October 8th Macroeconomic Index: Goldman Sachs Raises S&P 500 Target, A-Share Market Optimism Grows

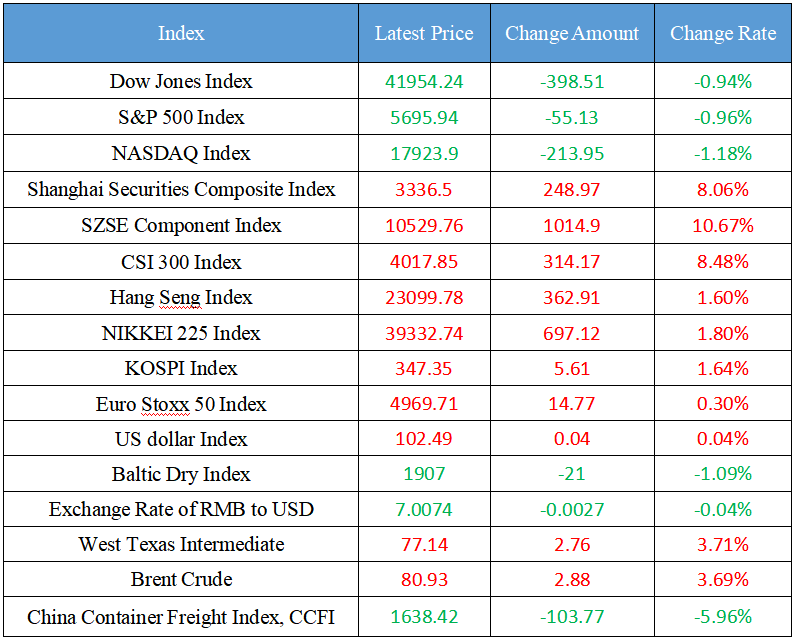

Latest Global Major Index

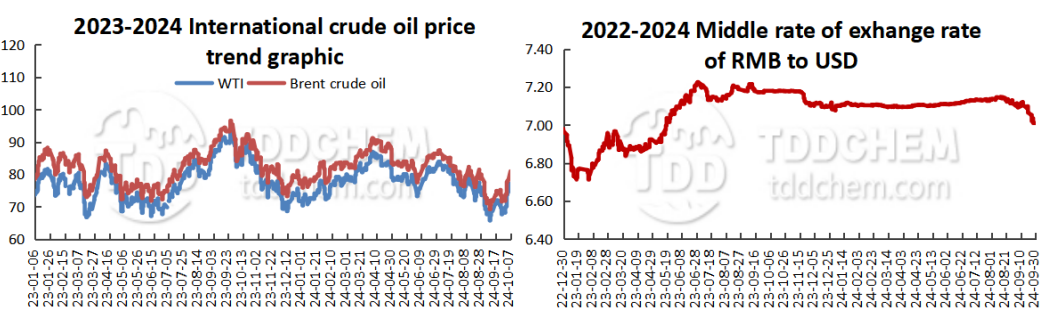

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Goldman Sachs once again raised the target point of the S&P 500 index

2. A-shares are "eager for a fight", and many institutions and economists expressed optimism about the market outlook

3. On the eve of the opening of A-shares, many market funds "rose to the point of suspension"

4. In the first three quarters, local governments borrowed about 6.7 trillion yuan, and the fiscal incremental policy was expected

5. During the National Day, some new real estate projects in Shenzhen sell a suite every 10 minutes

International News

1. FTX's bankruptcy reorganization was approved, and creditors were refunded more than $10 billion

2. The probability that the Fed will cut interest rates by 25BP in November is 86.3%, and the probability of no rate cut rises to 13.7%

3. The United States State Council approved arms sales to Italy, India, and Romania, totaling $965 million

4. Malta prohibits a merchant ship carrying explosives bound for Israel from entering its waters

5. The Israeli army launched a fierce air raid on the southern suburbs of Beirut, the capital of Lebanon

Domestic News

1. Goldman Sachs once again raised the target point of the S&P 500 index

Goldman Sachs' latest report showed that the bank raised its year-end target for the S&P 500 again to 6,300 points (from 5,600 points) and the 12-month target to 6,300 points (from 6,000 points previously), adding that these targets may be "too low". Goldman Sachs said: "Our economists' forecasts for United States GDP growth are higher than the market consensus, and the stable macroeconomic outlook will continue into next year, which favors a modest expansion of the company's profit margins." A recovery in the semiconductor cycle is expected, while the strength of big tech companies will continue to grow. ”

2. A-shares are "eager for a fight", and many institutions and economists expressed optimism about the market outlook

"People are in the scenic area, while their hearts are in the stock market." At a time when everyone is lamenting the quickness of holiday days, market participants from such as exchanges and brokerages have begun to work overtime to prepare for the opening of the market after the holiday. The historical biggest turnover of 2.59 trillion yuan, the surge in account opening, and the early start of brokerages all show the current popularity of the A-share market. On October 8, the first trading day after the National Day holiday, more than 200 million shareholders were "gearing up" and had already thought of a daily limit. Judging from the changes in the global market during the A-share market break, Chinese assets are continuing to be bought. Whether it is from the market sentiment or the rise of peripheral Chinese assets during the market break, many institutions are optimistic about the future market of A-shares. However, some industry experts pointed out that investors should look at the performance of the stock market with a normal heart, and no matter how the market interprets on the first day after the holiday, it will not affect its long-term positive trend.

3. On the eve of the opening of A-shares, many market funds "rose to the point of suspension"

On the eve of the highly anticipated opening of A-shares, a number of on-exchange funds "rose to the point of suspension". On the evening of October 7, four GEM related market funds, including Guotai ChiNext LOF, BOCI ChiNext ETF, Penghua ChiNext LOF Fund, and Guolian Anchuang Technology ETF, issued premium risk warnings and suspension announcements, announcing that they would suspend trading for one hour on the morning of October 8. Recently, due to the sharp rise in A-shares and Hong Kong stocks, the market prices of many funds have deviated greatly from the net value of the fund. There are funds that have obvious premiums due to the phenomenon of capital rushing, and there are also funds that are limited to 10% because of the rise and fall, and the component stocks have risen by more than 10% in batches, and then there has been a phenomenon of ETF price limit but sharp discount.

4. In the first three quarters, local governments borrowed about 6.7 trillion yuan, and the fiscal incremental policy was expected

In order to stabilize investment and economy, local governments have recently accelerated the issuance of bonds to invest in major projects. According to public data, in September, the country issued about 1.3 trillion yuan of local government bonds, and the net financing amount was about 1.1 trillion yuan, both hitting a new high in a single month this year. In the first three quarters of this year, about 6.7 trillion yuan of local government bonds were issued nationwide, including about 4.2 trillion yuan of new bonds and about 2.5 trillion yuan of refinancing bonds. Since the limit of new local government bonds this year is 4.62 trillion yuan, and about 4.2 trillion yuan has been actually issued, the issuance of new bonds is nearing the end, leaving only 0.4 trillion yuan to be issued, and the progress of new bond issuance has caught up with last year. Recently, the executive meeting of the State Council proposed to study and deploy the implementation of a package of incremental policies. With the successive introduction and implementation of financial incremental policies such as RRR and interest rate cuts, the future fiscal incremental policies have received widespread attention from the market. At present, many experts have suggested that consideration should be given to increasing the issuance of treasury bonds, special treasury bonds, and revitalizing the quota of special bonds, so as to appropriately expand fiscal spending and stabilize the economy.

5. During the National Day, some new real estate projects in Shenzhen sell a suite every 10 minutes

On the evening of September 29, Shenzhen introduced a new real estate policy, and the real estate market continued to heat up during the National Day Golden Week. A person in charge of a new real estate project in Bao'an District, Shenzhen, said: "One day, a house was sold every 10 minutes, and the average daily transaction volume increased by three or four times compared with before the new deal. According to data from the Shenzhen Real Estate Agents Association, from October 1 to 6, 1,580 new commercial residential buildings in Shenzhen were subscribed and sold, totaling 163,700 square meters, an increase of 780% over the same period last year, and the average daily transaction number of new houses in Shenzhen in October increased by 169.53% year-on-year compared with September.

International News

1. FTX's bankruptcy reorganization was approved, and creditors were refunded more than $10 billion

United States court judges approved the restructuring plan of cryptocurrency exchange FTX, which went bankrupt two years ago, allowing FTX to repay creditors for the first time, involving more than $14 billion. According to information released by FTX, the group has recovered $14.7 billion to $16.5 billion, and creditors have claimed $11.2 billion. As a result, 98% of creditors can receive 119% of the amount reported in November 2022 under the restructuring plan approved by Judge John Dorsey. FTX CEO John Ray III said the group's goal is to repay all non-government creditors with all arrears and interest. The price of Bitcoin has risen 2.6 times since the collapse of FTX, making the gain from the sale of assets higher than estimated.

2. The United States State Council approved arms sales to Italy, India, and Romania, totaling $965 million

According to CME's "Fed Watch": the probability that the Fed will cut by 25 basis points by November is 86.3%, and the probability of keeping the current interest rate unchanged is 13.7%. The probability of a cumulative rate cut of 50 basis points by December is 78.8%, and the probability of a cumulative rate cut of 75 basis points is 8.9%; The probability of a cumulative rate cut of 100 basis points is 0%.

3. The United States State Council approved arms sales to Italy, India, and Romania, totaling $965 million

On October 7, local time, the United States Department of Defense said that the United States State Council had approved potential arms sales to Italy, India and Romania, totaling $965 million. It is reported that these potential arms sales include the sale of MK 54 MOD 0 light torpedoes to India for $175 million, the Sentinel radar system to Romania for $110 million, and the sale of electronic attack warfare systems to Italy for $680 million.

4. Malta prohibits a merchant ship carrying explosives bound for Israel from entering its waters

A spokesman for the Ministry of Foreign Affairs of Malta said on October 7 local time that a merchant ship reportedly carrying explosives and preparing to sail to Israel was denied entry into its waters by Malta. The spokesman said that the merchant ship had requested to dock in Malta for a crew change, but the Malaysian side had refused and the merchant ship had not been allowed to refuel in Malta.

5. The Israeli army launched a fierce air raid on the southern suburbs of Beirut, the capital of Lebanon

On the evening of October 7, local time, Israel Defense Forces spokesman Avikai·Adraj issued an "evacuation order" through his social account, requiring people near two buildings in the southern suburbs of Beirut, the capital of Lebanon, to quickly evacuate to an area more than 500 meters away from the building, and said that the Israeli army would strike at the facilities of Hezbollah in the area. According to a number of Lebanon media reports, about half an hour after the "evacuation order" was issued, the Israeli army launched a fierce air strike on the southern suburbs of Beirut.

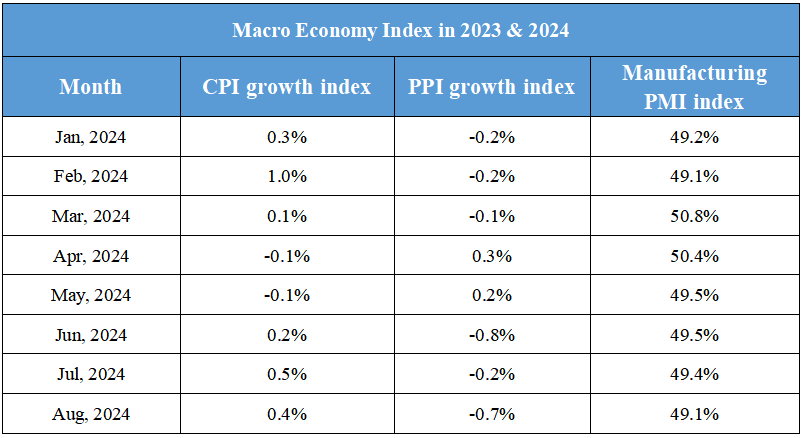

Domestic Macro Economy Index

- December 30 Macroeconomic Index:Financial stability and tariff adjustment guide economic policy, and China-Iran cooperation and Russia-Ukraine negotiations focus on873

- December 27 Macroeconomic Index:Energy Security and Economic Outlook658

- December 26 Macroeconomic Index:The interaction between new real estate policies, energy achievements and global political economy594

- December 25 Macroeconomic Index:Domestic policies are advanced in many aspects, and international energy and population challenges coexist - News overview at the end of 2024689

- December 24 Macroeconomic Index:Changes in India’s oil import sources, US and European economic indicators and energy agreement concerns504