Global Macro Update on August 23rd

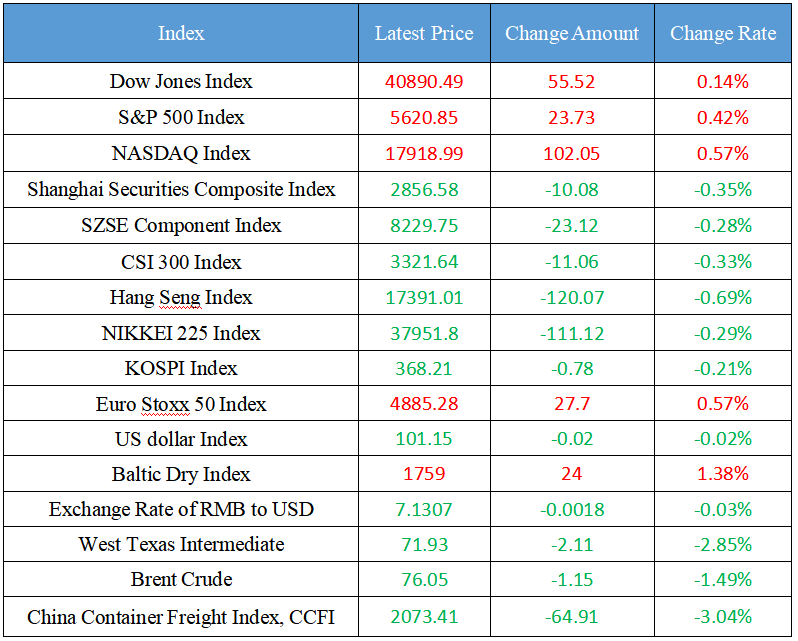

Latest Global Major Index

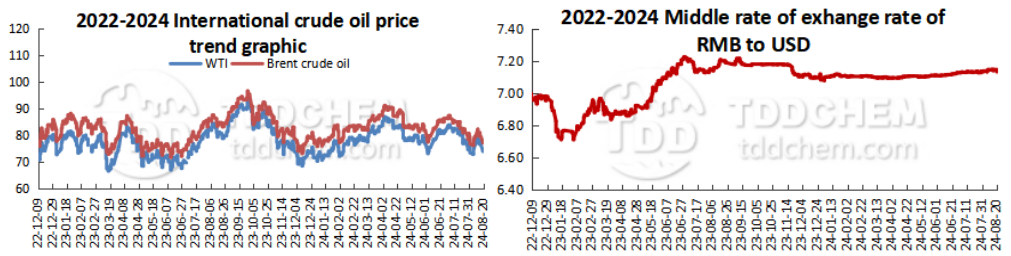

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The 3rd Global Digital Trade Expo will open on September 25

2. The number of people entering and exiting the Guangzhou Border Inspection Station during the year has exceeded the total number of last year

3. National Development and Reform Commission: Promote private investment and promote the high-quality development of the private economy

4. The Beijing Financial Supervision Bureau and others jointly issued a document to explore the financing model to support high-growth cultural enterprises

5. CICC: The resonance of fundamentals and capital has promoted the banking sector to run out of excess yield

International News

1. Ceasefire negotiations in Gaza have reached an impasse

2. The fire at the oil depot in Tov Oblast, Russia, lasted nearly 4 days, and 14 fuel tanks were completely burned

3. United States stock index futures rose slightly. Investors await the non-farm payrolls revision and the Fed meeting minutes

4. United States mortgage applications fell to their lowest level since February

5. Japan National Tourism Administration: More than 3.29 million foreigners visited Japan in July, a new monthly high

Domestic News

1. The 3rd Global Digital Trade Expo will open on September 25

Focusing on "national, international, and digital trade", the 3rd Global Digital Trade Expo will be held in Hangzhou, Zhejiang Province from September 25 to 29 this year. This year's Digital Trade Fair will create a series of special activities such as Silk Road E-commerce Day, Digital Trade Africa Day, Invest in China, and Digital Trade Night, as well as industrial activities such as artificial intelligence, low-altitude economy, and digital healthcare. Establish a number of special committees in the field of digital trade to actively explore industry innovation and ecosystem construction; Using technologies such as digital human, blockchain, artificial intelligence, and glasses-free 3D, we can enhance application scenarios online and interactive experience offline, creating an immersive and digital on-site atmosphere. And optimize and upgrade the "Digital Trade Online" platform to achieve the exhibition from 5 days offline to 365 days a year.

2. The number of people entering and exiting the Guangzhou Border Inspection Station during the year has exceeded the total number of last year

The Guangzhou Entry-Exit Border Inspection Station announced today that as of 24 o'clock on August 19, the number of people entering and exiting the station this year has reached 9.55 million, 1.87 times that of the same period last year, and has exceeded the total number of people entering and exiting last year. The data shows that since the beginning of this year, the passenger flow of the ports under the jurisdiction of the Guangzhou Border Inspection Station has increased month by month. Among them, the Baiyun Airport port has exceeded 8.828 million passengers, a year-on-year increase of 102.2%, the daily peak of entry and exit has exceeded 48,000 passengers, and more than 63,000 inbound and outbound flights have been inspected, a year-on-year increase of 66.3%. Since the beginning of this year, a total of 722,000 people have been inspected at Guangzhou Pazhou Port, Nansha Port, Dongguan Humen, Foshan Shunde Port and other ports. Among them, there were more than 343,000 inbound and outbound passengers, a year-on-year increase of 87.4%. More than 37,000 ships were inspected, a year-on-year increase of 10.7%.

3. National Development and Reform Commission: Promote private investment and promote the high-quality development of the private economy

From August 20th to 21st, the National Development and Reform Commission organized an on-site meeting to promote the high-quality development of the private economy in Jinan City, Shandong Province. The meeting emphasized that it is necessary to thoroughly implement the plenary meeting's arrangements for promoting the fair opening of the competitive field of infrastructure to business entities, improving the long-term mechanism for private enterprises to participate in the construction of major national projects, improving the system and mechanism for government investment to effectively drive social investment, and improving the mechanism for stimulating the vitality of social capital and promoting the landing of investment, and strive to promote private investment and promote the high-quality development of the private economy.

4. The Beijing Financial Supervision Bureau and others jointly issued a document to explore the financing model to support high-growth cultural enterprises

The Beijing Supervision Bureau of the State Administration of Financial Supervision and Administration and the People's Government of Dongcheng District jointly researched and formulated the "Several Measures on Accelerating the Construction of National Cultural and Financial Cooperation Demonstration Zones and Promoting Financial Support for the High-quality Development of Cultural Enterprises". Among them, it is proposed to "build a cultural and financial development highland with a dominant position in the country". The Beijing Financial Supervision Bureau and the Dongcheng District People's Government will not only build a "white list" management system for high-quality cultural enterprises, but also innovate the investment and financing services of "white list" enterprises. It is worth noting that the "Several Measures" show that it will "explore financing models to support high-growth cultural enterprises".

5. CICC: The resonance of fundamentals and capital has promoted the banking sector to run out of excess yield

Lin Yingqi, a banking analyst at CICC's research department, commented that banks' excess returns are mainly due to the combined effect of fundamentals and capital: despite the pressure on the operating environment, banks have achieved stable profits and dividends by reducing the cost of debt, as well as investment income and provision contributions. Under the guidance of "maintaining the bottom line of no systemic financial risks", the policy has also been more supportive of stabilizing bank interest margins, asset quality and profitability. As a result, banks have been able to maintain stable profit growth and high dividends, becoming scarce assets in the market, and inflows such as index funds and insurance have also promoted the rebalancing of the banking sector.

International News

1. Ceasefire negotiations in Gaza have reached an impasse

The Israel Times reporter reported that two Arab officials from the mediator and a third official involved in the negotiations revealed that United States Gaza ceasefire package proposed last week went too far in meeting Netanyahu's demands, which demanded that Israeli troops be stationed in Rafah and the Nezarim corridor. As a result, the talks have stalled, and one Arab official lamented that another high-level negotiators' meeting in Cairo later this week is pointless unless the United States presses Netanyahu to drop new demands and revise the mediation package accordingly. Another Arab official was baffled by United States Secretary of State Antony Blinken's repeated and public insistence in recent days that Netanyahu's endorsement of the United States mediation plan misportrayed Hamas as the only obstructor. "We're back to origin point, the negotiations are deadlocked, and United States' strategy is to publicly blame Hamas, but that has proven unworkable in the past," the official involved in the negotiations said.

2. The fire at the oil depot in Tov Oblast, Russia, lasted nearly 4 days, and 14 fuel tanks were completely burned

According to Ukraine Pravda, a satellite image related to a fire at an oil depot in Rosrezerv, Russia's Rostov Oblast, which has been going on for more than three days, has been published. Analysts estimate that the fire completely destroyed 14 fuel tanks, another four were partially destroyed and 16 were undamaged. The state of the remaining 44 fuel tanks could not be assessed, since they were covered with thick smoke.

3. United States stock index futures rose slightly. Investors await the non-farm payrolls revision and the Fed meeting minutes

United States stock index futures edged higher as investors awaited the annual revision of United States jobs data, as well as the minutes of the Federal Reserve's meeting for further clues about rate cuts. Fed Chair Jerome · Powell will speak at the Jackson Hole conference this weekend, which could determine whether there is room for a market rally further, and the market is increasingly anticipating this. Traders are eyeing Wednesday's non-farm payrolls revision, with fears that an excessively weak data will reignite concerns that the Fed is too late in cutting interest rates. "Given that the United States labor market is at the center of Fed policy, the data released this time is of unusually high interest," said Amanda Sundstrom, interim chief strategist at SEB AB Norway. "If the number of new jobs is revised sharply downward, it could exacerbate concerns that the Fed is waiting too long to cut interest rates."

4. United States mortgage applications fell to their lowest level since February

A measure of mortgage applications for home purchases in United States slipped last week to its lowest level since February, suggesting that rising home prices are hampering a recovery in demand from falling mortgage rates. The United States Mortgage Bankers Association's (MBA) home purchase mortgage application index fell 5.2% to 130.6 in the week ended Aug. 16. Refinancing applications also slipped after surging to a two-year high a week earlier. The contract rate on 30-year fixed-rate mortgages fell another 4 basis points to 6.5%, still the lowest since May last year, MBA data showed Wednesday. The 15-year fixed-rate mortgage rate rose, and the average 5-year adjustable mortgage rate rose the most since the start of the year. Although mortgage rates are more favorable on the prospect of the Federal Reserve easing monetary policy, high home prices have pushed housing affordability down to around multi-decade lows.

5. Japan National Tourism Administration: More than 3.29 million foreigners visited Japan in July, a new monthly high

According to estimated data released by the Japan National Tourism Organization on the 21st, the number of foreigners visiting Japan in July was 3.2925 million, a new monthly high and more than 3 million for five consecutive months. The depreciation of the yen continues to be a positive factor. The number of people in July increased by 41.9% year-on-year, and also increased by 10.1% compared to July 2019, before the pandemic. From January to July, the number of foreign visitors to Japan totaled about 21.07 million, setting a record for the fastest number of foreign visitors exceeding 20 million. However, due to the shortage of manpower, there are also problems such as over-tourism such as accommodation facilities not being able to adequately meet the surging demand and overcrowding on public transportation.

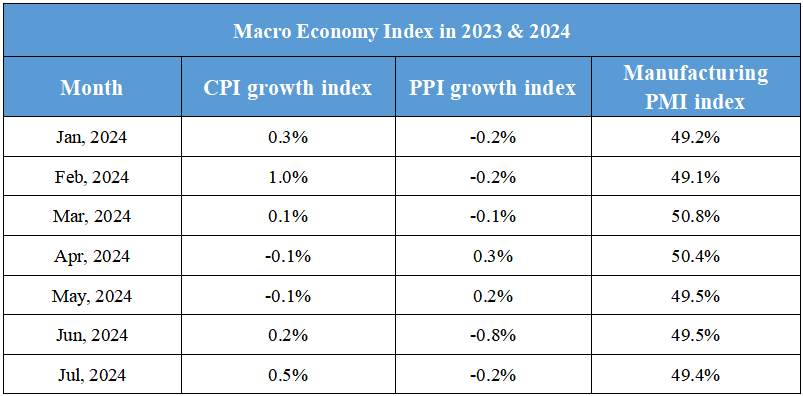

Domestic Macro Economy Index