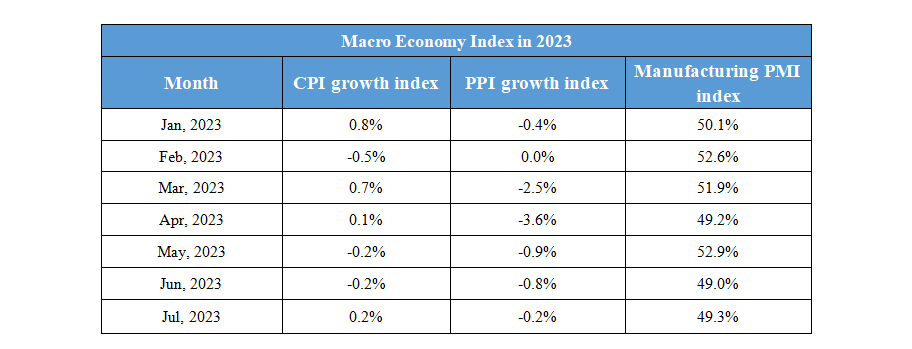

September 19th: Key Developments in Global and Domestic Macro Economy

Daily Macro Economy News

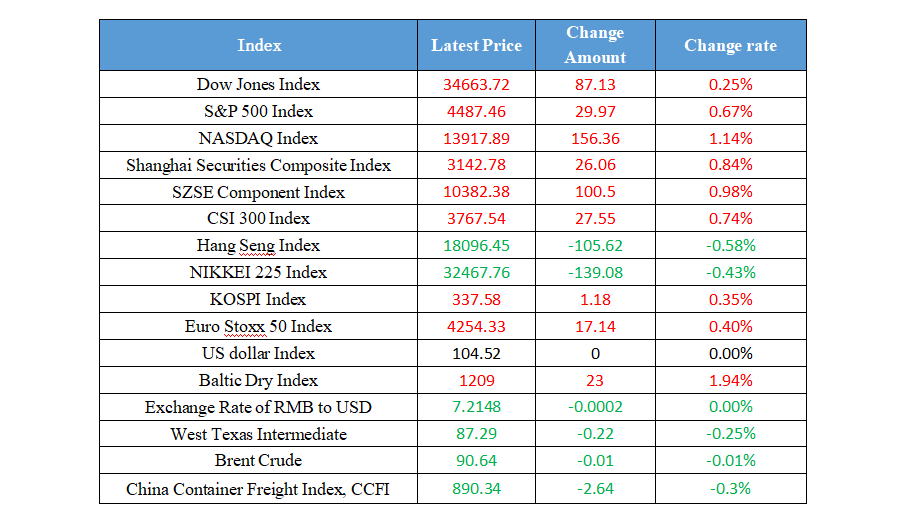

Latest Global Major Index

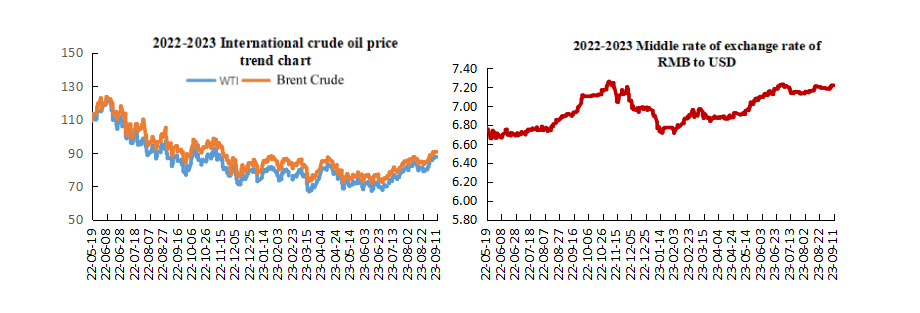

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The offshore RMB recovered the 7.30 mark against the US dollar

2. The People's Bank of China: The balance of RMB loans to the real economy was 230.24 trillion yuan, a year-on-year increase of 10.9%

3. The People's Bank of China: resolutely put an end to speculation, inciting customers and other behaviors that disrupt the order of the foreign exchange market

4. Guangzhou's first home loan broke through the lower limit of LPR, and it became the first first-tier city to break the lower limit

International News

1. Many places around the world have experienced extreme high temperature weather this summer, posing a threat to global fuel supply security

2. The Governor of the Bank of Japan hinted at the possibility of ending negative interest rates, and a potential of yen and Japanese bond yields rising simultaneously

3. CICC: The probability of the Federal Reserve raising interest rates in September is small, but there is still a possibility of another rate hike in the fourth quarter

4. The European Central Bank will lift leverage financing capital charges for certain banks

Domestic News

1. The offshore RMB recovered the 7.30 mark against the US dollar

The offshore yuan recovered the 7.30 mark against the US dollar, rising more than 600 points within the day, and on the news, the People's Bank of China said that the financial management department has the ability, confidence and conditions to keep the RMB exchange rate basically stable.

2. The People's Bank of China: The balance of RMB loans to the real economy was 230.24 trillion yuan, a year-on-year increase of 10.9%

As of the end of August, the balance of RMB loans issued to the real economy was 230.24 trillion yuan, a year-on-year increase of 10.9%; The balance of foreign currency loans issued to the real economy in RMB was 1.82 trillion yuan, a year-on-year decrease of 16.8%; The balance of entrusted loans was 11.33 trillion yuan, a year-on-year increase of 2.4%; The balance of trust loans was 3.77 trillion yuan, a year-on-year decrease of 2.9%; The balance of undiscounted bank acceptance bills was 2.67 trillion yuan, a year-on-year decrease of 8.2%; The balance of corporate bonds was 31.46 trillion yuan, a year-on-year decrease of 0.2%; The balance of government bonds was 65.15 trillion yuan, an increase of 11.5% year-on-year; The domestic stock balance of non-financial enterprises was 11.28 trillion yuan, a year-on-year increase of 10.2%.

3. The People's Bank of China: resolutely put an end to speculation, inciting customers and other behaviors that disrupt the order of the foreign exchange market

The meeting emphasized that the self-discipline mechanism of the foreign exchange market should continue to guide enterprises and financial institutions to establish the concept of "risk neutrality" under the guidance of the financial management department, and strengthen the behavior supervision and self-discipline management of the members of the self-discipline mechanism. Members of the foreign exchange market should consciously maintain market stability, carry out market-making and proprietary trading in an orderly manner, and resolutely put an end to speculation, inciting customers and other behaviors that disrupt the order of the foreign exchange market. Enterprises and residents should adhere to "risk neutrality", do not blindly follow the trend, do not gamble unilaterally, do not gamble on points, and maintain property safety.

4. Guangzhou's first home loan broke through the lower limit of LPR, and it became the first first-tier city to break the lower limit

According to monitoring data from the China Index Academy, from September 1st to 10th, over 30 provinces and cities across the country have optimized their real estate policies. After the implementation of the policy, the national willingness to purchase properties increased by 15 percentage points, but the overall transaction size of the new housing market did not increase significantly, and it will take time for the policy to take effect. From September 4th to 10th, the sales area of key cities in China decreased by more than 20% month on month. Among them, Beijing and Shenzhen saw a slight increase in sales area last week, with new home sales area of 103000 square meters in Beijing last week, a month on month increase of 16.9%, and sales of 860 units, a month on month increase of 17.8%; Last week, the sales area of new houses in Shenzhen was about 38000 square meters, an increase of 3.8% month on month.

International News

1. Many places around the world have experienced extreme high temperature weather this summer, posing a threat to global fuel supply security

U.S. gasoline prices remained high this summer, with diesel prices easily outpacing crude oil prices. According to Macquarie data, the heatwave has led to a decrease of at least 2% in the crude oil processing volume of global refiners over the past two months. Although it seems that the production reduction may not be very large, the shutdown has had an impact on the refining system. This field has already been affected by insufficient investment and the tension in the oil product market caused by the Russia-Ukraine conflict. Ben Luckock, co-head of oil trading at commodity giant Trafigura Group, said, "The extreme weather condition we have seen this year is indeed a major problem. The scorching heat has brought huge problems to refineries in Europe and America, with increased production shutdowns and increased difficulty in solving these problems. Serena Huang, chief Asia analyst at FVortexa Ltd., said that the interruption of refinery supply or shipping business will almost certainly exacerbate market uncertainty and price fluctuations.

2. The Governor of the Bank of Japan hinted at the possibility of ending negative interest rates, and a potential of yen and Japanese bond yields rising simultaneously

As traders reacted to the potential hawkish comments of the Governor of the BOJ Kazuo Ueda on negative interest rate policy, the yen rose against all ten major currencies, while treasury bond fell. Previously, Kazuo Ueda stated that ending negative interest rates is one of the feasible options if the Central Bank is confident that prices and wages will continue to rise. Takeshi Ishida, currency strategist at Risona Bank, stated that they expect the negative interest rate policy to end in the first three months of 2024, and Kazuo Ueda may have started encouraging the market to price in the situation. However, under the circumstances of the US 10-year treasury bond yield exceeded 4%, it was difficult for the United States and Japan to test its downward space just based on speculation about policy adjustments.

3. CICC: The probability of the Federal Reserve raising interest rates in September is small, but there is still a possibility of another rate hike in the fourth quarter

A research report by CICC indicates that the United States will release August inflation data this week. Under the rebound in oil prices, we expect the overall year-on-year growth rate of CPI to increase from 3.2% last month to 3.7%, which will see the second consecutive month of increase, and the core CPI may decrease from 4.7% to 4.1% year-on-year. We previously proposed that, in the second half of the year, inflation in the United States may show a pattern of "core CPI falling+overall CPI bottoming out and rebounding", and currently it is basically moving towards the direction we predicted. For the market, the impact of oil prices cannot be ignored. As an important factor of cost, rising oil prices will have a transmission effect on other product prices, such as the price of food and transportation service. The rise in oil prices will also have an impact on consumer inflation expectations. Considering the current good performance of the US economy, we believe that the probability of a rate hike in September is small, but there is still a possibility of another rate hike in the fourth quarter.

4. The European Central Bank will lift leverage financing capital charges for certain banks

After some banks address the deficiencies in their leveraged financing business, the European Central Bank will lift their capital surcharges. The Chairman of the Supervisory Board of the European Central Bank, Enria, stated that some banks have resolved the issue and capital surcharges will be canceled. Other banks, on the other hand, need to continue to pay fees for a period of time. Enria did not disclose the specific names of the banks involved. Previously, there were reports that the European Central Bank had raised bank capital requirements, including those of BNP Paribas and Deutsche Bank, on the grounds that they had ignored warnings about the risks of reducing leveraged financing risks. In addition, Enria confirmed that the European Central Bank will continue its crackdown. She stated that some banks that have not been required to pay capital surcharges but have not yet resolved the issues discovered last year may face new capital surcharges.

Domestic Macro Economy Index