December 8th, Key Domestic and International Economic Developments

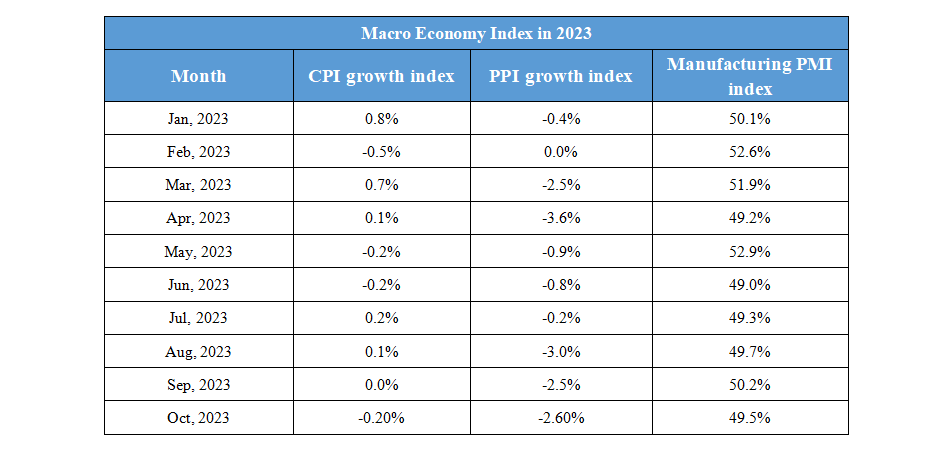

Daily Macro Economy News

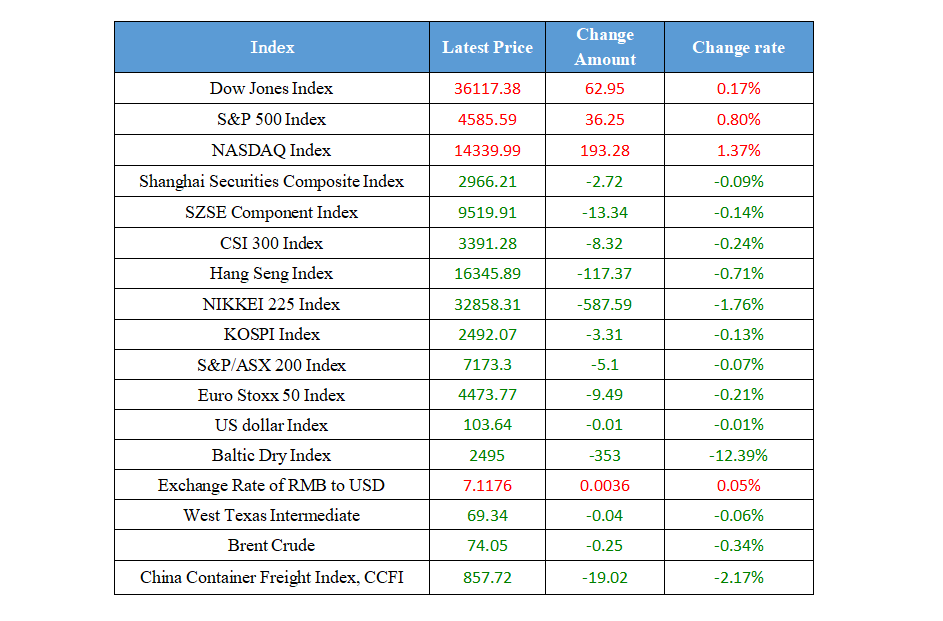

Latest Global Major Index

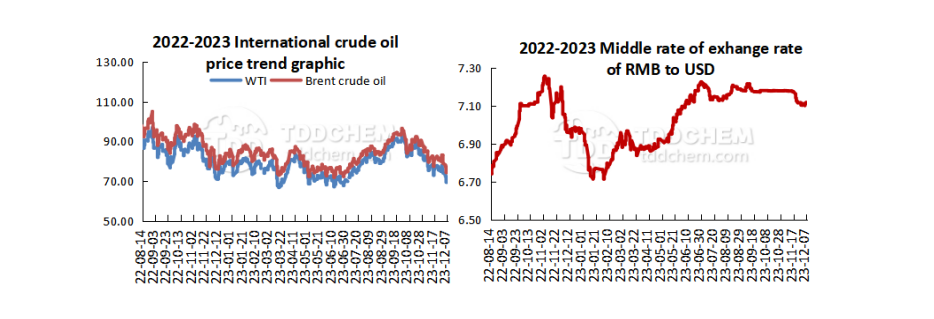

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Economic Daily: Financial institutions should "read and understand" private enterprises

2. The State Council issued the "Overall Plan for Promoting High-level Institutional Opening-up in the China (Shanghai) Pilot Free Trade Zone in Comprehensively Aligning with International High-standard Economic and Trade Rules", and 80 measures in 7 aspects are introduced to promote the high-level institutional opening-up of the Shanghai Pilot Free Trade Zone

3. In November this year, China's total import and export value was 3.7 trillion yuan, a year-on-year increase of 1.2%, maintaining positive growth for two consecutive months

4. The Third China-Japan Industrial Cooperation Vice-Ministerial-Level Dialogue was held in Beijing

International News

1. At a time when Guyana and Venezuela are tense in oil-producing areas, the United States announced military exercises with Guyana

2. U.S. consumer credit growth in October was lower than expected

3. CapitalEconomics: The dollar elasticity is expected to fade in 2024

4. The final GDP of the euro area in the third quarter was flat year-on-year

Domestic News

1. Economic Daily: Financial institutions should "read and understand" private enterprises

On December 8, the key for financial institutions to serve private enterprises is to "understand" private enterprises and avoid misreading. On the one hand, it is necessary to go deep into the real economy and jump out of finance to do finance. The staff of financial institutions should abandon the thinking of pawnshops, deeply understand the operation laws of the real economy, accurately grasp the financing characteristics and needs of private enterprises, and effectively improve the professionalism, effectiveness and accuracy of services. On the other hand, it is necessary to improve the credit information sharing mechanism of private enterprises. It is necessary to promote the opening of credit information related to enterprises such as water and electricity using, business and commerce, taxation, and government subsidies to banking financial institutions under the premise of compliance with laws and regulations, so as to alleviate information asymmetry. In the next step, financial management departments and financial institutions should continue to form a joint force, strengthen communication and cooperation with industry and information technology, science and technology, market supervision, taxation and other departments, and promote the sharing of relevant data with banking financial institutions through local credit reporting platforms. At the same time, it is necessary to find ways to solve the "data barriers" among different departments, and individual departments should not turn the information they have into business capital, and should not harm the public interest for their own self-interest.

2. The State Council issued the "Overall Plan for Promoting High-level Institutional Opening-up in the China (Shanghai) Pilot Free Trade Zone in Comprehensively Aligning with International High-standard Economic and Trade Rules", and 80 measures in 7 aspects are introduced to promote the high-level institutional opening-up of the Shanghai Pilot Free Trade Zone

The State Council issued the "Overall Plan for Promoting High-level Institutional Opening-up in the China (Shanghai) Pilot Free Trade Zone in Comprehensively Aligning with International High-standard Economic and Trade Rules", and 80 measures in 7 aspects are introduced to promote the high-level institutional opening-up of the Shanghai Pilot Free Trade Zone. The Plan proposes to support the Shanghai Pilot Free Trade Zone to take the lead in formulating important data catalogs, explore the establishment of a legal, safe and convenient cross-border data flow mechanism, promoting high-level opening-up in key areas such as finance and telecommunications, supporting multinational companies to set up fund management centers, orderly promoting the pilot of digital RMB, exploring the application scenarios of digital RMB in the field of trade, accelerating the establishment of a national carbon emission right trading institution, supporting the Lingang Special Area to accelerate the research breakthrough of core hydrogen energy technologies, supporting insurance funds to rely on the relevant business in the Shanghai Pilot Free Trade Zone to invest in gold and other commodities, and prudently exploring the relaxation of restrictions on non-resident M&A loans in the Lingang Special Area under the premise of controllable risks, and expand the applicable scenarios of loans.

3. In November this year, China's total import and export value was 3.7 trillion yuan, a year-on-year increase of 1.2%, maintaining positive growth for two consecutive months

According to customs statistics, the total value of China's imports and exports in November this year was 3.7 trillion yuan, a year-on-year increase of 1.2%, maintaining positive growth for two consecutive months. Among that, exports were 2.1 trillion yuan, up by 1.7 percent, imports were 1.6 trillion yuan, up by 0.6 percent, and trade surplus was 490.82 billion yuan, up by 5.5 percent. Lv Daliang, director of the Statistical Analysis Department of the General Administration of Customs, said that in the fourth quarter, the positive factors for the development of China's foreign trade have been increasing. According to the statistical survey of China's customs trade prosperity, the proportion of enterprises with increased export and import orders has increased, and the foundation for achieving the goal of promoting the stability and improving the quality of foreign trade throughout the year is more solid.

4. The Third China-Japan Industrial Cooperation Vice-Ministerial-Level Dialogue was held in Beijing

The 3rd China-Japan Industrial Cooperation Vice-Ministerial-Level Dialogue was held in Beijing. Xin Guobin, Vice Minister of the Ministry of Industry and Information Technology, and Shin Hosaka, Economic and Trade Review Officer of the Ministry of Economy, Trade and Industry of Japan, co-chaired the meeting, and the two sides exchanged views on topics such as new energy vehicles, intelligent manufacturing, semiconductor production and supply chains, green development, raw materials, and business environment, and agreed to further deepen dialogue and exchanges in the future to promote practical cooperation between China and Japan in the industrial field.

International News

1. At a time when Guyana and Venezuela are tense in oil-producing areas, the United States announced military exercises with Guyana

On December 8, the United States announced on Thursday a joint military flight exercise with Guyana, which is currently sparking tensions with neighboring Venezuela in a disputed oil-rich region, according to CBS. Guyana President Ali said the country would prepare military forces with allies for the "worst-case scenario," but he hoped there would be no conflict. The United States also called for peaceful diplomacy this week, with State Department spokeswoman Miller saying, "We urge Venezuela and Guyana to continue to seek peaceful ways to resolve their disputes."

2. U.S. consumer credit growth in October was lower than expected

U.S. consumer borrowing grew less than expected in October, reflecting more modest growth in credit card balances and non-revolving credit. According to data released by the Federal Reserve, total credit increased by $5.1 billion in October, which was revised upward to an increase of $12.2 billion in September. The median estimate of economists surveyed was $8.5 billion. Revolving credit balances, including credit cards, rose nearly $2.9 billion in October, the lowest in four months. Non-revolving credits, such as tuition and car loans, grew by nearly $2.3 billion. The figures are not adjusted for inflation.

3. CapitalEconomics: The dollar elasticity is expected to fade in 2024

Thomas Mathews, senior market economist at CapitalEconomics, said in a report that the strength of the dollar this year may finally shake in 2024. "We tend to believe that the resilience of the dollar will not last beyond 2024," he said. "While we do think safe-haven capital inflows could keep it ahead for longer... However, we expect yield spreads to fall back and the USD to resume its downward trend since November. ”

4. The final GDP of the euro area in the third quarter was flat year-on-year

The final GDP of the euro zone in the third quarter was flat year-on-year, with an expected increase of 0.1%, a revised value and a preliminary increase of 0.1%; and a month-on-month decrease of 0.1%, an expected decrease of 0.1%, with a revised value and a preliminary value of 0.1%. The final value of the seasonally adjusted employment in the third quarter rose by 1.3% year-on-year, with an expected increase of 1.4%, the preliminary value increased by 1.4%, the final value increased by 1.3% in the second quarter; and the quarter-on-quarter increase was 0.2%, the expected increase was 0.3%, the preliminary value increased by 0.3%, and the final value increased by 0.2% in the second quarter.

Domestic Macro Economy Index