- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

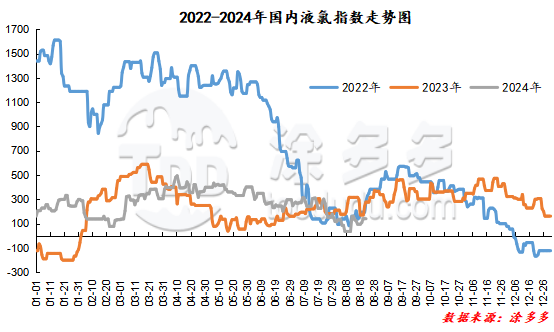

Since early April, the overall price of liquid chlorine has shown a turbulent downward trend. In early August, the price of liquid chlorine fell to a low point for the year, and then fluctuated repeatedly at the low point. According to Tuduo data, the price difference between the high and low points of China's liquid chlorine spot index so far is 457.99.

Since August, the price of liquid chlorine has fallen to its lowest point so far for the year. Subsequently, the price has risen and fallen, and the market has adjusted frequently. First of all, in the first ten days of the month, liquid chlorine prices in various regions continued to decline, and prices fell to low points during the year. The chlor-alkali market was generally weak, and industry profits were significantly compressed. On the one hand, chlor-alkali units started normally, and the supply was relatively stable and sufficient. On the other hand, the main downstream enterprises started their equipment at a low level and were not enthusiastic about purchasing liquid chlorine; resulting in a continued decline in liquid chlorine prices. After the price of liquid chlorine fell to a low point for the year on August 7, the market showed a certain wait-and-see attitude, followed by a reduction in production. Then, the price rebounded near the middle of the year. Enterprises 'reduction in volume and price protection had a certain effect. In addition, demand has improved, so prices rebounded to a certain extent on August 12. After the price recovery, the load was reduced in the early stage and the equipment under maintenance were partially restored, and the supply increased accordingly. In addition, the unstable start-up of individual downstream industries has posed certain obstacles to the increase in liquid chlorine prices. Since mid-year, prices in some areas have been adjusted frequently, and prices have fluctuated. Run.

Judging from the market price situation in major production areas, first of all, the lowest price of liquid chlorine in Central and Shandong in North China has dropped to around (-550)-(-450) yuan/ton, and the lowest price of liquid chlorine in Hebei is around (-500)-(-400) yuan/ton. From the perspective of the East China market, the East China region as a whole is greatly affected by the price adjustment in Shandong, the main producing area. The current lowest price in Jiangsu is around (-400)-200 yuan/ton, and the current lowest price in Anhui is around (-50)-50 yuan/ton. Prices in Zhejiang and Jiangxi are relatively high, and there has been no obvious subsidies. Looking at the liquid chlorine market in Central China, prices in Henan and Hubei regions have also declined weakly, and the purchasing enthusiasm of downstream companies has been generally weak. The sharp drop in prices in Central China has also been greatly affected by the price adjustment in Shandong, the main producing area, with the lowest price in Henan. Around (-100)-(-50) yuan/ton.

Looking at the market outlook, there are still new maintenance equipment in the short term from the supply side. At the same time, some maintenance equipment in the early stage has been gradually restored, and the overall capacity utilization rate in the later stage may still be expected to increase slightly. On the demand side, the main downstream PVC market is operating in a volatile manner, the number of maintenance equipment in the later period is reduced, the utilization rate at start-up may increase, and the procurement of liquid chlorine may increase to a certain extent. However, while the price is still weak, the price of liquid chlorine is still suppressed to a certain extent, and the market or overall recovery is limited. Demand from other downstream industries may continue to maintain a low replenishment or just-needed pace in the short term, but the current time node is in late August, which is approaching the peak season of gold, September and silver, and chlor-alkali companies have a certain price attitude, so we still have certain expectations for the market.