Global Economic Highlights and Market Trends on September 4th

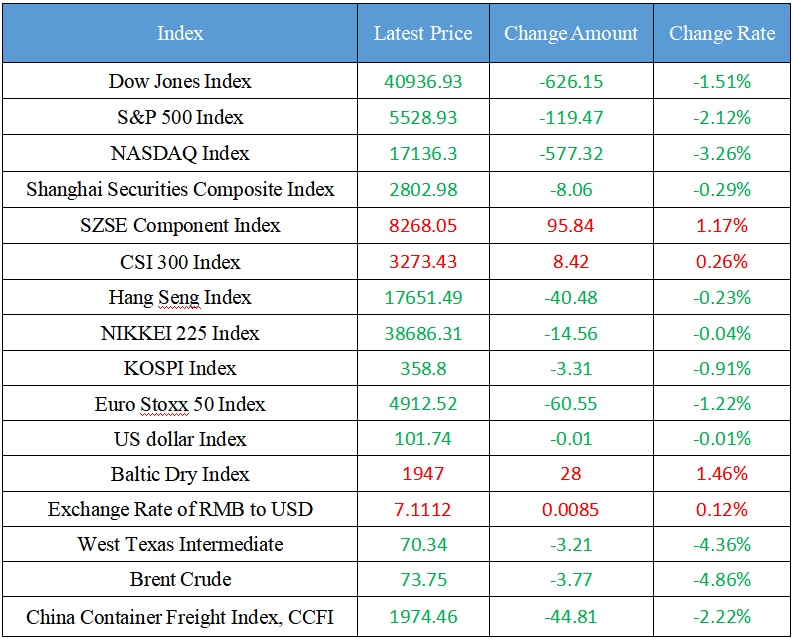

Latest Global Major Index

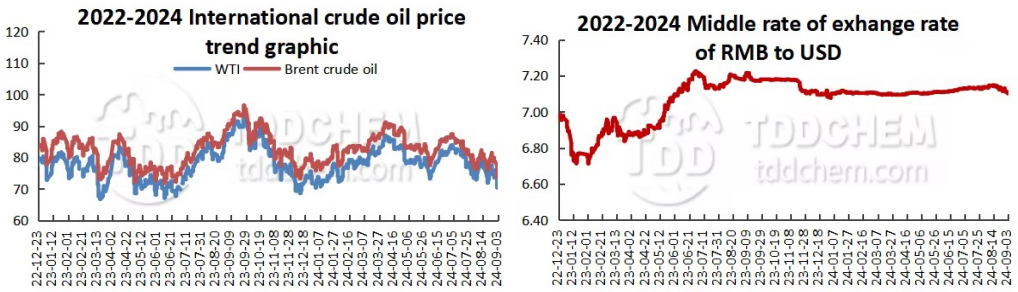

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Economic Daily: Accelerate the improvement of special residential maintenance funds management

2. Economic Daily: Compliance is a compulsory course, and development is a must-answer question

3. Competition is intensifying, and the non-performing rate of retail loans of some banks has risen

4. President Xi Jinping held talks with Nigerian President Bola Tinubu

5. The State Administration for Market Regulation announced the Key Measures of Market Regulation Authorities to Optimize the Business Environment (2024 Edition)

International News

1. Some people claimed that Israel agreed to withdraw from the "Philadelphia corridor" in the second phase of the hostage exchange agreement

2. The former governor of the Central Bank of Lebanon was arrested

3. Weak data once again triggered concerns about economic slowdown, and U.S. stocks had a "black start" in September

4. US stocks closed: There is a "black start" in September, and Nvidia fell nearly 10% in September

5. Nvidia received a subpoena from the United States Department of Justice, and the antitrust investigation was escalated

Domestic News

1. Economic Daily: Accelerate the improvement of special residential maintenance funds management

The article claimed that it is necessary to improve the services related to special residential maintenance funds, and further standardize the use of funds, information disclosure, process supervision and other links. For example, the electronic voting system for the decision-making of the owners can effectively solve the problems such as the difficulty of voting on public affairs of the owners of the community. Through the establishment of a directory of third-party service institutions such as project cost review and project supervision for the use of maintenance funds, the efficiency of the use of special maintenance funds can be effectively improved and the operation of maintenance projects can be standardized. It is also possible to establish an information disclosure and fund supervision mechanism, through the disclosure of information on the use of maintenance funds, value-added income and the total amount of maintenance funds in the community, etc., to inform the owners of the details of the owner's sub-account, fully protect the owner's right to know and supervise, and ensure the safety of the collection, use and operation of the maintenance fund.

2. Economic Daily: Compliance is a compulsory course, and development is a must-answer question

Recently, the State Administration for Market Regulation announced the supervision of Alibaba Group's compliance rectification, and released a positive signal in the briefing to support and encourage the standardized, healthy and sustainable innovation and development of the platform economy. Compliance is a compulsory course, and development is a must-answer question. From the filing and closing of the case against Alibaba Group to the announcement of the completion of the rectification, as Alibaba Group said in its response, "this is a new starting point for development", the industry has also generally felt positive signals. It is expected that Alibaba Group and other platform companies will find a new strategic positioning and direction, travel lightly for development, start again with vigor, continue to adhere to innovation and compliance management, increase investment in science and technology, promote the healthy development of the platform economy, and create more value for the society.

3. Competition is intensifying, and the non-performing rate of retail loans of some banks has risen

At present, the rate race of banks' personal loan business, especially consumer loans and business loans, has intensified, and the price war is like an all-consuming fire. Under aggressive marketing, risks and concerns have emerged. According to the data, the asset quality of listed banks remained stable as a whole, but the non-performing loan ratio of some banks in the retail loan sector increased in the first half of the year. "It is expected that in the second half of the year and in the future, the non-performing rate, the concern rate and the overdue rate will increase slightly, but the risk of the entire retail credit is stable and controllable." Wang Ying, Vice President of China Merchants Bank, believes that for the next stage of retail credit business, in terms of housing loan business, second-hand housing is a new force of China Merchants Bank, and small and micro and consumer loans are also important varieties. In the credit card business, the new focus is the installment business, including automobile installment and new energy vehicle installment.

4. President Xi Jinping held talks with Nigerian President Bola Tinubu

President Xi Jinping held talks with Nigerian President Tinubu. The two heads of state announced that China-Nepal relations will be upgraded to a comprehensive strategic partnership. Xi pointed out that China is further deepening reform in an all-round way and promoting Chinese-style modernization, which will bring more opportunities for the development of China-Nepal relations. The two sides should work together with high-quality cooperation to achieve their respective modernizations and promote new and greater development of China-Nepal relations.

5. The State Administration for Market Regulation announced the Key Measures of Market Regulation Authorities to Optimize the Business Environment (2024 Edition)

The State Administration for Market Regulation announced the Key Measures of Market Regulation Authorities to Optimize the Business Environment (2024 Edition). The "Key Measures" put the improvement of the basic system of the market economy in a more important position, stabilized market expectations, and stimulated the vitality of business entities. Comprehensively and thoroughly advance the categorical management of credit risks, truly reducing unnecessary interference with enterprises' normal production and business activities; Improve the system and mechanism of fair competition, focusing on eliminating problems such as restricting the independent relocation of enterprises, hindering fair market access, and building a self-"small cycle".

International News

1. Some people claimed that Israel agreed to withdraw from the "Philadelphia corridor" in the second phase of the hostage exchange agreement

On September 4, an Israel source said that Israel had notified the mediator that it agreed to withdraw from the "Philadelphia corridor" in the second phase of the hostage exchange agreement. Egypt's Foreign Ministry said in a statement earlier in the day that Egypt completely opposed Israel Prime Minister Benjamin Netanyahu's previous remarks about the "Philadelphia corridor." The statement said the statement sought to divert public opinion from Israel in the name of Egypt and was aimed at blocking a ceasefire and hostage exchange agreement and hindering the efforts of the mediators, including Egypt. Earlier, Israel Prime Minister Benjamin Netanyahu said that Hamas was acquiring weapons from Egypt through the "Philadelphia corridor". Netanyahu also insisted that Israel should control the Philadelphia corridor along the Gaza Strip with Egypt.

2. The former governor of the Central Bank of Lebanon was arrested

According to a report by the Lebanon State News Agency on the 3rd, Salama, who had served as governor of the Central Bank of Lebanon for 30 years, was arrested by the Lebanese judicial organs on the same day. According to the report, Lebanese prosecutor Hajar questioned and investigated Salama on the same day about a case related to a financial company called "Optimal Investment", and subsequently arrested him. Hajar told Lebanese television station that the judicial measures taken against Salama were "four-day preventive detention", after which he would be handed over to the investigating judge for questioning and making an appropriate judicial decision.

3. Weak data once again triggered concerns about economic slowdown, and U.S. stocks had a "black start" in September

New economic data has once again raised concerns about the health of the economy, with United States stocks witnessing a bad start in September and tech stocks tumbling collectively. The Dow fell more than 650 points, or 1.6%, intraday. The S&P 500 fell more than 2.2%, and the fear index VIX soared 30%. The Nasdaq fell 3.3%, its worst day since the global stock market crash on Aug. 5. Nvidia (NVDA. O) shares fell more than 9%, leading semiconductor stocks to weigh on the stock market. Previous data showed that the final S&P global manufacturing PMI in United States fell in August, and the ISM manufacturing index in United States in August fell short of economists' expectations. Larry Tentarelli, chief technical strategist at Blue Chip Trends Report, said: "The market seems to be very sensitive to any data at the moment. "We've become a very data-dependent marketplace."

4. US stocks closed: There is a "black start" in September, and Nvidia fell nearly 10% in September

The Dow initially closed down 1.5%, the S&P 500 fell 2.1%, the Nasdaq fell 3.2%, and the fear index VIX rose 32%. The Philadelphia Semiconductor Index fell 7.7%, while Nvidia (NVDA. O) fell 9.5%, and Intel (INTC. O) fell nearly 9%. Apple (AAPL. O) fell 2.7%. The Nasdaq China Golden Dragon Index closed down 0.86%, while Xpeng Motors (XPEV. N) rose 4%, and Alibaba (BABA. N) fell 1%.

5. Nvidia received a subpoena from the United States Department of Justice, and the antitrust investigation was escalated

It is reported that the United States Department of Justice has issued a letter to Nvidia (NVDA. O) and other companies issued subpoenas seeking evidence of Nvidia's violations of antitrust laws, reflecting an escalation in the investigation. Previously, the Ministry of Justice only sent questionnaires to relevant companies, but now it has issued a legally binding request for information from the recipients, according to people familiar with the matter. This means that the government's investigation is one step closer to the formal filing of a lawsuit. Antitrust officials are concerned that Nvidia is making it harder for customers to switch to other suppliers and penalizing buyers who don't exclusively use its AI chips, people familiar with the matter said. Representatives for the Justice Department and Nvidia declined to comment.

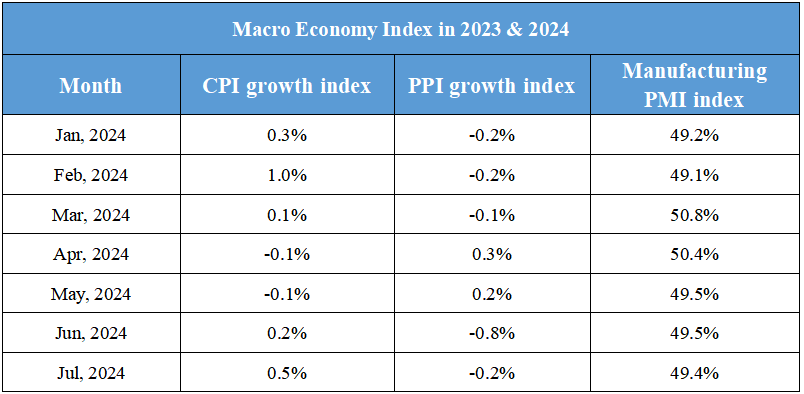

Domestic Macro Economy Index