- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

1. Analysis of China's sulfuric acid market price

Unit: yuan/ton

|

Type of acid making |

markets |

Type of acid making |

May 16 |

May 17 |

rise and fall |

|

sulfuric acid |

Shandong area |

98% sulfuric acid |

150-200 |

150-200 |

0 |

|

Jiangsu area |

98% sulfuric acid |

100-230 |

100-230 |

0 |

|

|

Zhejiang area |

98% sulfuric acid |

200-300 |

200-300 |

0 |

|

|

Sichuan area |

98% sulfuric acid |

250-450 |

250-450 |

0 |

|

|

Hebei region |

98% sulfuric acid |

200-260 |

200-260 |

0 |

|

|

smelting acid |

Anhui area |

98% smelting acid |

20-80 |

20-80 |

0 |

|

Shandong area |

98% smelting acid |

50-120 |

50-120 |

0 |

|

|

Hunan area |

98% smelting acid |

50-160 |

50-160 |

0 |

|

|

Jiangxi area |

98% smelting acid |

50-120 |

50-120 |

0 |

|

|

Henan area |

98% smelting acid |

1-50 |

1-50 |

0 |

|

|

Hubei area |

98% smelting acid |

10-130(Factory price) |

10-130(Factory price) |

0 |

|

|

Guangxi region |

98% smelting acid |

160-260(Factory price) |

160-260(Factory price) |

0 |

|

|

Yunnan region |

98% smelting acid |

230-280(Factory price) |

230-280(Factory price) |

0 |

|

|

Fujian area |

98% smelting acid |

50-200 |

50-200 |

0 |

|

|

Inner Mongolia region |

98% smelting acid |

100-160 |

100-160 |

0 |

|

|

Liaoning area |

98% smelting acid |

100-240 |

100-240 |

0 |

|

|

Sichuan area |

98% smelting acid |

50-200 |

50-200 |

0 |

|

|

Guizhou area |

98% smelting acid |

150-200 |

150-200 |

0 |

|

|

Zhejiang area |

98% smelting acid |

100-200 |

100-200 |

0 |

|

|

Gansu region |

98% smelting acid |

10-80 |

10-80 |

0 |

|

|

mineral acid |

Shandong area |

98% mineral acid |

110-140 |

110-140 |

0 |

|

Guangdong area |

98% mineral acid |

120-220 |

120-220 |

0 |

|

|

Hebei region |

98% mineral acid |

160-220 |

160-220 |

0 |

|

|

Sichuan area |

98% mineral acid |

300-450 |

300-450 |

0 |

Today, China's soda ash market is operating stably. As of now, 98% of the smelting acid in Fujian is around 50-200 yuan/ton, 98% of the smelting acid in Shandong is around 50-120 yuan/ton, and 98% of the ore acid is around 110-140 yuan/ton; Due to the good export orders of acid companies in Fujian, although China's order support is insufficient, there is no inventory pressure in the short term; Demand in the sulfuric acid market in Shandong is still light, purchasing sentiment in the downstream titanium dioxide market is not high, new orders in the region are under pressure, and market prices are weak and stable. In the short term, the sulfuric acid market has no favorable market, and supply and demand in some areas of the market have basically remained stable and market prices are firm.

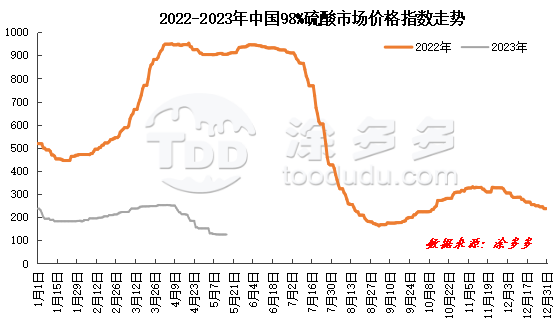

2. Analysis of sulfuric acid price index

According to Tuduo data, the sulfuric acid market price index on May 17 was 125.25, which was the same as yesterday.

3. Future outlook forecast

Some acid plants in Yunnan are planning equipment maintenance, and expectations are also lowered to start operating mineral acid and sulfonic acid under cost pressure. Market supply has shrunk. However, downstream market demand continues to be weak and demand for sulfuric acid is insufficient. Recently, sulfuric acid prices have continued to fall, and prices in some regions have dropped to low. Although downstream procurement enthusiasm has not increased significantly, due to the impact of cost prices, the price of sulfuric acid has dropped limited, and the market has maintained a weak and stable operation.