December 14th, Key Insights in Global and Domestic Macro Economy

Daily Macro Economy News

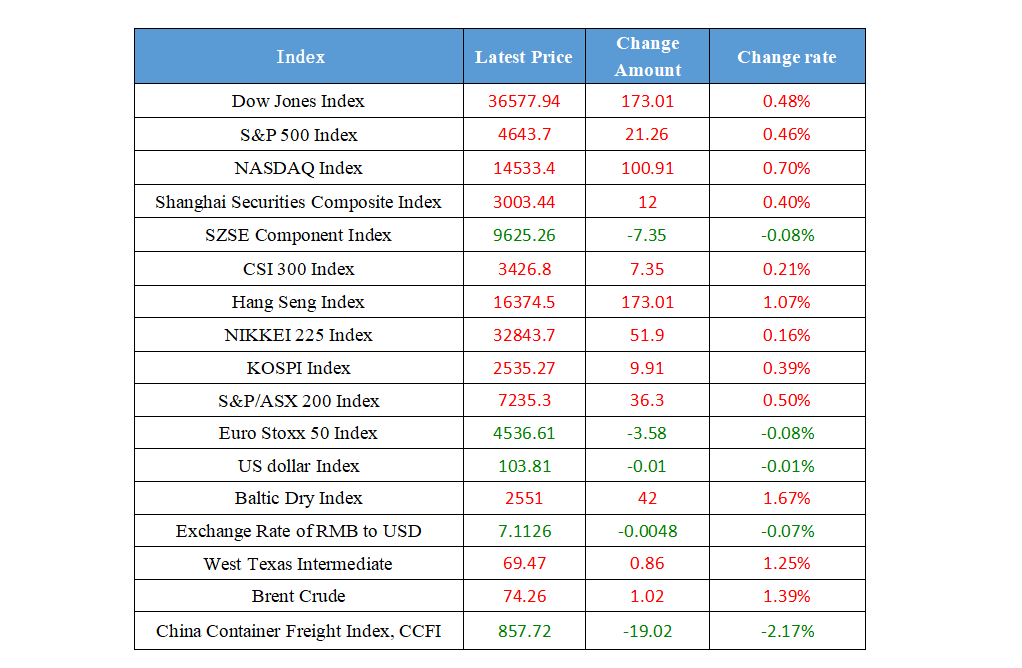

Latest Global Major Index

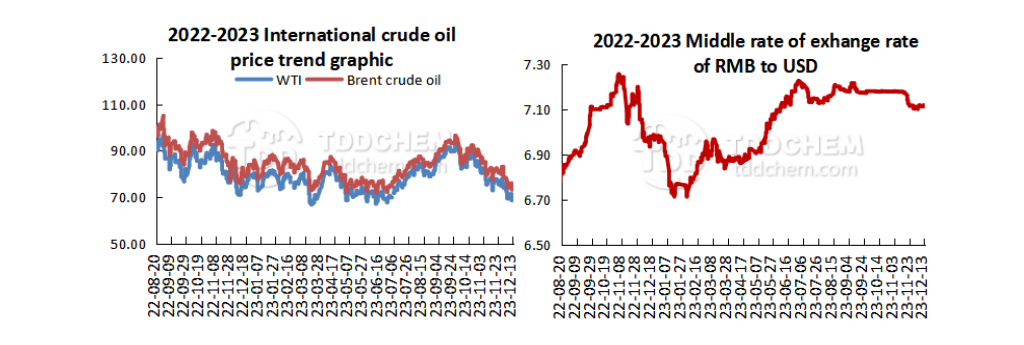

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The increase in loans in the first 11 months of this year has exceeded that of last year, and data such as M2 and social finance also show that finance has strong support for the real economy

2. The China Center for International Economic Exchanges held the "2023-2024 China Economic Annual Conference", and many departments revealed the policy direction for the next stage

3. China and Vietnam issued the Joint Statement on Further Deepening and Enhancing the Comprehensive Strategic Cooperative Partnership and Building a China-Vietnam Community with a Shared Future of Strategic Significance

4. The State Administration for Market Regulation held an enlarged meeting of the Party Group to convey the spirit of the Central Economic Work Conference

International News

1. Powell: The Fed is aware of the risk of not cutting interest rates fast enough

2. Nikkei: The Bank of Japan may withdraw from the negative interest rate policy sooner than expected

3. Charlotte analysts: The FOMC statement and economic forecast are quite moderate, which is conducive to corporate bond issuance

4. OPEC released a monthly report pointing out that the growth rate of global crude oil demand is forecast to be 2.5 million barrels per day in 2023 and 2.2 million barrels per day in 2024

Domestic News

1. The increase in loans in the first 11 months of this year has exceeded that of last year, and data such as M2 and social finance also show that finance has strong support for the real economy

China's RMB loans increased by 1.09 trillion yuan in November, a year-on-year decrease of 136.8 billion yuan, and a cumulative increase of 21.58 trillion yuan in the first 11 months, an increase of 1.55 trillion yuan year-on-year. In November, the increase in the scale of social financing was 2.45 trillion yuan, 455.6 billion yuan more than the same period of last year, and the cumulative amount in the first 11 months was 33.65 trillion yuan, 2.79 trillion yuan increase year-on -year. At the end of November, the balance of broad money (M2) was 291.2 trillion yuan, up 10% year-on-year. The analysis points out that the increase in loans in the first 11 months of this year has exceeded that of last year, and data such as M2 and social finance also show that finance has strong support for the real economy.

2. The China Center for International Economic Exchanges held the "2023-2024 China Economic Annual Conference", and many departments revealed the policy direction for the next stage

The China Center for International Economic Exchanges held the "2023-2024 China Economic Annual Conference", and many departments revealed the policy direction for the next stage. Han Wenxiu, deputy director of the Central Finance Office in charge of daily work, said that the main expected goals of this year are expected to be successfully achieved, and the economic rebound will be consolidated and strengthened next year, and the policy effects such as the issuance of additional treasury bonds will continue to be released next year. Dong Jianguo, Vice Minister of the Ministry of Housing and Urban-Rural Development, said that he would support real estate companies with tight capital chains to solve the problem of short-term cash flow constraints to promote their resumption of normal operations, and resolutely prevent the concentrated outbreak of debt default risks. Lin Zechang, director of the General Department of the Ministry of Finance, said that next year's active fiscal policy should be moderately strengthened, improve quality and efficiency, and do a good job in six "efforts". Lu Lei, deputy director of the State Administration of Foreign Exchange, said that it is necessary to actively revitalize the financial resources that are inefficiently occupied and improve the efficiency of capital use.

3. China and Vietnam issued the Joint Statement on Further Deepening and Enhancing the Comprehensive Strategic Cooperative Partnership and Building a China-Vietnam Community with a Shared Future of Strategic Significance

China and Vietnam issued the Joint Statement on Further Deepening and Enhancing the Comprehensive Strategic Cooperative Partnership and Building a China-Vietnam Community with a Shared Future of Strategic Significance. The two sides agreed to promote cross-border standard-gauge railway connectivity between China and Vietnam, study and promote the construction of Lao Cai-Hanoi-Haiphong standard-gauge railway in Vietnam, and carry out research on Dong Dang-Hanoi and Mong Cai-Ha Long-Haiphong standard-gauge railways in a timely manner. We will do a good job in running economic and trade cooperation zones, focusing on strengthening investment cooperation in agriculture, infrastructure, energy, digital economy, green development and other fields, and taking practical measures to expand the scale of bilateral trade in a balanced and sustainable direction.

4. The State Administration for Market Regulation held an enlarged meeting of the Party Group to convey the spirit of the Central Economic Work Conference

The State Administration for Market Regulation held an enlarged meeting of the party group to convey the spirit of the Central Economic Work Conference. The meeting pointed out that it is necessary to focus on the construction of a modern industrial system and the expansion of domestic demand, and give full play to the leading role of quality support and standards. It is necessary to focus on deepening the reform of key areas and highlight the quality of the development of business entities.

International News

1. Powell: The Fed is aware of the risk of not cutting interest rates fast enough

Fed Chair Jerome Powell said at this press conference that he wants to make sure that it is not too late to ease policy as policymakers consider the timing of interest rate cuts. Powell stated that we are aware of the risks of “staying on hold for too long" and cutting rates too late. He acknowledged that the Fed's new projections show that interest rates will be lowered before inflation returns to 2%, and he deemed that reflected a lag in the impact of monetary policy adjustments on the economy.

2. Nikkei: The Bank of Japan may withdraw from the negative interest rate policy sooner than expected

An article in Nikkei argues that the Bank of Japan may exit its negative interest rate policy sooner than expected, between January and March next year, as bets that the Fed is now expected to cut interest rates in 2024 have already increased. A BOJ insider said: "The end of negative interest rate policy will be the beginning of a tightening cycle. "The Bank of Japan is the only central bank in the world with a negative interest rate policy, so along this line of thinking, exiting the negative interest rate policy will be accompanied by multiple rate hikes and will mean the first rate hike in about 17 years.

3. Charlotte analysts: The FOMC statement and economic forecast are quite moderate, which is conducive to corporate bond issuance

Blair Shwedo, head of the U.S. at Charlotte, believes that the FOMC statement and economic forecasts are quite moderate and seem to be eagerly awaited by the market over the past few weeks. The Fed's forecasts confirm the market's expectations for a rate cut in 2024. This should be a very welcome environment for corporate bond issuance, as the combination of stronger US Treasuries and tighter credit spreads has caused investment-grade bond yields to fall by more than 100 basis points since early November.

4. OPEC released a monthly report pointing out that the growth rate of global crude oil demand is forecast to be 2.5 million barrels per day in 2023 and 2.2 million barrels per day in 2024

OPEC released a monthly report saying that global crude oil demand growth is forecast to be 2.5 million b/d in 2023 and 2.2 million b/d in 2024. The report raised the global growth forecast for 2023 to 2.9% and 2.6% for 2024, and the US economic growth forecast for 2023 to 2.4% and 1% for 2024.

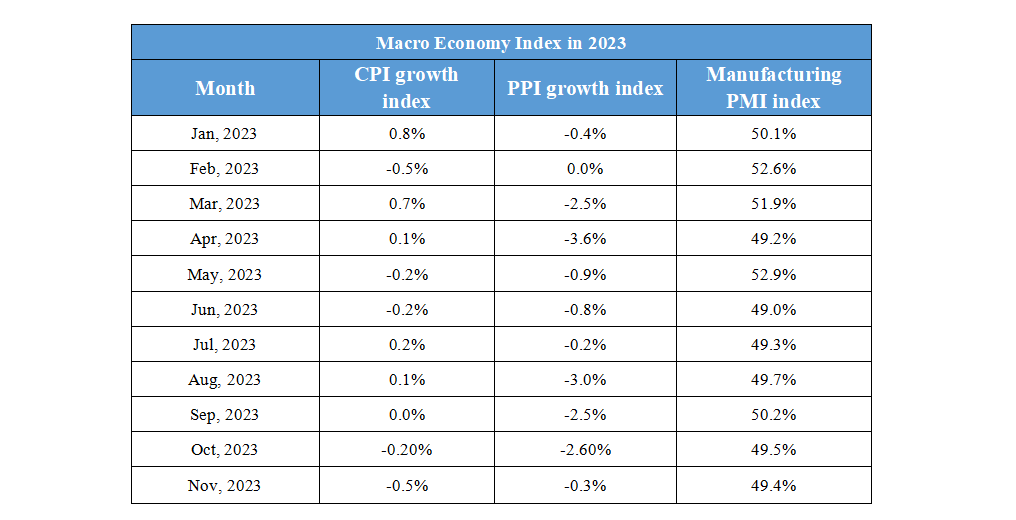

Domestic Macro Economy Index