October 16th Macroeconomic Index: Chinese Equity ETFs Attract Over $5 Billion, Global Smartphone Market Grows 5%

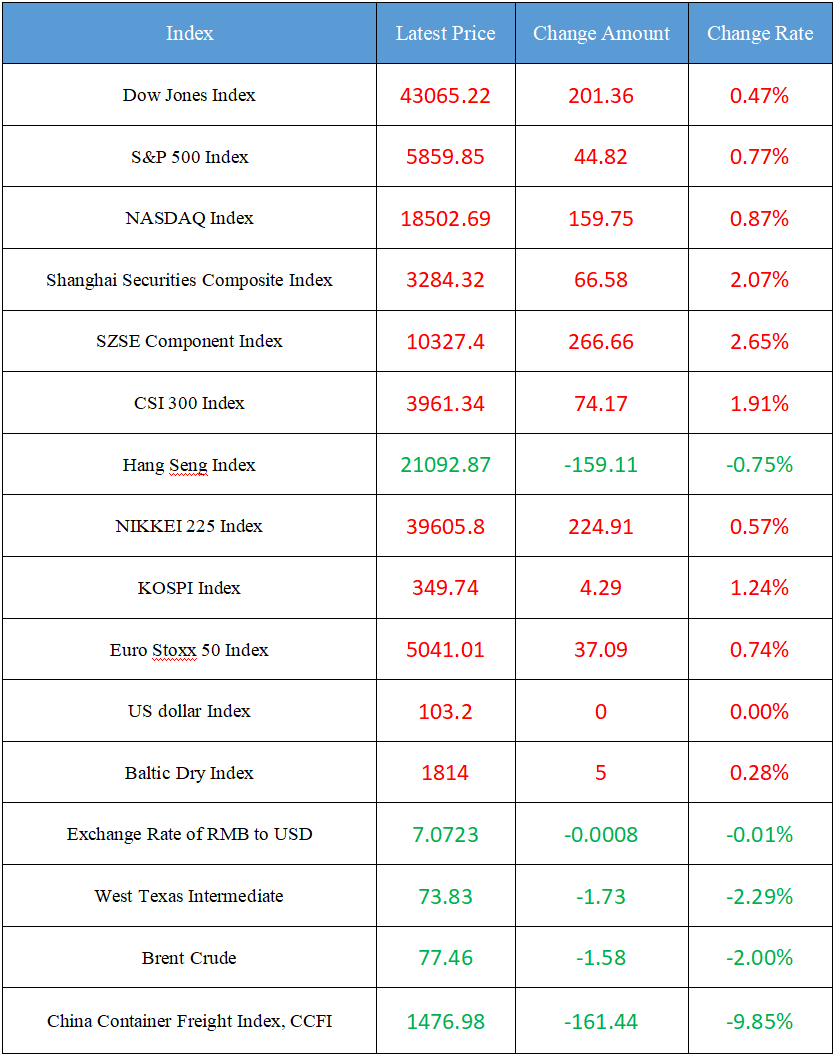

Latest Global Major Index

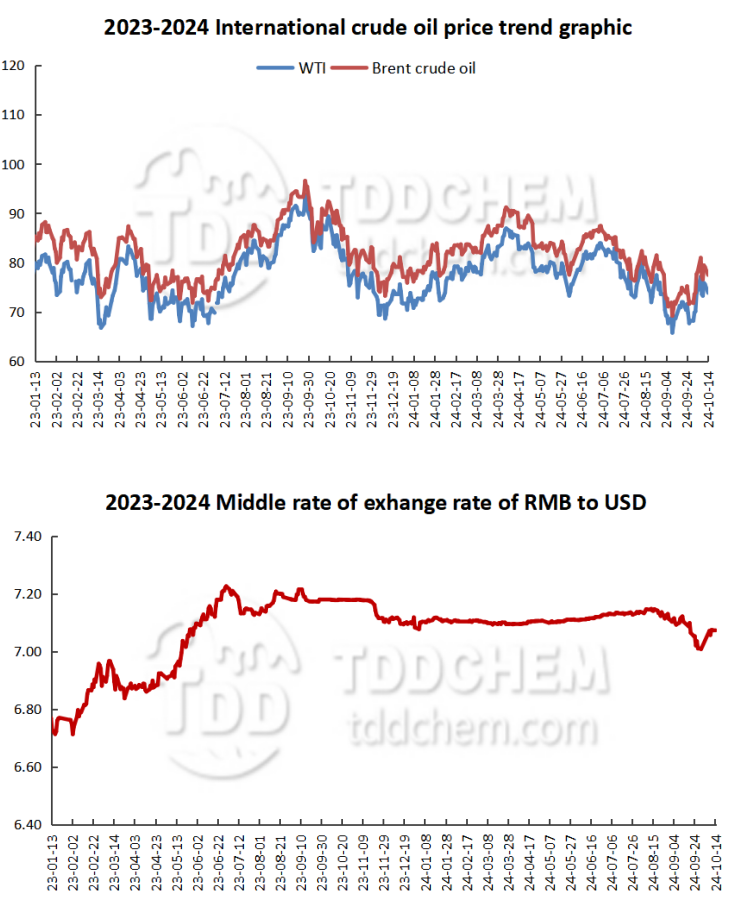

International Crude Price Trend & Exchange Rate of RMB to USD Trend

Domestic News

1. There is long-term optimism about the equity market. Insurance funds have a strong willingness to increase allocation on low

2. Chinese equity ETFs attracted more than $5 billion in a single week

3. Institutions: The global smartphone market grew by 5% in the third quarter, achieving four consecutive quarters of growth

4. Wang Yi had a telephone conversation with Iran Foreign Minister Araghzi

5. Fund managers “take the pulse” of the market in the fourth quarter and actively prepare for the "second stage" market

International News

1. Kim Jong Un presided over a meeting on national defense and security to clarify the military-political stance

2. Warren Buffett continued to invest and buy a broadcaster in a row

3. Tesla's humanoid robot is reported can be remotely controlled

4. Nvidia's stock price closed at a record high. Investors expect AI demand to be strong for a long time

5. US media: Israel will avoid hitting Iran's energy and nuclear facilities, and International oil prices plummeted

Domestic News

1. There is long-term optimism about the equity market. Insurance funds have a strong willingness to increase allocation on low

It was learned from the relevant persons in charge of a number of insurance institutions that the market turned too fast at the end of September, and the pace of adjustment of the equity positions of many insurance institutions was slow, and they did not fully grasp the rapid rise of the market. After the National Day holiday, the market rebounded, and insurance institutions that have been optimistic about the performance of the equity market for a long time are interested in increasing the allocation of equity assets on dips. "At the end of September, we took into account that the fiscal policy increase has not yet been substantially implemented, and it is predicted that the National Day holiday may be a stage high of market sentiment, so we have been more cautious in our positions, and we are basically 'standing still'." The person in charge of equity investment of a large insurance asset management company in Shanghai told reporters.

2. Chinese equity ETFs attracted more than $5 billion in a single week

Last week, investors poured massive amounts of money into Chinese equity-related exchange-traded funds (ETFs). Bloomberg aggregate data showed a total of $5.44 billion flowing into emerging market ETFs traded in the United States in the week ended Oct. 11, although bond funds saw small outflows. Chinese equities absorbed $5.15 billion. Led by the iShares China Large Cap ETF, which attracted US$2.5 billion, while the Deutsche Bank Xtrackers Harvest CSI 300 China A-share ETF recorded a record weekly inflow of US$1.5 billion. iShares, iShares, MSCI China ETF and Direxion Daily Triple Long FTSE China ETF also attracted $762 million and $735 million, respectively.

3. Institutions: The global smartphone market grew by 5% in the third quarter, achieving four consecutive quarters of growth

According to the Canalys research report, in the third quarter of 2024, global smartphone shipments increased by 5% year-on-year, achieving four consecutive quarters of growth. Samsung leads the way in smartphone shipments, accounting for 18% of the world's total. Apple's market share reached 18%, ranking second. With a market share of 14%, Xiaomi continues to maintain its position as the third largest smartphone manufacturer. OPPO returned to fourth place in the market for the first time this year with a market share of 9%. Vivo is among the top five with double-digit growth and a 9% market share.

4. Wang Yi had a telephone conversation with Iran Foreign Minister Araghzi

On October 14, Wang Yi, Member of the Political Bureau of the CPC Central Committee and Foreign Minister, had a telephone conversation with Iran's Foreign Minister Araghzi. The two sides spoke positively of China-Iran relations and pledged to maintain exchanges at all levels and promote practical cooperation. Wang Yi said that the negative impact of the current conflict in Gaza has clearly spilled over, and regional tensions have been escalating. China has always advocated resolving hotspot issues through dialogue and consultation, opposes the intensification of contradictions and the expansion of conflicts, opposes adventurous military actions, and calls on all parties to do more things conducive to maintaining regional peace and stability. China will continue to demonstrate its responsibility as a responsible major country, proceed from the merits of the matter, strengthen communication with all parties, pool more international consensus and strength, and play a constructive role in de-escalating the conflict. Wang Yi said that China is happy to see the Iran government carrying out mediation diplomacy to enhance understanding with all parties and improve relations with countries in the region.

5. Fund managers “take the pulse” of the market in the fourth quarter and actively prepare for the "second stage" market

Recently, a reporter from the Shanghai Securities Daily jointly conducted an investment survey on the fund managers of domestic mainstream fund companies. The results show that nine out of ten fund managers remain optimistic about the market in the fourth quarter, focusing on technology, finance, consumer and other sectors. A number of fund managers said that this wave of market will gradually shift from the first stage of the emergence of "policy combination punches" and the general rise of the market to the second stage of verifying economic fundamentals. In addition, after the sharp rise, the fund manager's "playing style" has changed, and while ensuring the early results, he is actively preparing for the subsequent differentiation of the market.

International News

1. Kim Jong Un presided over a meeting on national defense and security to clarify the military-political stance

On October 14, local time, Kim Jong-un, General Secretary of the Workers' Party of Korea and Chairman of the State Affairs Commission of the DPRK, presided over a national defense and security meeting. After receiving a report on the implementation of the relevant work of the General Staff and the state of readiness for the mobilization of the main joint forces, Kim Jong Un pointed out the current direction of military activities and set out the tasks of activating the national defense forces and exercising the right of self-defense to safeguard the country's sovereignty and security interests. At the meeting, Kim Jong-un expounded the hard-line military-political stance of the DPRK party and government.

2. Warren Buffett continued to invest and buy a broadcaster in a row

Broadcaster Sirius recently filed with regulators showing that Buffett' investment company, Berkshire·Hathaway, bought shares of the company for a total value of $86.73 million. Berkshire· Hathaway bought 869,800 shares of Sirius XM shares last Wednesday, according to the regulatory filing; Bought 917,800 and 517,200 shares of the company in two separate transactions on Thursday and another 1,259,300 shares on Friday. As a rough calculation, Berkshire·Hathaway bought about $86.73 million worth of Sirius XM shares in three days, increasing his total stake in the company to 108.72 million shares. The reporter's inquiry learned that as early as November 2023, Berkshire·Hathaway disclosed its stake in Sirius XM.

3. Tesla's humanoid robot is reported can be remotely controlled

According to foreign media citing people familiar with the matter, in Tesla’s (TSLA. O) "We, Robot" showcase last week, Tesla remotely controlled its prototype Optimus humanoid robot, with employees elsewhere responsible for controlling many of the interactions between the humanoid robot and attendees. At least one video purportedly from the Oct. 10 "We, Robots" campaign online shows an Optimus "bartender" admitting that it was "helped by humans." The Optimus prototype can be controlled by artificial intelligence without external control.

4. Nvidia's stock price closed at a record high. Investors expect AI demand to be strong for a long time

Nvidia shares closed at record highs on Monday for the first time in about four months, as investors continue to expect a strong long-term demand trend for artificial intelligence. Nvidia shares closed up 2.4% at $138.07, breaking the record set in June. The stock has recovered 40% from its August lows and is up 179% year-to-date. The rally in 2024 has added more than $2 billion to the company's market capitalization. The stock's recent strong performance was aided by a speech by CEO Jensen Huang. He said demand for the Blackwell chip had reached "insane" levels, alleviating concerns that the chip's release had been delayed due to engineering issues.

5. US media: Israel will avoid hitting Iran's energy and nuclear facilities, and International oil prices plummeted

According to the Washington Post, Israel Prime Minister Benjamin Netanyahu told the Biden administration in a call that he plans to strike Iran's military facilities, not oil or nuclear facilities, suggesting that Israel will take a more limited counterattack to prevent a full-scale "war." It was the first call in months of tensions between Biden and Netanyahu. Officials familiar with the matter said Israel's retaliation would be adjusted to avoid giving the impression of "political interference in United States elections." This suggests that Netanyahu understands that the scope of Israel's attacks has the potential to reshape the presidential campaign. Affected by the news, international oil prices fell by 2 US dollars, and the decline once expanded to 4.5%.

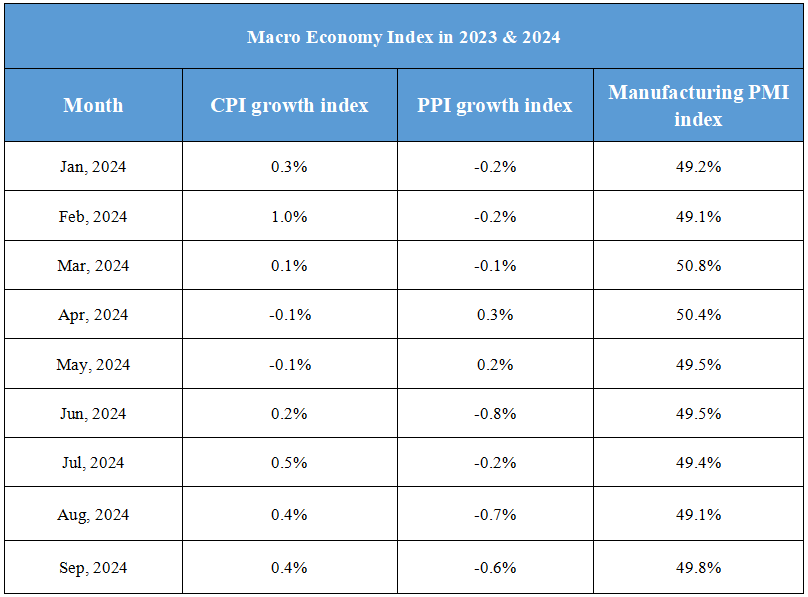

Domestic Macro Economy Index