October 21st "SFISF rules help stocks stabilize bonds."

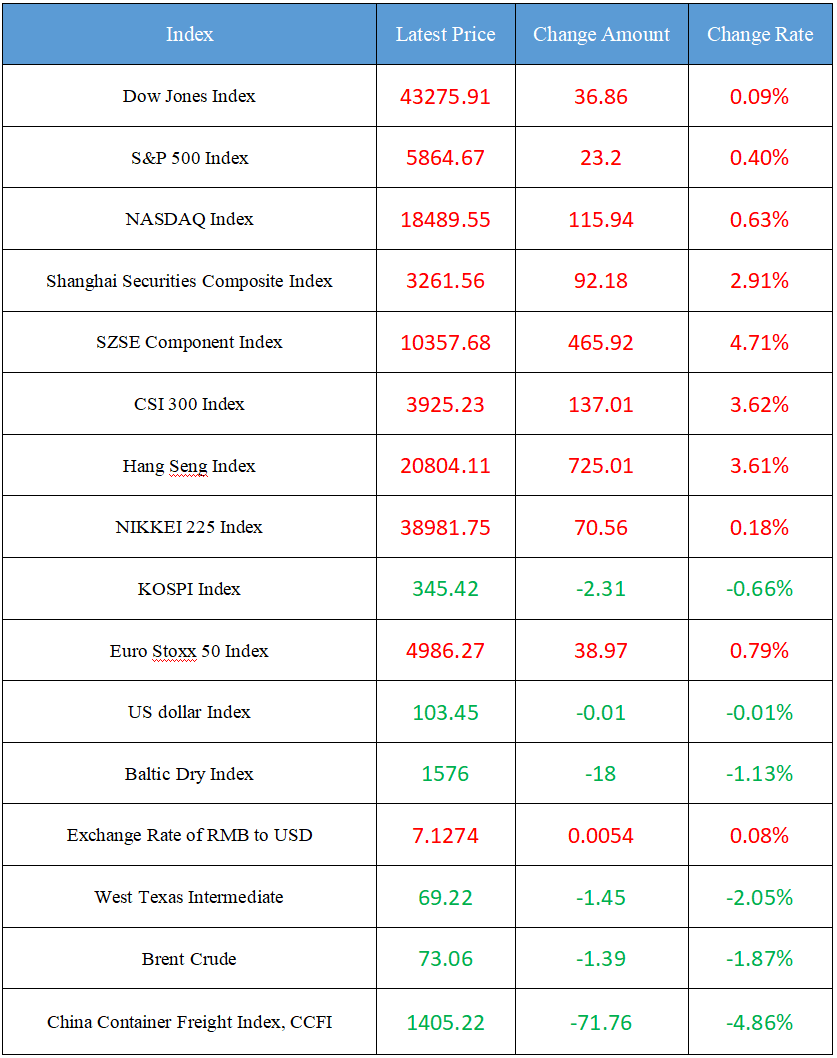

Latest Global Major Index

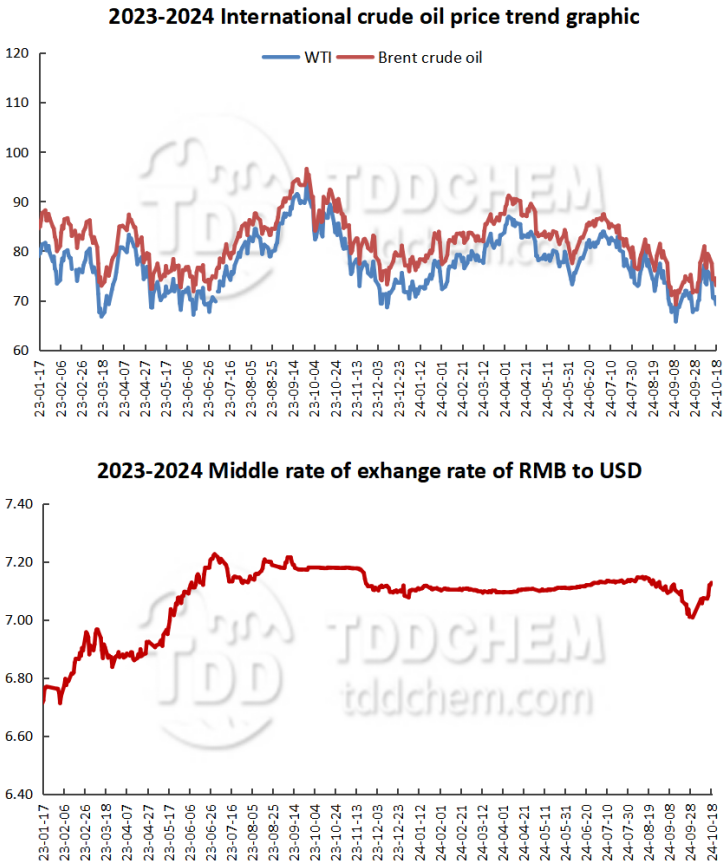

International Crude Price Trend & Exchange Rate of RMB to USD Trend

Domestic News

1. The 6-month opening period is approaching, and new funds are expected to accelerate their entry into the market

2. Support the implementation of new tools in the capital market. Experts: The impact on the bond market is moderate

3. Private equity research is in full swing, and the consumer sector has become a new favorite

4. A fire broke out on a covered bridge at Shanghai Hongqiao Airport, and it was suspected that the power bank spontaneously combusted

5. Bankers: It is expected that a number of listed companies will disclose special loan announcements soon

International News

1. Gold company stocks are expected to push the Australian stock market higher

2. Germany denies legislation to prevent foreign capital from annexing domestic banks

3. Putin: Russia and the U.A.E. are "strategic partners"

4. Sudan and South Sudan discussed the resumption of South Sudanese oil exports through Sudan

5. Israeli officials say Israel's response to Iran's missile attack is "final"

Domestic News

1. The 6-month opening period is approaching, and new funds are expected to accelerate their entry into the market

Despite the current high sentiment in the A-share market, the net value of most new fund products is still almost zero volatility. Industry participates believe that this phenomenon may be related to the survival characteristics of new fund products, and even a slight loss of 5% in new products may have a negative impact on the scale of fund products and the later operation of fund managers. Therefore, some fund managers are still waiting for a better opportunity to open positions in the rapidly volatile market to avoid excessive short-term volatility after buying, which will affect the stability of the fund. Considering that many new fund products have an agreed opening period of up to 6 months, it is clear that the sub-new products with low positions also have more room to go long. At present, there is a strong expectation that market sentiment will continue to pick up in the coming months, and new funds are likely to accelerate their positioning.

2. Support the implementation of new tools in the capital market. Experts: The impact on the bond market is moderate

On October 18, the operating rules of SFISF were officially clarified, covering key contents such as the scope of collateral, swap period and bidding rate. The first batch of 20 non-bank institutions have applied for more than 200 billion yuan, and market analysis believes that this tool will enhance the ability of securities, funds and insurance companies to obtain funds in the capital market, and have a positive impact on the stock market, while the overall impact on the bond market is moderate. One macro researcher said the impact of the implementation of swap facilities on the bond market was relatively limited. Treasury bonds originally held by the People's Bank of China were transferred to securities companies through swap operations. If securities companies plan to use these treasury bonds for stock investment, they need to pledge these treasury bonds first, thus increasing the supply of treasury bonds in the interbank market to a certain extent.

3. Private equity research is in full swing, and the consumer sector has become a new favorite

Since October, the market has rebounded, and private equity research has also been in full swing. According to the latest statistics of the private placement network, in the first half of October, more than 200 private placements have investigated 45 listed companies, including many bull stocks that rose by more than 40% in the first half of October. From the perspective of industry distribution, the consumer sector has become the new favorite of private equity research, and many leading private equity companies have increased their layout in the consumer sector. In the view of industry insiders, under the continuous release of favorable policies, the structural market of A-shares is expected to continue to deduce, and the consumer sector that has benefited from policy support and has fallen deeply in the early stage is worth focusing on and excavating.

4. A fire broke out on a covered bridge at Shanghai Hongqiao Airport, and it was suspected that the power bank spontaneously combusted

On the afternoon of October 20, in the T2 terminal of Shanghai Hongqiao Airport, a fire suddenly broke out in the bridge when an inbound flight got off the passengers, and it was suspected that the power bank spontaneously combusted. So far, airport staff have said that the situation has indeed occurred and has been properly handled. The fire has been extinguished and everything is normal with the people on board. The airline has not made a public response for the time being.

5. Bankers: It is expected that a number of listed companies will disclose special loan announcements soon

In addition to the first batch of special loans for stock repurchase and increase holdings, the reporter learned that a number of commercial banks are actively collecting the financing needs and time planning of listed companies, saying that the approval process will be launched soon, and it is expected that a number of listed companies will disclose special loan announcements soon. In view of which listed entities are more likely to obtain credit, a number of bank credit centers told reporters that the target customer groups should strictly comply with the national strategic guidelines and the bank's credit policy guidelines, including those with outstanding main business, stable operating conditions, good credit records, strong repayment ability, competitive advantages and growth potential in the industry.

International News

1. Gold company stocks are expected to push the Australian stock market higher

Australia stocks are set to open higher on Monday, with potential gains in gold-like stocks compensating for some of the potential losses in mining and energy stocks on the back of falling commodity prices. Australian stock index futures rose 0.5%, a premium of 81.8 points to the closing of Australia's S&P/ASX200 index. The index fell 0.9% on Friday. New Zealand's S&P/NZX50 index fell 0.8% in early trade.

2. Germany denies legislation to prevent foreign capital from annexing domestic banks

A spokesman for the Germany Ministry of Finance denied considering new legislation to prevent foreign banks from annexing Germany banks. Italy's largest bank, UniCredit, recently acquired a stake in Commerzbank Germany, becoming the latter's largest shareholder, sparking merger fears. The Italy newspaper La Repubblica earlier quoted a source close to the German government as saying that Germany is considering legislation to prevent foreign capital from acquiring 100% of local banks, as well as requiring local banks to be listed in Germany.

3. Putin: Russia and the U.A.E. are "strategic partners"

On Sunday, Russia President Vladimir Putin told the visiting U.A.E. counterpart that the relationship between the two countries amounted to a "strategic partnership" and thanked him for his mediation efforts to exchange prisoners of war with Ukraine. Russia news agencies quoted Putin as saying that the situation in the Middle East is "complicated" and that Israel has waged war against Gaza and southern Lebanon. Russia President Vladimir Putin expressed gratitude for the relationship with the U.A.E. President, which has enabled the two countries to solve the problem. He singled out the two-and-a-half-year-long conflict between Russia and Ukraine, where the U.A.E. helped arrange prisoner exchanges.

4. Sudan and South Sudan discussed the resumption of South Sudanese oil exports through Sudan

Sudanese Sovereign Council Chairman and Commander-in-Chief of the Armed Forces Burhan met with visiting South Sudanese President's Security Adviser Tut·Garwak in the eastern Sudanese city of Port Sudan on the 20th, and the two sides discussed the resumption of South Sudanese oil exports through Sudan. In a statement issued on the same day, Garwak said that "oil is the lifeblood of the people of both countries" and that it is necessary to address all obstacles to the export of South Sudanese oil through Sudan. The energy and oil Ministries of both countries will meet to discuss how to address the issue, and the technical teams of both sides are ready to ramp up oil production.

5. Israeli officials say Israel's response to Iran's missile attack is "final"

On the evening of the 20th local time, it was learned from Israel that some Israel officials revealed that Israel's response to Iran's missile attack has been "set in stone". The news also shows that the drone attack on Israel Prime Minister Benjamin Netanyahu's residence on the 19th will not affect the scale or timing of Israel's attack on Iran. It is reported that the Israel Security Cabinet meeting will be held later to discuss Israel's response to Iran and the progress of the agreement with Gaza Strip organizations on the exchange of detainees, and report on the drone attack on the Israeli Prime Minister's residence. In addition, the meeting will provide an update on the fighting in Lebanon and Gaza.

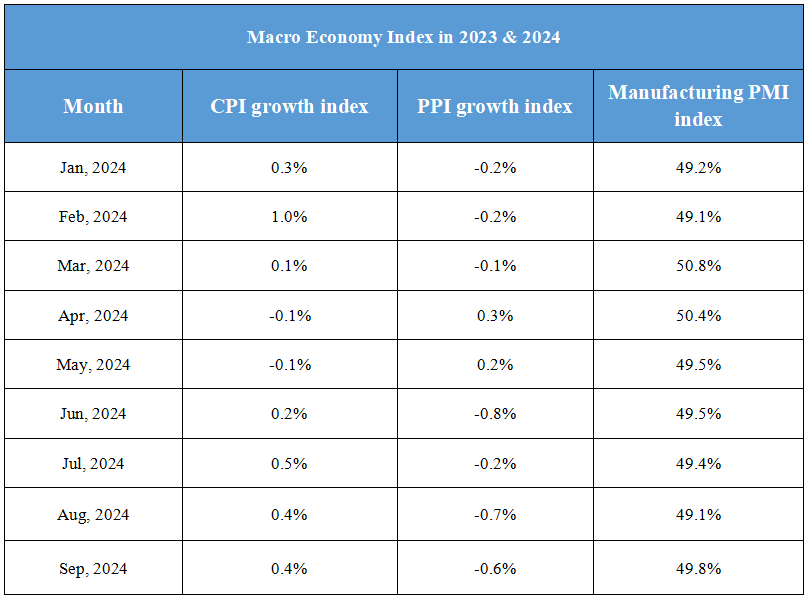

Domestic Macro Economy Index