January 16th Macroeconomic Index: China's CPI and PPI Show Signs of Stabilization, Interest Rate Cuts Expected

Daily Macro Economy News

Latest Global Major Index

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The National Bureau of Statistics released CPI and PPI data on the 12th

2. Experts: The expectation of interest rate cuts in January is getting stronger, and the RRR may be lowered after the Spring Festival

3. Shanghai Fengxian canceled the purchase restriction for singles from other places: eligible people can buy houses after 3 years of social security

4. The National Development and Reform Commission launched the seventh batch of major foreign-funded projects

International News

1. USDA quarterly inventory report

2. The Baltic Dry Bulk Freight Index recorded the largest weekly decline since 2008

3. U.S. media: The heating up of the Red Sea situation is pushing up global shipping prices

4. Bulgarian refineries are restricted from importing Russian crude oil, and the Russian-controlled company behind it is considering selling the asset

Domestic News

1. The National Bureau of Statistics released CPI and PPI data on the 12th

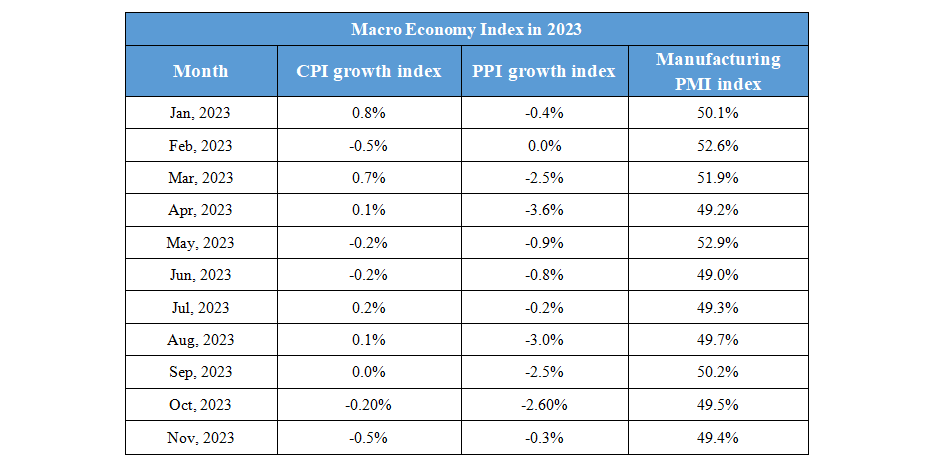

According to data released by the National Bureau of Statistics on the 12th, in December 2023, CPI fell by 0.3% year-on-year, 0.2 percentage points narrower than that in November, and PPI fell by 2.7% year-on-year, 0.3 percentage points narrower than that in November.

2. Experts: The expectation of interest rate cuts in January is getting stronger, and the RRR may be lowered after the Spring Festival

The period before and after the Spring Festival has always been an important period for the central bank to cut the reserve requirement ratio and interest rates. Recently, 10-year Treasury futures have rebounded significantly, causing the 10-year Treasury yield to exceed 2.5% again. This shows that the market's call for the central bank to further strengthen its macro policy is gradually increasing. On January 15, the central conducted its first medium-term lending facility (MLF) operation in 2024, and the market is paying special attention to the change in the MLF rate. Professionals believe that through macroeconomic policies with earlier and sufficient force, economic growth can be significantly stabilized and market confidence boosted. Regarding the RRR and interest rate cuts, a number of experts said that judging from the current economic recovery demand and real interest rates, the interest rate cut in the first quarter is very necessary, and it is very likely to be implemented in January. In addition, with the pre-issuance of government bonds and the increase in credit volume, the RRR cut may also be implemented, but it may be implemented later.

3. Shanghai Fengxian canceled the purchase restriction for singles from other places: eligible people can buy houses after 3 years of social security

The WeChat public account "Shanghai Fengxian" released the "Implementation Rules for Talents to Buy Houses in the New Town Area of Fengxian District". In accordance with the regional development and industrial orientation of Fengxian New Town, non-Shanghai talents who have signed a labor (employment) contract with the employer for two years or more, worked in the unit for more than one year, paid employee social insurance or individual income tax in Shanghai for three years or more according to the regulations, and have no housing in the city, and at the same time meet one of the conditions of the relevant unit and one of the personal conditions, can purchase 1 set of housing in Fengxian New Town, and the qualification for purchasing a house is adjusted from a resident family to an individual.

4. The National Development and Reform Commission launched the seventh batch of major foreign-funded projects

According to the National Development and Reform Commission on the 12th, the National Development and Reform Commission recently launched the seventh batch of landmark major foreign-funded projects, with a total planned investment of more than 15 billion US dollars. According to the relevant person in charge of the National Development and Reform Commission, 11 foreign-funded projects, including Shanghai Moderna Pharmaceutical R&D Production Base and Jiangsu Taizhou Xinpu Chemical High-end Chemicals Project, have been listed as the seventh batch of landmark major foreign-funded projects, and the number of selected projects is the largest in the past, involving biomedicine, automobile manufacturing, new energy batteries, chemical industry and other fields. According to reports, up to now, the first six batches of 40 major foreign-funded projects have completed a total investment of 73 billion US dollars.

International News

1. USDA quarterly inventory report

As of December 1, 2023, U.S. old crop soybean stocks totaled 3.0 billion bushels versus the market expectation of 2.975 billion bushels, U.S. old crop corn stocks totaled 12.169 billion bushels versus the market expectation of 12.05 billion bushels, and total U.S. old crop wheat stocks totaled 1.41 billion bushels versus the market expectation of 1.387 billion bushels.

2. The Baltic Dry Bulk Freight Index recorded the largest weekly decline since 2008

The Baltic Dry Bulk Index slipped on Friday as freight rates for all types of vessels fell. The Baltic Dry Index fell 94 points, or 6.1 percent, to 1,460 points, the lowest level since Nov. 2, and has fallen more than 30 percent this week, the biggest weekly drop since 2008. The capesize freight index fell 252 points, or 10.4%, to 2,172 points, the lowest level since Nov. 3, and fell 43% for the week, the biggest drop in 11 months. The average daily profit of capesize vessels decreased by $2,090 to $18,015. The Panamax freight index fell 11 points, or 0.8%, to 1,410 points, falling for the 11th consecutive session and down 15% for the week, the biggest weekly decline since July. The average daily profit of Panamax ships fell by $97 to $12,693. The Supramax Bulk Carrier Index fell 20 points to a four-month low of 1,088 points, having fallen every trading day since Dec. 5.

3. U.S. media: The heating up of the Red Sea situation is pushing up global shipping prices

The U.S. Consumer News & Business Channel reported that the longer the current tensions in the Red Sea continue, the greater the impact on global shipping, and the higher the cost of shipping. According to statistics, affected by the situation in the Red Sea, container prices on some Asia-Europe routes have soared by nearly 600% recently. At the same time, to compensate for the suspension of the Red Sea route, a number of shipping lines are moving their vessels on other routes to the Asia-Europe and Asia-Mediterranean routes, which in turn is pushing up shipping costs on other routes. "I don't think shipping companies will return to the Red Sea route anytime soon, in fact, four more tankers have decided to avoid the area as a result of the US-UK strike at Houthi targets," said market analyst Tamas. It seems to me that after the US-UK strikes on Houthi targets, tensions in the Red Sea may not only not stop, but will intensify. ”

4. Bulgarian refineries are restricted from importing Russian crude oil, and the Russian-controlled company behind it is considering selling the asset

Bulgaria will import crude oil from Kazakhstan, Iraq and Tunisia in January, replacing oil imports from Russia, according to traders and LSEG. Bulgaria has been granted an exemption from the European Union, allowing it to continue importing Russian oil by sea in 2024. But the country has imposed restrictions on all refined oil exports from Russia since this month, making it nearly impossible for the country's only refinery to use Russian oil, and has decided to stop importing Russian crude from March. Bulgaria buys oil to supply its Burgas refinery, which is operated by Russia's Lukoil and has a capacity of 190,000 barrels per day. Since Lukoil could no longer supply the refinery with Urals oil, the use of alternative oil increased the plant's costs. The company is considering selling its assets in Bulgaria.

Domestic Macro Economy Index