August 16th Macroeconomic Index: US Monetary Market Funds Hit New High, Retail Sales Boost Stocks

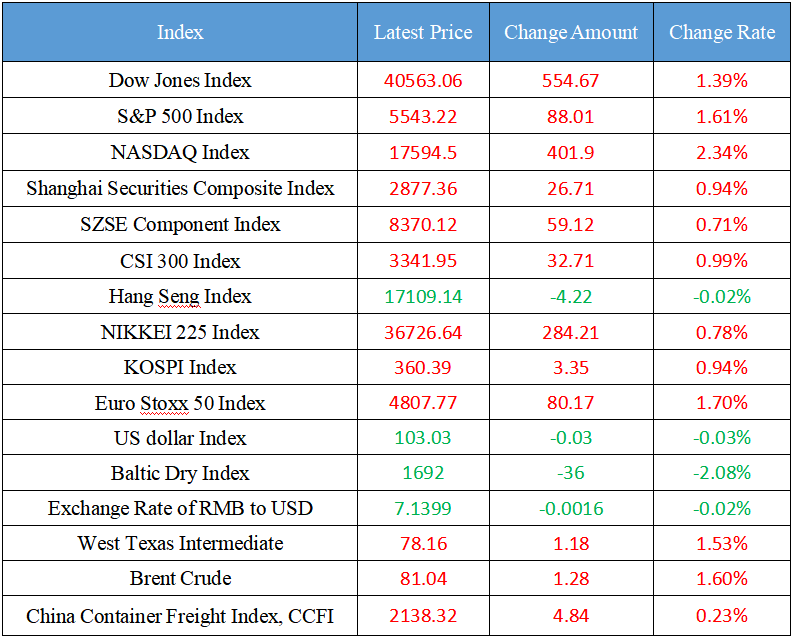

Latest Global Major Index

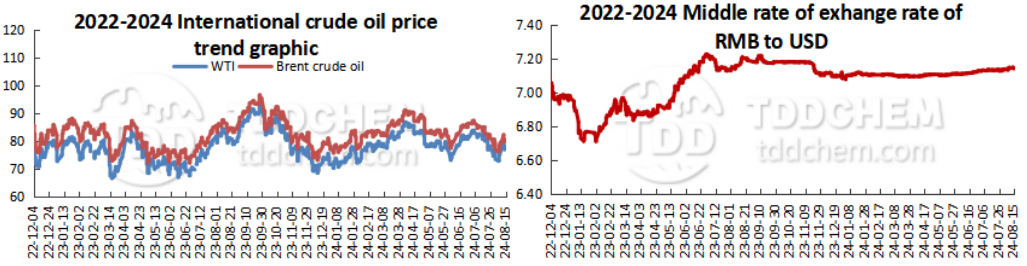

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Cancel tax incentives for public bonds? Several agencies said they had not received the notice

2. Director of the Legislative Affairs Committee of the Standing Committee of the National People's Congress: The next step will be to formulate a law on the promotion of the private economy

3. Xu Hong, Chief Financial Officer of Alibaba: It is expected that the conversion of Hong Kong's primary listing will be completed by the end of August, and whether to access the Hong Kong Stock Connect will be done in accordance with the rules and procedures

4. Macrolink: The proportion of revenue in the real estate sector will gradually decline

5. It will take time for the overseas debt financing of real estate enterprises to recover

International News

1. The asset scale of United States monetary market funds hit a new high

2. United States import prices rose slightly in July, continuing the moderate trend of CPI

3. Affected by the hurricane, United States industrial production recorded the largest decline since January

4. Retail sales were unexpectedly strong, and U.S. stocks opened higher

5. US Treasuries fell to intraday lows after United States data were released, and the yield curve flattened significantly

Domestic News

1. Cancel tax incentives for public bonds? Several agencies said they had not received the notice

On August 15, rumors of "canceling tax incentives for public bond funds" fermented in the industry. The reporter verified with many parties in the industry, and a number of public offering and banking institutions responded that there is no relevant notice or guidance at present. "I haven't heard of it or received any feedback from the bank." A head public offering channel participate said. However, some institutional sources replied that "I have heard relevant rumors".

2. Director of the Legislative Affairs Committee of the Standing Committee of the National People's Congress: The next step will be to formulate a law on the promotion of the private economy

Shen Chunyao, Director of the Legislative Affairs Committee of the Standing Committee of the National People's Congress, said in an interview that on the new journey, further deepening reform in an all-round way and promoting Chinese-style modernization should be organically combined with further comprehensively governing the country according to law, and efforts should be made to properly handle the relationship between reform and the rule of law. In the next step, the National People's Congress will formulate a number of laws in the legislative field, such as the Law on the Promotion of the Private Economy, the Financial Law, and the Ecological and Environmental Code. For institutional innovation measures that need to be advanced step by step, methods such as "decision + legislation" and "decision + law amendment" may be adopted, with relevant decisions made in accordance with law first, and then promptly deployed and advanced relevant legislative amendments.

3. Xu Hong, Chief Financial Officer of Alibaba: It is expected that the conversion of Hong Kong's primary listing will be completed by the end of August, and whether to access the Hong Kong Stock Connect will be done in accordance with the rules and procedures

On August 15, at Ali's financial report meeting, Xu Hong, Chief Financial Officer of Alibaba Group, said that Ali is seeking the conversion of Hong Kong's primary listing, and the company will hold a general meeting of shareholders on August 22, and there is such a proposal in the shareholders' meeting, if the shareholders' meeting can be approved, it is expected that the Hong Kong primary listing conversion can be completed by the end of August 2024, "As for whether to access the Hong Kong Stock Connect later, we have to perform some procedures under the different rules of various exchanges, which should be done in accordance with the procedures and can be achieved." ”

4. Macrolink: The proportion of revenue in the real estate sector will gradually decline

In an interview, Macrolink said that the company had previously retained several real estate projects with profitability and cash flow in the restructuring process, so these real estate projects currently account for a relatively large proportion of the revenue structure. With the successive delivery and carry-over of real estate projects until after liquidation, the proportion of revenue in the real estate sector will gradually decline. In addition, in view of the uncertainty of the overseas economic and policy environment, the company is currently cautious about the acquisition of overseas asset-heavy projects, and the focus is still on seeking the expansion of high-quality projects in areas with large domestic passenger flow. In overseas markets, the company will fully assess the operational risks and steadily promote and carry out the extension of the travel agency business.

5. It will take time for the overseas debt financing of real estate enterprises to recover

Logan Group announced on the Hong Kong Stock Exchange that Qiwan (Hong Kong) Investment Co., Ltd., a project company in which the company has a 50% interest, has successfully obtained a refinancing of HK$8.2 billion. Liu Shui, Director of enterprise research at the China Index Research Institute, said that since the beginning of this year, real estate companies such as Zhongliang and Aoyuan have successfully eased short-term debt repayment pressure by completing debt restructuring, but a large number of real estate companies have not yet completed overseas debt restructuring and have accumulated great debt repayment pressure. In the short term, the sales market is still in the process of bottoming out, the risk of overseas bonds has not yet been cleared, and the issuance of overseas bonds will still be open to a small number of high-quality real estate companies, and the overall recovery will take time.

International News

1. Fed's Goolsbee: Growing concern about employment rather than inflation

United States monetary market funds hit a new high after the sell-off in global risk assets last week caused investors to cash out, as money flocked further into high-quality assets. About $28.4 billion flowed into United States monetary market funds in the week ended Aug. 14, bringing total assets to an all-time high of $6.22 trillion, according to the United States Investment Company Association. Since 2022, when the Fed began one of its most aggressive tightening cycles in decades, retail investors have flocked to monetary market funds. So far, the inflow has continued, although investors expect the Fed to start cutting interest rates soon.

2. Cleveland Fed survey: Corporate CEO inflation expectations fell in the third quarter

United States import prices barely rose in July, continuing the trend of moderate inflation data that supported financial markets' expectations for a Fed rate cut next month. United States import prices edged up 0.1% last month as the cost of energy products rebounded modestly after flattening in June. Economists had expected import prices excluding tariffs to fall by 0.1 percent. The report comes on the heels of a modest rise in CPI in July, which strengthened expectations of a 25 basis point rate cut by the Fed in September.

3. Analysts: Inflation will no longer be a problem, and the Fed will focus on the labor market

United States July, industrial output fell by the most since the start of the year due to lower factory production, including Hurricane Beryl that reduced refinery activity along the Mexico Bay Coast. Data released on Thursday showed output in the factories, mines and utilities sector fell 0.6 percent, compared with a downward revision of a month's previous figure to a 0.3 percent increase. Manufacturing production fell by 0.3%, while mining and energy extraction remained unchanged. Utility output fell by 3.7%.

4. Analysts: The "okay" CPI data is not enough to impress the Fed

US stocks opened higher, with the Dow up 1.02%, the S&P 500 up 0.94%, and the Nasdaq up 1.18% after unexpectedly strong United States retail sales data. Walmart (WMT. N) rose 7.9%, with Q2 revenue exceeded expectations. JD.com (JD.O) rose more than 4%, with Q2 revenue of 291.4 billion yuan, a year-on-year increase of 1.2%. Cisco (CSCO. O) rose 8.7%, the company plans to lay off 7% of employees with Q1 revenue guidance exceeded expectations.

5. Core inflation in the United States slowed for the fourth consecutive month, and the Federal Reserve is expected to decide to cut interest rates

United States Treasury futures fell sharply to intraday lows, flattening the yield curve significantly after better-than-expected United States retail sales data and United States jobless claims last week came in at 227,000, below expectations of 235,000. The overnight index swap (OIS), which is related to the Fed's meeting showed that the Fed cut rates by about 29 basis points at its September meeting, compared with 32 basis points at Wednesday's close. During the day, the yield on the 2-year United States Treasury rose 10 basis points to around 4.06%; After the release of the data, the front and middle of the curve led the decline, with the 2-year and 10-year and 5-year and 30-year flattening by 3 basis points and 4 basis points respectively.

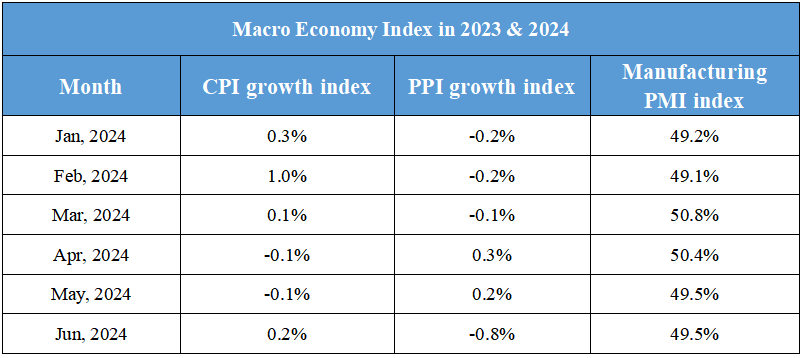

Domestic Macro Economy Index