September 27th Macroeconomic Index: China's Assets Rally Continues, A50 Index Hits One-Year High

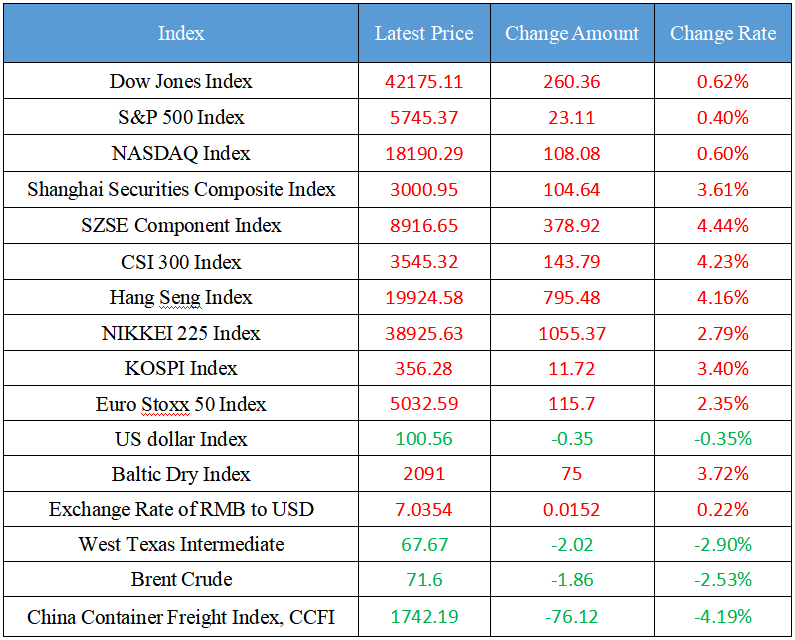

Latest Global Major Index

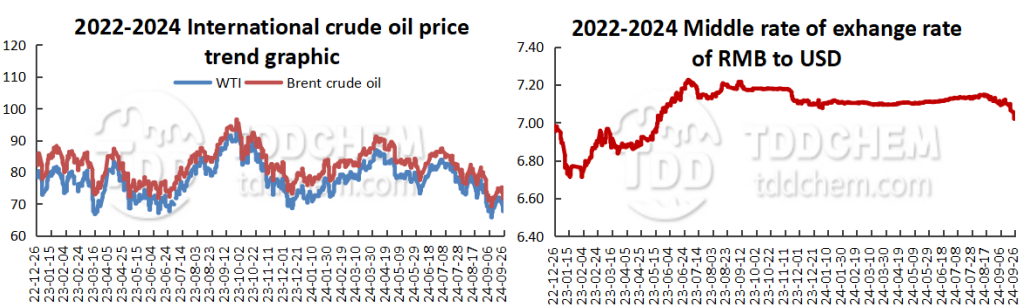

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The rally of China's assets continued overnight, and the A50 index hit a one-year high

2. US stocks closed: China's assets broke out in an all-round way, and the Chinese concept stock index rose nearly 11%

3. The Shanghai Composite Index returned to 3,000 points. Small and medium-sized investors: "During the National Day, we will hold shares for the holiday"

4. Shanghai pig industry collective roadshow: the performance at the first half of the year picked up, expansion and cost reduction became the main theme

5. Comprehensively optimize the capital market ecology and attract more medium and long-term funds to enter the market

International News

1. The size of United States money market funds hit a new high of $6.42 trillion

2. "Helene" intensified into a Category 3 hurricane approaching Florida in the United States

3. United Nations: The government of eastern Libya has committed to lifting the oil blockade

4. At least 18 people were killed in shelling of cities in western Sudan

5. The New York Court of Appeals challenged the $454 million fine imposed on Trump

Domestic News

1. The rally of China's assets continued overnight, and the A50 index hit a one-year high

Following a sharp rise in Chinese assets such as A-shares on Thursday, FTSE China A50 Index futures closed up 2.2% overnight, hitting a one-year high, the Nasdaq China Golden Dragon Index closed up nearly 11%, and the offshore yuan appreciated nearly 600 points against the US dollar, stabilizing at the 7 mark at the 6.97 level.

2. US stocks closed: China's assets broke out in an all-round way, and the Chinese concept stock index rose nearly 11%

US stocks closed up 0.6% on Thursday, with the Dow preliminarily closing up 0.6%, the S&P 500 0.4%, and the Nasdaq up 0.6%. China's "Super Thursday" continued overnight, with the Nasdaq China Golden Dragon Index closing up 10.9%, hitting its highest intraday high since September last year, and Alibaba (BABA. N) rose 10%, JD.com (JD. O) rose 14%, and Bilibili (BILI. O) rose 15%.

3. The Shanghai Composite Index returned to 3,000 points. Small and medium-sized investors: "During the National Day, we will hold shares for the holiday"

With the A-share market showing a strong rebound, the stock bar forum is full of confidence and enthusiasm from investors. Small and medium-sized investors have said: "The cold winter of A-shares has passed, and the solid bottom of the market is clearly visible. "Some shareholders showed reporters that the positions they invested in include real estate, non-ferrous metals, etc., and the yields from September 24 to September 26 reached 4.05%, 1.14%, and 4.52% respectively. He said that he is full of confidence in A-shares, "During the National Day, I will hold shares for the holiday." Dongxing Securities Beijing Dawang Rd. Securities Business Department staff said: "In the past two days, the number of customers who have come to consult and open accounts has increased significantly, and some people even asked whether the suspended margin financing and securities lending business will resume, which shows that everyone's confidence in the A-share market is accelerating the recovery." The staff of the Beijing Guangqu Road Business Department of China Securities told reporters: "The introduction of the future continuation policy is worth looking forward to." As the policy continues to take effect, the macroeconomic environment will accelerate and corporate fundamentals will also benefit, thereby helping the A-share market to recover. ”

4. Shanghai pig industry collective roadshow: the performance at the first half of the year picked up, expansion and cost reduction became the main themeo

On the afternoon of September 26, the 2024 semi-annual Shanghai pig industry special collective roadshow was officially held. Since the beginning of this year, the prosperity of the pig breeding industry has rebounded. The three companies all mentioned that the sales price of live pigs has been rising since March this year, and the enthusiasm of the superimposed market for "secondary fattening" has further pushed up pig prices, and the recovery of pig prices has made the company's performance in the first half of the year better. At the same time, several companies have also achieved positive results in their ongoing efforts to reduce costs and increase efficiency. Zhu Zengyong, a researcher at the Beijing Institute of Animal Husbandry and Veterinary Medicine, Chinese Academy of Agricultural Sciences, said that since June this year, the pig breeding industry has continued to maintain profitability, and in August, it hit a peak of profitability in the past two years, driving the continuous growth of revenue of breeding enterprises. At present, the pig industry has entered a period of steady development, and consumer demand is stable.

5. Comprehensively optimize the capital market ecology and attract more medium and long-term funds to enter the market

On September 26, the Political Bureau of the Central Committee of the Communist Party of China held a meeting to emphasize that efforts should be made to boost the capital market, vigorously guide medium and long-term funds to enter the market, and open up the blocking points for social security, insurance, wealth management and other funds to enter the market. On the same day, the China Securities Regulatory Commission announced that recently, with the consent of the Central Financial Commission, the Central Financial Office and the China Securities Regulatory Commission jointly issued the "Guiding Opinions on Promoting Medium and Long-term Funds into the Market". The interviewees agreed that with the implementation of the various measures of the "Guiding Opinions", it is conducive to building a long-term mechanism for patient capital to enter the market, forming a continuous inflow of medium and long-term funds, and promoting the stable operation of the capital market. In addition, it will also promote the formation of more equity capital, better match the financing needs of enterprises in the context of the full implementation of the stock issuance registration system, and better serve the recovery of the real economy and the high-quality development of the economy.

International News

1. The size of United States money market funds hit a new high of $6.42 trillion

Although the Fed's rate-cutting cycle has begun, investors are still pouring heavily into United States money market funds, driving assets to new highs. About $121 billion flowed into United States money market funds in the week ended Sept. 25, according to data released Thursday by the United States Investment Company Association. Total assets reached a record $6.42 trillion.

2. "Helene" intensified into a Category 3 hurricane approaching Florida in the United States

On September 26, local time, it was learned that the National Hurricane Center of United States said that the hurricane "Helene" threatening Florida has now intensified into a category 3 hurricane, and the current sustained wind speed is about 193 kilometers per hour. It is reported that Hurricane Helenie will bring storm surge to the northwest of Florida and destructive strong winds, rainfall and flash floods to much of the southeastern United States.

3. United Nations: The government of eastern Libya has committed to lifting the oil blockade

The head of the United Nations Mission in Libya (UNSMIL), Stephanie · Curry, said the government in eastern Libya had committed to lifting the oil blockade. But there is still some way to go before the oil fields restart. Curry made the comments after representatives of two Libya legislatures agreed to appoint new central bank leaders. A controversy over the central bank's leadership led the government in the east of the country to announce an oil blockade on August 26. But the agreement still faces difficult obstacles to its implementation. An oil industry source said: "There are still a lot of negotiations to go. "The resumption of closed oil fields ultimately requires approval from the Libya National Army (LNA) in the east. OPEC member Libya currently produces about 500,000 b/d of crude oil compared with the normal of 1.2 million b/d, according to agency Argus estimates.

4. At least 18 people were killed in shelling of cities in western Sudan

On September 26, local time, the Sudanese local organization El Fasher Resistance Committee said that at least 18 civilians were killed and 41 others were injured in shelling in El Fasher, the capital of Northern Darfur State in western Sudan. Local paramedics said five shells landed in a market south of the city of El Fasher, causing a large number of casualties, but many of the wounded were unable to receive proper care due to a severe lack of medical facilities and medicines in local hospitals. Recently, the city of El Fasher has been shelled several times, resulting in a large number of civilian casualties.

5. The New York Court of Appeals challenged the $454 million fine imposed on Trump

A New York appeals court on Thursday cast doubt on some of the arguments in the case of the New York state attorney general against former President Trump seven months after a trial judge fined Trump $454 million for commercial fraud, according to ABC News. The judge said the fine was "shocking". A panel of five judges from the first division of the New York State Appellate heard Trump's appeal and expressed concerns about the case to both sides, appearing to call into question some key elements of the case, including the application of consumer fraud statutes, the justification for financial penalties sought by prosecutors, and the private nature of the transactions in question. Trump himself did not attend Thursday's hearing in New York.

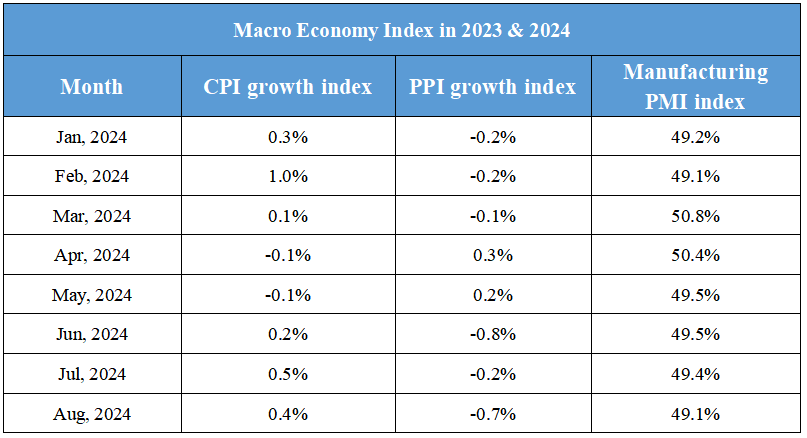

Domestic Macro Economy Index