September 26th Macroeconomic Index: Policy 'Gift Package' Boosts Investor Confidence, Liquidity Enhanced

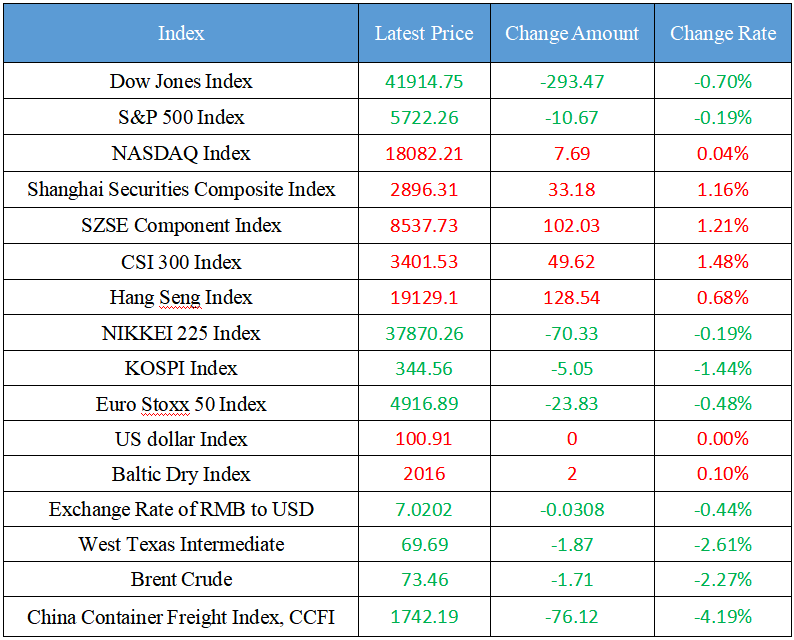

Latest Global Major Index

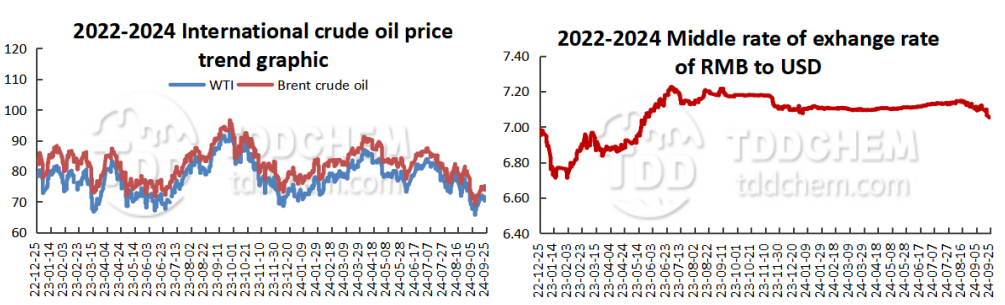

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The policy "gift package" boosts confidence. The industry: there are more investors who transfer money to securities accounts

2. The main contract closes at night

3. Morgan Stanley: Liquidity has been significantly boosted, and A-shares may outperform emerging markets

4. The China-Japan People-to-People Exchange Forum was held in Tokyo

5. The central bank's media: There is a solid foundation for the RMB exchange rate to remain basically stable, and there is no bet on the direction of the exchange rate

International News

1. Foreign Minister of France: It is promoting a temporary 21-day ceasefire between Israel and Hezbollah

2. The probability that the Fed will cut interest rates by 25BP in November is 40.8%

3. The United States Congress passed the Temporary Appropriations Act, and the government was able to avoid a "shutdown"

4. US stocks closed: major stock indexes closed down and Chinese concept stock indexes pulled back

5. Severe drought was appeared in Brazil, and more than hundreds of cities have had no significant precipitation for three consecutive months

Domestic News

1. The policy "gift package" boosts confidence. The industry: there are more investors who transfer money to securities accounts

On September 24, the central bank, the State Administration of Financial Regulation, and the China Securities Regulatory Commission released a policy "gift package" to ignite the enthusiasm of the capital market for longs. "There are significantly more investors who take the initiative to consult." On September 25, a reporter from the Securities Times visited several brokerage business departments, and almost every staff member mentioned this. A person from the sales department said that individual investors transferred more money to their securities accounts. Another interviewee mentioned that employees and important customers have agreed on communication policies and market outlook during the National Day holiday. Some brokerage employees bluntly said that the daily trading volume has doubled in the past two days. The reporter learned from the interview that due to the impact of the new policy, some investors' confidence has been greatly boosted, and they are optimistic about the future market trend. However, some investors are still waiting and seeing, they are more concerned about the implementation of the policy, and look forward to the subsequent incremental fiscal policy.

2. The main contract closes at night

As of the close at 2:30, the main contract of Shanghai Gold closed up 0.58% at 601 yuan / gram, the main contract of Shanghai Silver closed up 1.18% at 7834 yuan / kg, and the main contract of SC crude oil closed up 0.73% at 535 yuan / barrel.

3. Morgan Stanley: Liquidity has been significantly boosted, and A-shares may outperform emerging markets

Wang Ying, chief equity strategist at Morgan Stanley China, said in her latest commentary that the People's Bank of China's larger-than-expected policy support measures should help improve investor sentiment and liquidity, and drive a positive response in both onshore and offshore markets in the short term. The size and long-term sustainability of the rebound will depend on the macroeconomic recovery and the bottoming out of corporate earnings growth. Wang Ying said that the supportive policies so far have been centered on A-shares, but before the Fed's interest rate cut cycle began, the liquidity of the Hong Kong stock market may benefit more from global monetary policy easing. Sentiment is expected to gather in the near term, with both onshore and offshore markets expected to see a tactical rebound and even outperform emerging markets.

4. The China-Japan People-to-People Exchange Forum was held in Tokyo

On the 23rd local time, the China-Japan People-to-People Exchange Forum was held in Tokyo, Japan, with nearly 60 experts and scholars from China and Japan attending. Shi Yong, Minister of the Chinese Embassy in Japan, said that the two sides should be guided by the important consensus of the leaders of the two countries, continuously strengthen people-to-people exchanges and cooperation, enhance understanding and trust between the two peoples, and lay a solid foundation of public opinion for the development of China-Japan relations.

5. The central bank's media: There is a solid foundation for the RMB exchange rate to remain basically stable, and there is no bet on the direction of the exchange rate

On September 18, the Federal Reserve announced a 50 basis point rate cut, the first rate cut since the Fed started raising interest rates in March 2022, according to a front-page article in the Financial Times, the head of the central bank. First of all, in the short term, interest rate cuts in major economies have significantly reduced the external pressure on the RMB exchange rate. Second, in the medium and long term, there is a solid foundation for the RMB exchange rate to remain basically stable. Third, from the perspective of policy space, the People's Bank of China has the ability to cope with any interest rate fluctuations and can continue to maintain the basic stability of the RMB exchange rate at a reasonable and balanced level. In addition, for market participants, risk neutrality is adhered to. Financial institutions, enterprises and even individual residents should establish the concept of risk neutrality and not bet on the direction of the exchange rate. From past experience, betting on the unilateral appreciation or depreciation of the exchange rate often brings unnecessary losses.

International News

1. Foreign Minister of France: It is promoting a temporary 21-day ceasefire between Israel and Hezbollah

France's Foreign Minister said it was working with United States to promote a temporary 21-day Israel-Hezbollah ceasefire to allow for negotiations. A temporary ceasefire plan will be announced shortly.

2. The probability that the Fed will cut interest rates by 25BP in November is 40.8%

According to CME's "Fed Watch": the probability of a 25 basis point cut by the Fed by November is 40.8%, and the probability of a 50 basis point rate cut is 59.2%. The probability of a cumulative 50 basis point rate cut by December is 19.5%, and the probability of a cumulative rate cut of 75 basis points is 49.6%; The probability of a cumulative rate cut of 100 basis points is 30.9%.

3. The United States Congress passed the Temporary Appropriations Act, and the government was able to avoid a "shutdown"

The United States Senate has received enough votes to pass the interim government appropriations bill, and voting continues. The bill aims to ensure that United States government funds can continue to be maintained for three months, until December 20, when Biden signs the bill into effect.

4. US stocks closed: major stock indexes closed down and Chinese concept stock indexes pulled back

US stocks closed down 0.7% on Wednesday, the Dow closed down 0.7%, the S&P 500 fell 0.2%, and the Nasdaq closed basically flat. Nvidia (NVDA. O) rose 2%, and Intel (INTC. O) rose 3%, and Trump Media Technology Group (DJT. O) rose 10%. The Nasdaq China Golden Dragon Index closed down 2.8%, while Alibaba (BABA. N) fell 1.8%, and iQiyi (IQ. O) fell nearly 5%.

5. Severe drought was appeared in Brazil, and more than hundreds of cities have had no significant precipitation for three consecutive months

According to data released by the Brazil Natural Disaster Monitoring and Early Warning Center on the 25th local time, as of September 22, more than 1,000 cities in Brazil experienced severe drought in 2024, and there was no significant precipitation for three consecutive months, accounting for about one-fifth of the total number of cities in Brazil. According to satellite data from more than 5,000 cities in Brazil, as of September 22 this year, 1,188 cities in Brazil have had no significant precipitation for 90 consecutive days, and about 600 cities have been without significant precipitation for more than 130 consecutive days. The states of Goiás, Minas Gerais and Mato Grosso are the most affected regions.

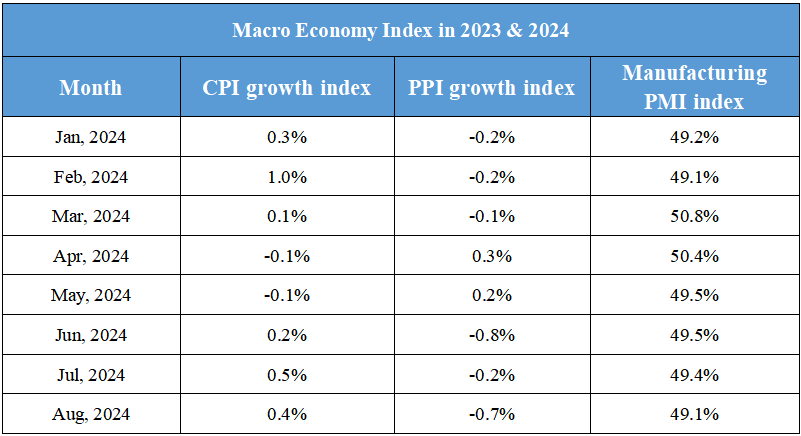

Domestic Macro Economy Index