September 24th Macroeconomic Index: Bond Issuance Rises, 'Panda Bond' Market Expands Rapidly

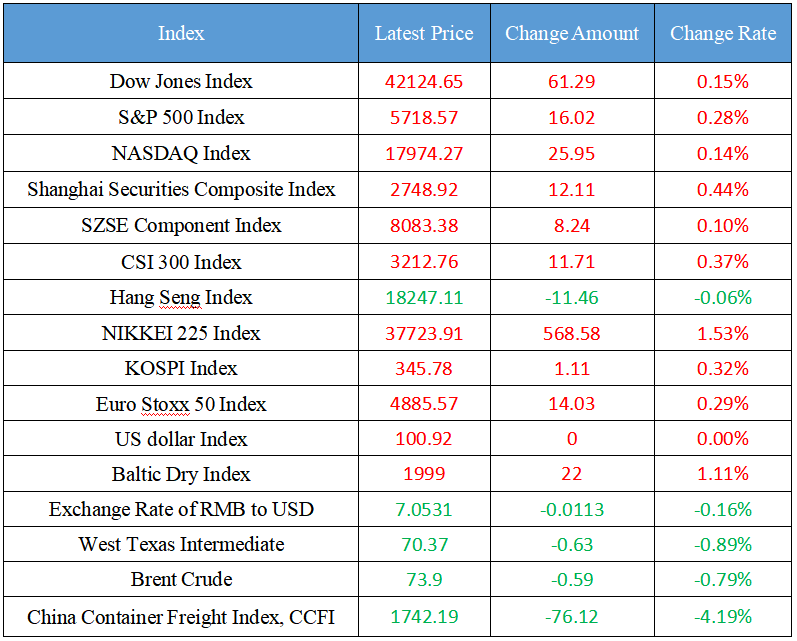

Latest Global Major Index

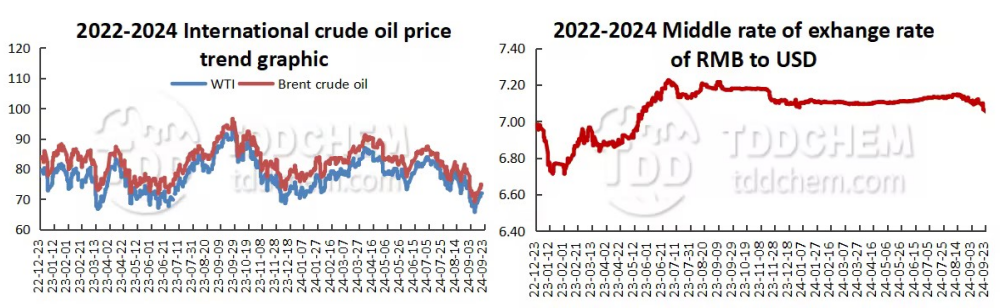

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The issuance of bonds has risen, and the expansion of the "panda bond" market has accelerated

2. Economic Daily: Work together to rectify the illegal sales of e-cigarettes

3. Many banks have lowered deposit interest rates, and experts recommend diversifying asset allocation

4. The yield on 10-year Treasury bonds is approaching 2%, and market views are divided

5. The catering industry "increases income but does not increase profits", and looks forward to the implementation of support policies to stimulate market vitality

International News

1. Goldman Sachs top trader: U.S. stocks are still in a bull market, but the margin for error is quite small, and the risk/reward is not very attractive

2. The FAA vowed to hold Boeing accountable and reform its institutional safety program

3. Zakharova: The main purpose of the European energy strategy is to deny Russia energy and make Russia suffer economic losses

4. The CPC delegation visited Kuwait

5. Iran condemns Israel's attempts to create a broader conflict

Domestic News

1. The issuance of bonds has risen, and the expansion of the "panda bond" market has accelerated

Since the beginning of this year, "panda bonds" have been favored as RMB bonds issued by overseas institutions in China's capital market, and the issuance has been rising. Experts said that factors such as low financing costs and friendly regulatory policies have jointly boosted the rapid development of the "panda bond" market, and the "panda bond" is expected to continue to expand during the year. Zhang Yalan, a researcher at the foreign exchange commodity department of Industrial Research Company, said that in the second half of 2024, there is still room for RRR and interest rate cuts in China, and the financing cost of "panda bonds" will maintain a significant advantage. The low interest rate environment in China has enhanced the attractiveness of "panda bond" financing. It is expected that about 36.1 billion yuan of "panda bonds" will mature in the second half of 2024, and the issuer's demand for refinancing at maturity will support the issuance scale of "panda bonds" in the second half of 2024, which is expected to boost the issuance scale of "panda bonds" to a new high in the whole year.

2. Economic Daily: Work together to rectify the illegal sales of e-cigarettes

According to the article, effectively cracking down on the illegal sales of e-cigarettes is not only an important measure to ensure the healthy growth of teenagers, but also an inevitable requirement for maintaining the order of the e-cigarette industry. At present, there are various channels for teenagers to obtain e-cigarettes, and the iteration of new technologies and new products related to e-cigarettes is very rapid, which increases the difficulty of supervision. Curbing illegal sales requires the joint efforts of multiple departments and the whole society. Relevant laws and regulations should continue to be improved to increase the illegal cost of selling e-cigarettes to minors; Intensify law enforcement, severely punish illegal acts, and ensure that laws and regulations are effectively enforced. Make full use of modern information technology means such as big data and artificial intelligence to strengthen the monitoring of online sales platforms, and severely crack down on the sale of e-cigarettes involving minors.

3. Many banks have lowered deposit interest rates, and experts recommend diversifying asset allocation

Industry participates believe that the recent reduction of deposit interest rates by small and medium-sized banks is a continuation of the new round of interest rate cuts that began on July 25. Looking ahead, under the macro guidance of benefiting the real economy, financial institutions may further reduce the interest rate on loans to the real economy in the future, and there is still room for the deposit rate to be lowered. Investors need to understand the risk and return characteristics of different financial products, choose the appropriate investment portfolio based on their own risk tolerance and capital needs, and diversify the allocation of bank wealth management, funds, treasury bonds, gold and other assets.

4. The yield on 10-year Treasury bonds is approaching 2%, and market views are divided

Since the beginning of this year, the performance of treasury bonds has been outstanding. Among them, the 10-year Treasury bond was the most active, and its yield fell from 2.5% to 2.03%, all the way to the ground. However, as we enter the fourth quarter, the market is diverging in the face of the key point of 2%. The person in charge of a bank wealth management company said: "It is difficult to judge whether the yield of 10-year treasury bonds can exceed 2% in the near future, and we must wait for the implementation of policies such as interest rate cuts and RRR cuts." At the same time, it is necessary to observe the central bank's open market treasury bond trading operations. The bond market has been unexpectedly good so far this year. At the beginning of the year, the most optimistic view was that the yield on the 10-year Treasury note fell to a minimum of 2.2%, while the pivot of the interest rate was around 2.5%. ”

5. The catering industry "increases income but does not increase profits", and looks forward to the implementation of support policies to stimulate market vitality

Since the beginning of this year, with the increasing number of cross-border entrants, the catering industry has shown the phenomenon of "increasing revenue but not increasing profits". Factors such as price wars, homogeneous competition and intensified cost pressures are several major reasons for the industry's predicament. In order to cope with the increasingly fierce market competition, leading catering brands are actively seeking changes, and policies to boost the catering industry have been continuously introduced since 2024. An executive of a listed catering company said: "The total revenue of the catering industry has exceeded 5 trillion yuan, and it is becoming more and more important in the proportion of the entire consumption. As a basic livelihood security industry, the catering industry provides a large number of employment opportunities and has significant social value. In addition to the active adjustment and response of catering enterprises themselves, it is hoped that relevant support policies can be introduced and implemented, such as optimizing the business environment and stimulating market vitality. ”

International News

1. Goldman Sachs top trader: U.S. stocks are still in a bull market, but the margin for error is quite small, and the risk/reward is not very attractive

Tony·Pasquariello, a top trader at Goldman Sachs, noted that five Fed rate cuts over the past four decades have not followed a recession, with the S&P 500 rising 17% in the 12 months since the first rate cut, on average. However, under the current rate cut cycle, United States GDP growth hovers at 3% strongly, and the Dow and S&P regain record highs, making the current stock market, especially the technology-heavy Nasdaq 100, "not very attractive on risk/reward" and "quite little room for error". He still believes that US equities are in a bull market and that "the future trend is still higher", but the risk/reward has been significantly downgraded, "the setting is very harsh, and the path will be unstable", but the strategy of buying in the past two years in the event of a future sharp correction in the market is still effective.

2. The FAA vowed to hold Boeing accountable and reform its institutional safety program

The United States Federal Aviation Administration (FAA) administrator will tell Congress on Tuesday that the agency will hold Boeing accountable to ensure that Boeing makes safe planes and will reform its own safety management program. Federal Aviation Administration Administrator Mike Whitaker will tell the United States House Aviation Subcommittee: "Because of systemic production quality issues, Boeing must make significant changes to reform its quality system to ensure that the right level of safety is in place." "I'm ready to use all my authority to make sure that both the manufacturer, the airlines, and the FAA's own operations are held accountable."

3. Zakharova: The main purpose of the European energy strategy is to deny Russia energy and make Russia suffer economic losses

Russia Foreign Ministry spokeswoman Maria·Zakharova said that the main purpose of the European energy strategy is to reject Russia energy and make Russia suffer economic losses. Commenting on the European Commission's recent annual report on the state of affairs in the EU in the energy sector, Zakharova said: "Now the EU has publicly stated that the main purpose of the EU's proposed energy strategy is to deny Russia energy, undermine the potential of the country's fuel energy complex and cause economic losses to our country." ”

4. The CPC delegation visited Kuwait

From September 21 to 23, Li Mingxiang, Deputy Director of the International Liaison Department of the CPC Central Committee, led a CPC delegation to Kuwait and met with Minister of Public Works of Kula, Deputy Minister of Foreign Affairs Jala, Director of the Investment Bureau Ghanim, and President of the Science and Technology News Agency Fatima to deeply publicize Xi Jinping's Thought on Socialism with Chinese Characteristics in the New Era and the spirit of the Third Plenary Session of the 20th CPC Central Committee. The two sides pledged to implement the important consensus reached by the two heads of state, strengthen the exchange of ideas and practical cooperation, and push the China-Kuwait strategic partnership to a new level.

5. Iran condemns Israel's attempts to create a broader conflict

In response to the attack launched by Israel on Lebanon on the 23rd local time. Iran President Petzeshiziyan criticized on the same day: "We know better than anyone that if a larger war breaks out in the Middle East, it will not benefit anyone." It was Israel that tried to create this broader conflict. On the same day, Iran's Foreign Ministry spokesman Kanaani condemned Israel's attack as "insane." Kanaani said Israel's "crimes" in the Palestinian territories and its "broader attacks on Lebanon are a serious threat to regional and international peace." He strongly criticized United States' support for Israel and called on the UN Security Council to "take immediate action to stop these crimes."

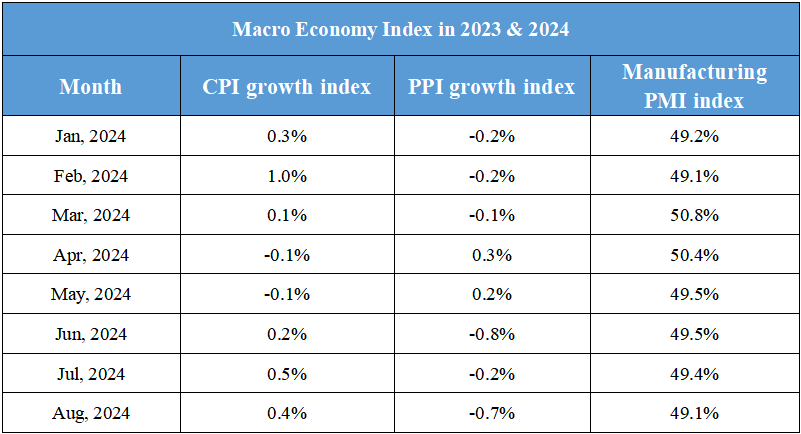

Domestic Macro Economy Index

- December 30 Macroeconomic Index:Financial stability and tariff adjustment guide economic policy, and China-Iran cooperation and Russia-Ukraine negotiations focus on873

- December 27 Macroeconomic Index:Energy Security and Economic Outlook658

- December 26 Macroeconomic Index:The interaction between new real estate policies, energy achievements and global political economy594

- December 25 Macroeconomic Index:Domestic policies are advanced in many aspects, and international energy and population challenges coexist - News overview at the end of 2024689

- December 24 Macroeconomic Index:Changes in India’s oil import sources, US and European economic indicators and energy agreement concerns504