On August 15th, Domestic and International Economic Trends and Key News

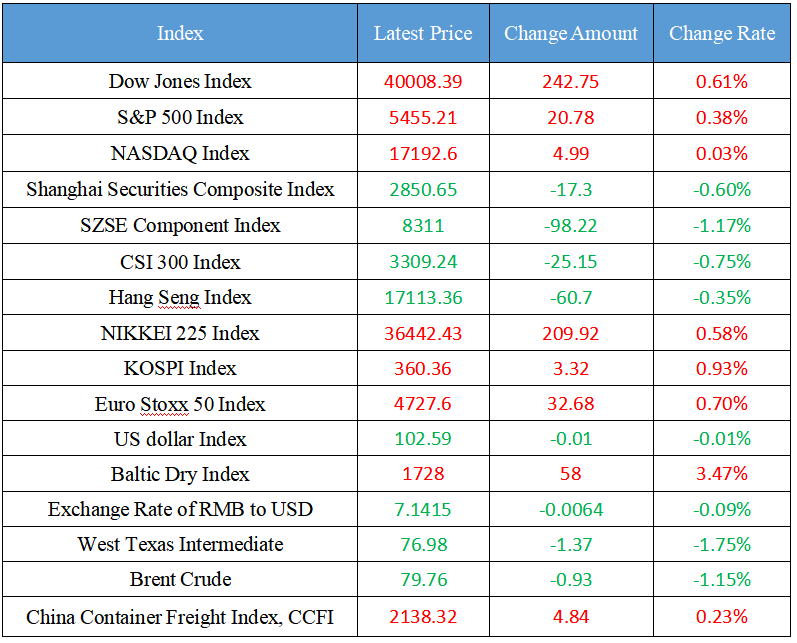

Latest Global Major Index

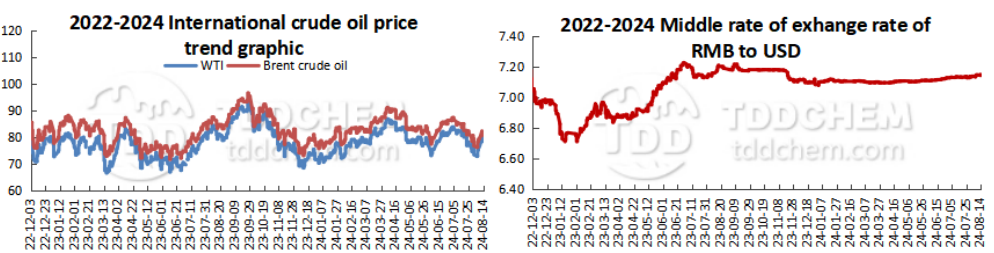

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The daily injection of natural gas in China's largest gas storage has reached a record high

2. China Aoyuan: Profit is about RMB21 billion to RMB23 billion in the first half of the year, which was attributable to the proceeds from overseas debt restructuring

3. The State Administration of Financial Supervision holds intensive meetings and assigns new tasks

4. The bond market is turning back, and confidence is still there? Market participants: The strong pattern will continue

5. Shenzhen held a symposium on foreign trade and economic cooperation to promote high-level opening up

International News

1. Fed's Goolsbee: Growing concern about employment rather than inflation

2. Cleveland Fed survey: Corporate CEO inflation expectations fell in the third quarter

3. Analysts: Inflation will no longer be a problem, and the Fed will focus on the labor market

4. Analysts: The "okay" CPI data is not enough to impress the Fed

5. Core inflation in the United States slowed for the fourth consecutive month, and the Federal Reserve is expected to decide to cut interest rates

Domestic News

1. The daily injection of natural gas in China's largest gas storage has reached a record high

The reporter learned from PetroChina today (15th) that China's largest natural gas storage Xinjiang Oilfield Company's Hutubi gas storage, since March 28 began this cycle of gas injection, has accumulated gas injection of more than 2 billion cubic meters, the highest daily gas injection volume of 26 million cubic meters, a record high, for the gas supply of cities from the west to the east this winter and next spring.

2. China Aoyuan: Profit is about RMB21 billion to RMB23 billion in the first half of the year, which was attributable to the proceeds from overseas debt restructuring

China Aoyuan (03883.HK) Hong Kong Stock Exchange announced that the Group expects to record a net profit of approximately RMB21 billion to RMB23 billion for the period (six months ended 30 June 2023: net loss of RMB2.9 billion), and the net profit for the period is mainly due to the restructuring gain recorded by the Company after completing the restructuring of its overseas debt. Excluding the impact of the aforesaid restructuring gains, the Group expects to record a loss for the six months ended 30 June 2024 mainly due to a combination of factors, such as the impact of the continued downturn in the operating environment of the industry, the decrease in the Group's delivery volume in the current period due to the decrease in revenue recognition from the sale of properties, and the increase in financing costs due to the decrease in capitalized interest on properties under construction.

3. The State Administration of Financial Supervision holds intensive meetings and assigns new tasks

According to the Financial Times, the main media in charge of the central bank, a preliminary combing found that since the end of July, the financial regulatory bureaus of Shanghai, Anhui, Fujian, Jiangxi, Hubei, Hainan, Chongqing, Sichuan, Guizhou, Xiamen and other ten places have successively held the 2024 mid-year work conference, clarifying the key work arrangements for the second half of the year. Among them, it has become a "must-answer question" to promote risk prevention and control in key areas such as real estate, local government debt, and small and medium-sized financial institutions in a steady and orderly manner, do a good job in the "five major articles", unswervingly strengthen supervision and strict supervision, and continue to promote comprehensive and strict governance of the Party.

4. The bond market is turning back, and confidence is still there? Market participants: The strong pattern will continue

The bond market has recently corrected significantly, with the 10-year Treasury bond returning to above 2.2%. Strong regulatory signals have become the biggest confidence for short-term bond market short, while firm longs are waiting for the Fed's September rate cut to open up further downside in interest rates. "As far as the bond market is concerned, the core logic of the current market game may still lie in the attitude of the central bank and the changes in the capital side under the follow-up operation, whether it is the sale of bonds by major banks or the irregularities in treasury bond trading prompted by the dealers association, under the supportive monetary policy stance, aiming to stabilize long-term interest rates and create a good monetary and financial environment, rather than forming a trend reversal, more reflecting the signal significance and expected guidance, exchanging time for space, and waiting for the time point of fiscal cooperation." Tan Yiming, chief analyst of fixed income at Minsheng Securities, said recently. A number of market participants interviewed also said that the overall strength of the bond market is expected to continue in an environment where the expectation of easy money is still clear. In the short to medium term, the Fed's interest rate cut in September has become a high probability event, and in the context of reduced external pressure, bond market bulls may launch a new round of offensive.

5. Shenzhen held a symposium on foreign trade and economic cooperation to promote high-level opening up

Meng Fanli, Secretary of the Shenzhen Municipal CPC Committee, presided over a forum of foreign trade and economic cooperation enterprises and industry associations to thoroughly study and implement the spirit of the Third Plenary Session of the 20th CPC Central Committee. At the meeting, representatives of 11 enterprises and 2 industry associations put forward suggestions on strengthening the docking of international economic and trade rules, improving service trade, and ensuring the security and stability of the supply chain. Meng Fanli thanked the company for its contribution and asked the relevant departments to sort out the suggestions one by one and implement the solutions, so as to build a long-term mechanism to serve the enterprise.

International News

1. Fed's Goolsbee: Growing concern about employment rather than inflation

Chicago Fed President Goolsbee said he was increasingly concerned about the labor market rather than inflation given the recent progress in price pressures and disappointing jobs data. Goolsbee said on Wednesday that the current level of interest rates was "very restrictive", saying that such a stance would only be appropriate if the economy was overheating. He declined to comment on the likelihood and magnitude of a rate cut by the Fed at its September meeting. Asked about the balance between inflation and labor market risks, Goolsbee said, "It feels like I'm more and more worried about the mission in terms of employment." He noted that the recent rise in unemployment may reflect more people entering the labor market, but it may also "show that we are not at a stable level, but are moving towards a worse situation in the short term."

2. Cleveland Fed survey: Corporate CEO inflation expectations fell in the third quarter

The Cleveland Fed's Business Inflation Expectations Survey showed that inflation expectations of United States business leaders fell in the third quarter of 2024. According to the report, they expect CPI inflation to be 3.4% over the next 12 months, down from 3.8% expected in the second quarter. This quarterly survey gathers feedback from large, representative companies in the manufacturing and service sectors. The Cleveland Fed released these survey data because business leaders' inflation expectations affect the prices that businesses charge customers, which in turn affects the direction of inflation.

3. Analysts: Inflation will no longer be a problem, and the Fed will focus on the labor market

Jim Baird, chief investment officer at Plante Moran Financial Advisors, said: "At the moment, the inflationary pressures that we are seeing have indeed dissipated significantly. "The recent rate of inflation is not an issue...... It is widely believed that the worst is behind us. "Given that the focus is on the relative weakness of the labor market and the fact that inflation is coming down rapidly, and I expect inflation to continue to fall in the coming months, it would be a surprise if the Fed didn't start moving to easing policy soon, which was to cut rates in September," Baird said. ”

4. Analysts: The "okay" CPI data is not enough to impress the Fed

Analyst Chris Anstey said the "super-core" services inflation measure, which excludes food, energy, goods and housing costs, rose 0.21% month-on-month in July after falling for two consecutive months. As a result, there is less cooling inflation there. This increase is also well below the average for 2023 and 2022. We should keep in mind that before the next policy meeting, the Fed will also get a CPI report. Policymakers will also have access to the August jobs report, which is likely to be even more significant. For Powell and his colleagues, a substantial further weakening of the labor market will be more important than the "okay, but not great" CPI data.

5. Core inflation in the United States slowed for the fourth consecutive month, and the Federal Reserve is expected to decide to cut interest rates

In July, underlying inflation in the United States fell for the fourth consecutive month, setting the Fed to lower interest rates next month. Core CPI recorded an annual rate of 3.2%, still the slowest pace since the start of 2021. Economists believe that the core indicator is a better indicator of underlying inflation than the headline CPI. As the economy slowly turns into a deceleration, inflation remains on a downward trend overall. Coupled with a weaker job market, the Fed is widely expected to start cutting interest rates next month, and the magnitude of the rate cut may depend on more upcoming data.

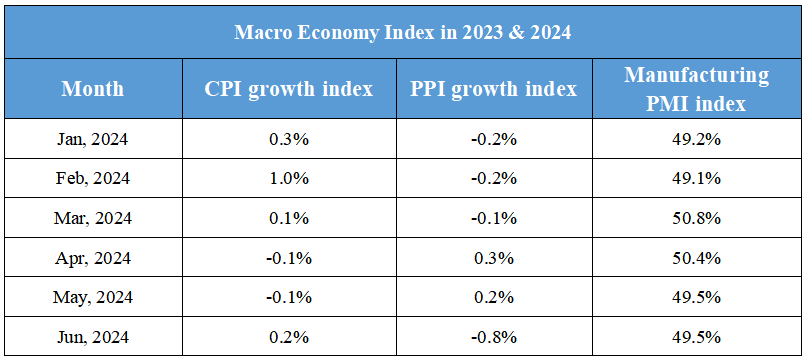

Domestic Macro Economy Index