December 7th Macro Economy Update: Resilience and Stability

Daily Macro Economy News

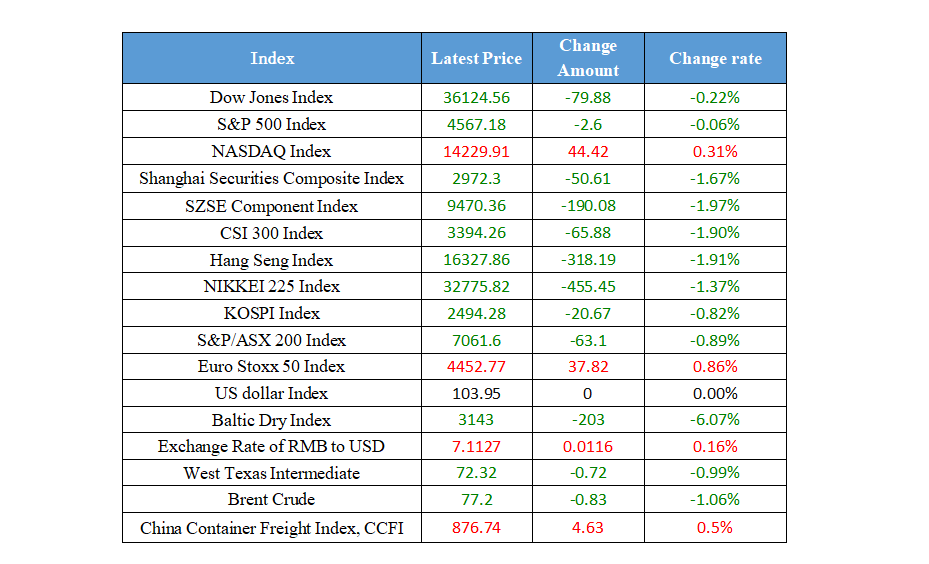

Latest Global Major Index

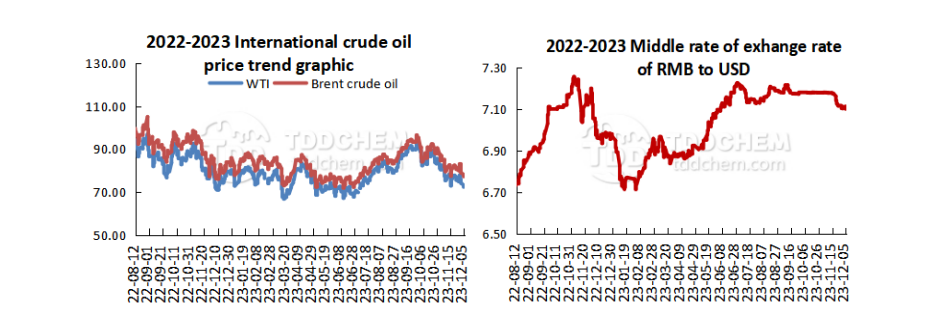

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. China's economy has great resilience and potential for development, and the fundamentals of long-term improvement have not changed

2. The real estate market will move from a period of adjustment to a period of stability

3. Maintaining the stable operation of the capital market requires the concerted efforts of all parties

4. A number of bank wealth management subsidiaries have lowered product rates, and the lowest has reached "zero rate"

International News

1. Wall Street pointed out that investors were overly optimistic and warned that the U.S. market was "no longer short"

2. CEO of the Bank of America: The U.S. economy is slowing down, but a soft landing is still expected

3. Bank of America: Wages and service industry CPI should be able to persuade the Bank of Canada to maintain a "hawkish" stance

4. Russian Prime Minister: Russia's production of armored weapons and drones has increased significantly this year

Domestic News

1. China's economy has great resilience and potential for development, and the fundamentals of long-term improvement have not changed

China's economy has tremendous resilience and potential, and its long-term positive fundamentals have not changed, and it will continue to be an important engine of global economic growth in the future. China has a strong domestic market, with a population of 1.4 billion people with great demand potential, employment and prices are generally stable, and the old and new drivers are changing in an orderly manner, and the endogenous driving force is constantly strengthening. All these characteristics will promote China's economy to achieve qualitative and effective improvement and reasonable growth.

2. The real estate market will move from a period of adjustment to a period of stability

At present, China's real estate market is still in an adjustment cycle. In 2023, the real estate market shows a trend of high and low fluctuation and then stable trend. It is expected that after a period of adjustment, there will be a gradual transition to stability. We should have confidence in the steady and healthy development of the real estate market, and there is still a lot of room for growth in the market determined by demand. In the long run, the adjustment of the real estate market is conducive to China's economic growth and sustainable development, but in the short term, we should pay attention to risk prevention. In the future, China will further weaken the risk level of the real estate market and prevent the spillover of real estate market risks. Guide the debt ratio and leverage ratio of real estate enterprises to decline in an orderly manner, and optimize the asset and liability structure of enterprises. Meet the reasonable financing needs of real estate enterprises with different ownership systems without discrimination, and maintain the steady operation of the real estate market.

3. Maintaining the stable operation of the capital market requires the concerted efforts of all parties

Strictly and quickly crack down on illegal activities, strengthen the supervision of abnormal trading behaviors in the stock market, and promote long-term funds to enter the market... A series of measures taken by the regulatory authorities have played a positive role in maintaining the stable operation of the capital market. However, maintaining the stable operation of the capital market is a systematic work that needs to be promoted for a long time, and the author believes that it can be continuously promoted in the following aspects. First of all, it is necessary to further strengthen monitoring and supervision, and constantly improve regulatory measures. Secondly, we should give full play to the internal role of various business entities in stabilizing the market. Thirdly, we should firmly guard the bottom line of risks and earnestly maintain the smooth operation of the capital market. Confidence is more important than gold. All parties should join hands to form a joint force to continue to maintain the stable operation of the capital market.

4. A number of bank wealth management subsidiaries have lowered product rates, and the lowest has reached "zero rate"

The wealth management subsidiary of the bank has recently launched a "discount" promotion of the rate again. Recently, a number of bank wealth management subsidiaries have issued announcements to offer preferential rates for some wealth management products, and the preferential products are mainly fixed income wealth management items and cash management wealth management items. Industry insiders surveyed believe that rate reduction is a marketing strategy in a competitive environment that can enhance the attractiveness of products to investors. However, in the long run, the wealth management subsidiaries of banks still need to improve the management level of wealth management products and establish a diversified product system to attract customers with better products and services.

International News

1. Wall Street pointed out that investors were overly optimistic and warned that the U.S. market was "no longer short"

On December 6, Wall Street believed that investor optimism has risen to dangerous levels. Equity experts at JPMorgan and Morgan Stanley didn’t believe the Fed would cut interest rates as quickly as the market expects. Scott, managing director at Goldman Sachs, said there were "no shorts" in the market. The rise is a sign of over-optimism in the market. BlackRock strategists didn't expect the Fed to start easing policy until the middle of next year, recommending reducing its holdings of longer-dated bonds. And James Zelter, co-president of Apollo Asset Management, hold that the Fed's decision to keep interest rates high meaned that the Fed has "a loaded gun to use when needed" if economic conditions deteriorate.

2. CEO of the Bank of America: The U.S. economy is slowing down, but a soft landing is still expected

On December 6, Brian Moynihan, chief executive of the Bank of America, said at the Goldman Sachs U.S. Financial Services Conference on Tuesday that there were signs that the U.S. economy was slowing down, but the bank still expect a soft landing rather than a recession. "The reality is that there will be a slowdown, but we need to remain optimistic," Moynihan said, adding that money was flowing out of customers' accounts and consumer spending has "leveled off," so "this was good news that the economy has normalized." Moynihan's statement was in line with recent data. U.S. consumers have been scaling back spending, especially on big-ticket goods, inflation continues to linger, and borrowing costs remain high. Many economists also believed that the strength of spending is enough to avoid a recession, but the outlook depends largely on the labor market. And in recent months, the labor market has been cooling.

3. Bank of America: Wages and service industry CPI should be able to persuade the Bank of Canada to maintain a "hawkish" stance

On December 6, Bank of America economists said that the risk to the Bank of Canada's interest rate decision on Wednesday was that the position of central bank officials may shift from "hawkish" to "dovish". Economists believed it's too early to do so. The Bank of America said higher interest rates would certainly weigh on private sector activity, and the company expected the output gap to narrow in early 2024. Inflation is easing and the weakness in the labor market is intensifying. However, annual wage growth of around 5% remains sticky, and "this headwind implies upside risks to inflation." At the CPI perspective, Bank of America noted that services inflation was still quite high at 4.6%, which was the reason that the core economy was not slowing down as much as the Bank of Canada would like.

4. Russian Prime Minister: Russia's production of armored weapons and drones has increased significantly this year

Russian Prime Minister Mishustin said at a meeting of the Coordination Committee for Ensuring the Needs of the Russian Armed Forces on the 5th that in 2023, Russia's production of armored weapons tripled, and the production of aviation equipment and drones doubled. According to the Russian government's website news, Mishustin said at the meeting on the same day that in the past 11 months, Russia's output of related products has increased significantly compared to the amount of last year, and the output of communications equipment, weapons, electronic war, and reconnaissance equipment has increased more than fourfold, and the output of automobiles has almost tripled. Mishustin also said that the Russian government has invested a lot of money in increasing the production capacity of defense orders and the supply of essential goods. More than 360 enterprises and about 520,000 employees are involved in ensuring the needs of the Russian armed forces.

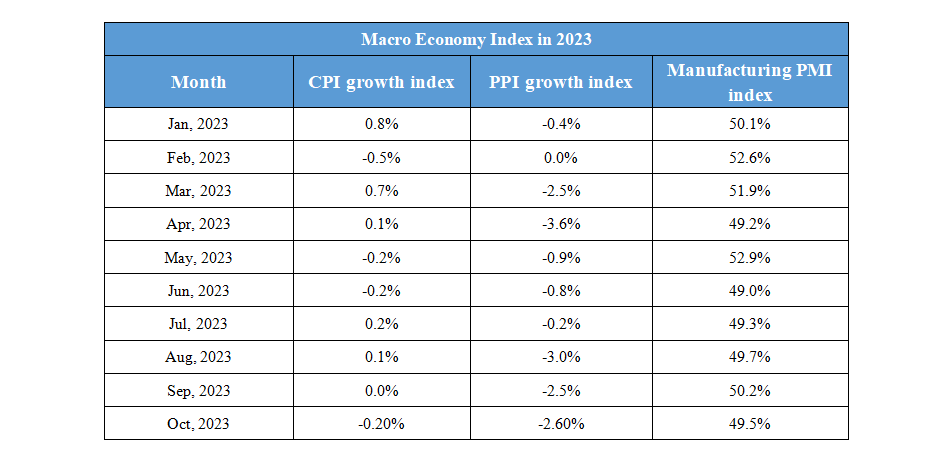

Domestic Macro Economy Index