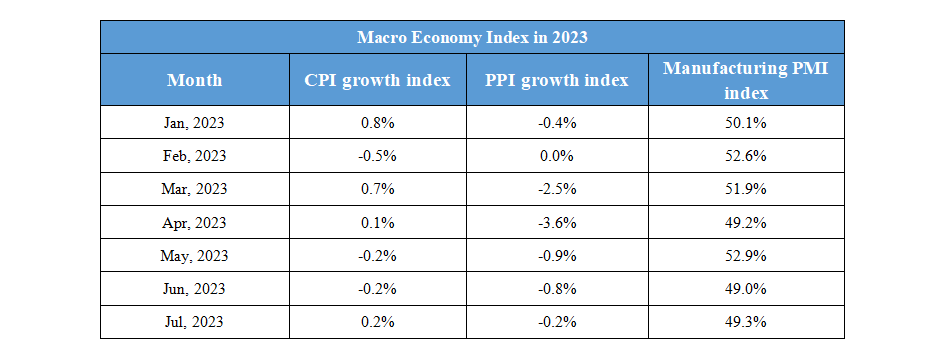

September 19th Macroeconomic Index: Shanghai Port Container Throughput Up 3.6%, Japan's Bond Market Signals End of Negative Interest Rates

Daily Macro Economy News

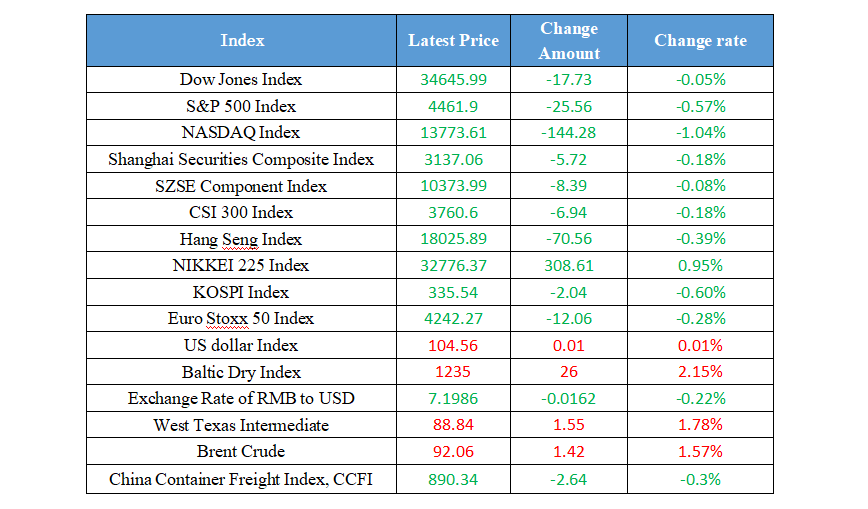

Latest Global Major Index

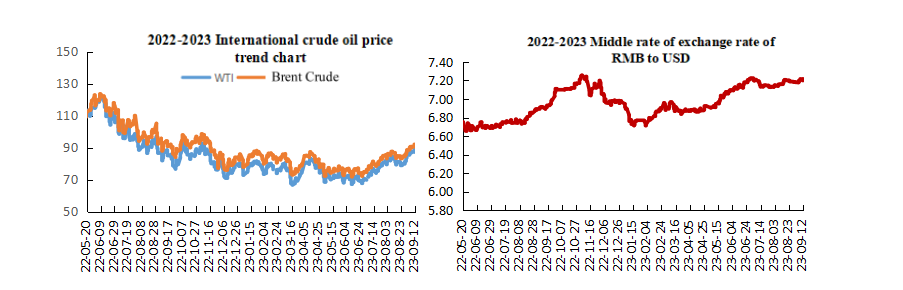

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. In the first 8 months of this year, the container throughput of Shanghai Port was 32.14 million TEUs, an increase of 3.6% year-on-year

2. Ministry of Civil Affairs: From January to June this year, the cumulative expenditure of the country was 126.5 billion yuan for basic living allowances, special hardship cases and temporary relief funds

3. The list of "China's Top 500 Private Enterprises in 2023" was released

4. Notice of the Ministry of Finance on the issuance of the Measures for the Management of Special Funds for the Development of Inclusive Finance

International News

1. Pricing of Japan's short-term bond market makes the Central Bank to end negative interest rate policy

2. Institution: The strike of natural gas workers in Australia is not likely to repeat the previous impact

3. Australian businesses are doing well, but consumer confidence remains sluggish, comparable to that during the recession of the 1990s

4. UK employment data is basically in line with expectations. It is a foregone conclusion for the Bank of England to maintain interest rates unchanged

Domestic News

1. In the first 8 months of this year, the container throughput of Shanghai Port was 32.14 million TEUs, an increase of 3.6% year-on-year

Wang Weiren, Deputy Secretary General of the Shanghai Municipal Government, introduced that the construction of the container terminal and supporting projects in the Xiaoyangshan North Operation Area, the first phase of the container terminal renovation project in the Luojing Port Area, and the construction of the Taicang to Situan section of the Shanghai Nantong Railway have started. The construction of the second phase of the Dalu Line waterway regulation project and the Lingang Collection and Distribution Center (land area) project have been completed. The strategic layout of Shanghai Port is steadily advancing along the coast, rivers, and inland ports. In 2022, the container throughput of Shanghai Port exceeded 47.3 million TEUs, ranking first in the world for 13 consecutive years. According to the LSCI by the United Nations Conference on Trade and Development, Shanghai Port has been ranked first in the world for 12 consecutive years. From January to August this year, Shanghai Port completed a container throughput of 32.14 million TEUs, a year-on-year increase of 3.6%.

2. Ministry of Civil Affairs: From January to June this year, the cumulative expenditure of the country was 126.5 billion yuan for basic living allowances, special hardship cases and temporary relief funds

Liu Xitang, Director of the Social Assistance Department of the Ministry of Civil Affairs, stated at a press conference that since the beginning of this year, the Ministry of Civil Affairs has established and improved a proactive discovery mechanism, focusing on identifying and assisting disadvantaged groups with insufficient application capacity. We will comprehensively carry out the identification of families on the edge of subsistence allowances, and separately include severely ill and disabled individuals from these families into the subsistence allowance. We will strive to achieve the goal of "Putting as much effort as we can to include all people who need basic living allowances and rescue them". Timely adjustments should be made to the assistance and guarantee standards based on the level of economic and social development. By the end of June this year, the minimum living allowance standards for urban and rural areas in China have increased by 4.8% and 8.5% respectively compared to the same period last year. From January to June this year, the cumulative expenditure of the country was 126.5 billion yuan for basic living allowances, special hardship cases and temporary relief funds, which effectively ensured the basic living standards of people in need.

3. The list of "China's Top 500 Private Enterprises in 2023" was released

On September 12th, the All-China Federation of Industry and Commerce released the list of "China's Top 500 Private Enterprises in 2023" and the " Research and Analysis Report on China’s Top 500 Private Enterprises in 2023". According to the research and analysis report, the threshold for the top 500 private enterprises to be shortlisted in 2022 is 27.578 billion yuan, an increase of 1.211 billion yuan compared to the previous year. Among them, there are 95 enterprises with total operating revenue exceeding 100 billion yuan (inclusive) in 2022. It is reported that this is the 25th survey of large-scale private enterprises organized by the All-China Federation of Industry and Commerce, with a total of 8961 enterprises with annual revenue of over 500 million yuan participating.

4. Notice of the Ministry of Finance on the issuance of the Measures for the Management of Special Funds for the Development of Inclusive Finance

The notice proposes that in order to implement the employment priority policy, support the employment and entrepreneurship of key groups, guide financial institutions to increase the investment of entrepreneurial guarantee loans, and allocate special funds to provide certain rewards and subsidies for entrepreneurial guarantee loans supported by government interest subsidies. For eligible entrepreneurial guarantee loans, the finance department will provide a discount of 50% of the actual loan interest rate. Encourage places with conditions to gradually reduce or waive counter-guarantee requirements for entrepreneurial guarantee loans.

International News

1. Pricing of Japan's short-term bond market makes the Central Bank to end negative interest rate policy

The pricing of the Japanese bond market increasingly reflects the prospect of the end of the Central Bank's negative interest rate policy, which has pushed up short-term borrowing costs. According to data compiled by institutions, Japan's overnight index swap trading indicates that the Bank of Japan will end its negative interest rate policy in January next year. Last weekend, the Governor of the BOJ Kazuo Ueda told Yomiuri Shimbun that ending negative interest rates is one of the feasible options if the Central Bank is confident that prices and wages will continue to rise. This statement comes as Japan's core inflation rate has exceeded the Central Bank's target rate of 2% for 16 consecutive months. However, despite the rise in real interest rates in the United States and the eurozone, Japan's real interest rates are still close to historical lows, indicating that the BOJ needs to change its ultra loose policy.

2. Institution: The strike of natural gas workers in Australia is not likely to repeat the previous impact

Although the strike at the Chevron LNG plant in Australia may interfere with natural gas supply, Kyle Rodda, an analyst at Capital.com, said in a report that it is unlikely to cause market shocks similar to those in 2021/22, when the market was hit by epidemics, bad weather and the Russia-Ukraine conflict. He stated that natural gas prices are still below $3, which is still lower compared to the prices during the supply shock period of 2021/22, when natural gas prices were above $9. He believes that the large reserves of natural gas in Europe and other regions have buffered rising prices. However, Rodda stated that the rise in natural gas prices may cause distress for businesses and consumers, especially considering the recent rise in oil prices and the still unsettling level of inflation.

3. Australian businesses are doing well, but consumer confidence remains sluggish, comparable to that during the recession of the 1990s

Faced with rising interest rates and persistently high price pressures, Australian businesses have shown sustained resilience, but consumer confidence has further declined in the "extremely pessimistic" region, highlighting the vastly different reactions of businesses and households to policy tightening. Prior to this, another consumer survey released by Westpac Bank showed that consumer confidence decreased by 1.5% to 79.7 points, indicating that pessimists far exceeded optimists, with a critical value of 100. The index has remained between 78-86 over the past year. The only comparable period of sustained weakness since the start of this survey in 1974 was during the recession of the early 1990s, "said Bill Evans, Chief Economist at Westpac Bank. Although concerns about further interest rate hikes have eased, the persistent pessimism continues, "Evans said, noting that the assessment of household financial conditions has decreased by 4.4% compared to a year ago, which is the lowest level in the current cycle. The sub index of "Family Financial Situation in the Next 12 Months" rose 1.8% but is still in a pessimistic region.

4. UK employment data is basically in line with expectations. It is a foregone conclusion for the Bank of England to maintain interest rates unchanged

German Bunds futures escaped the overall impact of UK employment data, the agency said. UK employment data and pound movements suggest that there is nothing to worry about when gilts open later. It now seems certain that the Bank of England will keep interest rates unchanged. While the average annual rate of wages including dividends in the UK for the three months in seven months was slightly higher than expectation, this was offset by changes in employment (rising unemployment). For the rest of today, the development of G10 bonds will depend on US Treasuries.

Domestic Macro Economy Index