September 11th Macroeconomic Index: Steel Prices Set to Rise in 'Golden September and Silver October', Losses May Narrow

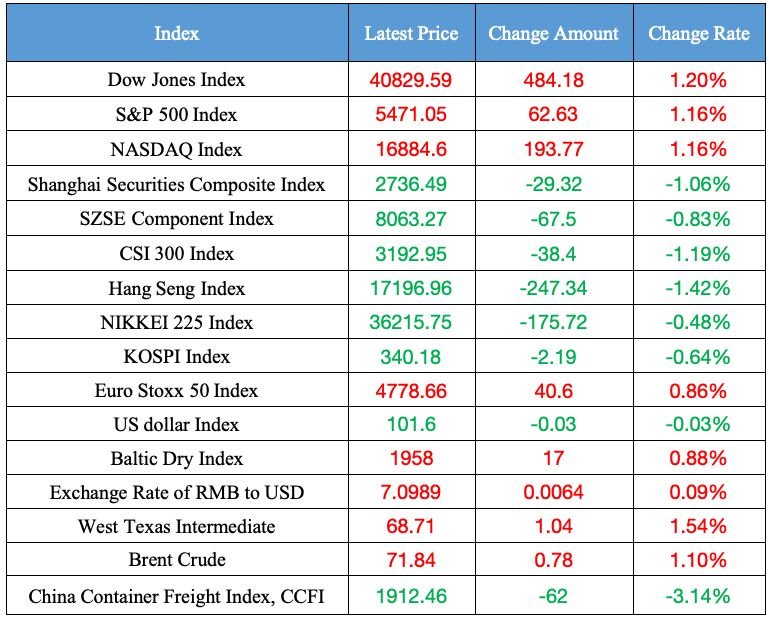

Latest Global Major Index

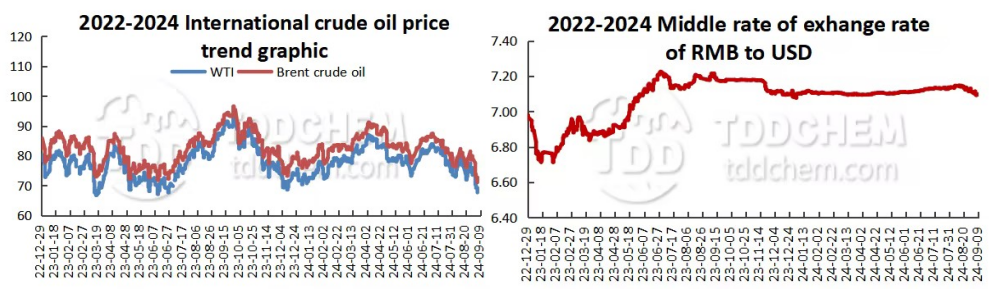

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Economic Daily: How China's game industry has "72 changes"

2. Steel prices are to be raised in "Golden September and Silver October", and the loss of production enterprises may be narrowed.

3. High-level strong stocks make up for the decline. Institutions: A-shares seem to have the characteristics of the bottom

4. A number of private banks have lowered deposit interest rates and gradually weakened the high-interest deposit model

5. The bank wealth management companies has achieved "bumper harvest", and wealth management scale is concentrating on the head

International News

1. It is reported that the capital increase requirements of large banks will be halved United States

2. Morgan Stanley is bearish on some emerging market bonds, and the Fed's interest rate cut is unlikely to stimulate the influx of funds

3. US stocks closed: all the three major stock indexes rose more than 1%, and NIO hit a 4-month high

4. The Prime Minister of Qatar called for an immediate ceasefire in the Gaza Strip

5. The Walmart heiress will co-host a fundraising activity for Harris

Domestic News

1. Economic Daily: How China's game industry has "72 changes"

According to the article, on the one hand, it is necessary to continue to increase policy support, attract a number of domestic and foreign chain leading enterprises, terminal platform enterprises, IP incubation enterprises, cultural venture capital funds and creative teams, promote the overall creation of financial products and services in the game industry, expand funding sources through multiple channels, and focus on supporting content production, technology research and development, talent training, brand events and other fields; With the help of overseas channels such as Steam, TikTok, YouTube and other overseas channels to promote global communication and popularization, open up the whole chain of IP production, research and development, finance, launch, operation and derivation, and accelerate the construction of an industrial chain ecosystem in which large and medium-sized enterprises cooperate and support, and the two markets work in the same direction. On the other hand, it is necessary to support the excellent and large enterprises, focus on supporting those game companies with strong original innovation ability with promising development prospects, and increase the prize and subsidy for original works and scientific and technological innovation teams.

2. Steel prices are to be raised in "Golden September and Silver October", and the loss of production enterprises may be narrowed.

Steel prices have fallen sharply in recent years, the industry has fallen into losses as a whole, and the problem of overcapacity has become prominent again. In this context, the industry has been calling for active production restrictions. At the policy level, the Ministry of Industry and Information Technology has also recently issued a document to suspend the replacement of steel production capacity. Industry analysts believe that the current steel industry is still weak, and the seasonal rebound in steel demand is still expected to occur with the destocking of social inventories. Although the overall rebound in steel prices is not expected to be strong, the loss of steel enterprises is expected to narrow.

3. High-level strong stocks make up for the decline. Institutions: A-shares seem to have the characteristics of the bottom

On Monday, the market fluctuated and diverged throughout the day, with the Shanghai Composite Index opening low and continuing to hit a new low, and the Growth Enterprise Index bottoming out. On the market, many high-level stocks fell sharply, Shenzhen Huaqiang, and Public Transportation fell to the limit; Banks, coal and other heavyweight stocks have been adjusted; State-owned enterprise reform concept stocks and pharmaceutical stocks broke out against the trend; The folding screen concept is active, and TATFook Technology has a 20% daily limit. Recently, the A-share market has continued to be weak, the adjustment of major broad-based indices has increased, the market lacks a main line as a whole, and the strong sectors in the early stage have made up for the decline. Looking ahead, the agency believes that the market has shown more bottom characteristics, and confidence repair still needs more positive factors to support.

4. A number of private banks have lowered deposit interest rates and gradually weakened the high-interest deposit model

Since the end of August, a number of private banks such as WeBank, MYbank, and Liaoning Zhenxing Bank have lowered the interest rates on some term deposits, ranging from 10 basis points to 30 basis points. After the reduction, the interest rate on long-term deposits of some private banks is still above 3%, and the interest rate has a certain advantage. Previously, private banks had been taking deposits at higher interest rates. However, in the context of the net interest margin pressure of the banking industry as a whole, private banks cannot stay away. Industry participates said that under the effect of the interest rate marketization mechanism, private banks are enhancing their awareness of active debt, avoiding problems such as blindly raising debt costs, so that they can have more space to benefit entity enterprises.

5. The bank wealth management companies has achieved "bumper harvest", and wealth management scale is concentrating on the head

In the first half of this year, bank wealth management companies ushered in a "bumper harvest". In the context of the abolition of manual interest compensation and the continuous decline of deposit interest rates, the scale of bank wealth management has developed rapidly in the first half of the year. The wealth management subsidiaries of A-share listed banks achieved good results as a whole, with a year-on-year increase of 14%, and the number of companies with net profits exceeding 1.1 billion yuan increased to 6, doubling from last year. At the same time, in the first half of the year, the competition in bank wealth management has become increasingly fierce, and the industry pattern is quietly changing. In terms of scale, CMB Wealth Management, IB Wealth Management and CNCBI Wealth Management still maintain the top three positions, but the scale growth rate of wealth management subsidiaries of large state-owned banks is obvious, and the gap is narrowing. From the perspective of profits, the top three banks have changed hands.

International News

1. It is reported that the capital increase requirements of large banks will be halved United States

Eight large United States banks, including Bank of United States and JPMorgan Chase, will face capital increase requirements halved, from 19 percent to 9 percent, after United States regulators agree to a sweeping package of rules, according to people familiar with the matter. A sharp reduction in capital requirements is more likely to appease the banks, which have been engaged in one of the most intense lobbying campaigns since the proposal was introduced last year. The revised draft could also help Fed Chair Powell achieve his goal of garnering broad support from Fed committees. Powell has made it clear to the banks that he also wants to avoid a lengthy legal battle. Barr, the Fed's vice chair for supervision, is scheduled to outline the changes in his speech on Tuesday.

2. Morgan Stanley is bearish on some emerging market bonds, and the Fed's interest rate cut is unlikely to stimulate the influx of funds

Morgan Stanley's view on selected emerging market sovereign bonds has shifted to cautious attitude, with the bank believing that Fed rate cuts are unlikely to spur significant inflows into bond funds. Strategists such as Simon Waever recommend investors to be bearish on the asset class in the short term, increase the level of cash in their portfolios, focus on investment-grade bonds rather than riskier bonds, or sell emerging market credit default swap indices. According to a report published Monday, the bank removed Nigerian, Argentina and Morocco bonds from a basket of preferred bonds and included Mexico and Romania bonds, which have become "cheaper." The forecast is partly influenced by expectations that the United States interest rate market is already pricing in a soft landing for the economy. "A further decline in United States Treasury yields could be detrimental to risk appetite," they said, adding that "it will take up to 12 months for money market funds to move from money market funds to risky assets after the first rate cut."

3. US stocks closed: all the three major stock indexes rose more than 1%, and NIO hit a 4-month high

US stocks closed up 1.2% on Monday, with the Dow up 1.2%, the S&P 500 up 1.16%, and the Nasdaq up 1.16%. Tesla (TSLA. O) rose 2.6%, while Nvidia (NVDA. O) rose 3.5%, and Apple (AAPL. O) rose slightly. The Nasdaq China Golden Dragon Index closed up 0.69%, while Alibaba (BABA. N) rose 0.3%, while Nio (NIO. N) closed up nearly 11% to close at a four-month high.

4. The Prime Minister of Qatar called for an immediate ceasefire in the Gaza Strip

Qatar's Prime Minister and Foreign Minister Mohammed called for an immediate ceasefire in the Gaza Strip during the Gulf Cooperation Council and Brazil's Ministerial Strategic Dialogue in Riyadh, Saudi Arabia. He said that ending the conflict in the Gaza Strip was a crucial step towards easing escalating tensions in the region and achieving lasting peace in the region, and that all parties concerned needed to continue mediation and consultation to ensure a ceasefire in the Gaza Strip, alleviate the suffering of the Palestinian people and guarantee the release of detainees. He stressed that diplomatic efforts are an effective way to avoid the cycle of violence and escalation and achieve regional security and stability.

5. The Walmart heiress will co-host a fundraising activity for Harris

Walmart heir Christy Walton will co-host a fundraising activity for United States Vice President Kamala·Harris, signaling the Democratic nominee's growing popularity among wealthy donors and business leaders. According to the invitation, the lunch reception that will be held on Sept. 15 in Jackson Hole, Wyoming, will be attended by Michigan Gov. Gretchen Whitmer and former Montana Gov. Steve Bullock. Walton, who was named as a co-sponsor of the event, was previously one of the key donors to the Democratic Party who urged President Joe·Biden to withdraw from the election. According to the Billionaires Index, she is worth $15.4 billion.

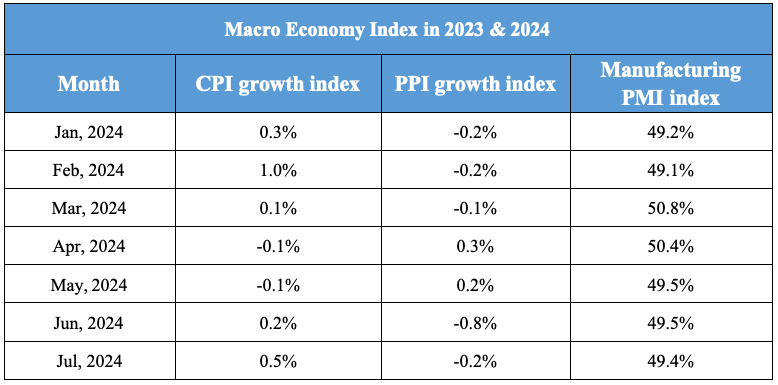

Domestic Macro Economy Index