Global Economic Highlights on August 8th

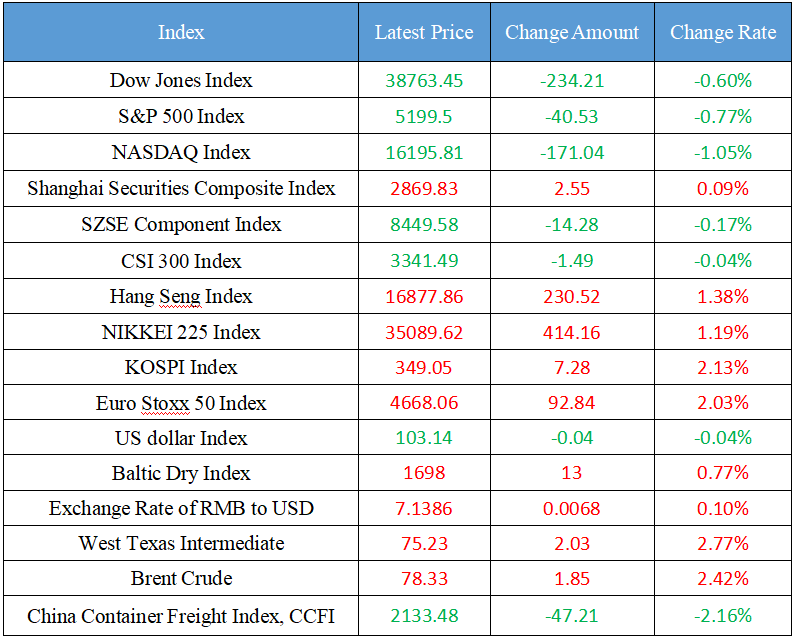

Latest Global Major Index

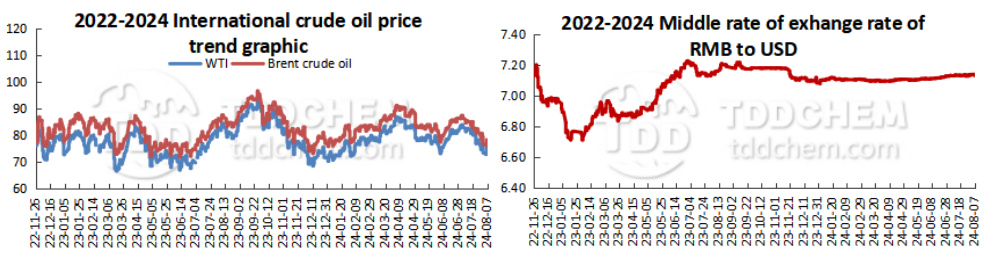

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Jin Guanping, Economic Daily: Accelerate the construction of more world-class enterprises

2. Launch a rocket? Taobao's official response: It is indeed a real rocket launch, and the rocket will be formally launched within the year

3. KPMG: China's economy is at a critical turning point of the deep integration of ESG concepts and development

4. Is the approval of the debt base suspended? Industry experts: The approval of the debt base has been operating normally last week, and the two of them have received written feedback

5. Shanghai: A number of "self-media" accounts that provoked conflicts were punished strictly

International News

1. JPMorgan Chase raised the probability of the United States economy falling into recession to 35% by the end of the year

2. US stocks closed: the stock index opened high and went low, and the Nasdaq fell more than 1%

3. Fierce clashes broke out in United States areas controlled by Syria illegal garrisons

4. Natural gas prices rise in Europe, Ukraine troops reportedly occupied a natural gas transit station in Russia

5. BBH: The Bank of Japan turned dovish, and the dollar resumed its upward trend

Domestic News

1. Jin Guanping, Economic Daily: Accelerate the construction of more world-class enterprises

The front-page article of the Economic Daily pointed out that in recent years, with the introduction of a series of policies and measures to protect and support the reform and development of enterprises, the strength of China's enterprises has been continuously enhanced, and some industry leading enterprises have formed strong international competitiveness. This year, 133 companies in China have shown on the Fortune Global 500 list, and the number of large companies continues to lead. However, it should also be noted that compared with world-class enterprises, Chinese enterprises still have room for improvement in terms of R&D capabilities, brand leadership, and management level. In the face of the complex international and domestic situation, in order to seize the major opportunities of a new round of scientific and technological revolution and industrial transformation, the pace of building a world-class enterprise must be accelerated. To this end, it is necessary not only to speed up the improvement of the market environment that is suitable for it as the basic guarantee, but also to accelerate the cultivation of the matched entrepreneurial spirit as a driving force.

2. Launch a rocket? Taobao's official response: It is indeed a real rocket launch, and the rocket will be formally launched within the year

On August 7, Taobao officially announced that it would invite 88VIP members to participate in a special event. Members had the opportunity to paint their wishes on a rocket through interactive messages, and had the opportunity to witness the rocket launch. Some netizens expressed doubts about whether it was a real rocket. Taobao official responded to this, it is indeed a real rocket launch, and the wishes of netizens will be painted on the real rocket in the live broadcast at the night of August 8, and the message of netizens is now being solicited that the rocket will be officially launched within the year. Zhongke Aerospace also officially announced that Taobao and Zhongke Aerospace achieved cross-border cooperation today, and the navigator Liu Cixin jointly launched the 'Space Walking Plan', inviting Taobao 88VIP users and navigator Liu Cixin to send 'a big rocket gift' together to witness the 'Lijian No. 1 launch rocket Taobao 88VIP Exploration' flying within the year."

3. KPMG: China's economy is at a critical turning point of the deep integration of ESG concepts and development

KPMG, one of the big four accounting firms, said that China's economy is at a critical turning point when ESG concepts (environment, society and governance) are deeply integrated into development. KPMG pointed out that at present, from the rise of green finance, to the sustainable transformation of supply chains, and then to the improvement and optimization of corporate governance, ESG is gradually penetrating into every corner of economic development and becoming an important yardstick to measure corporate sustainability. "The ESG concept can help enterprises gain an advantage in industry changes and market fluctuations, and further enhance their innovation capabilities and competitiveness, thereby contributing to the long-term stable and high-quality development of the economy." KPMG said.

4. Is the approval of the debt base suspended? Industry experts: The approval of the debt base has been operating normally last week, and the two of them have received written feedback

Recently, there have been rumors in the market that "the supervision apartment does not allow the issuance of public debt bases", and a number of industry experts said that "there has indeed been no debt base approved for nearly a month", but since last week, the regulatory approval of the debt base has been "carried out normally", but "the speed will be slower than that of equity products". The reporter checked the relevant information and found that there were still debt-based products approved in June, but were not in July. According to the official website of the China Securities Regulatory Commission, on July 31, Xinyuan Chengxin Tianyi Bond and Zheshang Huijin Jinli Enhanced 30-day Holding Period Bond have received a written feedback.

5. Shanghai: A number of "self-media" accounts that provoked conflicts were punished strictly

According to the WeChat official account of Netinfo Shanghai, recently, after receiving reports from netizens, some "self-media" accounts in the territory have unscrupulously stirred up social hotspots, incited group conflicts, and took the opportunity to attract popularity and make it into money, and earn "toxic popularity" for profit. In accordance with relevant laws and regulations on the Internet, the Cyberspace Administration of the Shanghai Municipal Party Committee coordinated the strict handling of a number of bottomless "self-media" accounts such as "Ziqi Tanfang", "Modu Nan", and "Zhengcaishen". Among them, "Ziqi Visit" (23,000 fans) was banned by the whole platform, "Modu Nan" (1.52 million fans) and "Zheng Caishen" (15,000 fans) were banned for 60-180 days, and they were banned from following others and suspending profit-making functions.

International News

1. JPMorgan Chase raised the probability of the United States economy falling into recession to 35% by the end of the year

JPMorgan now sees a 35% chance that the United States economy will fall into recession by the end of the year, up from 25% early last month. JPMorgan Chase economists, led by Bruce Kasman, wrote in a note to clients on Wednesday that news in the United States "suggests that labor demand is weaker than expected and that the first signs of layoffs are emerging." The team maintains a 45% chance of the economy falling into a recession by the second half of 2025. "We have modestly raised our assessment of recession risk more than we have adjusted our assessment of the interest rate outlook," Kasman and his colleagues wrote. JPMorgan now sees only a 30% chance that the Fed and other central banks will keep interest rates high for a long time, compared to a 50% chance predicted just two months ago. As inflationary pressures in the United States decline, JPMorgan expects the Fed to cut rates by 50 basis points in September and November.

2. US stocks closed: the stock index opened high and went low, and the Nasdaq fell more than 1%

US stocks closed on Wednesday, with the Dow Jones Index initially closing down 0.6% or about 230 points, and the S&P 500 down 0.77%; The Nasdaq fell 1.05%, rising more than 2% at one point during the session. Broadcom (AVGO. O), Nvidia (NVDA. O) fell more than 5%, and Tesla (TSLA. O) fell more than 4%, and Intel (INTC. O) fell 3.6%. The Nasdaq China Golden Dragon Index closed down 1.45%, Dingdong (DDL.N) fell nearly 11%, and Xpeng Motors (XPEV. N) fell more than 5%, and Bilibili (BILI. O) fell more than 4%.

3. Fierce clashes broke out in United States areas controlled by Syria illegal garrisons

On August 7, local time, fierce clashes broke out between Arab tribal forces and Kurdish forces in the eastern countryside of Deir ez-Zor, Syria. Arab tribal forces launched a massive assault on Kurdish forces in the eastern countryside of Deir ez-Zor in Syria and took control of several towns. Arab tribal forces seized United States military equipment from Kurdish forces and bombarded towns with mortars, causing civilian casualties. According to some sources, the area where the fighting took place is the sphere of influence of the illegal US military stationed in Syria, which is managed by Kurdish forces supported by the US military. After the fighting, the Koniko and Omar oil fields, illegally occupied by U.S. forces, were put on alert, and United States helicopters were seen firing at Arab tribal forces near the banks of the Euphrates River east of Deir ez-Zor.

4. Natural gas prices rise in Europe, Ukraine troops reportedly occupied a natural gas transit station in Russia

European gas prices soared after reports that Ukraine forces had seized a key fuel transit terminal in Sudzha. Benchmark natural gas futures rose as much as 5.3% on Wednesday, reversing earlier losses. Russia's unofficial military blog Rybar says Ukraine forces have captured gas import points in the Russia town of Sudzha, near the border. The claim could not be independently confirmed, and the Russia state-owned enterprise Gazprom PJSC, the Ministry of Defense of Ukraine and the General Staff of the Armed Forces declined to comment.

5. BBH: The Bank of Japan turned dovish, and the dollar resumed its upward trend

BBH analysts said in a note that the dollar index DXY has recovered more than a third of its post-FOMC losses as the Bank of Japan turns dovish and "is in the process of damage control." USD/JPY rose 0.3% on the day from Monday's low of 142 basis points to 147 basis points, with the dollar index DXY up 0.3% on the day. Earlier this week, the yen strengthened against the dollar as the Fed appeared to be under pressure to cut rates quickly, while the Bank of Japan took the opposite direction. But now both central banks seem to be in less of a hurry. The market expected the Fed to cut interest rates by 50 basis points in September, but BBH disagreed. BBH pointed out that the United States economy is "still growing at an above-trend rate" and the market is getting carried away.

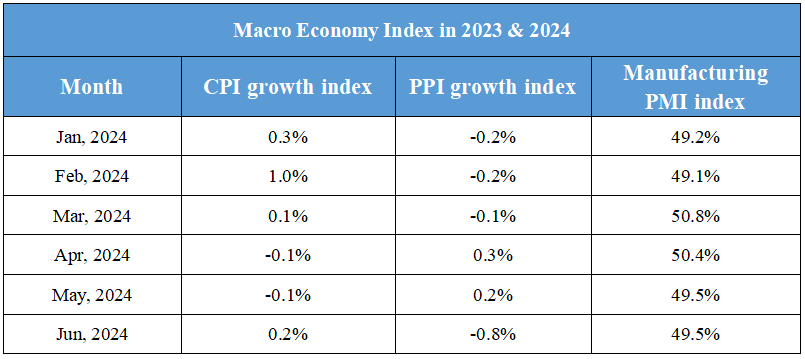

Domestic Macro Economy Index