October 21st Macroeconomic Index: Equity Fund Issuance Heats Up, M&A Policy Boosts Industrial Fund Enthusiasm

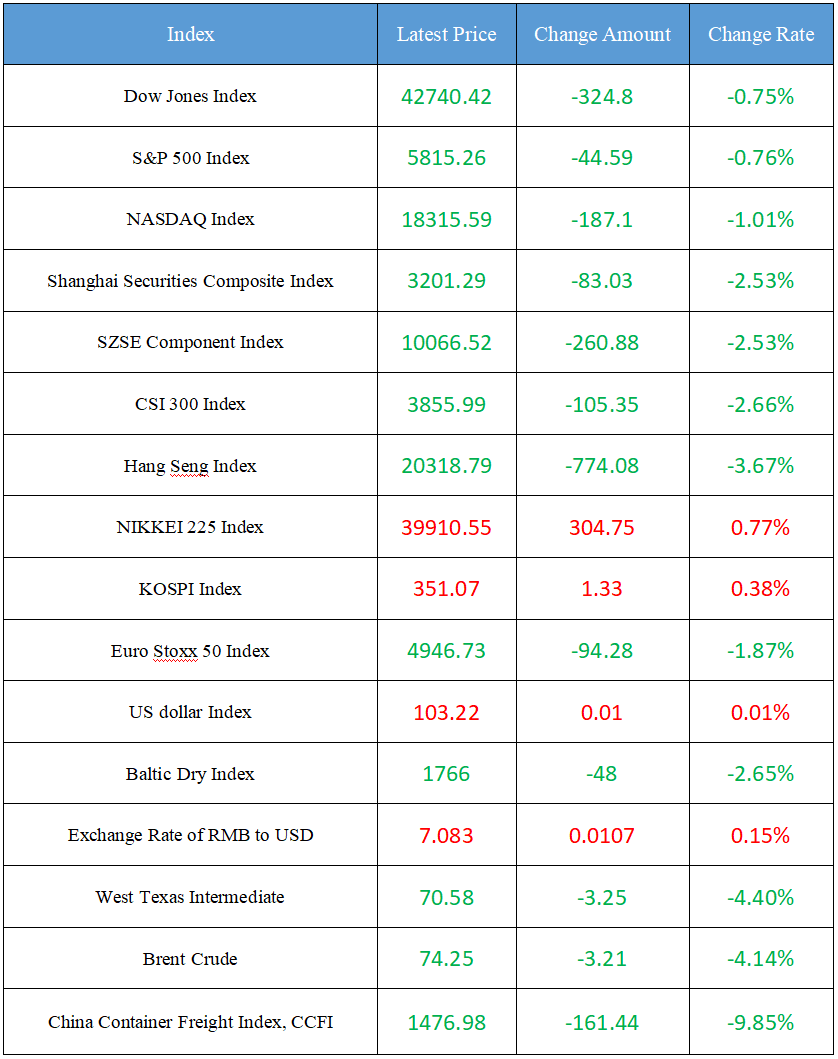

Latest Global Major Index

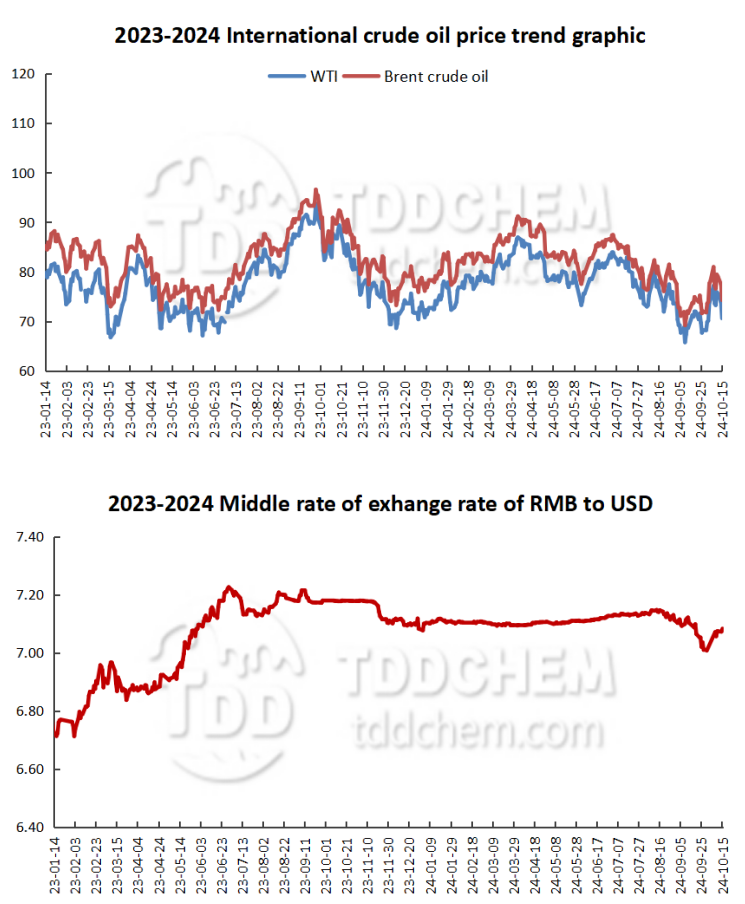

International Crude Price Trend & Exchange Rate of RMB to USD Trend

Domestic News

1. The issuance of equity funds is heating up, and the pace of position building is accelerated in a timely manner

2. The warm wind of mergers and acquisitions policy is blowing, and the enthusiasm of listed companies to set up industrial funds is high

3. The scale of private asset management of securities companies reached 5.75 trillion yuan, and the layout of "private placement + public offering" was accelerated

4. Demand is expected to improve in the fourth quarter, and pig prices may remain range-bound

5. The fund is improving but encounters embarrassment. Institutions suggest investors change their thinking.

International News

1. Prime Minister of Qatar: No other country is allowed to use its military base in Qatar to launch military operations

2. International Organization for Migration: Sudan has more than 14 million displaced people

3. Fed's Daly: The FOMC meeting was more heated than the voting results

4. Netherlands Rabobank: The euro is still likely to fall in the medium term

5. Lebanon may be greylisted by the FATF due to poor anti-money laundering

Domestic News

1. The issuance of equity funds is heating up, and the pace of position building is accelerated in a timely manner

Recently, a number of equity funds have ended their fundraising ahead of schedule, and new funds have also seized the opportunity to build positions. Industry participates said that new funds should speed up the pace of position building in a timely manner, and pay close attention to investment targets and industry rotation opportunities to achieve the optimal allocation of investment portfolios. At the same time, the market generally believes that the release of good policy news has laid a solid foundation for the long-term healthy development of the stock market. According to the data, as of October 15, 50 funds have begun to subscribe since October, of which 9 have now closed for subscription. Looking back on September, the issuance of equity products heated up, and 37 new equity funds were established in the month, with a total of 25.150 billion shares issued, a new high for the year.

2. The warm wind of mergers and acquisitions policy is blowing, and the enthusiasm of listed companies to set up industrial funds is high

Since the beginning of this year, under the warm wind of mergers and acquisitions and restructuring policies, the enthusiasm of listed companies to participate in the establishment of industrial funds has been increasing. Since September alone, 19 listed companies have announced that they intend to participate in the establishment of new industrial funds. In addition, nearly 70 listed companies have issued announcements related to the establishment of industrial funds, covering the completion of industrial and commercial registration, fund filing, or other relevant progress. Listed companies are actively exploring new growth points through industrial funds, optimizing resource allocation, and accelerating transformation and upgrading. A number of interviewed veterans in the investment community said that the establishment of industrial funds by listed companies will become a long-term trend and play a more important role in the investment market, becoming an important part of the "patient capital" of China's economy in the future.

3. The scale of private asset management of securities companies reached 5.75 trillion yuan, and the layout of "private placement + public offering" was accelerated

At present, the asset management of securities companies is continuously optimizing the structure, improving the active management capabilities, and actively establishing the layout of "asset management sub + public offering sub", enriching the asset management product portfolio and realizing complementary advantages of products. Recently, the transformation process of large collection products of securities companies is also accelerating, such as Guoyuan Securities chose to change the manager of its large collection reference public fund transformation products. At the same time, the latest data shows that as of the end of August, the total scale of private asset management of securities companies was 5.75 trillion yuan, an increase of 442.985 billion yuan or 8.35% from the end of last year. At the same time, the establishment scale of private asset management products of securities companies in August was a new high in the past year, showing the vigorous development of the asset management business of securities companies.

4. Demand is expected to improve in the fourth quarter, and pig prices may remain range-bound

After a short rebound, the future price of pig returned to decline recently, and the 2411 contract once touched a minimum of 16,635 yuan/ton, a new low since March this year. Industry participates said that the increase in pressure on the supply side, as well as the poor terminal demand during the Mid-Autumn Festival and National Day this year, have led to a weak spot price trend for live pigs in the near future. However, considering that pork consumption will enter the peak season stage of the whole year in the fourth quarter, the room for further decline in pig prices during the year is limited, and there is a high probability that it will remain range-bound.

5. The fund is improving but encounters embarrassment. Institutions suggest investors change their thinking.

Since the start of this round of market, the net value of many funds has recovered rapidly. In this context, some investors choose to enter the market through equity funds, while some investors choose to redeem their products. Recently, a number of funds have issued announcements, suggesting that the fund size is less than 50 million yuan and is facing the risk of liquidation. Fund people believe that due to the impact of the previous market shocks, some investors take the operation of redemption to study and judge the market outlook, and it is expected that the follow-up index will maintain a strong trend of shocks, and the certainty of a long-term upward trend of A shares is strong, and it is recommended that investors change their investment thinking in a timely manner.

International News

1. Prime Minister of Qatar: No other country is allowed to use its military base in Qatar to launch military operations

On the 15th local time, Prime Minister and Foreign Minister of Qatar Mohammed said that Qatar does not allow any country to use its military base in Qatar to carry out military strikes or wars against other countries. Mohammed said that Qatar and United States are strategic partners, and the two sides enjoy full sovereignty and do not interfere in each other's affairs. He also said that Qatar has been committed to mediating the Israeli-Palestinian conflict, but the agreement requires the cooperation of both sides of the conflict. Qatar will continue its diplomatic efforts to end Israel's military operations in Palestine. In addition, the Qatar side also hopes to promote an immediate ceasefire in Lebanon and has engaged extensively with the Lebanon side. At present, United States, Turkey and other countries have military bases in Qatar, among which the Al Udaid airbase is one of the largest military installations in the Middle East in United States.

2. International Organization for Migration: Sudan has more than 14 million displaced people

On October 15, local time, the International Organization for Migration issued a report on the situation in Sudan, saying that the current displaced population in Sudan has exceeded 14 million. There are currently more than 10.91 million internally displaced people in Sudan, of whom 8.16 million fled their homes after the outbreak of the armed conflict in Sudan, while the remaining 2.75 million were displaced before the outbreak of the conflict, the report said. In addition, more than 3.11 million Sudanese have sought refuge in Sudan's neighbouring countries as a result of the conflict.

3. Fed's Daly: The FOMC meeting was more heated than the voting results

Fed watchers note that there has been relatively little dissent in the Fed's official rate-setting vote during the rapid rate hikes over the past few years and the rate cuts that began last month. Fed's Daly said in a speech at NYU's Stern School of Business, but that doesn't mean there aren't heated debates at every FOMC meeting. Daly said the voting committee may disagree with a Fed decision, but they won't disagree if their disagreement doesn't rise to a firm disagreement. "Dissent is not the only sign of disagreement and controversy." She said.

4. Netherlands Rabobank: The euro is still likely to fall in the medium term

Jane Foley, s currency strategist at Netherlands Co-operative Bank, said in a note that while the European Central Bank may be cautious about future interest rate cuts at Thursday's meeting due to stubbornly high inflation in the services sector, the euro may appreciate in the short term, its short-term gains are unlikely to last. Regardless of who wins the United States presidential election in November, the euro is still likely to fall against the dollar in the medium term. Neither United States presidential candidate is aware of the need for budget consolidation, suggesting that United States' fiscal policy could exacerbate inflation. This could make the dollar's strength more durable.

5. Lebanon may be greylisted by the FATF due to poor anti-money laundering

Lebanon has been shut out of global debt markets and is expected to be placed on a "grey list" by regulators due to deficiencies in combating illicit financing. The Paris-based Financial Action Task Force on Money Laundering (FATF) is poised to greylist Lebanon as early as October 25, according to people familiar with the matter. No final decision has been made yet. Being greylisted will add obstacles to a country that defaulted on its debt for the first time in 2020, is battling high inflation and has been operating without a president at the helm. Lebanon is also battling Israel forces as Israel tries to reduce the threat posed by Hezbollah. A FATF spokesperson declined to comment, and the central bank of Lebanon did not respond to a request for comment.

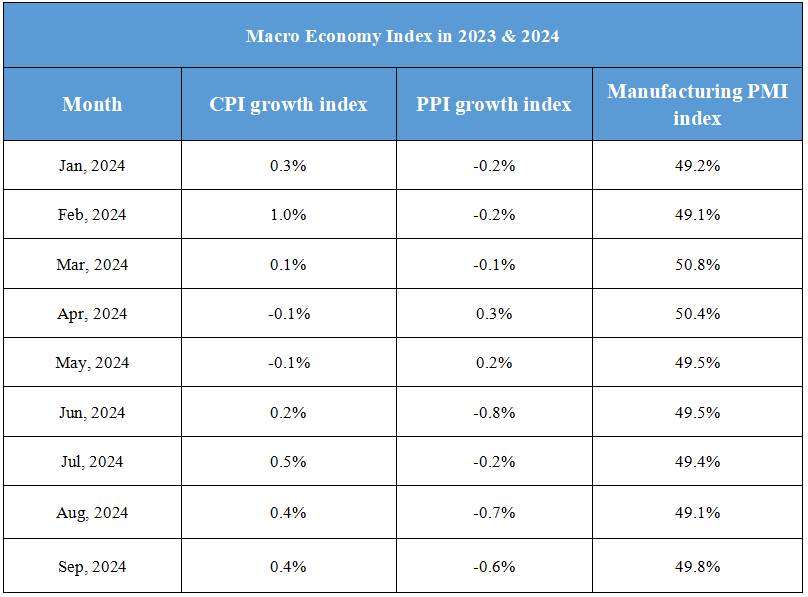

Domestic Macro Economy Index