August 30th Macroeconomic Index: Domestic Wine Companies Reduce Channel Burden, CTA Strategy Performs Well

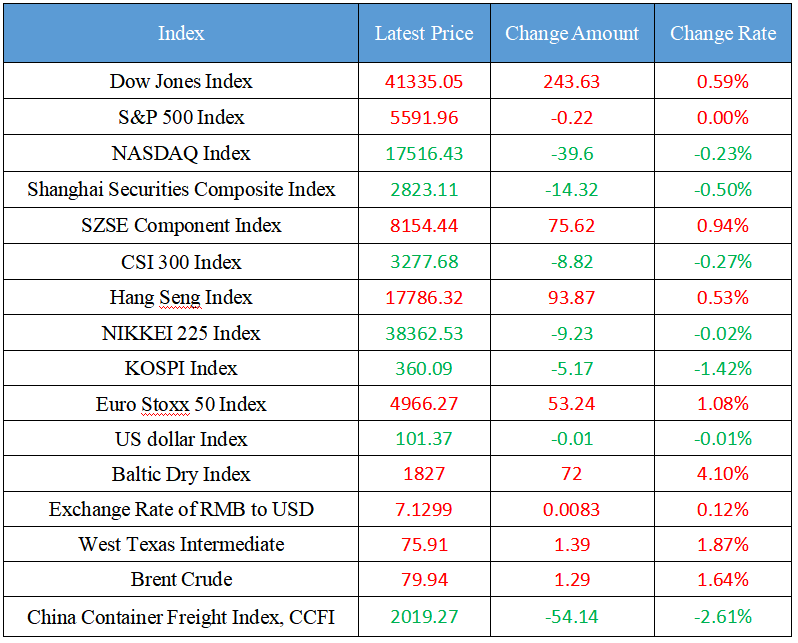

Latest Global Major Index

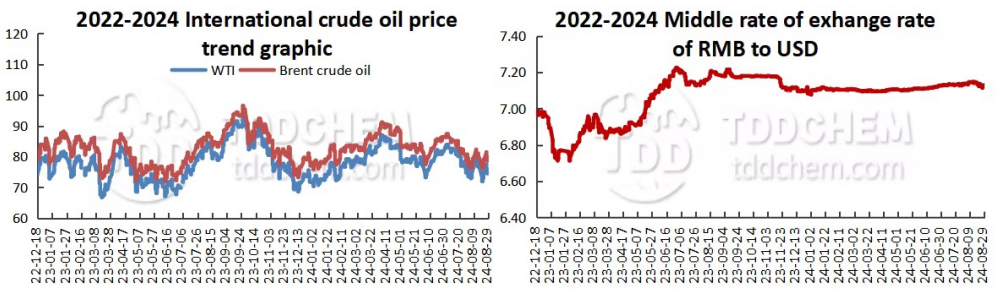

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. We’re witnessing obvious differentiation of performance. Listed wine companies began to reduce the burden on the channel.

2. Economic Daily: Illegal rebates for housing loans should be prohibited.

3. The central bank buys 400 billion yuan of special treasury bonds. Expert: routine move.

4. The commodity market is going on current trend. CTA strategy has well performed.

5. Trust institutions prudently allocate private placement products of urban investment bonds

International News

1. Nokia is considering various options for mobile network assets, and Samsung is reported to be interested

2. UN agencies will roll out polio vaccination in the Gaza Strip from 1 September

3. ECB Governing Council member Nagel: We can't rush to cut interest rates

4. Trump: Preparing to announce plans to make United States a global "crypto capital"

5. Crude oil spill occurred after the attack on the oil pipeline in eastern Colombia. The local government launched an emergency plan.

Domestic News

1. We’re witnessing obvious differentiation of performance. Listed wine companies began to reduce the burden on the channel.

As of August 29, a total of 17 of the 20 A-share liquor companies have disclosed their 2024 semi-annual reports. Among them, there are 12 companies with both revenue and net profit, accounting for about 71%; 4 companies saw their revenue and net profit both decline; 1 company was in the red. It is worth mentioning that under the pattern of industry adjustment and shrinkage competition, the performance of listed wine companies as a whole shows the characteristics of "slowing down growth and intensifying differentiation". As the "reservoir" of wine enterprises, the change in the amount of contract liabilities can reflect the willingness of distributors to pay to enterprises to a certain extent, and reflect the market expectations of distributors. According to statistics, among the 17 wine companies that disclosed semi-annual reports, 12 had a year-on-year decline in contract liabilities, and some companies had a large decline.

2. Economic Daily: Illegal rebates for housing loans should be prohibited.

The article said that the "rebate" of housing loans is essentially a marketing means for commercial banks to obtain customers and seize the market share of personal housing loans. In practice, some small and medium-sized banks will attach additional clauses to the loan contract, such as the borrower cannot repay the loan early for several years after the loan is disbursed. In addition, due to the non-compliance of the mortgage "rebate", the bank cannot sign a formal "rebate" contract with the borrower, and the borrower cannot restrain the bank's post-rebate behavior, and there is a risk of non-cashing or shrinkage to a certain extent. Rebates, a seemingly reasonable market behavior, hurt the normal market competition order. The wool comes out of the sheep. The rebate benefits lost by banks in the housing loan business are either made up for in the performance of grassroots employees or filled in the loans of other entities.

3. The central bank buys 400 billion yuan of special treasury bonds. Expert: routine move.

The central bank carried out a cash buyout transaction in the open market business by means of quantity bidding, and bought 400 billion yuan of special treasury bonds from the primary dealers in the open market business. "The key point is that on August 29, 2017, the Ministry of Finance issued 600 billion yuan of special treasury bonds, and the People's Bank of China carried out cash bond purchase operations on the 600 billion yuan of special treasury bonds again on that day. On the 29th, the People's Bank of China took the same operation on the continuation of 400 billion yuan of special treasury bonds." As a result, Wang Qing, chief macro analyst of Oriental Jincheng, pointed out that the People's Bank of China's purchase of 400 billion yuan of special treasury bonds is a routine operation for the renewal of special treasury bonds issued in the previous direction, and the market generally understands that the People's Bank of China expands the monetary policy toolbox, buys and sells treasury bonds in the secondary market, and regulates the medium and long-term bond yields.

4. The commodity market is going on current trend. CTA strategy has well performed.

Since July, the volatility of the commodity market has risen, and the performance of the managed futures strategy (CTA) has been boosted. According to the data of the private placement network, as of August 23, the average return of private securities investment funds in the past month was negative, and the bond strategy that led in the early stage also pulled back, but the CTA strategy bucked the trend and obtained positive returns. It is worth mentioning that although the bond strategy has led the way this year, the CTA strategy has shown a "catch-up trend" recently. Industry insiders said that the performance of CTA strategies often has a certain periodicity, and after the downturn of the previous three years, there is a possibility of mean reversion in this strategy. At the same time, with the gradual clarity of the Fed's monetary policy adjustment expectations and the continued efforts of the domestic economic recovery policy, the commodity market is expected to usher in a trendy market, and the CTA strategy will also be performed.

5. Trust institutions prudently allocate private placement products of urban investment bonds

After a wave of upward movement, the bond market ushered in a "brake". Among them, with the support of the government's bond policy, the sentiment of urban investment bonds has declined. The enthusiasm of private equity and trust institutions, which previously favored the allocation strategy of urban investment bonds, has declined. In the context of the "non-standard transfer" of trusts, a private equity institution mainly engaged in bond business told the China Securities Journal reporter that because the current trust industry is still in a transition period, it is difficult to establish strict risk control measures, and some trust funds are currently selectively flowing into the private debt base. However, at the same time, due to the strict control of new products on the regulatory side, the new private debt base is indeed much smaller than before.

International News

1. Nokia is considering various options for mobile network assets, and Samsung is reported to be interested

Nokia's mobile web assets have attracted initial interest from bidders, including Samsung Electronics, according to people familiar with the matter. Nokia has been in discussions with consultants about potential options for its mobile network business, which has struggled for years with competition from larger rivals. Nokia has considered a number of different options, including a partial sale or full sale, a spin-off or a merger with a competitor, the people said. The overall valuation of the business could be around $10 billion. Samsung has initially signaled its interest in acquiring some of Nokia's assets as it seeks to expand its scale in the wireless access network that connects mobile phones to its telecommunications infrastructure.

2. UN agencies will roll out polio vaccination in the Gaza Strip from 1 September

The World Health Organization's representative in the Occupied Palestinian Territory, Piperkorn, said that the WHO, the United Nations Children's Fund (UNICEF), the United Nations Relief and Works Agency for Palestine Refugees in the Near East (UNRWA) and other agencies will carry out polio (polio) vaccination in the Gaza Strip starting from September 1. According to reports, the vaccination program will cover 64,000 children under the age of 10, and the vaccination will be divided into two rounds lasting four weeks, starting in the central Gaza Strip, then traveling to the southern Gaza Strip and finally to the northern Gaza Strip. Some 2,180 local personnel will be involved in the vaccination campaign, and the United Nations hopes that the vaccination rate will reach more than 90%.

3. ECB Governing Council member Nagel: We can't rush to cut interest rates

European Central Bank Governing Council and Germany Central Bank President Nagel said on Thursday local time that the ECB must remain "cautious" and not rush to lower the key interest rate. In his speech, Nagel said that the tightening of the job market and the growth of the economy could delay the sustained return of inflation in the eurozone to the central bank's 2% target. "It cannot be taken for granted that prices will return to stability in time," he said. Therefore, we need to be cautious and never lower the policy rate too quickly. "The European Central Bank cut its key interest rate in June, and investors expect policymakers to cut rates again at its next meeting on September 12. Earlier on Thursday, data released by Statistics Germany showed that Germany's inflation rate returned to the ECB's target in August. Germany's economy contracted in the three months to June, with recent surveys showing continued weakness.

4. Trump: Preparing to announce plans to make United States a global "crypto capital"

United States' Republican presidential candidate Donald Trump has announced that he will launch a plan to ensure that United States becomes the "global crypto capital." Mr. Trump posted on social media on Thursday, though he did not give any details. The video he shared also features a decentralized finance project that his sons recently pushed for. "This afternoon (Aug. 30th Beijing time), I will present my plan to ensure that United States becomes the global crypto capital," Trump said in the video.

5. Crude oil spill occurred after the attack on the oil pipeline in eastern Colombia. The local government launched an emergency plan.

On August 29, local time, an oil pipeline in the border area of Cesar and Norte de Santander in eastern Colombia was attacked, and a large-scale crude oil spill occurred. The local government has launched an emergency plan to mitigate the impact on the environment. It is reported that unidentified persons detonated explosives near the oil pipeline that morning, attacking crude oil infrastructure. On the 19th of this month, a similar attack occurred in the country's province of Arauca. Gas supplies in eastern Colombia are currently on alert.

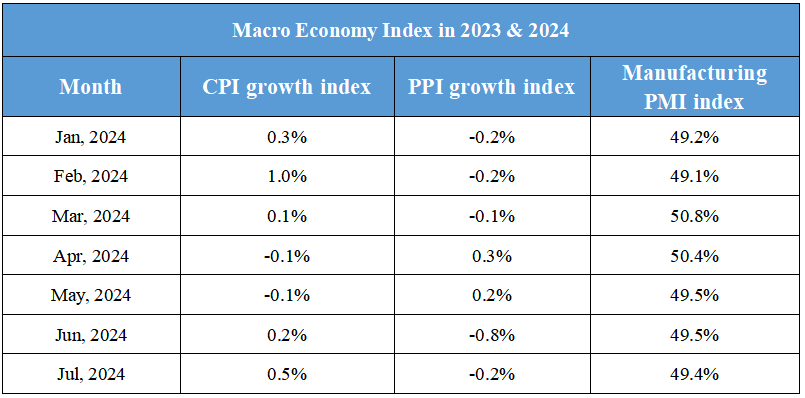

Domestic Macro Economy Index