- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Lead: With the downward adjustment in dragon prices in June, titanium dioxide prices have collectively fallen, and the demand side has been weak. Under the pressure of high costs, where will titanium dioxide companies go?

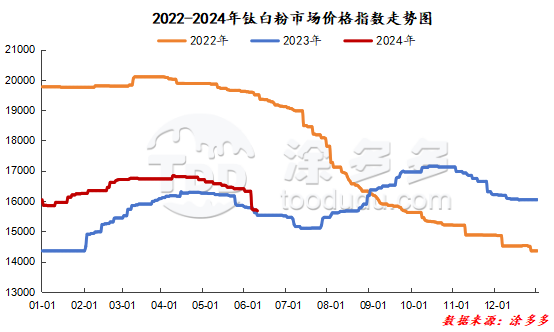

In May, the titanium dioxide market continued to fall into a downward trend, with a cumulative decline of about 500 yuan/ton. In the off-season of the market, affected by market demand, the listed price of Longbai Group dropped by 1300 yuan/ton on June 1. Subsequently, companies followed suit one after another. However, because the prices of second-and third-tier manufacturers in the early stage were mostly lowered to below 16000 yuan/ton, the mainstream market price dropped to about 15500 yuan/ton this time, and the corporate price adjustment range was mostly 300-500 yuan/ton. At present, only a few brands in the market have prices above 16000 yuan/ton, and the titanium dioxide market is stable and weakening. As of press time, the ex-factory price of rutile titanium dioxide including tax in China was 14,800 - 16,200 yuan/ton, and the ex-factory price of anatase titanium dioxide including tax was 14,000 - 14,800 yuan/ton.

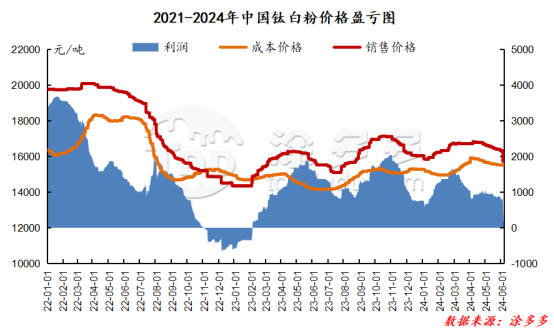

Cost: The price of titanium dioxide continues to be high, and the cost pressure of titanium dioxide is high. Taking the price of Panxi titanium ore as an example, the transaction price of small and medium-sized titanium ore fell by nearly 100 yuan/ton in May, and the price fell from 2,220 - 2,260 yuan/ton in early May. The price fell to 2,150 - 2,180 yuan/ton at the end of the month, so that the cost price of titanium dioxide decreased by more than 200 yuan/ton; However, imported titanium dioxide ore returned to China due to less imports of mainstream titanium concentrate in the first half of the year, and the price of titanium raw materials remained firm.

The sulfuric acid market also maintained a weak and volatile operation. Demand for downstream phosphate fertilizers weakened. Major acid plants in some regions were overhauled, and the decline in sulfuric acid prices slowed down. In May, the cumulative decline in sulfuric acid prices was 8%, and the cost price of titanium dioxide was reduced to about 100 yuan/ton.

Judging from the cost of main raw materials, the decline in titanium dioxide prices was higher than the decline in raw materials. After the price of titanium dioxide was lowered, some companies also chose to increase to reduce comprehensive costs, and titanium dioxide output remained at a high level.

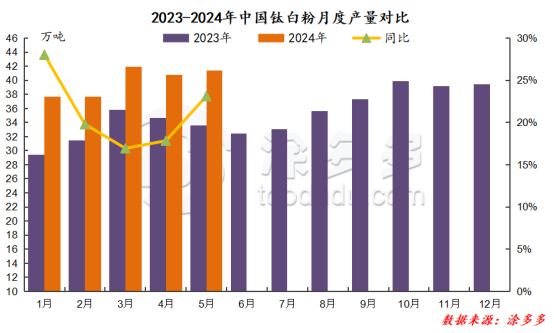

Supply: According to statistics from Tuduo, China's titanium dioxide output in May 2024 was 413,900 tons, a year-on-year increase of 23.12%, and a month-on-month increase of 1.51%. The overall performance of the titanium dioxide market in the first half of the year was relatively good; Due to the overall reduction in titanium dioxide prices in June and the increase in inventory pressure, according to Tuduo's incomplete statistics, about 4 companies in the market (Longbai Xiangyang, Suzhou Hongfeng, Pinggui Feiyue, and Guangxi Detian) have maintenance plans this month. The market impact output is expected to be around 4000 tons; in the off-season of the market, some companies in the market will re-stock maintenance plans in July, and titanium dioxide output is expected to fall back.

Conclusion: Under the high cost and high supply, China's titanium dioxide market is under pressure. Although international titanium dioxide prices have been announced to rise, which is good for China's titanium dioxide market, China's demand is still sluggish, and the titanium dioxide market is expected to remain weak from June to July. Maintenance companies are expected to increase again.

In 2024, purchase restrictions in the real estate industry will be relaxed, and some cities will usher in a "Xiaoyangchun" market. However, the overall market is still unclear, and real estate enterprises will be under great operating pressure; the reform of the pre-sale system for commercial housing will gradually restore market confidence. Real estate policies continue to be loosened, and destocking has become a key task. New quality productivity promotes the healthy development of real estate, and we need to keep up with the trend of the times and explore new models. The titanium dioxide market will continue to improve in the future.