January 11th Macro Economy Update: Key Policies and Market Trends

Daily Macro Economy News

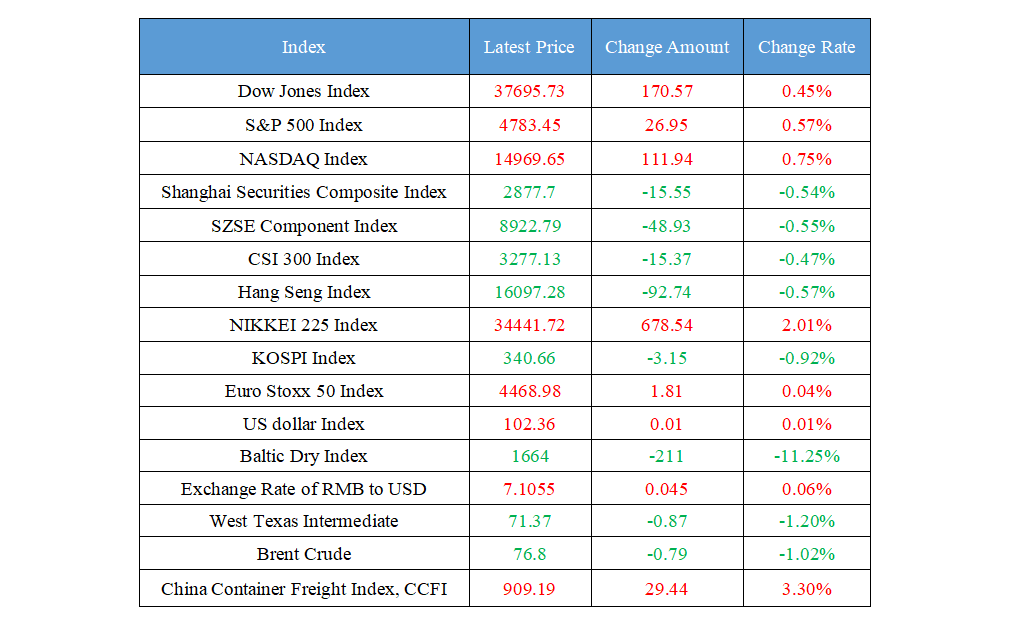

Latest Global Major Index

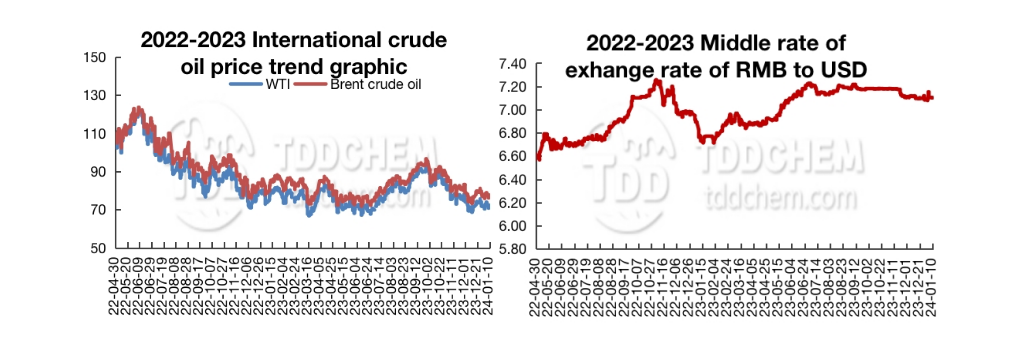

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Department of Foreign Trade of the Ministry of Commerce: study and reserve new policies and measures, and promote their introduction in a timely manner

2. One residential land in Qujiang New District, Xi'an, was unsold due to the absence of a valid quotation, covering an area of 47.28 acres

3. Thirteen Departments: By the end of 2025, 5G and gigabit optical networks will be accessible to counties and towns in border areas

4. China Duty Free Group: plans to deploy overseas markets next year

International News

1. Russia has fulfilled its commitment to reduce crude oil exports as agreed

2. World Gold Council: Global gold ETFs recorded net outflows for 7 consecutive months

3. HSBC: Inflation is still well above target, and the Reserve Bank of Australia may not cut interest rates until 2025

4. Technical analysis: Brent crude oil prices broke through this resistance level

Domestic News

1. Department of Foreign Trade of the Ministry of Commerce: study and reserve new policies and measures, and promote their introduction in a timely manner

Li Xingqian, director of the Department of Foreign Trade of the Ministry of Commerce, said that about the expansion of cross-border e-commerce exports, we will continue to improve policies on customs clearance, taxation, foreign exchange and other aspects, improve the level of regulatory facilitation, and help enterprises reduce costs and increase efficiency. Support cross-border e-commerce comprehensive pilot zones, industry organizations and enterprises to actively participate in the "Silk Road E-commerce" and jointly build the "Belt and Road" economic and trade cooperation. Cultivating new momentum for foreign trade, it is also necessary to promote the digitalization and greening of trade, consolidate the basic market of foreign trade and foreign investment, and accelerate the construction of a trade power. The Ministry of Commerce will work with all local departments to continue to implement the various policies that have been introduced to stabilize foreign trade. At the same time, in view of the new situation and new tasks, we will study and reserve new policies and measures, and promote the introduction of them in a timely manner to help foreign trade enterprises reduce costs and increase efficiency.

2. One residential land in Qujiang New District, Xi'an, was unsold due to the absence of a valid quotation, covering an area of 47.28 acres

In Xi'an City, Shaanxi Province, 47.28 acres of land, at the east of Cuihua Road, south of Yannan Third Road, west of Yanta South Road and north of Yanzhan Road in Qujiang New District, Shaanxi Province, where the listing date has expired, was unauctioned, because there was no valid quotation for the parcel due to the expiration of the listing period. The land plot is numbered QJ2-1-50, and the land is located east of Cuihua Road, south of Yannan Third Road, west of Yanta South Road and north of Yanzhan Road, Qujiang New District, with a net land area of 31,522.9 square meters (equivalent to 47.284 acres).

3. Thirteen Departments: By the end of 2025, 5G and gigabit optical networks will be accessible to counties and towns in border areas

Thirteen departments, including the Ministry of Industry and Information Technology, issued the Notice on Accelerating the Construction of "Broadband Frontiers". The "Notice" clearly defines the work goals: by the end of 2025, the counties and towns in the border areas will be connected to 5G and gigabit optical networks; administrative villages, rural areas with more than 20 households, border management and trade institutions, and inhabited islands will have broadband access (including optical fiber, 4G or 5G) to 100%; mobile network coverage will be basically achieved along national and provincial highways at border; and network coverage will be achieved on demand in inland sea areas. By the end of 2027, more than 95% of administrative villages, border management and trade institutions in border areas will be connected to 5G networks; 5G network coverage will be basically achieved in areas with more than 20 rural populations and along border national and provincial highways; All inhabited islands will be connected to 5G networks; and 5G network coverage will be basically achieved in inland seas and territorial waters.

4. China Duty Free Group: plans to deploy overseas markets next year

China Duty Free Group released a performance report on the evening of January 8, achieving a year-on-year increase of 24.15% in revenue and a year-on-year increase of 33.52% in net profit in 2023. On January 9, China Duty Free A-share and H-share both rose sharply. In early trading today, China Duty Free A shares rose 2.34%, while Hong Kong stocks edged down 0.35%. The reporter called the China Duty Free Securities Department today as an investor, and the staff said that the supplementary agreement signed by the company and the Beijing and Shanghai core airport duty-free shops has come into effect. The overall poor performance of the market is a big challenge for consumer companies. The staff said that they would strive to run the company well and give back to shareholders, and planned to lay out overseas markets next year.

International News

1. Russia has fulfilled its commitment to reduce crude oil exports as agreed

Russia's seaborne crude exports in the first week of 2024 are in line with the levels it pledged in the OPEC+ deal. Russian crude shipments averaged 3.28 million b/d between Jan. 1 and Jan. 7, 300,000 b/d lower than seaborne exports in May and June (Russia had pledged to cut oil exports by 300,000 b/d by the end of 2023 as a show of solidarity with Saudi Arabia), the data showed. At its latest OPEC+ meeting in late November, Russia said it would raise the reduction in exports to 500,000 b/d in the first quarter of 2024, compared with an average of 3.28 million b/d in the first week of 2024, 300,000 b/d less than in May-June 2023 and 500,000 b/d from the week before Dec. 31. Russian crude exports averaged 3.34 million b/d in the four weeks to Jan. 7, about 245,000 b/d below May and June levels.

2. World Gold Council: Global gold ETFs recorded net outflows for 7 consecutive months

According to data released by the World Gold Council (WGC), global gold-backed ETFs saw net outflows of around US$1 billion in December last year, marking the seventh consecutive month of net outflows, with total holdings falling by 10t to 3,225t. However, global gold-backed ETFs rose 1% to US$214 billion due to higher gold prices. According to the report, European funds recorded a net outflow of US$2 billion in December, while North American and Asian funds continued to buy gold, with North American funds increasing their holdings of gold for the second consecutive month with a net inflow of US$717 million, while Asian funds recorded net inflows of US$208 million, marking the ninth consecutive month of gold inflows.

3. HSBC: Inflation is still well above target, and the Reserve Bank of Australia may not cut interest rates until 2025

Paul Bloxham, chief economist at HSBC, said Australia's monthly inflation data for November strengthened the case for the RBA to keep the official cash rate steady in February. Still, the data suggests that inflation is only slowly declining and is still well above the 2%-3% target range. The data also showed a further recovery in rent, which is one of the more stubborn components of inflation. Bloxham expects the RBA will remain concerned that the final stages of the process may remain challenging and take some time to bring inflation back within its target range despite the fact that inflation has fallen. He added that the RBA is likely to remain on hold in 2024 and will not cut interest rates until early 2025.

4. Technical analysis: Brent crude oil prices broke through this resistance level

Today's latest opinion from Economies.com analyst: Brent crude oil prices continued to rise, breaking through the 77.44 level and closing above this level, moving towards building a new upward wave on an intraday basis today, targeting 79.15, followed by 81.00. Therefore, a bullish bias will be suggested today, although there may be some sideways moves due to the negative impact of the Stochastic. A break above the levels of 77.44 and 76.90 will halt the expected rise and push the price back into the main bearish track. Today's trading range is expected to be between 76.50 support and 79.50 resistance.

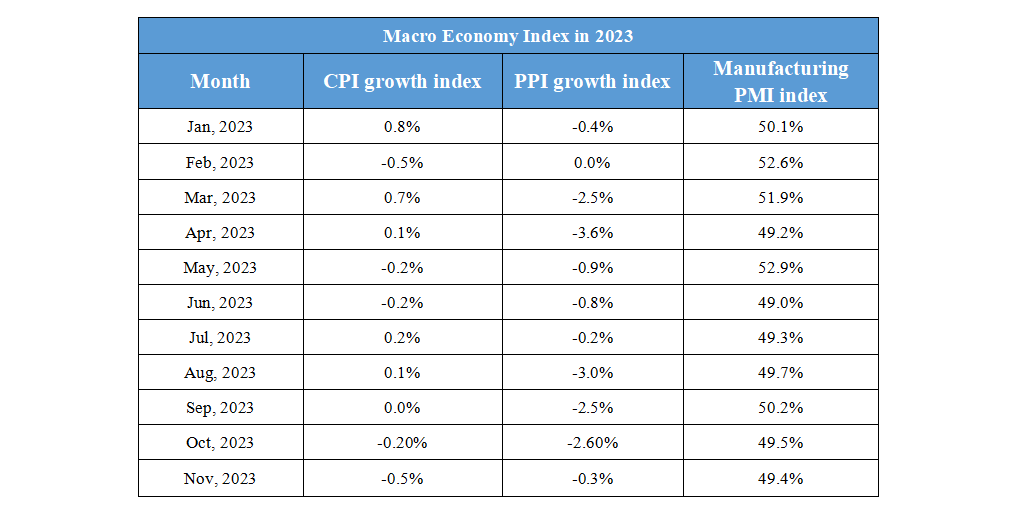

Domestic Macro Economy Index