October 25th There are three major trends in the financial management of China's new rich, and investment participation will increase.

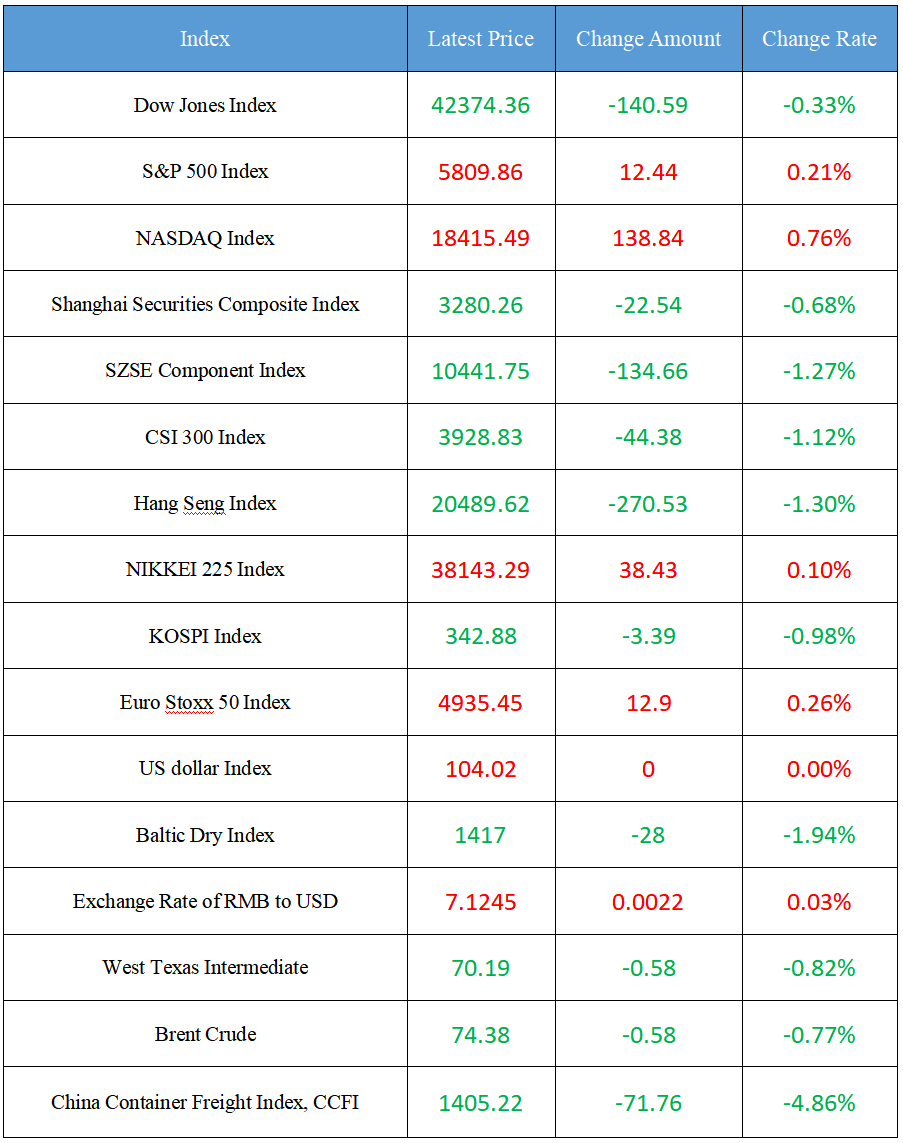

Latest Global Major Index

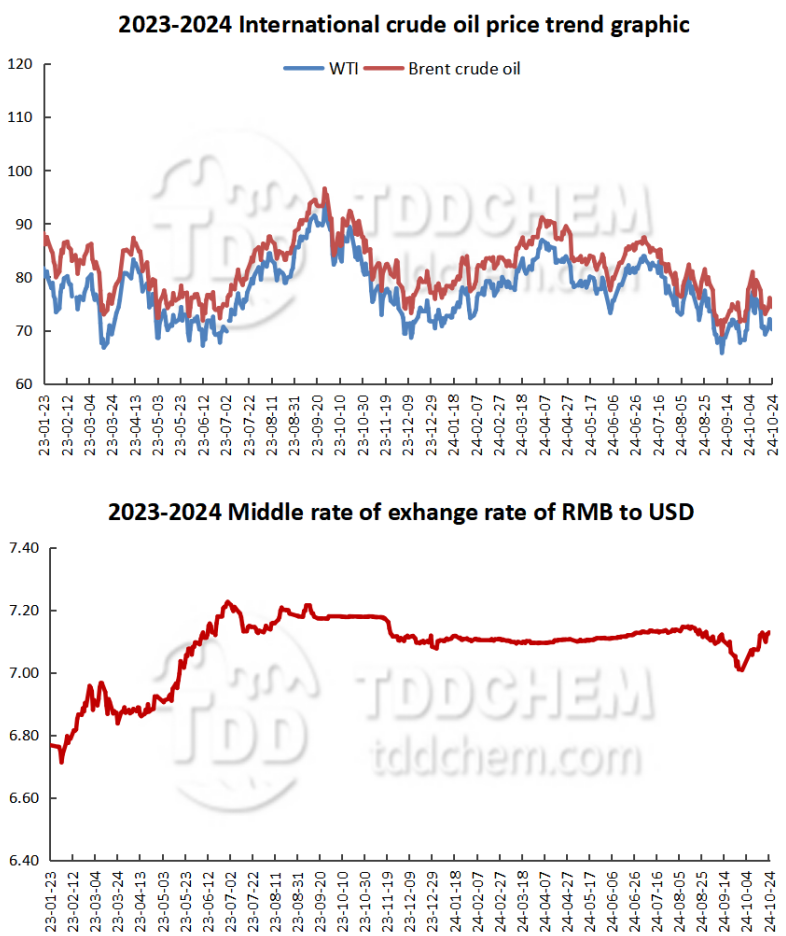

International Crude Price Trend & Exchange Rate of RMB to USD Trend

Domestic News

1. Chairman of EY China: China has played a major role in the global financial system

2. Xi Jinping returned to Beijing after attending the 16th BRICS Summit

3. Charles Schwab: China's newly wealthy people are becoming more diversified in their use of various financial services

4. The first 24-hour self-service centre for government affairs in Macao was opened in Hengqin

5. Insurance companies are preparing for the coming year earlier and earlier, and industry participates suggest focusing more on product innovation and services

International News

1. The company and operator of the United States Baltimore bridge collision freighter agreed to pay nearly $102 million in compensation

2. Musk's net worth soared by $33.5 billion in one day

3. The governor of the Bank of Japan is cautiously optimistic about the outlook for the United States economy, warning that the market remains unstable

4. Morgan Stanley appoints CEO Ted Pick as Chairman

5. US media: Russia provided target data for Houthi attacks on Western merchant ships

Domestic News

1. Chairman of EY China: China has played a major role in the global financial system

Swift (Society for Worldwide Interbank Financial Telecommunication) International Banking Operations Conference 2024 Annual Conference (Sibos 2024 Annual Conference) held in Beijing, EY China Chairman and Greater China CEO Chen Kai said in an exclusive interview with reporters during the meeting that from the data point of view, China has played a major role in the global financial system and has "big" hard core power. For example, Chen Kai said that at present, the total assets of China's banking industry rank first in the world, the scale of stocks, bonds and insurance ranks second in the world, and the scale of foreign exchange reserves ranks first in the world for many years. He said that finance is the blood of the national economy, with China, at the national level, putting forward the concept and goal of "financial power" for the first time, financial work has risen to a new height, China is gradually moving from the world's "financial power" to "major financial power", but in the market mechanism, service to the real economy, green development and other aspects need to be improved and strengthened.

2. Xi Jinping returned to Beijing after attending the 16th BRICS Summit

At midnight on October 24, President Xi Jinping returned to Beijing by special plane after attending the 16th BRICS Summit. Cai Qi, Member of the Standing Committee of the Political Bureau of the CPC Central Committee and Director of the General Office of the CPC Central Committee, Wang Yi, Member of the Political Bureau of the CPC Central Committee and Minister of foreign affairs, and other members of the entourage returned on the same plane. When leaving Kazan, the head of the administration of the Federal Republic of Tatarstan of Russia Minnikhanov and senior officials of the Ministry of Foreign Affairs of Russia saw him off at the airport.

3. Charles Schwab: China's newly wealthy people are becoming more diversified in their use of various financial services

Thomas·Pixley, General Manager of Charles Schwab Banking, said in a recent interview that in recent years, there have been three trends in the wealth management of China's newly wealthy people: the recognition of investment advisory services is getting stronger; the growing need for diversification in investments; There is a growing correlation between the need for financial planning and its effective recognition. According to the "China Newly Wealthy Health Index" jointly released by Shanghai Advanced Institute of Finance of Shanghai Jiao Tong University and Charles Schwab, a financial services institution in United States, the newly rich people refer to people with an annual income of between 125,000 and 1 million yuan and investable assets of less than 7 million yuan. Pixley pointed out that in 2024, the investment participation level of China's newly wealthy people will increase to a certain extent, from 78.95 in the previous year to 79.72 points, mainly reflected in the respondents' more diversified use of various financial services, and the perception and attitude towards investment advisory services have also continued to improve.

4. The first 24-hour self-service centre for government affairs in Macao was opened in Hengqin

The 24-hour self-service centre for government affairs in the Guangdong-Macao In-Depth Cooperation Zone in Hengqin was officially opened on 24 July. The center allows Macao residents to enjoy all-round, zero-distance and one-stop Macao government services without leaving the country. It is understood that the 24-hour self-service center for Macao government affairs in the Co-operation Zone was jointly established by the Macao SAR Government and the Executive Committee of the Co-operation Zone. At present, the center is equipped with self-service equipment such as the Macao SAR Government's new remote service counters, smart filing cabinets, self-service certificate processing machines and certificate collection machines, which can provide nearly 70 services from 12 departments, including the Macao Administrative and Civil Service Bureau, the Legal Affairs Bureau, the Identification Services Bureau, the Finance Bureau, the Health Bureau, the Transport Affairs Bureau, the Municipal Affairs Bureau, the Public Security Police Force, the Cultural Affairs Bureau, the Social Welfare Bureau, the Pension Fund and the Social Security Fund.

5. Insurance companies are preparing for the coming year earlier and earlier, and industry participates suggest focusing more on product innovation and services

Entering the fourth quarter, insurance companies have started to prepare for marketing activities in the coming year. Compared with previous years, this year's preparation for the next year's marketing activities has been opened earlier, and some insurance company branches began to prepare in July, and launched the marketing activities for the coming year in September. Since October, more insurers have joined the "war" of marketing campaigns. In terms of the main products, dividend-paying products have become a major highlight. In recent years, the regulatory authorities have issued many documents to guide insurance companies to carry out marketing activities scientifically and reasonably, and there are also some voices in the industry that downplay the preparation for marketing activities in the coming year. Industry insiders said that the insurance industry should dilute the preparation for marketing activities in the coming year or the general trend, and should retain customers through innovative products and services.

International News

1. The company and operator of the United States Baltimore bridge collision freighter agreed to pay nearly $102 million in compensation

On October 24, local time, the United States Department of Justice announced that the company and operator of the cargo ship that crashed the Baltimore City Bridge in March this year had agreed to pay nearly $102 million in compensation. Under the settlement, the owners and operators of the Dali will pay nearly $102 million to settle the civil claims filed against them by the Justice Department in September, the Justice Department said. In the early morning of March 26, local time, the freighter "Dali", flying the Singapore flag, lost power and hit the "Francis·Scott · Base" bridge in Baltimore, causing the steel bridge to collapse. The accident caused 8 construction workers on the bridge deck to fall into the water, 2 of whom were rescued and 6 others died.

2. Musk's net worth soared by $33.5 billion in one day

Tesla (TSLA. Musk's net worth also jumped by $33.5 billion in a single day after his share price posted its biggest gain in more than a decade, extending the world's richest man's lead on the billionaire list. Musk's wealth grew by the third-highest in his own history and reached $270.3 billion, $61 billion higher than Jeff·Bezos, who came in second. Tesla stocks and options account for about three-quarters of his total wealth, and he also has significant stakes in SpaceX, social media platform X and artificial intelligence company xAI.

3. The governor of the Bank of Japan is cautiously optimistic about the outlook for the United States economy, warning that the market remains unstable

Bank of Japan Governor Kazuo Ueda said optimism about the outlook for the United States economy is growing, but the market remains unstable. Markets have been carefully studying Ueda's comments on the United States economy and markets, and he recently highlighted uncertainty and nervous markets over a "soft landing" of the United States economy as the main risks that require the Japan Bank to slow down its pace in raising interest rates further. "But we need to analyze further to see if this optimism will persist or if it's just temporary," Ueda said, adding that the Japan bank has plenty of time to scrutinize the risks to the economy to decide when to raise rates again. He said the market remained volatile and implied volatility remained "quite high", suggesting that the central bank had not let its guard down on the risk of a resurgence of volatility. Regarding the yen, he said: "Part of the reason for the recent decline in the yen is the rising optimism about the United States economy. ”

4. Morgan Stanley appoints CEO Ted Pick as Chairman

Morgan Stanley, MS. N) said on Thursday that CEO Pick will succeed James Gorman as the next Chairman. In keeping with Wall Street's tradition, the bank merges the roles of chief executive and chairman — an approach that has sometimes come under fire for potentially concentrating too much power in one person. Proponents argue that such a merger could speed up decision-making. They say the board's lead independent Director can provide adequate oversight to ensure accountability. Earlier this year, Pick won the competition, replacing CEO Gorman’s longtime management.

5. US media: Russia provided target data for Houthi attacks on Western merchant ships

Earlier this year, Russia provided target data for Yemen's Houthi attacks on Western ships in the Red Sea, according to the Wall Street Journal. An anonymous source said the data was passed to the Houthis in Yemen through members of Iran's Islamic Revolutionary Guard Corps. Satellite data provided by Russia is intended to help the Houthi’s expanded attacks that began last November in what the Houthis say were in support of Palestinians in the ongoing war in the Gaza Strip. Since the outbreak of the Israel-Gaza conflict in October 2023, the Houthis have attacked more than 80 merchant ships with missiles and drones.

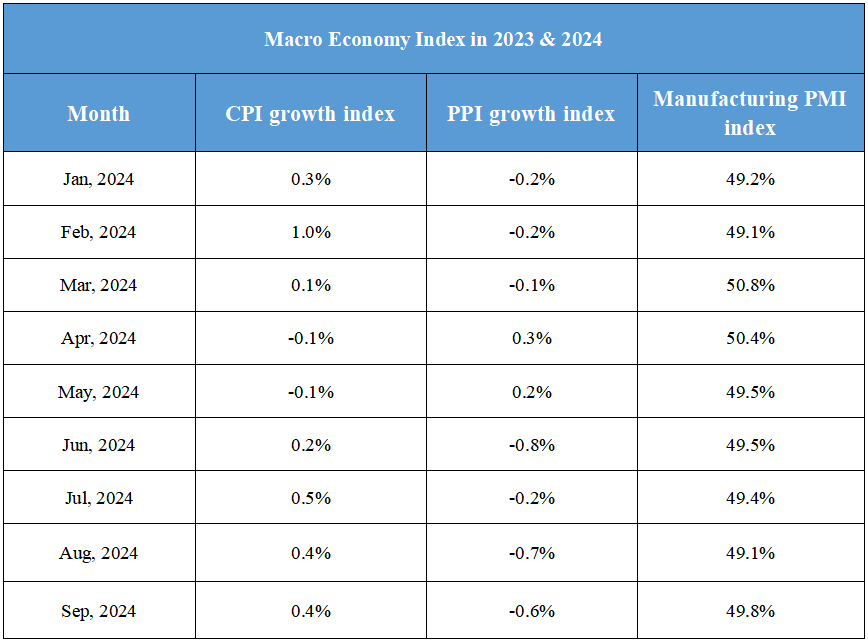

Domestic Macro Economy Index