October 24th The Bank of England may accelerate the pace of interest rate cuts

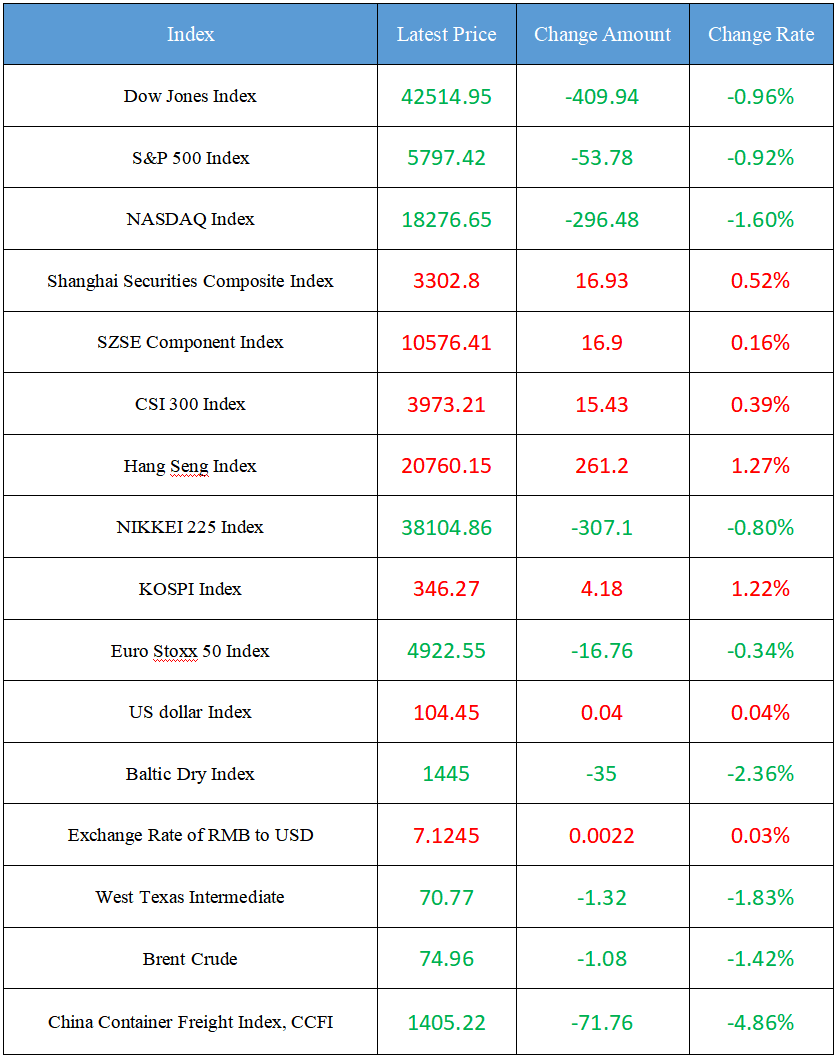

Latest Global Major Index

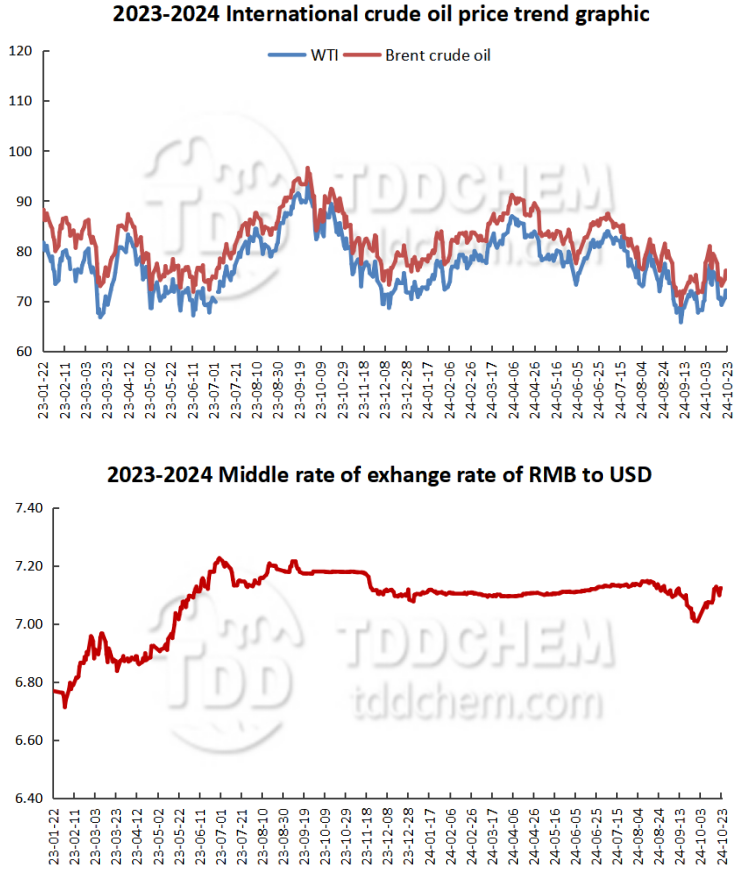

International Crude Price Trend & Exchange Rate of RMB to USD Trend

Domestic News

1. IBM's net loss in the third quarter was $330 million, and its stock price fell after hours

2. QFII heavy stocks were exposed in the third quarter, and the three major industries were favored.

3. The "siphon effect" of highly flexible products appears, and fund companies are preparing rapid layout.

4. A-share assets are "attractive", and foreign-funded institutions are busy with research and layout

5. Survey: Analysts don’t expect the Bank of Japan to raise interest rates in October

International News

1. Warren Buffett: He does not endorse any United States political candidate

2. Hamas: Israeli forces besieged Jabalya in Gaza for 19 days, killing at least 770 people

3. The Council of the European Union approved 35 billion euros in financial assistance and a new loan mechanism for Ukraine

4. Character.AI was prosecuted for potentially causing a minor to commit suicide

5. United Kingdom Bank Governor Bailey: United Kingdom inflation has cooled faster than expected

Domestic News

1. IBM's net loss in the third quarter was $330 million, and its stock price fell after hours

On Wednesday, IBM (IBM. N) shares fell 5% in after-hours trading after the company's third-quarter revenue fell short of Wall Street's expectations. According to the financial report, IBM's overall revenue increased by 1.5% year-on-year. Net loss for the third quarter was $330 million, or $0.36 per share, compared to a net loss of $1.7 billion, or $1.84 per share. For the fourth quarter, management expects revenue growth at constant currency rates to be flat compared to the third quarter. Third-quarter revenue increased 2% in constant currency terms. The company's consulting revenue was $5.15 billion, down 0.5%. Infrastructure segment revenue was $3.04 billion, down 7%.

2. QFII heavy stocks were exposed in the third quarter, and the three major industries were favored.

At present, the third quarter report of listed companies is being intensively disclosed, and the changes in QFII heavy stocks and holdings in the third quarter of 2024 have surfaced. Wind data shows that as of 17:30 on October 23, 403 listed companies have disclosed their third quarter reports for 2024. Among them, QFIIs appeared in the top ten circulating shareholders of 63 listed companies, and QFII's holdings in 30 stocks entered the top ten circulating shareholders in the third quarter of 2024, and the number of holdings in 18 stocks increased in the third quarter of 2024. In terms of industry, the market value of QFII's position in the non-ferrous metal industry exceeded 3 billion yuan, and the market value of its position in the basic chemical industry, agriculture, forestry, animal husbandry and fishery industry exceeded 1 billion yuan.

3. The "siphon effect" of highly flexible products appears, and fund companies are preparing rapid layout.

On October 23, the Beijing Stock Exchange 50 Index closed up more than 4%. Since September 24, the index has doubled. Among the index constituent stocks, many of them have risen several times in stages. In the interview and research, the reporter found that some investors have paid significant attention to highly elastic markets such as the Science and Technology Innovation Board, the Growth Enterprise Market, and the Beijing Stock Exchange. Related fund products have received a large number of net subscriptions in the past month. At the same time, a number of fund companies took advantage of the trend to issue new products, and some funds only had a fundraising period of 3 trading days. Industry insiders believe that the active layout of investors and fund companies reflects to some extent the continuous improvement of the investment risk appetite of some market players, but it is also necessary to pay attention to the coexistence of high return elasticity and high risk.

4. A-share assets are "attractive", and foreign-funded institutions are busy with research and layout

At the beginning of the fourth quarter, Goldman Sachs, JPMorgan Fund, UBS, Morgan Stanley and other foreign institutions frequently appeared in the research team of A-share companies. Wind data shows that since October, foreign institutions have investigated more than 40 A-share companies. From the perspective of industry distribution, electronics, basic chemicals, machinery and equipment and other industries have attracted much attention. The focus of foreign institutions on listed companies is mainly on the company's product gross profit margin expectations and orders in hand, and then explore the company's performance growth points in the fourth quarter. In addition, issues such as overseas business expansion and the progress of new projects are also frequently asked by foreign-funded institutions.

5. Survey: Analysts don’t expect the Bank of Japan to raise interest rates in October

Most economists polled by Bloomberg expect the Japan central bank to keep its benchmark interest rate unchanged next week before raising rates in December or January. According to the survey, almost all 53 Japan central bank watchers expect the Japan central bank to hold its ground on October 31. About 53% expect the Bank of Japan to raise interest rates in December, which is the most popular timing. Those expecting a rate hike in January jumped from 19% to 32%, while expectations for a rate hike this month have fallen. Analysts will be keeping a close eye on policy cues from this meeting. Japan will hold a general election a few days before the interest rate decision. And with uncertainty looming over the United States presidential election, Japan Bank Governor Kazuo Ueda may not make any definitive remarks, but he may reiterate that he will raise interest rates if the central bank's inflation expectations can be met.

International News

1. Warren Buffett: He does not endorse any United States political candidate

Warren·Buffett said he would not support any political candidate just two weeks before United States citizens went to the polls to elect their next president. The 94-year-old billionaire issued a statement on Berkshire's website, hoping to put an end to online rumors that Buffett is backing political candidates and investment products. "In light of the increasing use of social media, fraudulent claims have emerged that Mr. Buffett endorses investment products and endorses political candidates," the statement read. Warren Buffett has supported Democratic candidates in the past, and he endorsed Hillary·Clinton in the 2016 election.

2. Hamas: Israeli forces besieged Jabalya in Gaza for 19 days, killing at least 770 people

The Palestinian Islamic Resistance Movement (Hamas) media office issued a statement on the 23rd local time, saying that 19 days after the Israeli army launched a new round of ground operations in the Jabalya area in the northern Gaza Strip, at least 770 Palestinians have died and more than 1,000 have been injured so far. In addition, more than 200 people, including women, have been "abducted" and dozens have disappeared due to communication problems. More than 100,000 wounded and sick in the northern Gaza Strip are in dire need of assistance, but assistance remains elusive as Israel forces destroy health systems and hospitals in the area, the statement said.

3. The Council of the European Union approved 35 billion euros in financial assistance and a new loan mechanism for Ukraine

On the 23rd local time, the Council of the European Union voted on a written procedure and adopted a new mechanism for providing 35 billion euros of financial assistance and loans to Ukraine to Ukraine. The bill will enter into force the day after it is published in the Official Journal of the European Union. The loan is expected to be provided to Ukraine by the end of 2024 with a maximum borrowing period of 45 years.

4. Character. AI was prosecuted for potentially causing a minor to commit suicide

Character Technologies, a developer of robotic chatbots, was sued by a mother in Florida, United States. The Company designs and markets an artificial intelligence (AI)/bot chatbot for teenagers. The plaintiffs allege Character.AI encouraged her teenage child to become suicidal and caused her child to commit suicide in February 2024 through inappropriate human-computer interaction. According to the complaint, the technology of the Character.AI product is used to explore the psychological dependence of minor users on their fading decision-making ability, impulse control, emotional maturity, and incomplete brain development of the users.

5. United Kingdom Bank Governor Bailey: United Kingdom inflation has cooled faster than expected

United Kingdom Bank Governor Bailey said the United Kingdom's disinflationary process is moving faster than officials expected, which could be the latest hint that the central bank will continue to cut interest rates next month. Bailey said inflation was lower than he expected a year ago, highlighting the "good picture" that a second-round effect could keep price pressures elevated. "I think disinflation is happening faster than we expected, but we still have questions about whether there are some structural changes in the economy," Bailey said. Although the Bank of United Kingdom hinted at cautious easing at its last meeting, Bailey recently signaled that the central bank could be "a little more aggressive" in cutting interest rates if the good news on inflation continues. His comments on Wednesday could further cement bets that the United Kingdom's central bank will pivot to a faster rate-cutting cycle in the coming months. Traders now expect the United Kingdom Bank to cut rates next month and see a 60% chance of another 25 basis point cut in December.

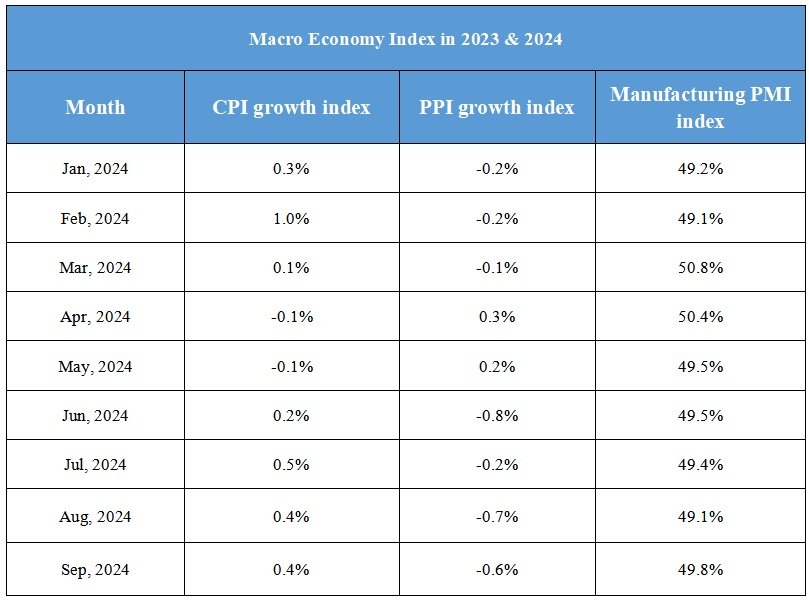

Domestic Macro Economy Index