On November 13th, Key Updates in Global and Domestic Macro Economy

Daily Macro Economy News

Latest Global Major Index

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. Foreign media: The U.S. Department of Commerce included 42 Chinese companies in the export control list

2. China Economic Daily Comment: Enhance the sustainability of financial support for the real economy

3. 1089 major projects started construction and mobilization in Anhui, with a total investment of 707.46 billion yuan

4. IPO tightening in the third quarter: In the past month and a half, 12 "food, clothing, and housing" companies terminated their IPOs

International News

1. Former US Treasury Secretary Summers: The Fed's interest rate hike effect is not as good as before, and the risk of a hard landing of the economy has increased

2. Saudi Arabia: If oil prices are high, it intends to take action early next year

3. U.S. consumer credit unexpectedly declined, and non-revolving credit fell by a record

4. U.S. CFTC: Hedge funds' irrational bullish sentiment towards international oil prices has dropped to a new four-week low

Domestic News

1. Foreign media: The U.S. Department of Commerce included 42 Chinese companies in the export control list

According to Reuters, the US Department of Commerce included 42 Chinese companies in the export control list on the 6th local time, and the United States accused these companies of "supporting the Russian defense industry foundation." China has previously made clear its position on the US inclusion of Chinese enterprises in the "Entity List" of export control on the grounds of Russia-related factors and other reasons. It was reported that another seven entities are also on the U.S. export control list, including entities from Finland, Germany, India, Turkey, the United Arab Emirates and the United Kingdom. According to the report, U.S. suppliers are required to obtain permission from the U.S. government when supplying goods to entities on export control lists.

2. China Economic Daily Comment: Enhance the sustainability of financial support for the real economy

The article states that the research found that the implementation of financial support for the development of the real economy and the prevention and resolution of financial risks require sufficient financial support for the real economy, which should be at stable pace, optimal structure and sustainable price. These four elements are organic and indispensable. Next, broad credit will play a more positive role in boosting the momentum of economic recovery. Financial policies will strengthen the coordination with fiscal and industrial policies, forming a policy synergy in promoting consumption, stabilizing investment, and expanding domestic demand, continuously promoting the continuous improvement of economic operation, the continuous enhancement of endogenous power, the continuous improvement of social expectations, and the continuous resolution of risks and hidden dangers. There is reason to believe that with the smooth circulation of China's economy and strong policy support, the driving force of domestic demand is expected to steadily increase, and financial support for the real economy will also be more precise and effective, with achieve both quality and efficiency improving.

3. 1089 major projects started construction and mobilization in Anhui, with a total investment of 707.46 billion yuan

On October 7th, Anhui Province held the mobilization meeting for the commencement of the fourth batch of major projects in the province in 2023. There are 1089 projects in Anhui Province that have been mobilized for centralized construction, with a total investment of 707.46 billion yuan; Among them, there are 31 projects worth over 5 billion yuan, and there has been an increase in new major projects. According to statistics, there are a total of 670 manufacturing projects mobilized in the fourth batch, with a total investment of 415.28 billion yuan and an annual planned investment of 45.75 billion yuan, accounting for 60% of the annual planned investment of the fourth batch of mobilization projects. Among them, there are 22 newly started manufacturing projects with a total investment of over 5 billion yuan, such as the Hefei integrated circuit 12 inch wafer manufacturing project with a total investment of 21 billion yuan, and the Wuhu Tianchen Energy Optical Storage Integrated New Energy Industry Base project with a total investment of 11.6 billion yuan.

4. IPO tightening in the third quarter: In the past month and a half, 12 "food, clothing, and housing" companies terminated their IPOs

According to statistics, a total of 91 new shares were listed in the third quarter of 2023, with a total fundraising amount of 113.9658 billion yuan, a decrease in the number of initial public offerings and total fundraising compared to the second quarter at the last year. In terms of withdrawal, a total of 74 enterprises withdrew in the third quarter. Among them, the withdrawal of IPOs for clothing, food and housing is more prominent. Between August 14th and September 28th, the IPOs of 12 "clothing, food and housing" companies were terminated. Among them, four "clothing, food and housing" companies withdrew their IPO application materials in August, and there are as many as eight "clothing, food and housing" companies withdrew their orders in September.

International News

1. Former US Treasury Secretary Summers: The Fed's interest rate hike effect is not as good as before, and the risk of a hard landing of the economy has increased

Former US Treasury Secretary Summers stated that the surge in the U.S. non-farm employment in September is currently "good news", but also indicates that the Federal Reserve's rate hike has not been as effective as before, exacerbating the risk of a hard landing for the economy. Our economy feels like a 'power rabbit', "Summers said. He refers to the mascot in the advertisement for the ultra durable battery brand "Jinliang". But he said that as employment growth accelerates, the risk of an economic hard landing may "look a bit greater".

2. Saudi Arabia: If oil prices are high, it intends to take action early next year

According to media reports, Saudi Arabia has informed the US White House of its intention to produce oil, stating that Saudi Arabia is willing to increase oil production in order to promote an agreement with Israel (approved by the US Capitol Hill). However, Saudi Arabia's oil production actions will depend on market conditions. If oil prices are on the high side, Saudi Arabia is willing to take actions in early 2024.

3. U.S. consumer credit unexpectedly declined, and non-revolving credit fell by a record

The unexpected decline in consumer borrowing in the United States in August reflects a sharp decline in non-revolving credit. The data released by the Federal Reserve on Friday showed a decrease of $15.6 billion in total credit for the month, with economists predicting a median increase of $11.7 billion. Non-revolving credit such as tuition fees and car purchase loans plummeted by a record $30.3 billion that month. Unadjusted data shows a decrease of nearly $27 billion in federal government loans, including student loans. The balance of revolving credit, including credit cards, increased by $14.7 billion, the largest increase since November last year.

4. U.S. CFTC: Hedge funds' irrational bullish sentiment towards international oil prices has dropped to a new four-week low

The United States Commodity Futures Trading Commission (CFTC): During the week of October 3rd, speculators' net long position in NYMEX WTI crude oil decreased by 7857 contracts to 306662 contracts. The net long position in Brent and WTI crude oil decreased by 32429 contracts to 491503 contracts, setting a new low in the past four weeks. The net long position in NYMEX natural gas increased by 33292 contracts to 86125 contracts, reaching a new high in the past three weeks.

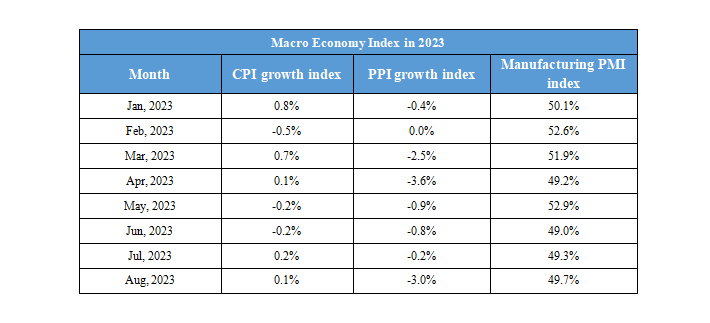

Domestic Macro Economy Index