On November 13th, Key Insights on Global and Domestic Macro Economy

Daily Macro Economy News

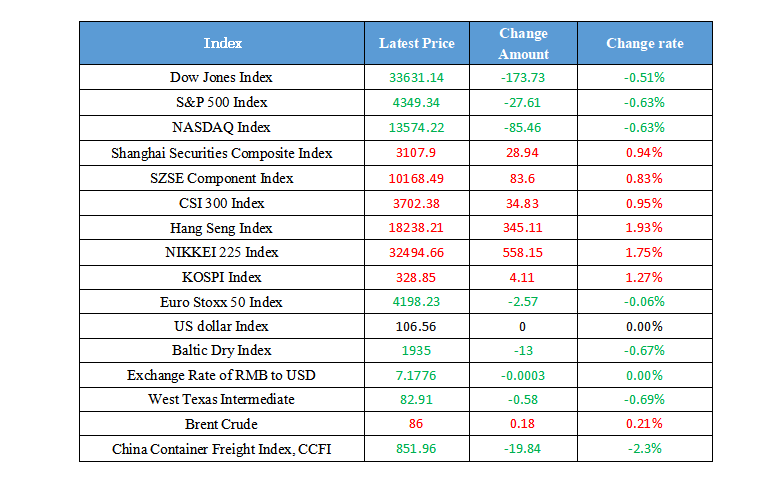

Latest Global Major Index

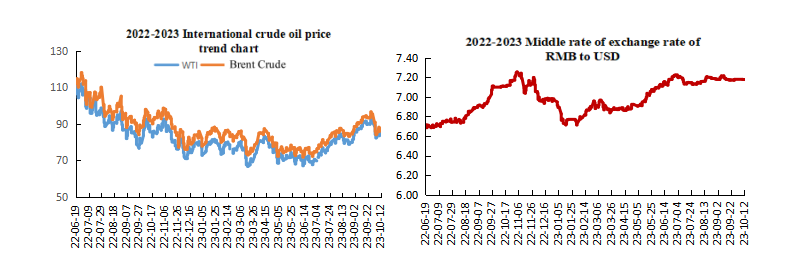

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. China Economic Daily: Steadily promote the transformation of local financing platforms

2. The Central Bank's attitude of protecting liquidity is clear, and the capital fabrics remained stable in October

3. The endogenous growth momentum of China's economy continues to strengthen, and experts stated that GDP growth is expected to be more than 4% year-on-year in the third quarter

4. Lu Lei, State Administration of Foreign Exchange: Under certain conditions, the Central Bank’s digital currency will have the opportunity to become broad currency

International News

1. US Treasury Secretary Janet Yellen: The U.S. economic outlook is optimistic, but risks remain here

2. Russia implements capital control measures

3. Russian Foreign Minister: The Commonwealth of Independent States (CIS) countries support a ceasefire and the start of negotiations between the two sides of the Palestinian-Israeli conflict

4. Fed Minutes: Despite the risk shift, interest rates will remain high "for some time."

Domestic News

1. China Economic Daily: Steadily promote the transformation of local financing platforms

The article said that the financing platform debt will be gradually resolved. Financing platforms should attach great importance to the improvement of credit ratings, combine regional planning, resource endowment and strategic positioning, coordinate infrastructure stock and increment, steadily promote the existing assets-backed securitization(ABS), introduce equity-based real estate investment trusts (REITs), and use the public-private partnership (PPP) model as appropriate, vigorously optimize investment and financing projects, revitalize various resource assets, reduce asset-liability ratio, and enhance the platform's asset quality, cash flow income, profit sources and debt commitment capacity. Legalize compliance and realize market-oriented debt. At the same time, financing platforms should grasp the current opportunity of the central government's policy on financial support for local debt risk resolution, make good use of debt extension, principal renewal and interest rate reduction, debt restructuring and other methods to fully reduce the cost of interest-bearing debt, extend the debt repayment period, and ensure sufficient operating cash flow for self-operation.

2. The Central Bank's attitude of protecting liquidity is clear, and the capital fabrics remained stable in October

According to the China Securities Journal, from October 7 to 11, the central bank withdrew more than 1.5 trillion yuan in the open market. Looking ahead to mid-to-late October, experts believe that the capital side still faces a variety of disturbances, but the central bank's attitude to protect liquidity remains clear. The central bank will use a combination of various policy tools to ensure that liquidity remains reasonably abundant.

3. The endogenous growth momentum of China's economy continues to strengthen, and experts stated that GDP growth is expected to be more than 4% year-on-year in the third quarter

According to the China Securities Journal, the National Bureau of Statistics will release macroeconomic data for the third quarter next week. Many industry experts are optimistic about the third quarter data, and the GDP growth rate in the third quarter is above 4% year-on-year. Under the continued effectiveness of a series of policies promoting stable growth introduced in the early stage, China's economy has shown a trend of stabilization and recovery, and the endogenous growth momentum of the economy has continued to strengthen. Zhang Wenlang, chief macro analyst of CICC's research department, said that the industrial production boom improved, and the industrial added value was expected to increase by 4.3% year-on-year in September. Wen Bin, chief economist of Minsheng Bank, said that considering the decline in the base in the same period last year, it is expected that the growth rate of total retail sales of consumer goods in September is expected to rise to about 5.5%.

4. Lu Lei, State Administration of Foreign Exchange: Under certain conditions, the Central Bank’s digital currency will have the opportunity to become broad currency

Lu Lei, deputy director of the State Administration of Foreign Exchange, said at the "2023 China (Beijing) Digital Finance Forum", "Under the existing model, the central bank digital currency (CBDC) is mainly positioned as a cash-type payment certificate (M0), which is an interest-free high-energy currency. Lu Lei pointed out that assuming that based on the programmability of digital currency, loading smart contracts on interest rates on the central bank digital currency, and the central bank digital currency will have the opportunity to become a broad currency (M2), and it is expected that the exploration of the Institute of Data Research can realize the monetary policy to adjust the interest rate of the central bank digital currency and achieve the macro-control goal. The programmability of central bank digital currencies provides innovation space for enriching central bank monetary policy tools, but it has to be said that this is a common challenge faced by central banks around the world.

International News

1. US Treasury Secretary Janet Yellen: The U.S. economic outlook is optimistic, but risks remain here

U.S. Treasury Secretary Janet Yellen continued to express an optimistic view on the U.S. economy. "I still deem the baseline scenario in the U.S. a so-called soft landing", she said, which means that inflation goes down but unemployment rate doesn't rise significantly. She pointed out that unemployment rate remained low, but wage pressures that could have contributed to the persistence of high inflation had eased, while inflation itself was falling. However, the U.S. economy remains at risk, including global external shocks, and the recent situation of Israel has brought additional concerns.

2. Russia implements capital control measures

Russia has implemented some degree of capital controls in response to the depreciation of the ruble. The Kremlin announced that it will require the top 43 largest oil exporters, including major oil producers, to exchange currency of overseas sales profit in the domestic market to rubles to safeguard foreign exchange supplies. Since May 2023, the Russian ruble has continued to fall against dollar from around 75 rubles to 102.3621 rubles on October 9, making it the third worst-performing emerging market currency this year. Russia has implemented a similar requirement since February 2022, but lifted the move after the currency recovered.

3. Russian Foreign Minister: The Commonwealth of Independent States (CIS) countries support a ceasefire and the start of negotiations between the two sides of the Palestinian-Israeli conflict

On the 12th local time, Russian Foreign Minister Sergei Lavrov, who was attending the meeting of the foreign ministers of the CIS in Bishkek, the capital of Kyrgyzstan, said that the CIS countries will negotiate a unified position on the Palestinian-Israeli conflict, and all countries expressed support for the ceasefire and start negotiations between the conflicting parties. He said that the two sides of the Palestinian-Israeli conflict should immediately cease fire, abide by relevant international law, and avoid terrorist attacks and the indiscriminate violence. The Russian side hopes that, after the end of the conflict, the parties will still stick to the implementation of the relevant United Nations resolutions.

4. Fed Minutes: Despite the risk shift, interest rates will remain high "for some time."

Fed Meeting Minutes: All members agree that the Fed can "carefully promote and launch" interest rate decisions, and all agree that interest rates should remain restrictive for a certain period of time. Future data should help the Fed decide whether to raise rates again in a few months. Officials generally agree that the risks to the target are more balanced. Officials agreed that credit tightening could dampen activity. Most officials still believe there are upside risks to inflation. While the U.S. economy remains resilient, there are (many) downside risks to the growth outlook, many officials said. Several officials sought to discuss the topic from "how high" interest rates should be to "how long" interest rates should be maintained.

Domestic Macro Economy Index