August 13th Macroeconomic Index: Bond Market Regulatory Signals Intensify, Car Companies Reduce Discounts

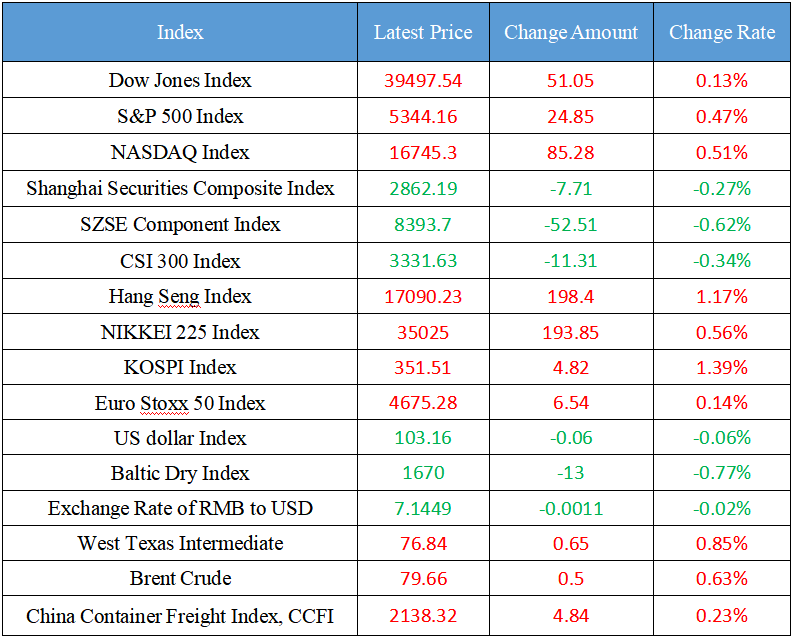

Latest Global Major Index

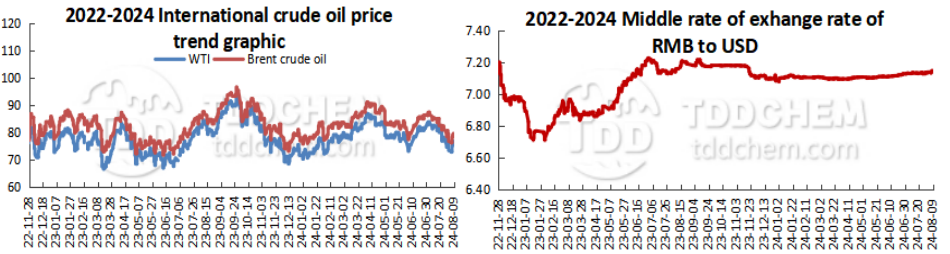

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The bond market continues to release strong regulatory signals

2. Many car companies have shrunk preferential margins and reduced production to stabilize the price system

3. The Central Committee of the Communist Party of China and the State Council: Accelerate the coordination of digital and green transformation and development

4. The Central Committee of the Communist Party of China and the State Council: Strengthen the clean and efficient utilization of fossil energy

5. National Development and Reform Commission: Establish a new mechanism for the comprehensive transformation from dual control of energy consumption to dual control of carbon emissions

International News

1. Former Japan Bank members ruled out another rate hike this year

2. The probability that the Fed will cut interest rates by 50 basis points in September is 48.5%

3. The earnings growth of U.S. stocks has expanded beyond the "Magnificent Seven"

4. Survey: 72% of Japan companies predict a good economic situation and are worried about exchange rates and prices

5. India's largest IPO this year was occurred, and serial entrepreneurs are known as India's "Musk"

Domestic News

1. The bond market continues to release strong regulatory signals

The bond market continued to fall on August 9, with long-term bond prices falling even more. The yields of major interbank interest rate bonds rose across the board. In the view of market participants, the recent continuous decline in the bond market is related to the regulatory attitude and measures introduced by the relevant departments. Some bond market traders said that the continuous release of strong regulatory signals has guided yields to rise continuously in recent days, and the current 10-year and 30-year treasury bond yields have basically determined the phased bottom, and the market continues to pay attention to the dynamics of the People's Bank of China and other management departments. Industry participates believe that the logic of the current bond market has not changed for the time being, but the disturbance factors may gradually increase.

2. Many car companies have shrunk preferential margins and reduced production to stabilize the price system

The price war in the auto market has been temporarily stopped. Recently, the reporter learned from NIO Inc that NIO's car purchase rights and interests will be reduced on August 11 with a "10,000 yuan car purchase subsidy". Li Auto Inc, which has always had little price change, has also shrunk its discount margin recently. The reporter contacted a number of auto brand stores as consumers and found that in addition to these two new car companies, many joint venture brands also have weakened model discounts. Since July, a number of auto brands have stopped cutting prices or reduced their discounts. Judging from the information reflected by the sales staff of various brands, car companies are facing pressure to make inventory in the second half of the year, and the fastest way at present is to reduce production and stabilize the system. To a certain extent, the reduction in preferential measures also reflects the efforts of some brands to find rationality and prudence between the interests of dealers and sales expectations, so the momentum of price competition has weakened.

3. The Central Committee of the Communist Party of China and the State Council: Accelerate the coordination of digital and green transformation and development

The opinions of the Central Committee of the Communist Party of China and the State Council on accelerating the comprehensive green transformation of economic and social development mentioned that the deep integration of industrial digitalization and intelligence with green will be promoted, and the application of artificial intelligence, big data, cloud computing, and industrial Internet in the fields of power system, industrial and agricultural production, transportation, and construction and operation will be deepened, so as to realize the green transformation empowered by digital technology. Promote all kinds of users to "use cloud, data, and intelligence", and support enterprises to use digital intelligence technology and green technology to transform and upgrade traditional industries. Promote the construction of green and low-carbon digital infrastructure, promote the energy-saving and carbon-reduction transformation of existing facilities, and gradually phase out "old and small" facilities. Guide the green and low-carbon development of digital technology enterprises, and help upstream and downstream enterprises improve their carbon reduction capabilities. Explore the establishment of efficient monitoring, active early warning, scientific analysis, and intelligent decision-making systems for environmental pollution and meteorological disasters. Promote the construction of real-life 3D China and the empowerment application of spatio-temporal information.

4. The Central Committee of the Communist Party of China and the State Council: Strengthen the clean and efficient utilization of fossil energy

The opinions of the Central Committee of the Communist Party of China and the State Council on accelerating the comprehensive green transformation of economic and social development mentioned that the construction of the energy production, supply, storage and marketing system should be strengthened, the construction of the energy production, supply, storage and marketing system should be strengthened, and the non-fossil energy should be promoted to replace fossil energy in a safe, reliable and orderly manner, and the energy structure should be continuously optimized, and the planning and construction of a new energy system should be accelerated. Resolutely control fossil energy consumption, further promote the clean and efficient use of coal, strictly and reasonably control the growth of coal consumption during the "14th Five-Year Plan" period, and gradually reduce it in the next five years. Accelerate the "three reforms" of energy-saving and carbon-reduction transformation, flexibility transformation and heating transformation of existing coal-fired power units, and rationally plan and build the regulatory and supporting coal-fired power plants necessary to ensure the safety of the power system。 We will intensify the exploration and development of oil and gas resources and increase reserves and production, and accelerate the integrated development of oil and gas exploration and development and new energy. Promote the construction of carbon dioxide capture, utilization and storage projects.

5. National Development and Reform Commission: Establish a new mechanism for the comprehensive transformation from dual control of energy consumption to dual control of carbon emissions

The person in charge of the National Development and Reform Commission answered reporters' questions on the "Opinions on Accelerating the Comprehensive Green Transformation of Economic and Social Development". The person in charge of the National Development and Reform Commission said that the opinions are the top-level design documents for accelerating the comprehensive green transformation of economic and social development. The National Development and Reform Commission will strengthen overall coordination, work with relevant departments to establish a new mechanism for the comprehensive transformation from dual control of energy consumption to dual control of carbon emissions, formulate and implement a comprehensive evaluation and assessment system for carbon peak and carbon neutrality, scientifically carry out assessment, and strengthen the application of evaluation and assessment results.

International News

1. Former Japan Bank members ruled out another rate hike this year

Makoto Sakurai, a former governor of the Bank of Japan, said that given the market turmoil after the recent interest rate hike and the low probability of a rapid recovery of the Japan economy, the Bank of Japan will not be able to raise interest rates again this year, and it is unknown whether it can raise interest rates once before March next year. It is good that the Bank of Japan wants to raise interest rates to the normal 0.25%, but it will take a lot of energy, so "they should wait and see for a while" to determine whether to raise interest rates further.

2. The probability that the Fed will cut interest rates by 50 basis points in September is 48.5%

According to CME's "Fed Watch": the probability of a 25 basis point rate cut by the Fed in September is 51.5%, and the probability of a 50 basis point rate cut is 48.5%. The probability of a cumulative 50 basis point rate cut by November is 36.8%, a 49.4% probability of a cumulative 75 basis point rate cut, and a 13.9% probability of a cumulative 100 basis point rate cut.

3. The earnings growth of U.S. stocks has expanded beyond the "Magnificent Seven"

As United States companies enter the final phase of another quarterly earnings season, one thing is clear: companies outside the AI boom are finally starting their long-awaited recovery, and this sign of upturn is not to be missed. Earnings growth from the Magnificent Seven Tech companies has fueled the S&P 500's rally for several quarters, but agency data suggests that is about to change, as the benchmark index is on track for its first earnings growth since the fourth quarter of 2022 with the exception of the so-called "Magnificent Seven." S&P 500 constituents (excluding the Magnificent Seven) will post a 7.4% increase in second-quarter earnings from a year earlier, after five consecutive quarters of decline, the data showed. Although more than 80% of the constituent companies have already reported results, Home Depot (HD. N), Wal-Mart Department Store (WMT. N) and Target (TGT. N) and other major weather vanes that measure the health of United States consumers have not yet reported their results. Clues about consumer spending revealed by these earnings reports will be closely watched as traders remain uneasy about the possibility of an economic slowdown.

4. Survey: 72% of Japan companies predict a good economic situation and are worried about exchange rates and prices

Japan's Kyodo News Agency compiled the results of a survey of 111 major companies in Japan on the 10th. As for the economic situation in the coming year, 72% of companies forecast "expansion" and "slow expansion", down 10 percentage points from 82% last summer. A total of 23% of companies forecast "flat" or "slow regression", up 8 percentage points from 15% last summer. As a result, the recovery of private consumption continues to be expected, but there are also concerns about the depreciation of the yen and the drag on the economy due to high prices. When asked about the reasons for predicting the expansion of the economic situation (multiple choice), the most common response was "recovery in personal consumption", which was the same as last summer, at 84%. This was followed by a recovery in capital investment (79%) and an increase in spending by foreign tourists visiting Japan (53%). When asked about the reasons for the flattening or regression forecast, "sluggish personal consumption" (64%) was the most common reason, followed by "negative impact of the depreciation of the yen" and "negative impact of high prices" (48%).

5. India's largest IPO this year was occurred, and serial entrepreneurs are known as India's "Musk"

Ola Electric, India's largest IPO company this year, listed on the India local market yesterday, saw its shares soar 20% to a market capitalization of $4.8 billion. This is India's largest IPO since the US$2.7 billion share offering of India's state-owned life insurer in 2022. Ola Electric's cheapest scooter costs around $900, which is about 20 to 30 percent lower than the price of the competition's offerings. According to industry bodies, the company sold 36,723 electric motorcycles in June, more than its closest rivals, TVS Motor and Bajaj Auto combined. The company's founder, Aggarwal, graduated from the India Institute of Technology in Mumbai and then joined Microsoft Research India. Aggarwal is outspoken and has a personality similar to Elon · Musk. He regularly discusses on social media and blogs how his company contributes to India's economic growth and is an active supporter of the Modi government's push for local manufacturing goals.

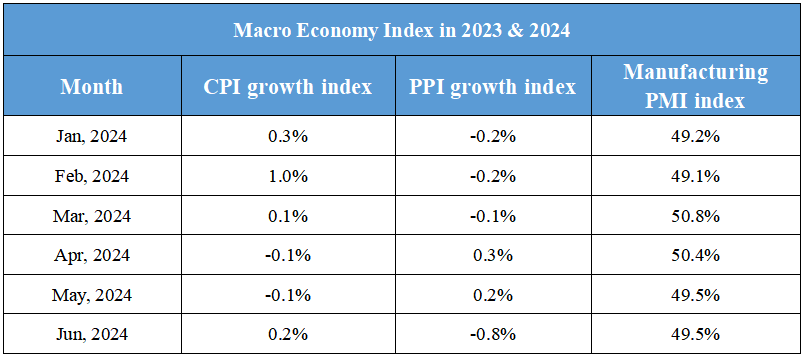

Domestic Macro Economy Index