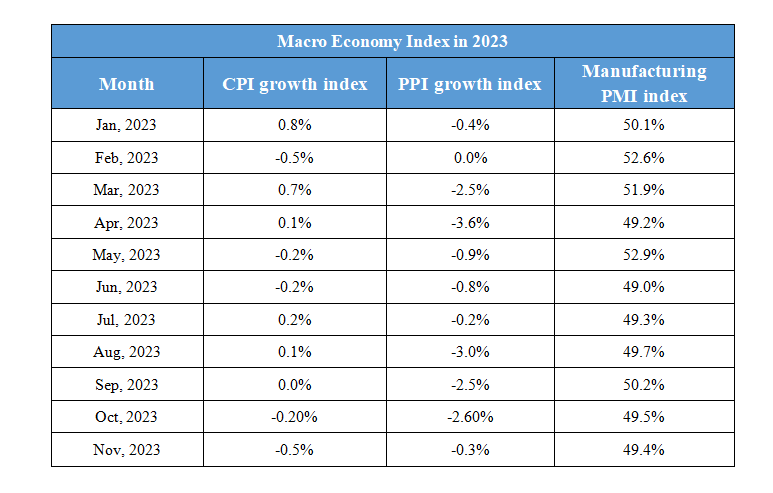

January 9th Macro Economic Overview

Daily Macro Economy News

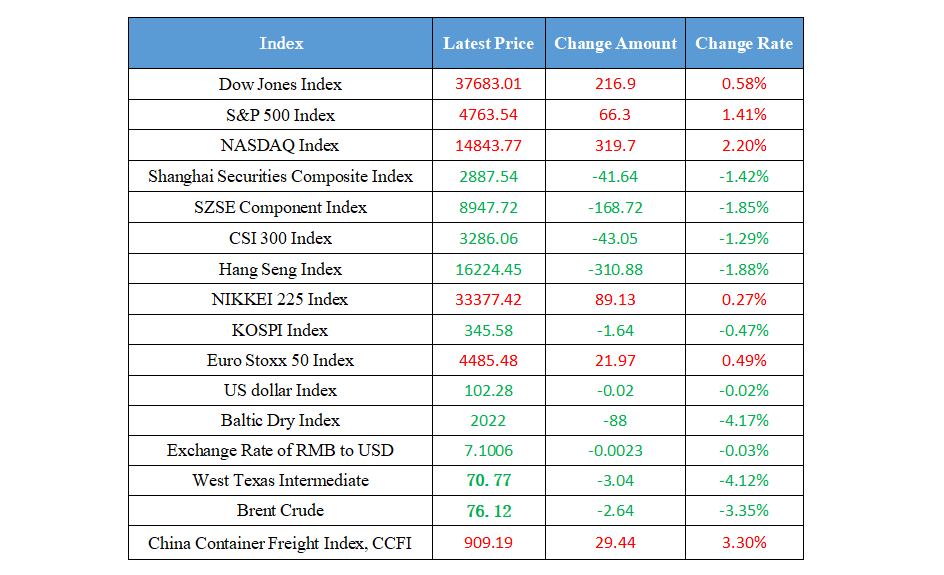

Latest Global Major Index

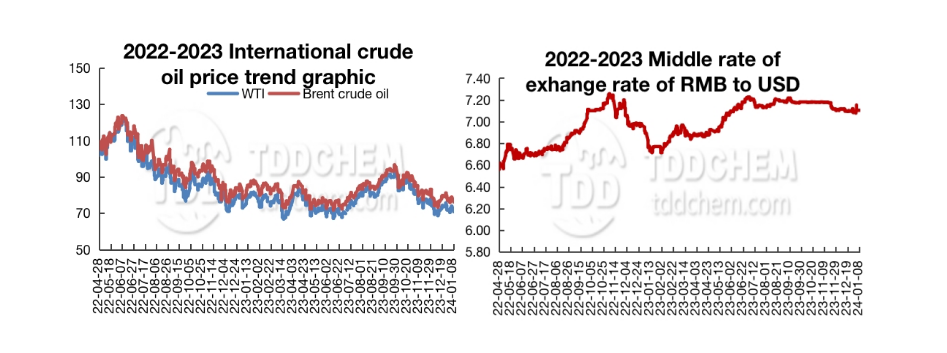

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. China Southern Power Grid Energy: By the end of 2023, it is estimated that the cumulative installed capacity of distributed photovoltaic projects will be about 1,910MW

2. The "house ticket" can be transferred in Guangzhou and limited to one transfer

3. January 8: The "200 Index of Wholesale Prices of Agricultural Products" rose 0.1 points from last Friday

4. Zhejiang's new policy of "individual transformation into enterprise": direct changes are allowed, and there is no need to cancel the self-employed and set up another enterprise

International News

1. CICC: Supply risks have increased, and the uncertainty of U.S. interest rate cuts has risen

2. Saudi Arabia's crude oil prices sold to Asia fell more than expected, driving oil prices weaker

3. The Russian Black Sea Fleet conducts anti-drone and unmanned boat exercises

4. Gazprom: It will continue to deliver natural gas to Europe through Ukraine, with a volume of 40.5 million cubic meters on Monday

Domestic News

1. China Southern Power Grid Energy: By the end of 2023, it is estimated that the cumulative installed capacity of distributed photovoltaic projects will be about 1,910MW

According to preliminary statistics, the company is expected to add about 550MW of newly running distributed photovoltaic projects in 2023, and the cumulative installed capacity of distributed photovoltaic projects is expected to be about 1,910MW by the end of 2023, a year-on-year increase of about 40%. In addition, it is expected that the installed capacity of distributed PV projects to be carried out will be more than 700MW in 2023.

2. The "house ticket" can be transferred in Guangzhou and limited to one transfer

The relevant person in charge of the Guangzhou Municipal Bureau of Planning and Natural Resources said that in order to encourage the expropriated to choose "house ticket resettlement", the expropriated person will be given a certain policy reward in addition to the basic compensation according to the regulations, and the specific proportion shall be formulated by each district itself. The house ticket is valid for the whole city, and you can buy houses in the "Housing Supermarket" across districts. House tickets can be transferred and limited to one transfer. The real-name system is implemented for house tickets, and no pledge financing or illegal cashing out is allowed.

3. January 8: The "200 Index of Wholesale Prices of Agricultural Products" rose 0.1 points from last Friday

According to the monitoring of the Ministry of Agriculture and Rural Affairs, on January 8, the "200 index of wholesale prices of agricultural products" was 126.17, up 0.10 points from last Friday, and the wholesale price index of "vegetable basket" products was 127.31, up 0.13 points from last Friday. As of 14:00 today, the average price of pork in the national agricultural products wholesale market was 19.79 yuan/kg, down 1.2% from last Friday.

4. Zhejiang's new policy of "individual transformation into enterprise": direct changes are allowed, and there is no need to cancel the self-employed and set up another enterprise

The General Office of the Zhejiang Provincial Government recently issued the "Implementation Opinions on Supporting the Transformation and Upgrading of Individual Industrial and Commercial Households into Enterprises", which will be implemented on January 15. The "Implementation Opinions" stipulate four policy measures, including optimizing the access services of "individual to enterprise", reshaping the handling mode of "individual to enterprise", allowing individual industrial and commercial households to transform into enterprises through "direct change", without the need to firstly cancel individual industrial and commercial households and then set up enterprises.

International News

1. CICC: Supply risks have increased, and the uncertainty of U.S. interest rate cuts has risen

CICC Research reported that the U.S. non-farm payrolls data in December was stable, the unemployment rate was still very low, the labor force participation rate showed signs of peaking, and the fastest recovery in labor force supply may have passed. At the same time, the fastest time for supply chain recovery may have passed, and recent safety issues in the Red Sea may increase supply chain risks. In our view, these changes could increase US inflation uncertainty, and if supply factors do not improve further, then inflation will be more resilient given the same demand. If the Fed cuts interest rates earlier and demand rebounds, there may also be a risk of "secondary inflation". Inflation uncertainty will increase the uncertainty of monetary policy, the Fed is reluctant to give too much commitment to rate cuts, and investors should be more cautious about rate cut expectations.

2. Saudi Arabia's crude oil prices sold to Asia fell more than expected, driving oil prices weaker

Saudi Arabia's larger-than-expected cut in official oil pricing for Asia reinforced signs of weakness in the spot crude market. Saudi Aramco lowered the official selling price of its flagship Arabian Light crude to $1.50 per barrel premium in February, the lowest level since November 2021. The decline of $2 per barrel was larger than expected. However, at least three Asian customers said lower oil prices were unlikely to push Saudi Arabia to request additional deliveries, as there was still cheaper and competitive crude supply in the spot market.

3. The Russian Black Sea Fleet conducts anti-drone and unmanned boat exercises

On January 8, local time, the Russian Ministry of Defense announced that the Russian Black Sea Fleet conducted a drill to destroy enemy drones and unmanned boats. In addition, in the course of the exercises, the ships of the Black Sea Fleet carried out cruises in the waters of the Black Sea, as well as conducted exercises of conventional weapons firing in both day and night conditions.

4. Gazprom: It will continue to deliver natural gas to Europe through Ukraine, with a volume of 40.5 million cubic meters on Monday

Gazprom: It will continue to deliver gas to Europe through Ukraine, with a volume of 40.5 million cubic meters on Monday.

Domestic Macro Economy Index