January 4th Macroeconomic Index: China's State-Owned Enterprises Aim for Strong Start, OPEC+ Plans Virtual Meeting

TDDChe Daily Macro Economy News

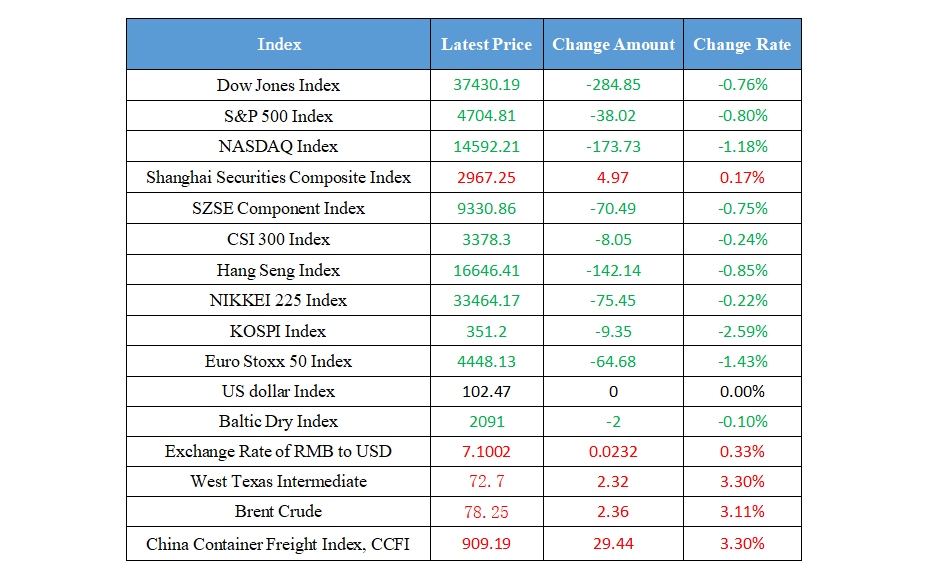

Latest Global Major Index

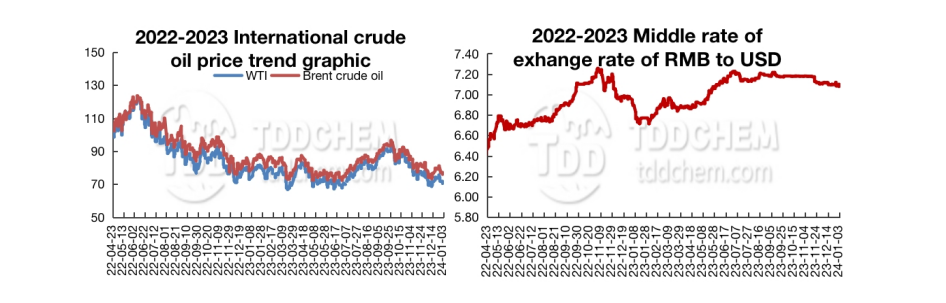

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. State-owned Assets Supervision and Administration Commission: Promote central enterprises to make a good start and take a good step, and strive to achieve a "good start" in the first quarter

2. Gotion High Tech, NIO Power and others registered 1.6 billion yuan to set up an energy company in Hefei

3. CNOOC Limited announced that the second phase of the Lufeng Oilfield Group development project was put into operation

4. Eight departments: strictly control the new production capacity of ammonium phosphate, yellow phosphorus and other industries

International News

1. British media: EU regulate organizations will investigate the links between banks and non-bank institutions

2. One of Libya's largest oil fields is at risk of complete closure

3. OPEC+ reportedly plans to hold a virtual meeting in early February to assess the oil market situation

4. Preview of MPOB’s monthly report of December: Horse palm oil inventory in December is 2.37 million tons

Domestic News

1. State-owned Assets Supervision and Administration Commission: Promote central enterprises to make a good start and take a good step, and strive to achieve a "good start" in the first quarter

The Party Committee of the State-owned Assets Supervision and Administration Commission of the State Council held an enlarged meeting to conscientiously convey the spirit of General Secretary Xi Jinping's 2024 New Year's message and the spirit of the important speech when General Secretary Xi Jinping presiding over the special democratic life meeting of the Political Bureau of the Central Committee. It is emphasized that it is necessary to closely combine the actual situation of the State-owned Assets Supervision and Administration Commission, study the implementation and practice measures, further improve the position and the standard, consolidate and expand the achievements of the theme education, effectively improve the ability to perform duties, and promote the central enterprises to make a good start and take a good step, and strive to achieve a "good start" in the first quarter, effectively improve expectations, boost confidence, and better play the role of stabilizer and ballast.

2. Gotion High Tech, NIO Power and others registered 1.6 billion yuan to set up an energy company in Hefei

Recently, Zhongan Energy (Anhui) Co., Ltd. was established with a registered capital of 1.6 billion yuan, and its business scope includes: electric vehicle charging infrastructure operation, centralized fast charging station, charging pile sales, motor vehicle charging sales, new energy vehicle battery swapping facilities sales, battery parts sales, battery sales, etc. According to the equity penetration of Qichacha, the company is jointly held by Anhui Energy Group Co., Ltd., Wuhan NIO Power, Gotion High-Tech and Anhui Natural Gas, etc.

3. CNOOC Limited announced that the second phase of the Lufeng Oilfield Group development project was put into operation

CNOOC Limited announced on January 3 that the second phase of the Lufeng Oilfield Group development project has been put into operation. The project is located in the eastern part of the South China Sea, with an average water depth of about 136 meters, and mainly includes Lufeng 8-1 oilfield, Lufeng 9-2 oilfield and Lufeng 14-8 oilfield. The project will build 1 new drilling and production platform, and plan to put into operation 14 development wells, including 13 oil production wells and 1 water injection well. It is expected to achieve peak crude oil production of about 22600 barrels per day in 2025. CNOOC Limited owns 100% of the project and acts as the operator.

4. Eight departments: strictly control the new production capacity of ammonium phosphate, yellow phosphorus and other industries

Eight departments including the Ministry of Industry and Information Technology issued the "Implementation Plan for Promoting the Efficient and High-value Utilization of Phosphorus Resources", which mentioned that it is necessary to adhere to the classification policy and promote the adjustment of product structure. Strictly control the new production capacity of ammonium phosphate, yellow phosphorus and other industries. Promote the supply and price stability of phosphate fertilizers, give priority to ensuring the phosphate ore demand of phosphate fertilizer enterprises, guide enterprises to scientifically schedule production, maintain reasonable inventory, stabilize market expectations, support backbone enterprises to become better and stronger, and actively develop new high-efficiency phosphate fertilizer varieties. Expand the in-depth processing production capacity of wet purified phosphoric acid and yellow phosphorus, extend the development of high value-added phosphorus chemicals such as functional phosphate, and promote the transformation of industrial development mode from scale expansion to refined, specialized, and serialized service-oriented manufacturing.

International News

1. British media: EU regulate organizations will investigate the links between banks and non-bank institutions

According to the Financial Times, José Manuel Campa, president of the European Banking Authority, said that EU regulation institution will conduct an in-depth investigation into links between banks and other financial institutions such as hedge funds. There is growing concern that stress across the financial system could spill over. Referring to regulation institution’s efforts to predict how banks will be affected by stress from NBFCs, including hedge funds, private capital firms and crypto groups, he said they need to understand the entire potential chain of NBFs. Campa said the European Banking Authority will work with the European Systemic Risk Committee and the Financial Stability Board to better understand how the shadow banking shock will ripple across the system. The institution is already assessing banks' balance sheet exposures to non-bank institutions, including loans.

2. One of Libya's largest oil fields is at risk of complete closure

According to sources, production fell from 265,000 barrels per day to 235,000 barrels per day as a result of protests by personnel, as part of the plant at the Sharara oil field, one of Libya's largest oil fields, was forced to shut down. Ten wells in the field have been shut down, but pumping work continues at the port of Zawiya. People familiar with the matter said they would seek to shut down the oil fields completely if their demands were not met.

3. OPEC+ reportedly plans to hold a virtual meeting in early February to assess the oil market situation

OPEC+ will hold a virtual meeting early next month to resume routine oil market monitoring, delegates revealed. A person familiar with the matter said the meeting was scheduled on Feb. 1. The Organization of the Petroleum Exporting Countries (OPEC) and its allies began a new round of production cuts this month in an attempt to avert a global oversupply in the first quarter and defend crude oil prices. Oil prices fell nearly 20% in the fourth quarter of last year, as record hitting supplies from the U.S. and other countries offset the impact of OPEC+ production cuts and strong fuel demand. Oil consumption growth is expected to slow down sharply this year, triggering forecasts of oversupply. Against the backdrop of controversy over production quotas, Angola announced its withdrawal after sixteen years of membership in the OPEC+. However, this is not expected to have any impact on supply from the country and the OPEC+ alliances.

4. Preview of MPOB’s monthly report of December: Horse palm oil inventory in December is 2.37 million tons

Malaysia's palm oil inventories in December 2023 are expected to be 2.37 million mt, down 2.1% from November and up 8% from November last year, Malaysia's palm oil output in December 2023 is expected to be 1.61 million mt, down 10% from November and the biggest monthly decline since January 2023, and Malaysia's palm oil exports are expected to be 1.33 million mt in December 2023, down 5% from November.

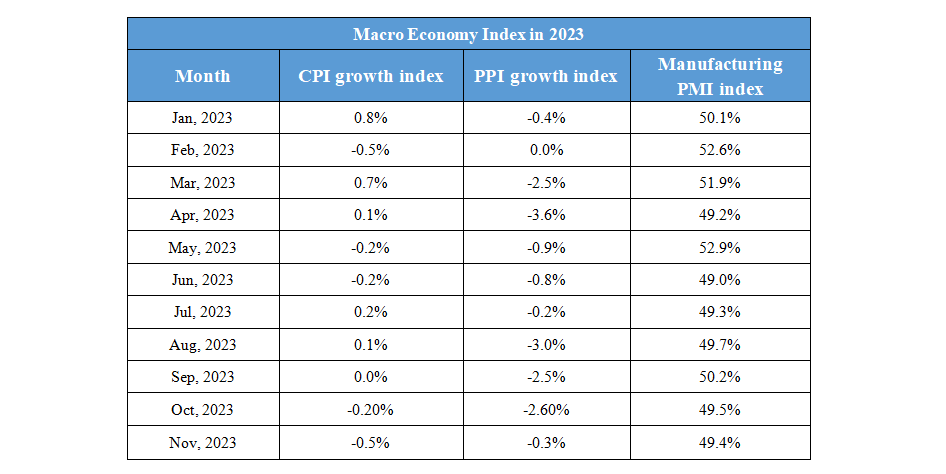

Domestic Macro Economy Index