December 11th Macro Economic Update

Daily Macro Economy News

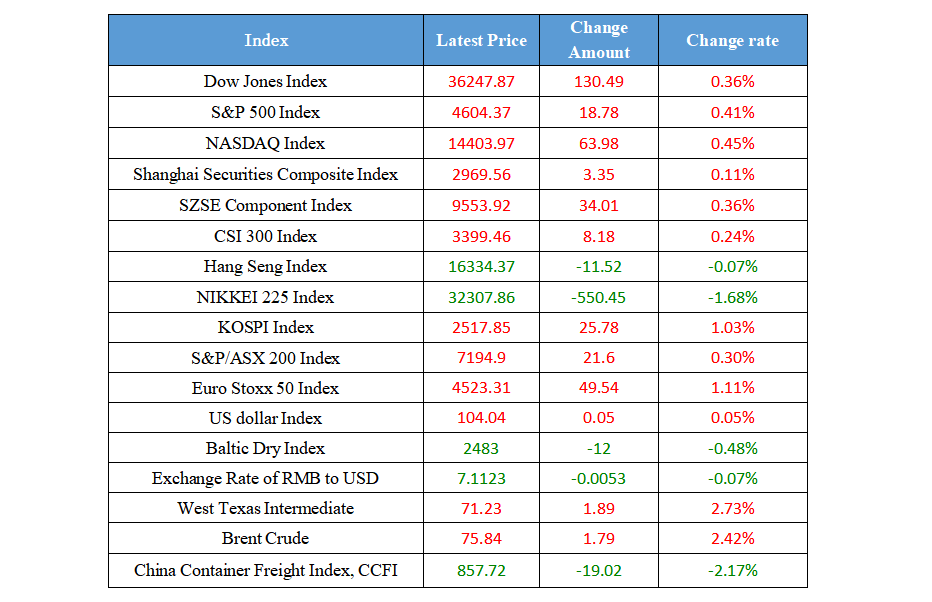

Latest Global Major Index

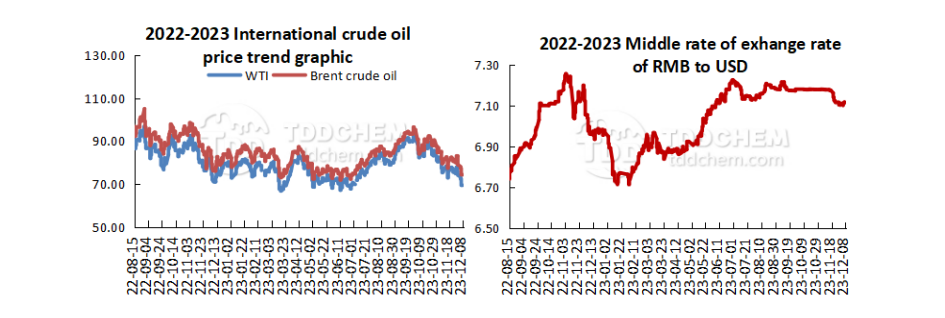

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The construction of large-scale wind power and photovoltaic base ("large bases") focusing on desert and Gobi desert areas is accelerating

2. A number of banks have issued special action plans to actively meet the financing needs of real estate enterprises

3. Policies continue to be optimized and adjusted to promote the stabilization and recovery of the property market

4. Experts believe that China's economy is resilient, potential and has wide room for maneuver, and the fundamentals of long-term improvement have not changed and will not change

International News

1. Fed Mouthpiece: The Fed is unlikely to talk about the timing of rate cuts, but the prospect of rate cuts is emerging

2. COP28 President: UN climate talks need to be significantly accelerated

3. The EU will impose carbon tariffs, and Chinese exporters actively respond

4. The probability that the Fed will keep interest rates unchanged this week is 97.1%

Domestic News

1. The construction of large-scale wind power and photovoltaic base ("large bases") focusing on desert and Gobi desert areas is accelerating

As the top priority of China's new energy development during the "14th Five-Year Plan" period, the construction of large-scale wind power and photovoltaic base ("large bases") focusing on desert and Gobi desert areas is accelerating. According to the National Energy Administration, at present, the first batch of large base projects have entered the peak period of production, the second batch of large base projects have started construction, and the third batch of large base projects are speeding up the preliminary work.

2. A number of banks have issued special action plans to actively meet the financing needs of real estate enterprises

Recently, a number of banks have issued special action plans to actively meet the financing needs of real estate enterprises, and at the same time convened relevant real estate enterprises to discuss related issues. In addition to the real estate supply side, it is also necessary to further help the real estate market stabilize from the demand side. For example, increase support for new citizens, young people and other groups to buy houses.

3. Policies continue to be optimized and adjusted to promote the stabilization and recovery of the property market

Towards the end of the year, many places have introduced a new round of new policies for the real estate market, involving housing provident fund loans and supporting real estate enterprises to launch new models such as "Old for New". Looking forward to 2024, the institution believes that the real estate policy will continue to be optimized and adjusted, and there is room for both supply and demand policies, and the financing environment for enterprises is expected to improve. It is expected that the land auction rules will continue to be eased, which will drive the energetism of the land market and promote the stabilization and recovery of property market demand. The construction of the three key projects of public affordable housing, urban village transformation, and "emergency and non-emergency dual-use" public infrastructure will become the starting point for building a new real estate development model.

4. Experts believe that China's economy is resilient, potential and has wide room for maneuver, and the fundamentals of long-term improvement have not changed and will not change

According to the China Securities Journal, experts believe that China's economy is resilient, potential and has wide room for maneuver, and the long-term positive fundamentals have not changed and will not change. With the vigorous implementation of a series of macro-control and reform and opening up measures, it is expected that the economy will continue to achieve effective qualitative improvement and reasonable quantitative growth next year, and move forward along the high-quality development channel.

International News

1. Fed Mouthpiece: The Fed is unlikely to talk about the timing of rate cuts, but the prospect of rate cuts is emerging

"Fed mouthpiece" Nick Timiraos posted that Fed officials are unlikely to have a serious discussion about when to cut interest rates this week, and probably not in the coming months, unless the economy is weaker than expected. The report mentions the Fed's history of cutting interest rates about six months after its last hike, and the major mistake of the Fed cutting interest rates prematurely. However, the latest interest rate projections are expected to show that most officials expect to cut interest rates next year.

2. COP28 President: UN climate talks need to be significantly accelerated

The 28th Conference of the Parties (COP28) to the United Nations Framework Convention on Climate Change is taking place in Dubai, United Arab Emirates. COP28 President Sultan Jaber said on the 10th that some progress has been made in the negotiations at the Dubai climate conference, but it needs to be significantly accelerated. Speaking at a press conference on the same day, Jaber said that positive progress had been made in the ongoing climate talks, but "I don't think it's fast enough" and needed to be accelerated significantly. He called on all parties to show flexibility, take action and reach consensus, emphasizing that "failure is not an option".

3. The EU will impose carbon tariffs, and Chinese exporters actively respond

The European Union has recently introduced a carbon border adjustment mechanism, which is a transition period from October 1, 2023 to December 31, 2025, during which only relevant information needs to be reported on a quarterly basis, and there is no need to actually pay carbon tariffs. From January 1, 2026, carbon tariffs will be officially imposed on products imported into the EU. Many exporters said that they have begun to formulate carbon reduction plans to quantify the annual emission reductions and meet the overall carbon emission target. At the same time, we will promote the application and procurement of green electricity and increase the intensity of energy-saving transformation.

4. The probability that the Fed will keep interest rates unchanged this week is 97.1%

According to CME's "Fed Watch": the probability that the Fed will keep interest rates unchanged in the range of 5.25%-5.50% in December is 97.1%, and the probability of raising interest rates by 25 basis points is 2.9%. The probability of keeping interest rates unchanged by February next year is 93.2%, the probability of a cumulative rate cut of 25 basis points is 4%, and the probability of a cumulative rate hike of 25 basis points is 2.8%.

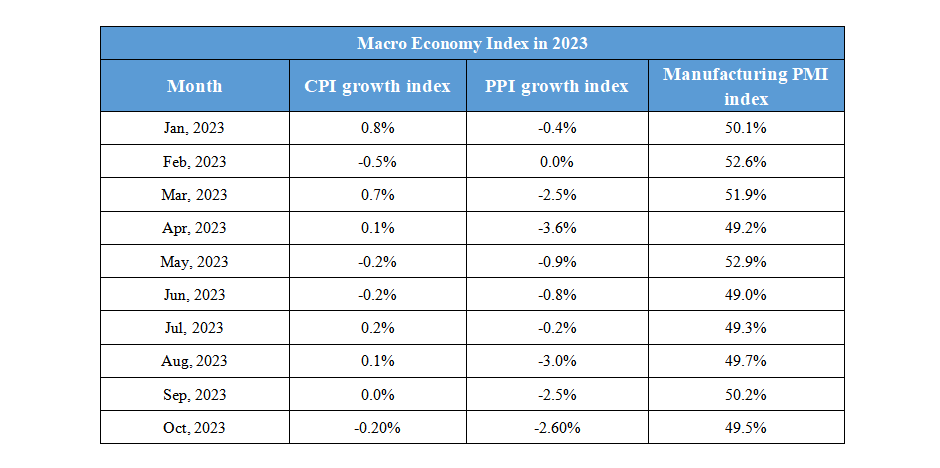

Domestic Macro Economy Index