7150-7250 |

100/100 |

This month, China's PP market stopped falling and rebounded. As of June 29, the mainstream price of wire drawing was 7000-7250 yuan / ton, ranging from 40-7250 yuan / ton higher than at the beginning of the month. The main factors affecting the market during the month are as follows: 1. The macro bearish atmosphere outside China has obviously weakened, and Mandarin commodities have stopped falling and rebounded. The Federal Reserve decided to suspend a rate hike and raise terminal interest rates at its June meeting. The Chinese side cut interest rates ahead of schedule and implemented a series of active monetary policies. The macro-profit resonance outside China, Wenhua commodities stopped falling and rebounded, boosting the confidence of the two cities; 2. During the month, Daqing, Zhejiang Petrochemical, Lanhua, Shenhua Xinjiang, Yanchang China Coal, Fulian and other equipment parking maintenance, petrochemical parking increased, petrochemical plant parking loss reached a new high this year, the market supply pressure significantly weakened. 3. The speed of the removal of the two oil depots is accelerated, and under the overall performance of the two cities in the future, the willingness of petrochemical price-raising is still obvious, and the supporting effect on the cost side is strong. 4. Downstream operating rate slowly increased, in the market was once strong to attract some speculative demand to enter, the market trading atmosphere appeared phased repair. Under the positive enhancement, PP out of the off-season to stop falling and explore the market.

1.2 Analysis of the market trend of polypropylene dollar

The US dollar market of polypropylene in China continued its downward trend this month. As of the end of the month, the US dollar wire drawing price was 880 US dollars / ton, down 50 US dollars / ton per month; the copolymerization price was about 970-980 US dollars / ton, 40 US dollars / ton per month. Insufficient orders in downstream factories, low start-up, weak terminal demand dragged down the market, the center of gravity of the market went down, the low price of the market increased since the middle of the year, and the turnover in the US dollar market was insufficient, and some Chinese importers made profits to promote the transaction. In the future, PP US dollar market price has no obvious growth space in the short term, US dollar price short-term or continue the range shock trend.

Table 2 & the change of nbsp; polypropylene dollar market price

Unit: United States dollars / ton

|

Variety |

June 1st price |

June 29th price |

Rise and fall |

|

Wiredrawing |

930 |

880 |

-50 |

|

Copolymerization |

1010-1020 |

970-980 |

-40/-40 |

Analysis on the trend of 1. 3 Polypropylene Futures Market

This month, PP's main 2309 contract rebounded slowly after setting a three-year low. Trading opened at 6800 on June 14, a new low for the month and year, with a peak of 7120 on June 19 and closing at 7050 on the 29th. In terms of the 29th transaction, the intraday transaction opened 24% more than the empty opening of 23.4%, and Duoping was 21.4% empty and 21.7% flat. Futures prices since the BOLL track correction, hovering near the middle track for 4 trading days, the short-term stand at the 70000 integer mark, the top focus on the pressure situation near the top high 7120.

2.1 yield analysis of polypropylene

The new parking maintenance equipment increased significantly during the month. China's polypropylene production is estimated to be 2.4 million tons and 2.6218 million tons in June 2023, down 221800 tons from the previous month, or 8.46 percent.

2.2 maintenance statistics of polypropylene enterprises

Table 3 overhaul statistics of polypropylene plants in China in June

|

Enterprise name |

product line |

Production capacity |

Parking Duration |

departure time |

|

Dalian Petrochemical Corporation |

Third line |

5 |

August 2, 2006 |

To be determined |

|

Wuhan Petrochemical Corporation |

Old equipment |

12 |

November 12, 2021 |

To be determined |

|

Haiguolong oil |

First line |

20 |

February 8, 2022 |

To be determined |

|

Haiguolong oil |

Second line |

35 |

April 3, 2022 |

To be determined |

|

Tianjin Petrochemical Company |

First line |

6 |

August 1, 2022 |

To be determined |

|

Tianjin Bohua |

Single line |

30 |

September 28, 2022 |

To be determined |

|

Jinxi Petrochemical |

Single line |

15 |

February 16, 2023 |

To be determined |

|

Fushun petrochemical |

First line |

9 |

April 14, 2023 |

To be determined |

|

Luoyang Petrochemical |

First line |

8 |

April 27, 2023 |

To be determined |

|

Wanhua chemistry |

Single line |

30 |

May 5, 2023 |

June 22, 2023 |

|

Daqing Petrochemical |

Single line |

10 |

May 9, 2023 |

July 10, 2023 |

|

Qingdao Refinery |

Single line |

20 |

May 15, 2023 |

June 30, 2023 |

|

Luoyang Petrochemical |

Second line |

14 |

May 16, 2023 |

July 8, 2023 |

|

Jingbo polyolefin |

First line |

20 |

May 23, 2023 |

To be determined |

|

Yan'an Refinery |

First line |

10 |

May 24, 2023 |

July 7, 2023 |

|

Yan'an Refinery |

Second line |

20 |

May 24, 2023 |

July 7, 2023 |

|

Shanghai Secco |

Single line |

25 |

May 25, 2023 |

July 23, 2023 |

|

Lanzhou Petrochemical |

Old line |

4 |

June 1, 2023 |

August 8, 2023 |

|

Zhejiang Petrochemical Corporation |

Third line |

45 |

June 6, 2023 |

June 22, 2023 |

|

CNOOC Daxie |

Single line |

30 |

June 8, 2023 |

June 25, 2023 |

|

Daqing sea tripod |

Single line |

10 |

June 8, 2023 |

July 23, 2023 |

|

Langang Petrochemical |

Single line |

11 |

June 13, 2023 |

August 1, 2023 |

|

Lanzhou Petrochemical |

New line |

30 |

June 13, 2023 |

August 1, 2023 |

|

Daqing Refining and Chemical Industry |

Second line |

30 |

June 13, 2023 |

July 24, 2023 |

|

Shenhua Xinjiang |

Single line |

45 |

June 14, 2023 |

July 1, 2023 |

|

Yanchang medium coal |

Third line |

40 |

June 15, 2023 |

July 15, 2023 |

|

Fujian Union |

Old line |

12 |

June 20, 2023 |

June 23, 2023 |

Table 4 maintenance statistics of polypropylene plants in China in July

|

Enterprise name |

product line |

Production capacity |

Parking Duration |

Driving time / maintenance days |

|

Donghua Energy (Zhangjiagang) |

Single line |

40 |

June 30, 2023 |

July 25, 2023 |

|

Chinese Science Refining and Chemical Industry |

First line |

35 |

Early July 2023 |

Driving time to be determined |

|

Dushanzi petrification |

First line |

7 |

July 5, 2023 |

July 14, 2023 |

|

Dushanzi petrification |

Second line |

7 |

July 5, 2023 |

July 14, 2023 |

|

Maoming Petrochemical |

Third line |

20 |

July 10, 2023 |

August 29, 2023 |

|

Ningbo Formosa Plastics |

Old line |

17 |

July 20, 2023 |

August 1, 2023 |

|

Ningbo Formosa Plastics |

New line |

28 |

July 20, 2023 |

August 1, 2023 |

|

Maoming Petrochemical |

First line |

17 |

July 20, 2023 |

July 25, 2023 |

|

Yan'an Nenghua |

Single line |

30 |

Early July 2023 |

50 days |

|

Maoming Petrochemical |

Second line |

30 |

July 28, 2023 |

July 29, 2023 |

3.1 statistics of operating rate of downstream polypropylene enterprises

By the end of June, the average operating rate downstream of PP had fallen to 49 per cent, up 2 per cent from the previous month and down 3 per cent from the same period last year. At present, factory raw material procurement mostly maintains rigid demand, and raw material inventory decreases slightly; market demand does not improve obviously, orders are mainly digested in the early stage, orders of medium and large enterprises are maintained for about 5-7 days, and small enterprises order more sporadic orders, mainly according to order production. Raw material prices shock finishing, product prices within the month to follow the interval adjustment, the profit of finished products is difficult to improve. In the upper reaches, it is difficult to see a sustained rebound in the market, the downstream stock preparation intention is not high, with the use of the main.

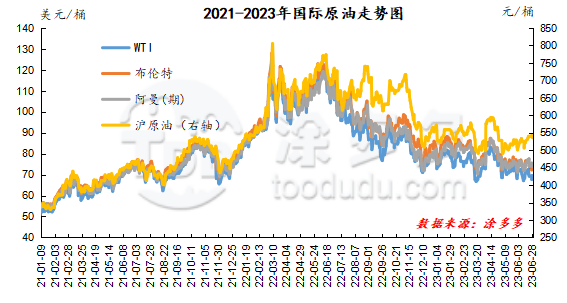

4.1 crude oil trend analysis

As of June 28, the price of WTI is US $69.56 per barrel, the price of Brent is US $74.03, the price of Oman is US $73.81 per barrel, and the price of Shanghai crude oil is 536 yuan per barrel. Compared with the beginning of the month, WTI fell 54 cents per barrel, Brent fell 0.25 US dollars per barrel, Oman (expected) rose 2.62 US dollars per barrel, and Shanghai crude oil fell 35.1 yuan per barrel.

4.2 carbinol trend analysis

On the supply side: recently, the equipment in the field is in the alternating process of overhaul and restart, and the overall market supply performance is relatively abundant, and the market inventory in the port area during the week is affected by the Dragon Boat Festival holiday, and the market pick-up volume has decreased, coupled with a reduction in some downstream demand, resulting in an increase in the total port inventory compared with the previous period, but considering that after July, there are maintenance plans for some installations in the northwest region. Local market supply is expected to be reduced, and in the later stage, attention should be paid to the implementation of equipment maintenance and the impact of the power restriction policy in the southwest region on the plant in the future. On the demand side: with the continuous reduction of methanol prices, the profits of downstream olefin enterprises have been repaired, and some olefin enterprises have extracted methanol from outside, and the terminal demand is slowly increasing, but considering that the traditional downstream is in the off-season of consumption, it is less likely to increase demand in the short term. At present, coal prices are weak and stable, and the cost support is limited. Although methanol prices have been raised recently, operators still hold wait-and-see sentiment towards the future market, with general enthusiasm for entering the market, and solid single continuation of rigid demand. It is expected that the short-term methanol market price will be mainly arranged in a narrow range, and in the later stage, we should also pay attention to crude oil, coal prices and the operation of the plant in the field.

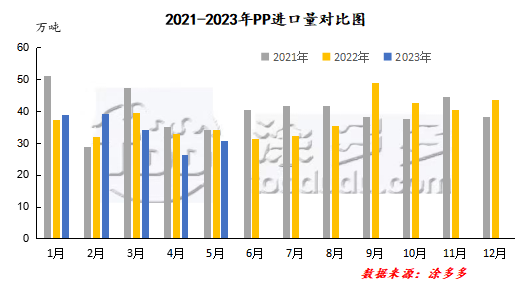

Total PP analysis: according to customs data, China's polypropylene imports reached 308300 tons in May 2023, an increase of 17.31% over the previous month. The average import price was US $1124.95 per ton, down 3.20% from the previous month. The cumulative import volume from January to May in 2023 was 1.6964 million tons, down 3.45% from the same period last year.

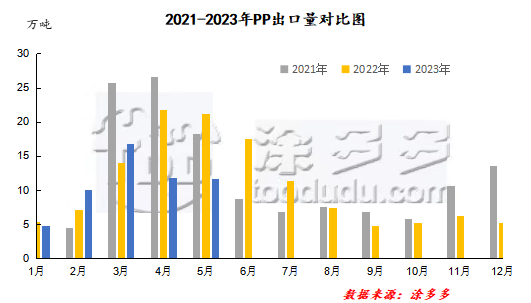

According to customs data, China's polypropylene exports in May 2023 were 116600 tons, down 1.85% from the previous month. The average export price was US $1253.89 / ton, down 3.38% from the previous month. The cumulative export volume from January to May in 2023 was 552700 tons, a decrease of 20.95 percent over the same period last year.

Fig. 3 monthly import volume of PP from 2021 to 2023

Fig. 4 comparison of monthly export volume of PP in 2021-2023

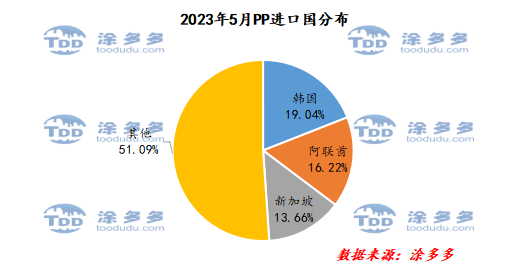

Analysis of PP importing countries:

According to customs data, in May 2023, China imported 58700 tons from South Korea, accounting for 19.04 percent of the total imports, 50, 000 tons from the United Arab Emirates, accounting for 16.22 percent of the total imports, and 42100 tons from Singapore, accounting for 13.66 percent of the total imports.

Fig. 5 PP import country distribution in May 2023

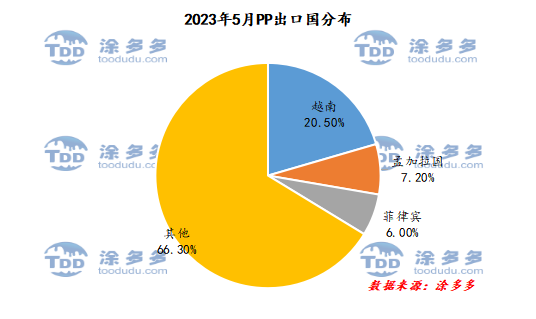

Analysis of PP exporting countries:

According to customs data, in May 2023, China exported 23900 tons of PP to Vietnam, accounting for 20.5 percent of total exports, 8400 tons to Brazil, accounting for 7.2 percent of total exports, and 7000 tons to Bangladesh, accounting for 6 percent of total exports.

Fig. 6 PP export country distribution in May 2023

From the supply side, 400000 tons of Donghua Energy Maoming Phase I and 300000 tons of Anqing Petrochemical plants are planned to be put into production, while the early maintenance enterprises will resume starting in the middle and first ten days, and it is planned that the new parking device will only be overhauled at the beginning of this month, and the overall supply pressure in the market is gradually increasing. On the demand side, July is still in the demand off-season, throughout the past three years of historical data, downstream construction in July basically changed little compared with June. Market variables exist more in speculative demand, the current inventory in the middle and lower reaches is low, in the market signs of rising, do not rule out the need to enter the market to prepare goods. From the inventory point of view, in view of the current petrochemical grasp of market demand and the effective planning of production arrangements, the two oil inventories continue to operate at a low level in July, and the backing effect of the market will continue to play a role. The macro trend deserves everyone's attention. On July 28-30, China held a meeting of the political Bureau of the CPC Central Committee. The market will gamble on policy expectations before the meeting, especially the expectations and rumors of favorable policies will affect the trend of the futures market in stages. Overseas, the probability of the Fed raising interest rates in July is now more than 80%, and it continues to focus on the impact of inflation and employment data on monetary policy at a later stage. Under the comprehensive influence, the PP market is expected to run mainly in July, and the market volatility will increase under the macro-sensitive window period.