September 19th Macroeconomic Index: China Faces Trillion Yuan Funding Gap, Market Calls for RRR Cut

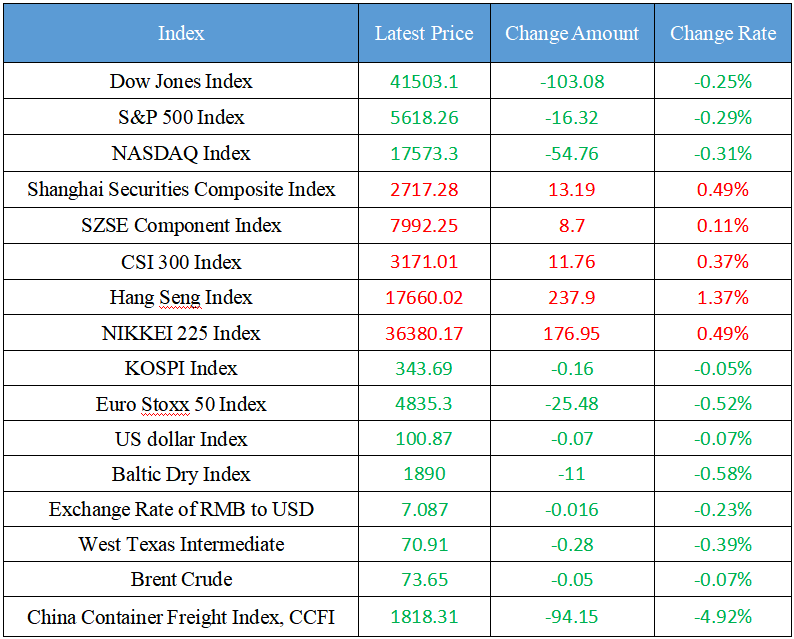

Latest Global Major Index

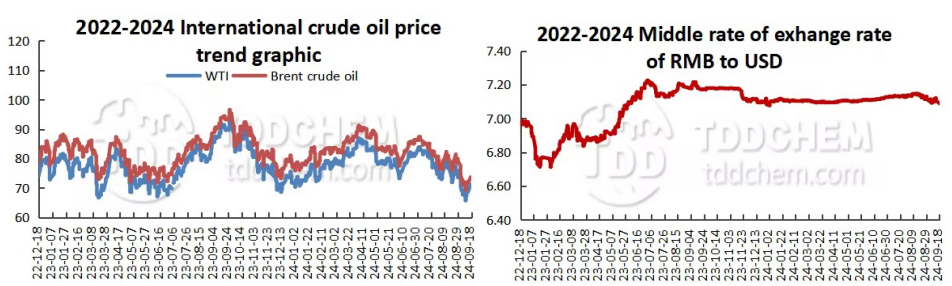

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The capital is facing a gap of one trillion yuan, and the market is calling for another deposit-reserve ratio cut

2. Experts: There is still room for further adjustment in reducing mortgage interest rates and transaction taxes and fees

3. A 4.7-magnitude earthquake occurred in Hefei, and the Anhui Provincial Earthquake Bureau reported that there was no one injured

4. Chief of the electronics industry of GF Securities: The domestic semiconductor equipment market has a broad space

5. Taiwan Affairs Office of the State Council: Support the State Council Taxation Commission to cancel the zero-tariff policy for 34 agricultural products in Taiwan

International News

1. "Fed mouthpiece": The Fed is actually making up for lost time

2. Bank of America: The Federal Reserve cuts interest rates to protect employment, and two interest rate cuts in the future can be expected

3. Powell: If you see the July employment report first, you may start cutting interest rates in July

4. The Israeli Prime Minister made his first statement after the explosion in Lebanon: he will let the residents of northern Israel return safely

5. Brazil's central bank raised interest rates for the first time in two years and signaled that interest rates could rise further

Domestic News

1. The capital is facing a gap of one trillion yuan, and the market is calling for another deposit-reserve ratio cut

The People's Bank of China announced on September 18 that in order to hedge the impact of factors such as MLF and the maturity of reverse repo in the open market, and maintain reasonable and sufficient liquidity in the banking system, a 7-day reverse repo operation of 568.2 billion yuan was carried out in the open market on the same day, with an operating interest rate of 1.7%. MLFs expired on that day, will be renewed on September 25. This week, there will be a shortfall of nearly 1.5 trillion yuan. Against the backdrop of challenges in cross-quarter funds, the instability of the liabilities of major banks and the exhaustion of the quota for certificates of deposit, industry insiders are looking forward to RRR cuts to stabilize the market. Xu Liang, chief analyst of fixed income at Huafu Securities, said that at present, the supply of certificates of deposit of state-owned banks is approaching the upper limit as a whole, and there is little room for substantial net financing in the future. Although the RRR cut cannot completely solve the funding gap of banks, it can alleviate the pressure on the debt side to a certain extent.

2. Experts: There is still room for further adjustment in reducing mortgage interest rates and transaction taxes and fees

Xu Yuejin, Deputy Director of research at the China Index Research Institute, expects that the end of September each year is the intensive introduction of property market policies, and it is expected that the relaxation of restrictive policies in core cities is still an important direction for demand-side optimization. From the trend point of view, the property market /84policy is expected to be optimized at the end of September, and with the support of the policy, the market transaction is expected to pick up in the fourth quarter."

3. A 4.7-magnitude earthquake occurred in Hefei, and the Anhui Provincial Earthquake Bureau reported that there was no one injured

After the 4.7-magnitude earthquake in Hefei on September 18, 2024, the Provincial Earthquake Bureau and the Provincial Emergency Management Department immediately activated the earthquake emergency service response. The epicenter of the earthquake was located at Liangyuan Town, Feidong County, Hefei City. The earthquake was felt in Hefei and generally felt in the whole province. No injuries were reported. So far, the maximum aftershock has been detected with a magnitude of 2.5. The China Earthquake Administration organized a joint consultation with the China Earthquake Network Center, the Anhui Provincial Earthquake Bureau, the Zhejiang Provincial Earthquake Bureau, the Shanghai Earthquake Bureau, and other units, and believed that there was unlikely that an earthquake of magnitude 5 or higher would occur in the original earthquake area in recent days. Provincial and municipal earthquake and emergency departments sent working groups to the epicenter area to check the disaster situation and guide the emergency response work.

4. Chief of the electronics industry of GF Securities: The domestic semiconductor equipment market has a broad space

Geng Zheng, chief analyst of the electronics industry of the GF Securities, said that the domestic semiconductor equipment market has a broad space. From the perspective of the semiconductor wafer manufacturing equipment market, the current domestic semiconductor equipment companies have made significant progress in product iteration and update, and the progress of introducing new products to customers has accelerated, continuously enriching business growth points and increasing the service market space. In addition, the process coverage of mature processes by domestic equipment is becoming more and more perfect, and the process breakthrough of advanced processes is actively promoted. In the future, domestic semiconductor equipment is expected to continue to benefit from the expansion of the equipment market.

5. Taiwan Affairs Office of the State Council: Support the State Council Taxation Commission to cancel the zero-tariff policy for 34 agricultural products in Taiwan

Chen Binhua, spokesman for the Taiwan Affairs Office of the State Council, said on 18 September that the mainland side adhered to the concept of "both sides of the strait are from one family" and exempted 34 agricultural products, including fresh fruits, vegetables, and aquatic products, from import tariffs in two Taiwan batches on 1 August 2005 and 20 March 2007, effectively helping Taiwan agricultural products to open up the mainland market and Taiwan farmers and fishermen to gain tangible benefits from them. However, since the Lai Qingde authorities came to power, they have stubbornly adhered to the "Taiwan independence" stance, constantly carried out provocations to seek "independence," escalated cross-strait hostility and confrontation, obstructed cross-strait exchanges and cooperation, and still unilaterally restricted the import of more than 1,000 agricultural products from the mainland, seriously harming the well-being of compatriots on both sides of the strait. In view of this, the Customs Tariff Commission of the State Council issued an announcement today to suspend the implementation of the import tariff exemption policy for 34 agricultural products from Taiwan from September 25, 2024, which we strongly support.

International News

1. "Fed mouthpiece": The Fed is actually making up for lost time

Nick Timiraos, the "Fed mouthpiece", recently wrote that the Fed voted today to cut interest rates by 0.5 percentage points, the first rate cut since 2020, and it is also a bolder start. Powell's decision to cut interest rates more than most analysts expected a few days ago has unwaveringly ushered in a new phase in the Fed's fight against inflation: the Fed is now trying to prevent past rate hikes from further weakening the United States labor market. Speaking at a press conference, Powell said: "We are committed to maintaining our economic strength. "This decision reflects our growing confidence that we can maintain the strong momentum in the labour market by appropriately adjusting our policy stance." While some Fed officials have argued in recent weeks that the economy is not yet weak enough to require a 50 basis point rate cut, others have concluded that the cooling of the labor market this summer makes a case for further rate cuts, as the Fed is effectively making up for lost time.

2. Bank of America: The Federal Reserve cuts interest rates to protect employment, and two interest rate cuts in the future can be expected

Tom Hainlin, Senior investment strategist of the Bank of United States, said we don't have a particular view on whether to cut rates by 25 basis points or 50 basis points. So wouldn't say we'd be surprised. Looking ahead, two more rate cuts should be expected, at least from now to the end of the year. As inflation begins to move closer to target, it is not surprising that Powell is focused on the employment side of the mission, and he is concerned about potential downside risks to the labor market. There are indications that the labor market may be weaker than the data suggests. So it seems to us to be a kind of insurance against the labor market to prevent unemployment from rising and keep the economy running well.

3. Powell: If you see the July employment report first, you may start cutting interest rates in July

Fed Chair Jerome Powell said at a press conference that the Fed could cut interest rates for the first time at its July meeting if it sees ahead of the non-farm payrolls report a few days after the July decision. The United States nonfarm payrolls report for July showed a weak United States labor market. Powell said: "If we get the July jobs report before the meeting, will we cut rates? We probably will. But we haven’t made that decision, but you know, we probably did. ”

4. The Israeli Prime Minister made his first statement after the explosion in Lebanon: he will let the residents of northern Israel return safely

On September 18, local time, Israel Prime Minister Benjamin Netanyahu issued a statement saying that residents in northern Israel would be allowed to return home safely. It was Netanyahu's first public statement after two consecutive days of massive explosions of communications equipment in Lebanon. In addition, on the 18th, at its tenth emergency special session to discuss the Palestinian-Israeli issue, the United Nations General Assembly voted to adopt a draft resolution on the Israel advisory opinion on the Occupied Palestinian Territory, calling on Israel to end its illegal presence in the Occupied Palestinian Territory within 12 months of the adoption of the resolution. In the vote, 124 votes were in favor, 14 votes were against by United States and Israel, and 43 abstentions. China voted in favor.

5. Brazil's central bank raised interest rates for the first time in two years and signaled that interest rates could rise further

Brazil's central bank started its interest rate hike cycle as expected on Wednesday, raising its benchmark interest rate by 25 basis points to combat the inflation outlook exacerbated by stronger-than-expected economic activity and fiscal problems. The COPOM, voted unanimously to raise the benchmark Selic rate to 10.75%, the first rate hike in more than two years. Despite the Fed's high-profile easing cycle earlier in the day, Brazil's central bank began to move in the other direction and signaled further rate hikes ahead. "The pace of future rate adjustments and the overall adjustment of the initial cycle will depend on a strong commitment to achieving the inflation target and inflation dynamics," the COPOM policy statement stated. "

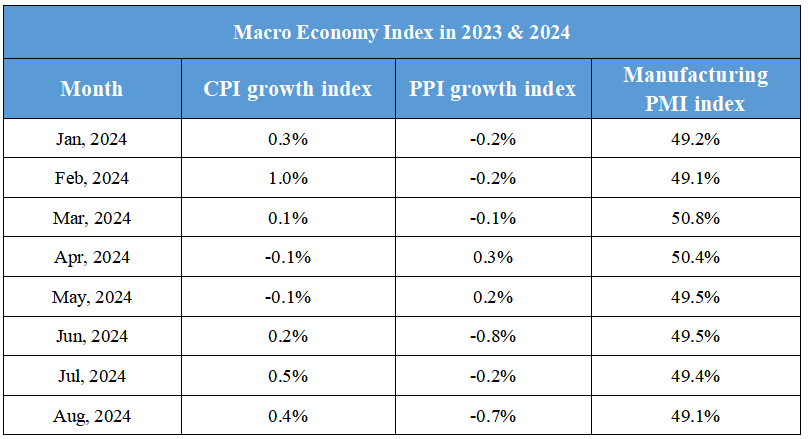

Domestic Macro Economy Index