On November 13th, Key Developments in Global and Domestic Macro Economy

Daily Macro Economy News

Latest Global Major Index

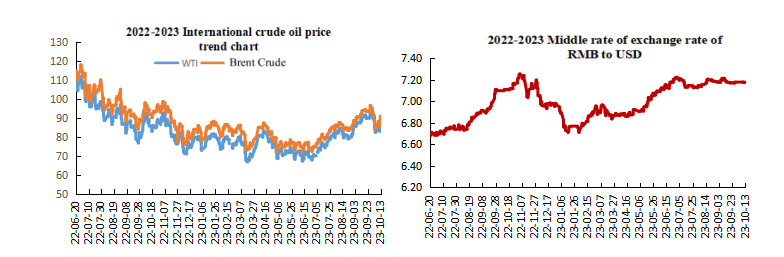

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. China's Ministry of Finance has allocated more than 10.7 billion yuan in special funds for inclusive financial development in 2023

2. Executive Vice Minister of Foreign Affairs Ma Zhaoxu: Promote the joint construction of high-quality "Belt and Road" on a larger scale, at a deeper level and at a higher quality

3. General Administration of Customs: Imports of bulk commodities and consumer goods expanded in the first three quarters

4. Digital RMB Helps Boost Festive Consumption

International News

1. Core inflation momentum in Europe and the United States has slowed down, and most Western central banks have ended their interest rate hike cycle

2. Moody's: $1.3 trillion of high-grade bond is at risk of refinancing, and more than $1 trillion of junk bond is at a dilemma

3. OPEC data still points to a record high oil supply gap this quarter

4. Investors will be more cautious about the outlook for U.S. inflation, and U.S. Treasury yields may remain high

Domestic News

1. China's Ministry of Finance has allocated more than 10.7 billion yuan in special funds for inclusive financial development in 2023

The Ministry of Finance recently allocated about 866 million yuan of special funds for inclusive financial development, which were included in the direct fund management, plus about 9.867 billion yuan has been allocated before, and a total of about 10.733 billion yuan special bonds will be allocated for inclusive financial development in 2023 to promote the high-quality development of inclusive finance.

2. Executive Vice Minister of Foreign Affairs Ma Zhaoxu: Promote the joint construction of high-quality "Belt and Road" on a larger scale, at a deeper level and at a higher quality

Vice Foreign Minister Ma Zhaoxu said today that over the past 10 years, the cooperation on the joint construction of "Belt and Road" has achieved fruitful results, benefiting the vast number of partners and hundreds of millions of ordinary people. We look forward to taking the Third Belt and Road Forum for International Cooperation as a new starting point and working with all parties to build consensus, sum up experience, plan for the future, and promote a deeper and solid international cooperation on the Belt and Road. We will adhere to the "golden rule" of c0-consultation, co-construction and co-sharing, adhere to the concept of open, green and clean cooperation, adhere to the development goals of high standards, sustainability and promote people's livelihood, and work with partners to promote joint construction of the "Belt and Road" on a larger scale, deeper level and higher quality, and continue to move towards the goal of common development and prosperity.

3. General Administration of Customs: Imports of bulk commodities and consumer goods expanded in the first three quarters

In the first three quarters, China's imports of energy, metal ores, grain and other bulk commodities increased by 16.5% year-on-year. Among them, energy products such as crude oil, natural gas and coal were 860 million tons, an increase of 31.8%; Iron, metal ores such as aluminum were 1.086 billion tons, an increase of 7.8%. In the same period, imported consumer goods reached 1.46 trillion yuan, an increase of 3.1%. Among them, dried and fresh melons, fruits and nuts and health care products increased by 22.8% and 18.5% respectively.

4. Digital RMB Helps Boost Festive Consumption

At present, the pilot scope of digital RMB has been expanded to 26 regions in 17 provinces, and the circulation volume of digital RMB has been continuously improved, accelerating its integration into the public’s various fields of clothing, food, housing and transportation. More importantly, since the pilot of the digital yuan, and the write-off rate of most of the consumption vouchers issued by using the digital currency is more than 90%, and the write-off rate in some places is even as high as 99%. From the perspective of driving consumption, according to incomplete statistics, the consumption amplification effect of issuing digital RMB consumption coupons in some pilot areas has exceeded 15 times, effectively promoting social consumption replenishment and potential release. Such a "report card" also fully verifies the feasibility, stability, safety and effectiveness of the digital RMB as a national legal tender to issue consumption subsidies.

International News

1. Core inflation momentum in Europe and the United States has slowed down, and most Western central banks have ended their interest rate hike cycle

Danske Bank noted that inflation drivers remain mixed, but inflation rate in the U.S. and eurozone is likely to decline in 2023. Underlying inflation and wage growth in the United States have begun to slow, but remain glued in the eurozone. Tight labor markets will continue to support upside risks to future core inflation in both regions. In our view, most Western central banks have now ended their respective rate hike cycles. Short-term inflation expectations among consumers have eased, especially in the US, but remain slightly above pre-pandemic levels. Long-term inflation expectations in the U.S. market have risen slightly over the past month, but remain in line with the Fed's target for now. Looking ahead, the base effect and downward momentum in the Eurozone are expected to pull down inflation, which is expected to fall from 5% to 3.2% in the fourth quarter.

2. Moody's: $1.3 trillion of high-grade bond is at risk of refinancing, and more than $1 trillion of junk bond is at a dilemma

Ratings agency Moody's pointed out that amid expectations that higher interest rates could remain longer, the risk of refinancing of the blue-chip companies rose to a 13-year high, while the risk of refinancing and default by junk bond issuers rose. Ignacio Rasero, a credit analyst at Moody's, said in the report: "As companies choose shorter maturities and high interest rates to dampen refinancing, the size of mature debts that with the maturities within a five-year period increases against the backdrop of increased issuance and forward risk during the window period."

3. OPEC data still points to a record high oil supply gap this quarter

OPEC kept global crude oil demand growth unchanged at 2.44 million b/d in 2023. Global oil demand is expected to grow by 2.25 million b/d in 2024, compared with a previous forecast of 2.25 million b/d. With crude demand climbing to record highs and Saudi Arabia curbing production, OPEC data continued to point to a record supply gap in the quarter. According to data in OPEC's latest report, global oil inventories are expected to shrink by about 3 million b/d in the final three months of the year. If this is real, it will be the largest gap in 30 years of that record.

4. Investors will be more cautious about the outlook for U.S. inflation, and U.S. Treasury yields may remain high

The US CPI in September rose 0.4% month-on-month (the market expectation was 0.3%), 3.7% year-on-year (the market expectation was 3.6%), and core CPI was in line with market expectations, the quarter-based adjustment was 0.3% month-on-month and 4.1% year-on-year. CICC Research reported that the reasons for inflation exceeding expectations came from three aspects, one was the rebound in the growth rate of owner-to-owner equivalent rent (OER) in housing, the second is that the transmission effect of rising oil prices is still there, and the third is that the inflation of services other than housing is still existing. An important lesson from the beyond expectation inflation is that a slowdown in inflation is not taken for granted, but presupposes continued monetary tightening, and the Fed may be able to stop raising interest rates, but it will be necessary to maintain a high pressure on inflation. We expect Fed officials to be more cautious in their speeches in the coming weeks, and those comments that could be interpreted as dovish by the market are redundant and unnecessary. Investors will also be more cautious about the outlook for U.S. inflation, and U.S. Treasury yields may remain high for longer.

Domestic Macro Economy Index