Global Economic Insights and Trends on August 9th

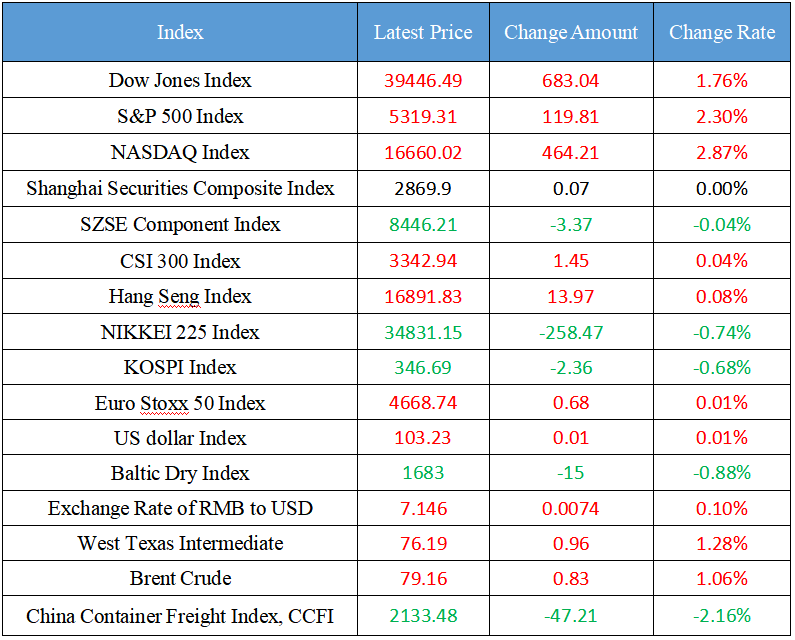

Latest Global Major Index

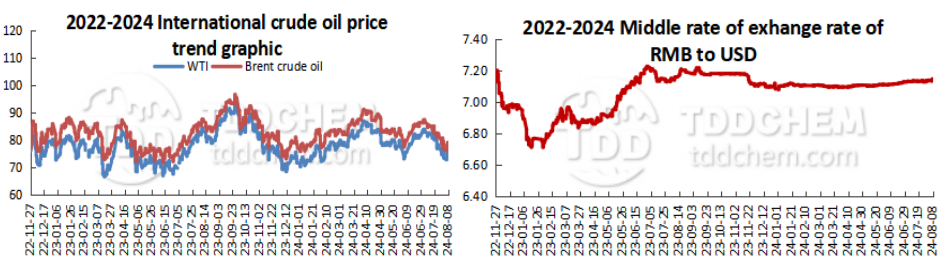

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Economic Daily columnist Jin Guanping: Prevent "involution-based" vicious competition

2. In July 2024, the domestic monthly retail sales of new energy passenger vehicles exceeded that of fuel passenger vehicles for the first time

3. The big news of mergers and acquisitions in the securities industry, one closer step to "Guolian Securities + People's Livelihood"

4. Forecast of financial data in July: credit may fall seasonally, and the growth rate of social finance may rebound slightly

5. CATARC signed a strategic cooperation agreement with Huawei

International News

1. The probability that the Fed will cut interest rates by 50 basis points in September is 56.5%

2. Wall Street expects the Fed to end its balance sheet reduction this year, but the possibility of a sharp brake is not high

3. World Gold Council: Multiple factors may lead to high uncertainty in the gold market in August

4. Netherlands International: If weak data causes the Fed to react, the dollar will fall further

5. The number of initial jobless claims in United States last week hit the largest drop in nearly a year

Domestic News

1. Economic Daily columnist Jin Guanping: Prevent "involution-based" vicious competition

Jin Guanping, Economic Daily, said in an article that there is no winner in the vicious competition of "involution". We have learned a lesson, and we should learn from it. Compared with traditional industries, emerging industries, especially future industries, have large capital investment, technology-intensive, and more stringent conditions for industrial cultivation, representing a new round of scientific and technological revolution and industrial transformation, and are the most active force for economic growth. Once planning and investment falls short of expectations, higher costs would follow. In the context of the increase in the adverse effects of changes in the external environment and the differentiation of domestic economic operations, it is necessary to correct the vicious "involution" of some emerging industries in a timely manner.

2. In July 2024, the domestic monthly retail sales of new energy passenger vehicles exceeded that of fuel passenger vehicles for the first time

According to the Passenger Car Market Information Joint Branch of the China Automobile Dealers Association, in July 2024, the national passenger car market retailed 1.72 million vehicles, down 2.8% year-on-year and 2.6% month-on-month, of which, 840,000 conventional fuel passenger cars were retailed in July, down 26% year-on-year and 7% month-on-month, and 878,000 new energy passenger vehicles were retailed in July, up 36.9% year-on-year and 2.8% month-on-month.

3. The big news of mergers and acquisitions in the securities industry, one closer step to "Guolian Securities + People's Livelihood"

The merger and acquisition of "Guolian Securities+ People's Livelihood" ushered in the latest progress. On the evening of August 8, Guolian Securities issued an announcement on the issuance of shares to purchase assets and raise matching funds and related party transaction report (draft), which is another substantial progress after Guolian Securities announced on May 14 that it intends to issue A shares to purchase 100% of Minsheng Securities. According to sources close to Guolian Securities, "the substantive work of the due liability investigation of Guolian Securities' acquisition of Minsheng Securities has been basically completed, and after the announcement, a general meeting of shareholders will be held in a timely manner according to the progress of the state-owned assets approval process, and then it will wait for the relevant approval of the exchange and the China Securities Regulatory Commission." This also means that the countdown to the landing of "Guolian Securities + People's Livelihood" in the capital market has begun. If the transaction is successfully completed, it is expected to become the first successful landing case of market-oriented mergers and acquisitions of securities companies and a demonstration case of Yangtze River Delta integration.

4. Forecast of financial data in July: credit may fall seasonally, and the growth rate of social finance may rebound slightly

As a traditional "small month" for credit delivery, the market expects that new loans will fall seasonally, and the growth rate of social financing stock is expected to re-back under the low base effect. In July last year, RMB loans increased by 345.9 billion yuan, and the scale of social financing increased by 528.2 billion yuan. Everbright Securities expects new RMB loans to be 200 billion yuan to 300 billion yuan in July, with a growth rate of around 8.7%. At this stage, the lack of effective financing demand is still the main contradiction restricting credit expansion, and the pressure of "shrinking volume, falling prices, and rising risks" in loan growth is rising, and it is difficult for credit activities to seek a "balance between volume and price". From a structural point of view, the investment in corporate loans is relatively stable, the differentiation of industry investment continues, and the quasi-financial strength needs to be increased. The demand for retail loans is weak, or it may still show a trend of "quantity shrinkage and price decline". The reposting of bills reappeared in the "zero interest rate" market, and the proportion of bills in credit and social finance increased. Industrial Research predicts that the growth rate of social finance may rebound slightly in July.

5. CATARC signed a strategic cooperation agreement with Huawei

On August 7, China Automotive Technology and Research Center Co., Ltd. and Huawei Technologies Co., Ltd. held a signing ceremony for a strategic cooperation agreement in Tianjin. An Tiecheng, Secretary of the Party Committee and Chairman of the Board of Directors of CATARC, said that the signing of the strategic cooperation agreement marks another in-depth advancement of the cooperative relationship between CATARC and Huawei, and hopes that the two sides will carry out all-round exchanges and cooperation in the fields of policy standards, testing and certification, and digital transformation.

International News

1. The probability that the Fed will cut interest rates by 50 basis points in September is 56.5%

According to CME's "Fed Watch": the probability of a 25 basis point rate cut by the Fed in September is 43.5%, and the probability of a 50 basis point rate cut is 56.55%. The probability that the Fed will cut interest rates by 50 basis points by November is 28.2%, the probability of a cumulative rate cut of 75 basis points is 51.9%, and the probability of a cumulative rate cut of 100 basis points is 19.9%.

2. Wall Street expects the Fed to end its balance sheet reduction this year, but the possibility of a sharp brake is not high

An end to the Fed's balance sheet reduction is in sight, but the actual closing date depends on the pace of rate cuts and funding market pressures. Policymakers have hinted at a reduction in U.S. debt holdings by the end of the year, and many on Wall Street believe that quantitative tightening is unlikely to end abruptly. But recent weak economic data and liquidity stress risks have clouded the outlook. "If the Fed intends to stimulate the economy, then it may stop shrinking its balance sheet," Bank of United States strategists Mark Cabana and Katie Craig wrote in a note to clients on Wednesday. "If the Fed's aim is to normalize monetary policy, then balance sheet reduction can continue." Growing signs of a faster slowdown in economic growth than expected a few weeks ago triggered a sharp rally in global bonds on Monday, with traders betting that the Federal Reserve and other central banks will become more aggressive in cutting interest rates. Morgan Stanley analysts wrote, "Two possible drivers could allow the Fed to end its balance sheet reduction early, one is the drying up of liquidity in the money market and the other is a recession in the United States." But we think neither is likely to happen."

3. World Gold Council: Multiple factors may lead to high uncertainty in the gold market in August

The World Gold Council said gold's seasonal strength in August could be influenced by a number of specific events: United States election updates, the Jackson Hole seminar and stock market volatility. These events will keep uncertainty stable. The Fed began to cut interest rates mainly on the premise of normalizing economic data. While the jobs report and ISM data unexpectedly fell to the downside, other data was quite red-hot. The type of economic landing is still unclear, and it is risky for the market to price in two rate cuts at almost 100%. In the United States election, while the Democrats seem to have reversed the slump, there is still a lot of time before the vote, and things may turn sharply. Finally, following the July sell-off in tech stocks, the volatility in the stock market in early August is likely to continue until Nvidia's earnings release at the end of the month. For the technology sector, which has risen the most in the United States so far this year, the second-quarter performance was not ideal. In addition, lower volumes usually witnessed in August, which can add the uncertainty to the market.

4. Netherlands International: If weak data causes the Fed to react, the dollar will fall further

Netherlands said that although a recession is unlikely, the dollar will face further losses as the Federal Reserve may cut interest rates due to weak upcoming United States economic data, which will reduce safe-haven inflows. Analyst Chris Turner said in the report that weak United States data and the Fed's reaction will lead to a steeper yield curve while risk appetite rises and the dollar weakens compared to a recession and the Fed's lack of response. The Fed is likely to signal a rate cut at the Jackson Hole symposium on August 22-24. In the coming weeks, the dollar index DXY may test 102.

5. The number of initial jobless claims in United States last week hit the largest drop in nearly a year

United States jobless claims fell last week by the most in nearly a year after last week's disappointing jobs report, which could ease some fears that the labor market is cooling too quickly. United States Labor Department data on Thursday showed initial claims fell by 17,000 to 233,000 in the week ended Aug. 3. States such as Michigan, Missouri, and Texas, which have seen significant increases in applications in recent weeks, have seen fewer applicants these days. The decline in initial claims may help reassure the market that the labor force is simply returning to pre-pandemic trends, rather than deteriorating rapidly. Last week's lower-than-expected non-farm payrolls report led to a sell-off in global markets and sparked calls for the Fed to start cutting interest rates ahead of its September meeting. Initial claims fluctuate at this time of year due to school summer vacations and auto factory restructuring.

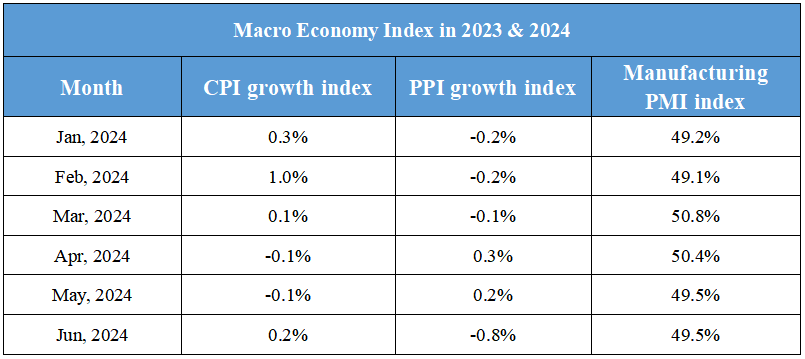

Domestic Macro Economy Index