September 25th Macroeconomic Index: Panda Bond Issuance Hits New High, RMB Exchange Rate Supported by Policy Measures

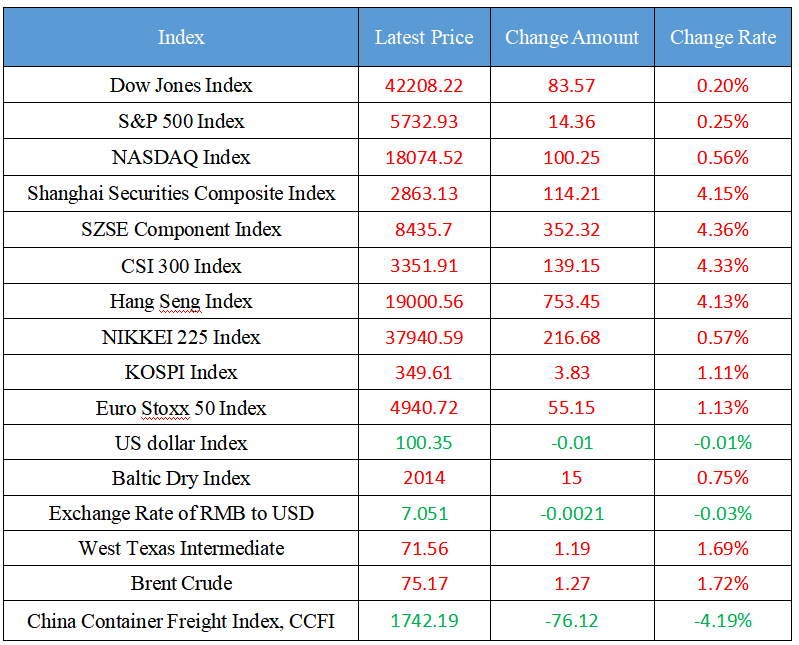

Latest Global Major Index

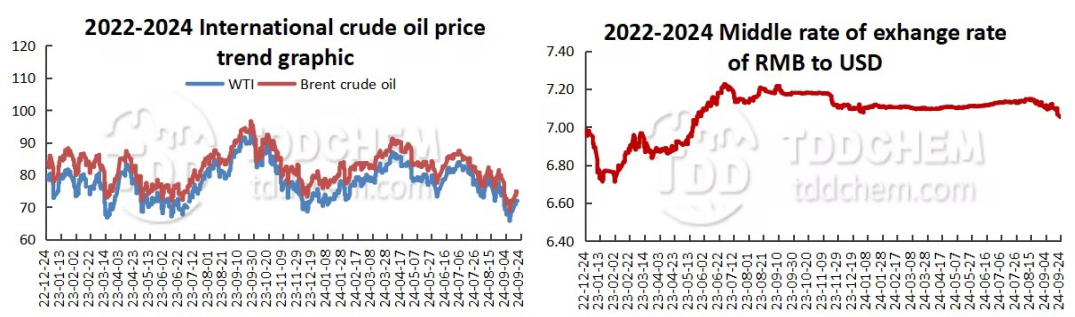

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Low interest rates attracted foreign investment, and the issuance of panda bonds reached a new high of nearly 160 billion yuan during the year

2. Securities Daily: The RMB exchange rate has solid support for maintaining stability

3. The "change portfolio" wealth management products have been adjusted, and the single-day quick redemption limit of many banks has been reduced to 10,000 yuan

4. The public offering is hotly discussed by the central bank's series of blockbuster policies, and the equity asset allocation window may appear

5. Policy news boosted the sharp rise of A-shares, and a number of first-line private equity said that the market will continue to be bullish in the future

International News

1. Bank of Canada Governor: It is reasonable to expect further interest rate cuts

2. The President of Iran called for an end to the Russia-Ukraine Conflict at the United Nations General Assembly

3. The IAEA is now preparing for potential negotiations on the Iran nuclear issue

4. S&P expects United States economic growth to slow in 2025

5. Severe floods in Myanmar have killed a total of 419 people

Domestic News

1. Low interest rates attracted foreign investment, and the issuance of panda bonds reached a new high of nearly 160 billion yuan during the year

It was reported that with the continuous advancement of the internationalization of the RMB, the continuous improvement of the openness of China's bond market, the continuous reduction of financing costs in the domestic market, and the increasing popularity of panda bond issuance have all been achieved. Wind data shows that as of now, the scale of panda bond issuance in 2024 has exceeded that of the whole year of 2023, approaching 160 billion yuan, setting a new historical record. A number of analysts said that the hot issuance of panda bonds in the market is mainly due to the advantages of RMB financing costs under the divergence of monetary policies between China and the United States, and at the same time, China has introduced a series of policies to optimize the issuance environment of panda bonds and facilitate the participation of both domestic and foreign institutions in the investment and financing of panda bonds.

2. Securities Daily: The RMB exchange rate has solid support for maintaining stability

According to the Securities Daily, the Federal Reserve has substantially shifted to interest rate cuts in September and is expected to cut interest rates twice this year, the external depreciation pressure on the RMB exchange rate has been significantly eased, and the appreciation channel of the RMB exchange rate against the US dollar has also been opened. Internally, there is also solid support for the RMB exchange rate to remain stable. The positive factors and favorable conditions in China's economic operation continue to accumulate, the economic rebound will continue to consolidate and strengthen, the effect of the superimposed steady growth policy will gradually appear, the new quality productivw forces will continue to develop rapidly, and continuous improvement of the economic fundamentals is the internal support of the RMB exchange rate. However, this does not mean that the short-term RMB has the possibility of "rising and falling sharply" away from the US dollar.

3. The "change portfolio" wealth management products have been adjusted, and the single-day quick redemption limit of many banks has been reduced to 10,000 yuan

Recently, Bank of Communications announced that it will adjust the daily maximum limit of rapid redemption and payment transfer of its two "change portfolio" wealth management products from October 19, and the total amount of a single day will be reduced to less than 10,000 yuan. In addition to Bank of Communications, since the beginning of this year, Bank of China, Minsheng Bank, China Merchants Bank, Ping An Bank and Bank of Ningbo have also taken corresponding measures to adjust their "change portfolio" wealth management products, including stopping smart deposit or withdrawal services and reducing the limit of quick redemption. Yang Haiping, a researcher at the Securities and Futures Research Institute of the Central University of Finance and Economics, said that there are two main reasons for the current adjustment of "change portfolio" wealth management products: First, it reduces the difficulty of liquidity management of wealth management products and reduces market volatility. Second, meet compliance management requirements.

4. The public offering is hotly discussed by the central bank's series of blockbuster policies, and the equity asset allocation window may appear

On September 24, 2024, the Information Office of the State Council held a press conference, at which a series of blockbuster policies were announced, including lowering the reserve requirement ratio and policy interest rate, lowering the interest rate on existing housing loans, and creating two structural monetary policy tools to further support stable economic growth. A number of fund companies believe that a series of policies are conducive to boosting market confidence and increasing residents' willingness to consume; It is conducive to improving the long-term shareholder return of listed companies and boosting market risk appetite. The A-share market is expected to usher in incremental funds, and it is recommended to pay attention to investment opportunities in large-cap stocks and dividend stocks. At the industry level, domestic demand-related consumption and other industries will benefit from the implementation of relevant policies, and the large financial industry will also benefit from capital market support policies.

5. Policy news boosted the sharp rise of A-shares, and a number of first-line private equity said that the market will continue to be bullish in the future

Boosted by bullish factors such as hot policy news, the three major stock indexes in the A-share market all rose by more than 4% on Tuesday, and the single-day turnover of the whole market approached 1 trillion yuan. Some private equity institutions said that with the gradual reversal of market sentiment and fundamental expectations, the medium and long-term performance of A-shares is worth optimism. The reporter's front-line research in the private equity industry last week showed that many private equity institutions have recently actively predicted on the left side of the market, and an important inflection point in the A-share market may not be far away.

International News

1. Bank of Canada Governor: It is reasonable to expect further interest rate cuts

Bank of Canada Governor Macklem said on Tuesday that it was reasonable to expect further rate cuts given the continued progress the Bank of Canada has made in bringing inflation down to its 2% target. The remarks represented a shift in McCollum's tone, which he had previously said could lead to further rate cuts if the central bank continues to make progress in the fight against inflation. On Tuesday, McCollum made it clear that the central bank had achieved at least some of its main objectives. "Given the continued progress we have made on inflation, it is reasonable to expect further policy rate cuts," he said. "The timing and pace of rate hikes will depend on the upcoming data and our assessment of what it means for future inflation." He reiterated that the central bank wants to see faster economic growth to absorb spare capacity in the economy.

2. The President of Iran called for an end to the Russia-Ukraine Conflict at the United Nations General Assembly

Speaking at the 79th session of the UN General Assembly, Iran's President Massoud Pezeshitsyan called for an end to the fighting between Russia and Ukraine, and dialogue was the only way to resolve the crisis between the two countries. "The Islamic Republic of Iran opposes the war and stresses the urgent need to stop combat operations in Ukraine," Pezeshitsian said. We support all peace initiatives and believe that dialogue is the only way to resolve the crisis. ”

3. The IAEA is now preparing for potential negotiations on the Iran nuclear issue

IAEA Director General Grossi said he saw Iran's willingness to re-engage in dialogue on the Iranian nuclear issue in a more substantive manner; It will visit Iran in the coming weeks, planned for October; Iran is continuing to advance its nuclear program at a steady pace; Future nuclear negotiations will differ from the 2015 nuclear deal, with the IAEA expected to play a greater role, and preparations for possible future negotiations between the West and Iran need to begin now. Earlier, the Iran President said at the United Nations that Iran was ready to improve relations with the world.

4. S&P expects United States economic growth to slow in 2025

S&P Global Ratings said in a report that it expects United States economic growth to slow to 1.8% next year from 2.7% this year. S&P said it expects consumers to control in their spending in the coming quarters. While the Fed is expected to continue cutting interest rates, S&P said: "We believe the upcoming period of gradual easing is more of a precautionary measure to prevent economic growth from falling too underneath potential than an immediate stimulus to the real economy." S&P said that with the exception of the continued downturn in housing and manufacturing, most of the latest activity indicators point to economic growth momentum remaining slightly above trend. The agency also said that it has raised its growth forecast for 2026 and 2027 due to rising potential growth.

5. Severe floods in Myanmar have killed a total of 419 people

The press and information team of the Myanmar National Management Council released a message on the evening of the 24th, saying that as of the morning of the same day, the severe floods had killed a total of 419 people in Myanmar. According to sources, affected by the monsoon and the aftermath of Typhoon "Capricorn", serious floods have occurred in many places in Myanmar in recent days. More than 140,000 people have been affected by the floods, destroying crops, roads, bridges and base stations. It was also said that the Myanmar government has allocated funds for flood relief and post-disaster reconstruction.

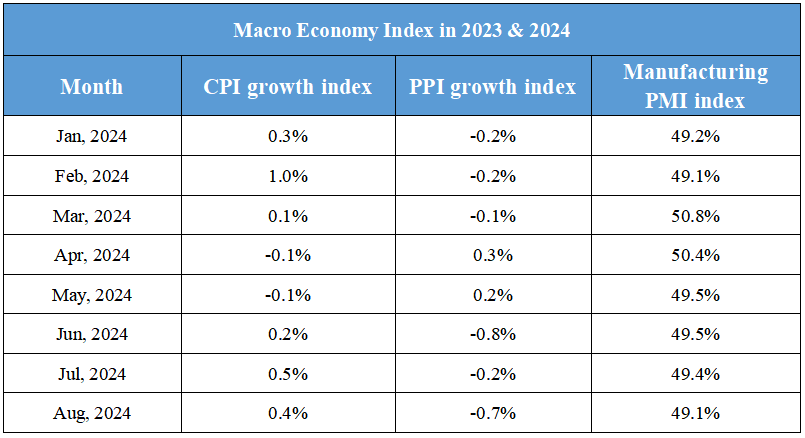

Domestic Macro Economy Index

- December 30 Macroeconomic Index:Financial stability and tariff adjustment guide economic policy, and China-Iran cooperation and Russia-Ukraine negotiations focus on873

- December 27 Macroeconomic Index:Energy Security and Economic Outlook658

- December 26 Macroeconomic Index:The interaction between new real estate policies, energy achievements and global political economy594

- December 25 Macroeconomic Index:Domestic policies are advanced in many aspects, and international energy and population challenges coexist - News overview at the end of 2024689

- December 24 Macroeconomic Index:Changes in India’s oil import sources, US and European economic indicators and energy agreement concerns504