September 3rd Macroeconomic Index: China's Brokerage Transformation, Gold Stocks Divergence, and Energy Storage Growth

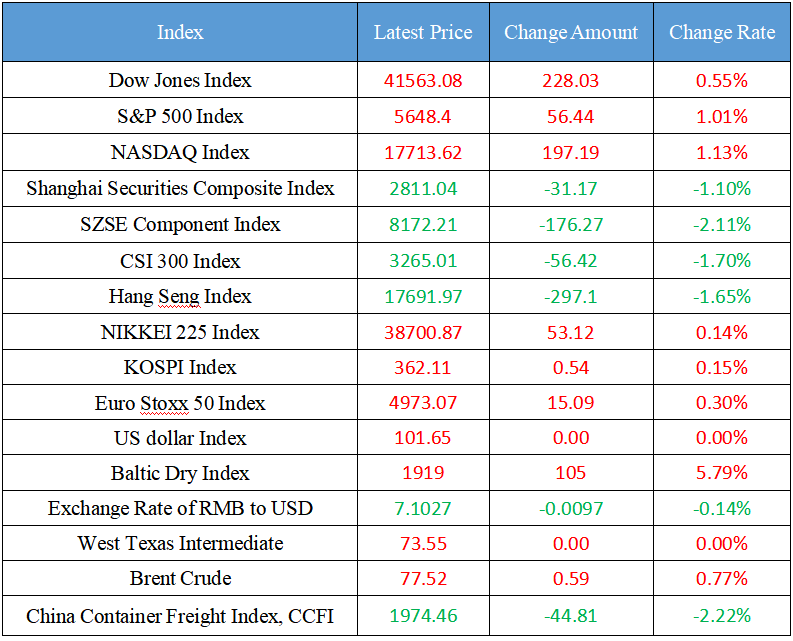

Latest Global Major Index

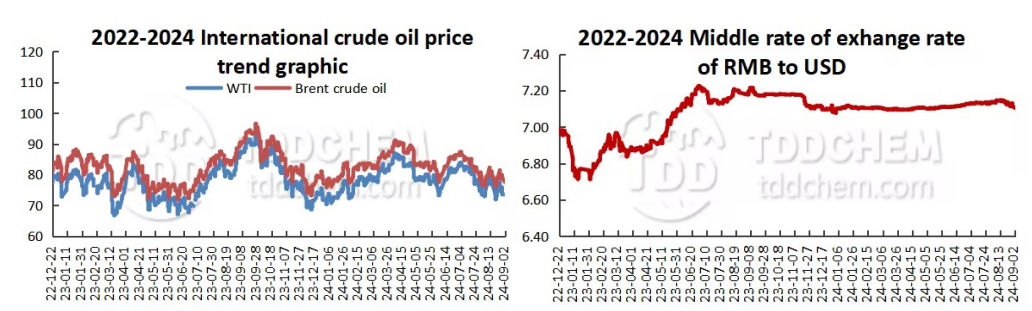

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Build the industrial investment bank, and help the brokerage company to explore new ideas for service entities

2. Capital side is expected to be supported continuously. The market expects that the liquidity gap will be limited in September

3. The embarrassing private equity FOF. Industry shows there is basically no customer dare to buy

4. Gold stocks and gold prices run in opposite directions

5. Experts are hotly discussing the "high standard" development of the industry, and energy storage is expected to become a new growth pole for power batteries

International News

1. The United Nations mediated the crisis of the Libya central bank, and all parties reached an important consensus

2. Media: At least 4 people were killed dead in a shooting on a train in United States

3. Large-scale military exercises will be held in Latvia

4. Turkey airstrikes on multiple targets of the Kurdistan Workers' Party in northern Iraq

5. Ministry of Foreign Affairs of Belarus: Belarus and Russia will sign a security guarantee agreement in December this year

Domestic News

1. Build the industrial investment bank, and help the brokerage company to explore new ideas for service entities

In the context of the increase in the supply of industrial bonds and the contraction of the supply of urban investment bonds, it is imminent for brokerages to transform from bond investment banks to industrial investment banks. According to market analysts, the transformation of securities companies into industrial investment banks is an inevitable choice to adapt to market changes, meet customer needs, respond to policy calls, grasp industry development trends, strengthen risk management, and optimize the allocation of talents and resources. In addition, the establishment of an industrial investment bank will help securities companies improve their resource allocation capabilities, serve the financing needs of innovative enterprises, and achieve revenue growth and diversification. By participating in the top-level design of enterprise development and accelerating the integration of capital, industry and innovation elements, brokerages can become value discoverers and enhance their position in the capital market.

2. Capital side is expected to be supported continuously. The market expects that the liquidity gap will be limited in September

The market liquidity gap is expected to remain at a low level in September. The market expects that the central bank will maintain the stability of the capital side through open market operations, avoid large fluctuations in short-term interest rates, and take measures such as RRR cuts if necessary to provide additional liquidity support. Still, it is important to keep an eye on the volatility of the price of funds during the month, as this may cause some disruption to the bond market. Against the backdrop of controllable pressure on government bond issuance and fiscal spending support, the liquidity gap is expected to be small in September. According to the calculation of Guolian Securities, the supply of government bonds in September will form a payment pressure of about 966.7 billion yuan, from the perspective of the amount of financing in a single month, less than the level of August and May, it is expected that there will still be some disturbance to the capital side, but the overall controllability.

3. The embarrassing private equity FOF. Industry shows there is basically no customer dare to buy

According to the statistics of the private equity network, as of September 2, there is only 1 FOF left in the 10 billion level private equity echelon, and the 10 billion FOF private equity managers who were quite famous in the past are now "cut in half", and some institutions are making a living by doing "buyer investment advisors" this year. According to many sources, since the beginning of this year, basically no customers dare to buy FOF products, and the performance and issuance of private FOF are bleak. In the eyes of industry participates, the reason why domestic private FOF is not welcomed is because of the lack of industry standards, low market awareness, poor in performance, and the occurrence of risk events from time to time. However, with the decline in long-term interest rates, investors' tolerance for volatility has been decreasing, and there is still room for development of domestic private FOF.

4. Gold stocks and gold prices run in opposite directions

For a period of time, A-share gold stocks have run counter to the "soaring" gold price, and the upstream and downstream sectors of gold stocks are also "ice and fire". Industry insiders believe that the difference in pricing logic, the fluctuation of the exchange rate market, and the market's concern about the sustainability of the rise in gold prices are the main factors that lead to the "divergence" of gold and gold stock prices, and make the stock prices of upstream and downstream companies of gold stocks "diverge". On the premise of continuing to be optimistic about the future trend of gold prices, the gold market is expected to usher in valuation repair.

5. Experts are hotly discussing the "high standard" development of the industry, and energy storage is expected to become a new growth pole for power batteries

From September 1st to 2nd, the "2024 World Power Battery Conference" was held in Yibin. As the core component of new energy vehicles, the power battery industry has ushered in rapid growth. However, behind the rapid growth, factors such as frequent power battery safety problems and inconsistent standards restrict the further development of the industry. Experts said that the power battery industry should enter the "high standard" development stage, technological innovation and standardization are the key factors, so as to promote the industry to reduce costs, and further improve safety. In addition, energy storage is expected to become the next industry growth pole. Industry participates said that the power battery industry is an important carrier of global energy structure transformation, and it is also one of the core driving forces for the high-quality development of China's economy, and will usher in a broader development space in the future.

International News

1. The United Nations mediated the crisis of the Libya central bank, and all parties reached an important consensus

The United Nations Support Mission In Libya (UNSMIL) held talks in Tripoli on Monday to resolve the Libya central bank crisis, which has prevented the central bank from trading for more than a week. Representatives of the Libya Chamber of Deputies, the Supreme Council of the State and the Presidential Council participated in the talks. The discussion lasted from morning until late at night. UNSMIL said that there was an important consensus on resolving the central bank crisis. Delegates agreed to submit a draft to their respective bodies for deliberation, with the goal of finalizing and signing the agreement on Tuesday. Under the central bank crisis, many oil fields in the country have previously announced the suspension of production.

2. Media: At least 4 people were killed dead in a shooting on a train in United States

United States ABC TV reported citing a police statement that a shooting occurred on a train in the city of "Forest Park" in Illinois, United States, killing at least four people. United States ABC TV released a message on its official website: "The 'Forest Park' City Police Department received an emergency call that three people were shot dead on a train in the city of 'Forest Park'. Law enforcement found four victims, three of whom died on the spot and one who was taken to Loyola University Medical Center in Maywood Township, where she died." United States ABC TV reported that the city police, together with Chicago Transportation Authority security personnel, found the suspect through surveillance cameras and arrested him.

3. Large-scale military exercises will be held in Latvia

The Latvian Ministry of Defense issued a press release on the evening of the 2nd, saying that Latvia will hold a military exercise codenamed "Namijes-2024" in the territory from September 3 to October 8. The announcement said that the exercise was jointly organized by the Latvian armed forces and the NATO Northern Multinational Division Command, with the participation of about 11,000 Latvian and military personnel from United States, Estonia and Lithuania.

4. Turkey airstrikes on multiple targets of the Kurdistan Workers' Party in northern Iraq

The Ministry of Defense of Turkey issued a statement saying that Turkish security forces carried out air strikes against PKK targets in the Medina, Zap, Gala, Hakuk, Kandil and Athos regions of northern Iraq, and 20 targets were destroyed, including caves, shelters, warehouses and other facilities used by the organization. Founded in 1979, the PKK has sought to establish an independent state by force in Kurdish-populated areas of Turkey along its borders with Iraq, Iran and Syria, which Turkey has designated as a terrorist organization.

5. Ministry of Foreign Affairs of Belarus: Belarus and Russia will sign a security guarantee agreement in December this year

"On the occasion of the celebration of the 25th anniversary of the signing of the Treaty of the Union States in December, we plan to sign with Russia an inter-state agreement on security guarantees between the two countries, which will lay down the principles of the use of nuclear and conventional weapons and other methods for the defense of the Union member states Russia and Belarus," BelTA reported, citing Belarus's Foreign Minister Rezhinkov's statement at the celebration of the new academic year at the Palace of the Republic. Foreign Minister Rezhinkov of Belarus noted that contacts between the two sides, especially between the heads of state and government of the two countries, have reached a record level and have achieved fruitful results.

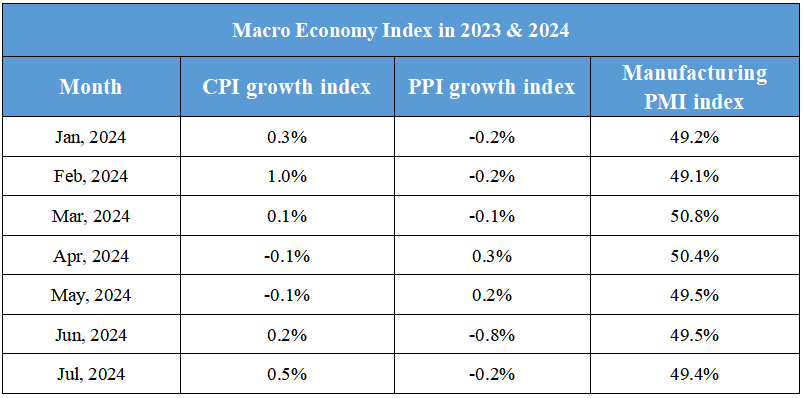

Domestic Macro Economy Index