January 16th, Key Insights into Global and Domestic Economic Trends

Daily Macro Economy News

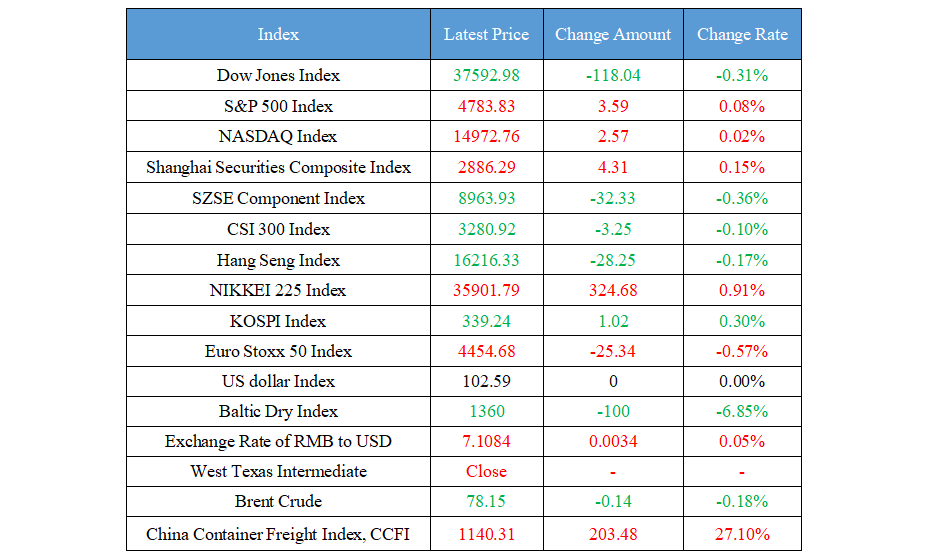

Latest Global Major Index

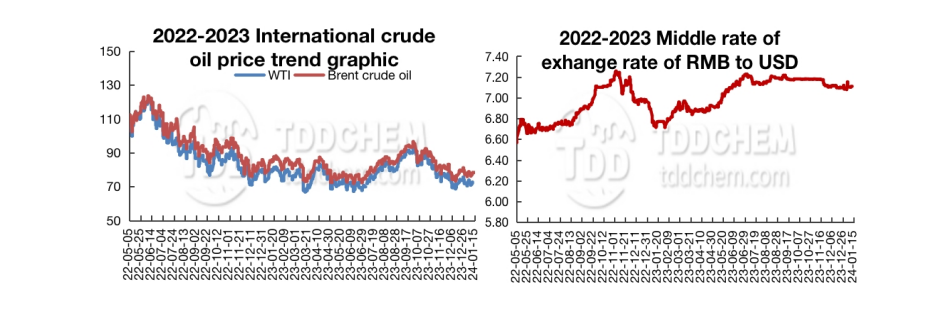

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. In January, MLF incremental parity continued to be 995 billion yuan. Expert: RRR and interest rate cuts are still in the policy toolbox, and the first time point is likely to fall in March ~ April

2. China Development Bank: In 2023, 7.6 billion yuan loan was issued to support the construction of high-standard farmland

3. Ministry of Transport: The cumulative volume of postal express delivery packages last week was about 2.905 billion pieces, an increase of 4.8% month-on-month

4. PetroChina established a new comprehensive energy service company in Fujian with 100 million yuan

International News

1. The situation in the Red Sea escalated! Container Shipping Index (European Line) futures rose more than 14%

2. The Baltic Dry Bulk Freight Index recorded the largest weekly decline since 2008

3. The Federal Reserve's interest rate cut bets have risen again, driving safe-haven gold to heat up

4. The survey shows that the European Central Bank is expected to cut interest rates four times this year, and the deposit rate will fall back to 3%

Domestic News

1. In January, MLF incremental parity continued to be 995 billion yuan. Expert: RRR and interest rate cuts are still in the policy toolbox, and the first time point is likely to fall in March ~ April

On January 15, the website of the central bank announced that it would carry out 89 billion yuan of open market reverse repurchase operations and 995 billion yuan of medium-term lending facility (MLF) operations today, with winning interest rates of 1.80% and 2.50% respectively, both consistent with the previous period. The period before and after the Spring Festival has always been an important window for the central bank to cut the reserve requirement ratio and interest rates, and the market is expected to cut interest rates in the near future. However, the operation mode of MLF volume increase and price parity at the beginning of the year also made the market call for interest rate cuts to fail. However, when it comes to whether there is a possibility of RRR and interest rate cuts in the later stage, Wen Bin, chief economist of Minsheng Bank, pointed out: "RRR and interest rate cuts are still in the policy toolbox, and it is expected that the first time point will most likely fall in March ~ April."

2. China Development Bank: In 2023, 7.6 billion yuan loan was issued to support the construction of high-standard farmland

On January 15, the reporter learned from the China Development Bank that in 2023, the Development Bank issued loans of 7.6 billion yuan to support the construction of high-standard farmland, focusing on supporting the construction, transformation and upgrading of high-standard farmland in Sichuan, Hunan, Guangxi, Jiangsu, Xinjiang, Guizhou, Chongqing, Liaoning and other provinces, implementing the service of "storing grain in the ground and storing grain in technology" to help secure China's rice bowl. According to the relevant person in charge of the Rural Revitalization Business Department of China Development Bank, in the next step, the Development Bank will continue to focus on accurately making up for the shortcomings, strengths and weaknesses of agricultural infrastructure, make good use of special loans for farmland construction, optimize resource allocation, increase investment, and continue to provide high-quality and efficient financial services to support the acceleration of agricultural modernization.

3. Ministry of Transport: The cumulative volume of postal express delivery packages last week was about 2.905 billion pieces, an increase of 4.8% month-on-month

According to the monitoring and summary data of the Office of the Leading Group for Logistics Guarantee and Smooth Work of the State Council, from January 8 to January 14, the national freight logistics operated in an orderly manner, including: the national railway transported a total of 76.549 million tons of goods, an increase of 2.54% month-on-month, a total of 53.759 million trucks on the national highway, an increase of 9.94% month-on-month, and a total of 259.094 million tons of cargo throughput in the monitored ports, an increase of 2.50% month-on-month The container throughput was 5.901 million TEUs, down 0.10% month-on-month, the total number of civil aviation guaranteed flights was 110,000 (including 3,987 cargo flights, 2,357 international cargo flights and 1,630 domestic cargo flights), an increase of 3.31% month-on-month, the cumulative collection volume of postal express was about 2.905 billion pieces, an increase of 4.80% month-on-month, and the cumulative delivery volume was about 2.834 billion pieces, an increase of 1.65% month-on-month.

4. PetroChina established a new comprehensive energy service company in Fujian with 100 million yuan

According to the Qichacha APP, Fujian Jinjiang Oasis Integrated Energy Service Co., Ltd. was established, the legal representative is Zhang Xiaofeng, with a registered capital of 100 million yuan, and its business scope includes: energy storage technology services, new energy vehicle sales, automobile sales, battery sales, etc. According to the equity penetration of Qichacha, the company is 100% controlled by PetroChina.

International News

1. The situation in the Red Sea escalated! Container Shipping Index (European Line) futures rose more than 14%

Since briefly hitting the stage low on January 10, the container shipping index (European line) futures have begun to rebound. On January 15, the container transportation index (European line) futures opened high and fluctuated, and the main 2404 contract rose by more than 14% at the beginning of the session, hitting a new high since January 8. Yide Futures said that the geopolitical conflict will intensify, and the possibility of short-term resolution will be reduced, and the resulting impact on the shipping market will be prolonged. At present, the proportion of mainstream shipping companies detouring is still large, the short-term supply pressure is increasing, the tight supply of European line space is superimposed on the domestic centralized shipment before the Spring Festival, and the degree of cash in spot booking prices may be further improved. In addition, due to the centralized detour, some shipping companies announced that they began to collect peak season surcharges from China to the northern region of West Africa, which will also provide support for freight rates. However, the spot side shows that loading goods on board for the African region can reduce the increase in freight rates to a certain extent. The spot price center of the container shipping market is still on the rise. Strategically, we should maintain a cautious attitude towards the long orders of the container transportation index (European line), the situation in the Red Sea region is complex, and the future is still facing great uncertainty, and the elasticity of freight rates will increase accordingly.

2. The Baltic Dry Bulk Freight Index recorded the largest weekly decline since 2008

At least five Qatari-operated liquefied natural gas (LNG) ships that are heading to the southern end of the Red Sea have been halted since Friday, ship-tracking data showed. The Baltic Dry Bulk Freight Index recorded the largest weekly decline since 2008

3. The Federal Reserve's interest rate cut bets have risen again, driving safe-haven gold to heat up

Gold prices edged higher on Monday, holding steady above $2,050 as safe-haven demand from escalating tensions in the Middle East sparked renewed bets that the Federal Reserve will cut interest rates earlier. Kyle Rodda, a financial market analyst at Capital.com, said that gold is only trading as a proxy for front-end yields, which themselves represent rising expectations of US interest rate cuts, and the market is currently focused on higher-than-expected CPI data. Overall, traders expect the Fed to cut rates by 166 basis points this year, up from 150 basis points in early trading on Friday. At the moment, traders are pricing in a 79% chance that the Fed could start cutting rates as early as March. Ahead of the Fed meeting, gold prices look reasonable if there is no evidence that the US economy is performing better than everyone expected.

4. The survey shows that the European Central Bank is expected to cut interest rates four times this year, and the deposit rate will fall back to 3%

According to a survey of economists, the European Central Bank is expected to cut interest rates four times this year as inflation falls faster than previously expected. The rate cuts are expected to be 25 basis points in June, September, October and December, respectively, and the deposit rate will be reduced to 3% as a result. While expectations for the number of rate cuts are one more than in last month's survey, they are still conservative than the total of six rate cuts expected by investors starting in April. The ECB is currently on hold and watching the impact on the economy of the 10 rate hikes since mid-2022. Policymakers are particularly concerned about wage trends in the first half of 2024 to confirm that rising labour costs will not hinder inflation from falling back towards the 2% target. Economists now expect price growth to accelerate back to 2.3% in 2024. This is 0.3 percentage points lower than the December survey results. However, they expect the road ahead to remain bumpy, with inflation expected to re-accelerate to an average of 2.1% in 2025 after returning to target in the fourth quarter.

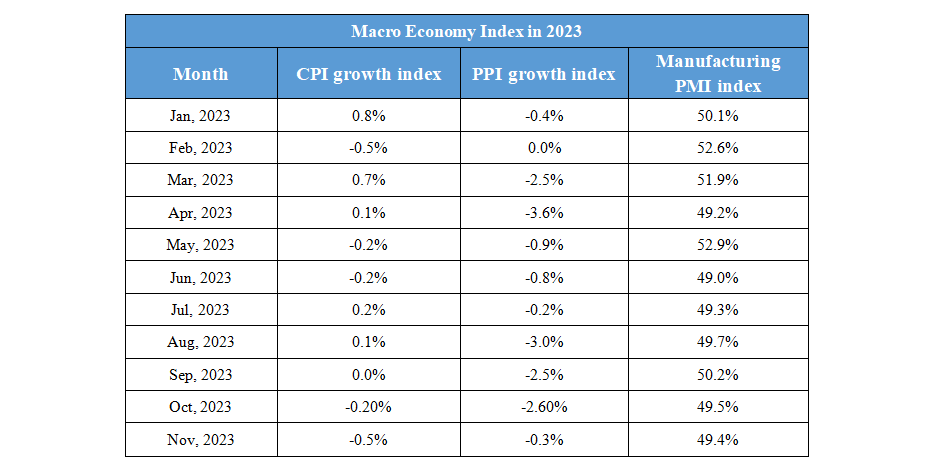

Domestic Macro Economy Index