September 19th, Key Domestic and International Economic Updates

Daily Macro Economy News

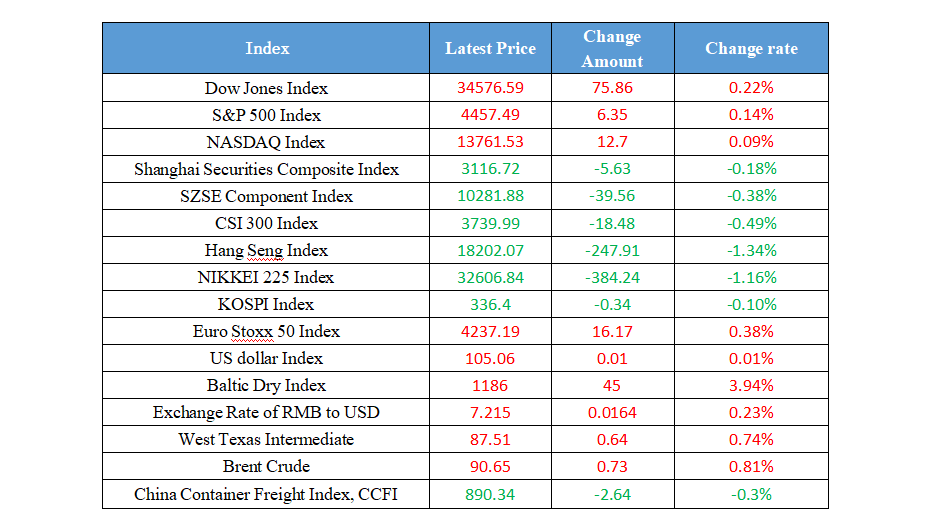

Latest Global Major Index

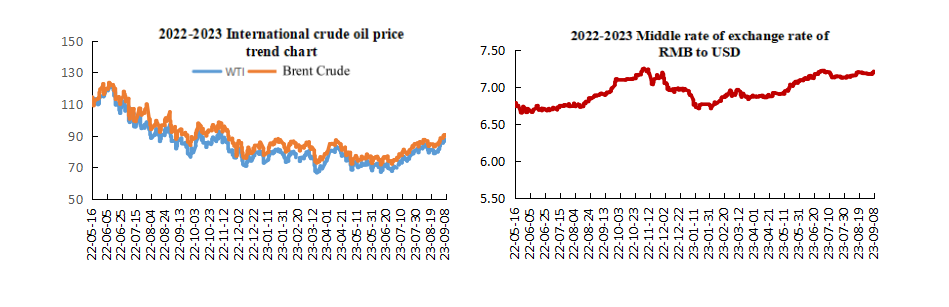

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The State Administration for Market Regulation issued the "Measures for the Promotion of Enterprise Standardization"

2. China successfully launched the Remote Sensing No. 40 satellite

3. The State Administration of Foreign Exchange: As of the end of August 2023, the scale of China's foreign exchange reserves was US$3,160.1 billion

4. Guangzhou's first home loan broke through the lower limit of LPR, and Guangzhou became the first first-tier city to break the limit

International News

1. Barclays: Global economic growth is set to slow down

2. Minister of the Russian Energy Ministry: Russia's liquefied natural gas exports have increased by several percentage points since the beginning of the year

3. Apollo Asset Management: $7.6 trillion of U.S. Treasury bonds will mature in the coming year, intensifying upward pressure on interest rates

4. The United States, India, Saudi Arabia, and the European Union will announce railway and port agreements during the G20 Summit

Domestic News

1. The State Administration for Market Regulation issued the "Measures for the Promotion of Enterprise Standardization"

The State Administration for Market Regulation has recently revised and issued the Measures for the Promotion of Enterprise Standardization, which will be officially implemented from January 1, 2024. The Measures for the Promotion of Enterprise Standardization have adjusted the management mode of enterprise standards, refined self-declaration disclosure and supervision system of enterprise product and service standards, strengthened the status of enterprise entities, and implemented their responsibilities. The focus of government standardization work has shifted from standard management to service enterprise standardization, and the name of the regulations has been adjusted from "Measures for Enterprise Standardization Management" to "Measures for the Promotion of Enterprise Standardization". It clarified for the first time that if the functional indicators and performance indicators items of enterprise standards that are disclosed publicly are less than or lower than the recommended standards, they shall be clearly indicated when the self-declaration is disclosed, further strengthening the disclosure of information on enterprise product and service quality standards, and enhancing market transparency.

2. China successfully launched the Remote Sensing No. 40 satellite

At 12:30 on September 10, 2023, Beijing time, China used the Long March 6 modified carrier rocket at the Taiyuan Satellite Launch Center to successfully launch the Remote Sensing No. 40 satellite, and the satellite successfully entered the predetermined orbit, and the launch mission was a complete success. The satellite is mainly used to carry out electromagnetic environment detection and related technology tests. Its mission was the 487th flight of the Long March series of carrier rockets.

3. The State Administration of Foreign Exchange: As of the end of August 2023, the scale of China's foreign exchange reserves was US$3,160.1 billion

According to statistics from the State Administration of Foreign Exchange, as of the end of August 2023, the scale of China's foreign exchange reserves was US$3,160.1 billion, a decrease of $44.2 billion or 1.38% compared to the end of July. In August 2023, due to factors such as macroeconomic data and monetary policy expectations from major economies, the US dollar index rose and global financial asset prices generally fell. The combined effects of exchange rate translation and changes in asset prices have led to a decrease in the size of foreign exchange reserves for the month. China's economy has maintained a rebound and positive trend, with strong economic resilience, great potential, and abundant vitality. The long-term positive fundamentals have not changed, which is conducive to maintaining basic stability in the scale of foreign exchange reserves.

4. Guangzhou's first home loan broke through the lower limit of LPR, and Guangzhou became the first first-tier city to break the limit

Guangzhou's first home loan broke through the lower limit of LPR, and Guangzhou became the first first-tier city to break the limit. It is reported that the latest policy is that if one has no houses in Guangzhou, and the down payment for the first home is 30%, with an interest rate of LPR-10%, which is 4.1%; if one has one house in Guangzhou that has no need to afford it or has cleared off debts, and the second apartment is subject to a 30% down payment with an interest rate of LPR-10%; if one has one apartment in Guangzhou and afford it, then the down payment would be 40% with an interest rate of LPR+30BP, which is 4.5%. For those with two or more apartments in Guangzhou, loan issuance will be suspended. The new policy will be implemented from September 8th. If the sales contract or real estate sales contract has been signed online before September 8th (excluding September 8th), the original regulations will be followed.

International News

1. Barclays: Global economic growth is set to slow down

Barclays Bank expects global economic growth to slow down as growth momentum in regions such as Europe appears to remain sluggish, while the US economy appears to be slowing down after experiencing an unexpected rebound in consumption. According to Barclays' forecast, the global economic growth rate will be 2.8% and 2.3% in 2023 and 2024 respectively. The acceleration of economic growth in Japan and the strong growth in India and other emerging markets will partially offset the slowdown in growth in the United States (2.1% and 0.5%), the eurozone (0.5% and 0.4%) and other regions.

2. Minister of the Russian Energy Ministry: Russia's liquefied natural gas exports have increased by several percentage points since the beginning of the year

Nikolai Shulginov, the Minister of the Russian Energy Ministry, stated in an interview with Sputnik News Agency at the Eastern Economic Forum that Russian liquefied natural gas exports have increased by several percentage points since the beginning of this year, and Russian LNG continued to be purchased worldwide, including the Europe. According to data from the Russian National Bureau of Statistics, in 2022, Russia's LNG production increased by 8.1% to 32.5 million tons. According to the June forecast, the Russian Energy Ministry predicts that the export volume of LNG in 2023 will increase by 1-2 million tons from the level set in the socio-economic development forecast, reaching approximately 32 million tons.

3. Apollo Asset Management: $7.6 trillion of U.S. Treasury bonds will mature in the coming year, intensifying upward pressure on interest rates

An analysis by Apollo Asset Management shows that nearly one-third of outstanding U.S. government debt will come due within the next 12 months. The share of U.S. public debt maturing in the coming year has risen steadily to pandemic-era levels and now stands at 31%. In dollar terms, the figure is $7.6 trillion, the highest level since the beginning of 2021. Apollo said this would be a source of upward pressure on U.S. interest rates.

4. The United States, India, Saudi Arabia, and the European Union will announce railway and port agreements during the G20 Summit

A White House official said an agreement on transnational rail and ports linking the Middle East and South Asia would be announced on Saturday during the G20 Summit in New Delhi. U.S. Deputy National Security Adviser Jon Finer told reporters that the agreement would benefit low- and middle-income countries in the region, allowing the Middle East to play a key role in global trade. U.S. officials have said the project aims to connect Middle Eastern countries by rail and connect them with India through ports, helping the flow of energy and trade in the Gulf to Europe by shortening transit time, reducing cost and fuel consumption.

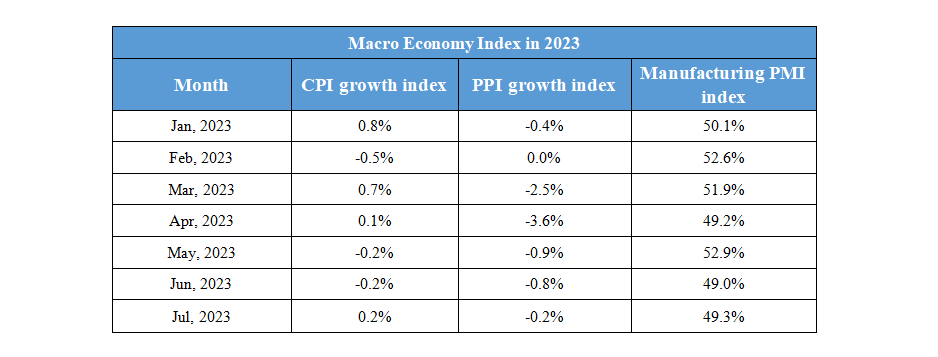

Domestic Macro Economy Index