Daily Macro Economy News on July 25

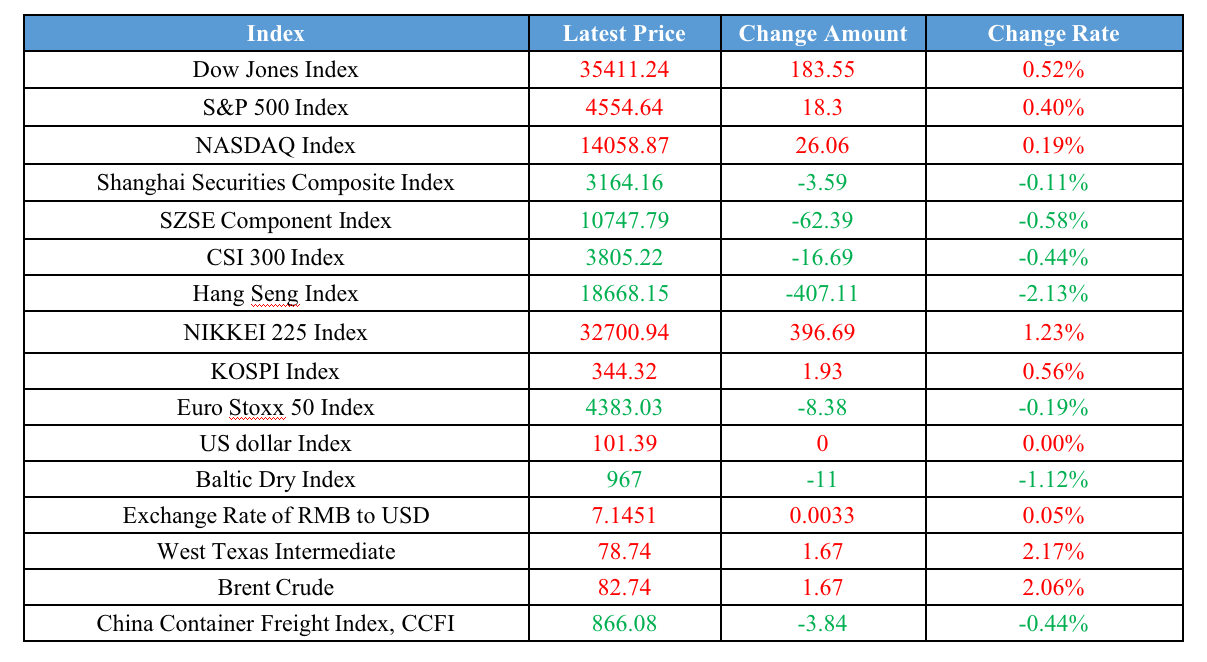

Latest Global Major Index

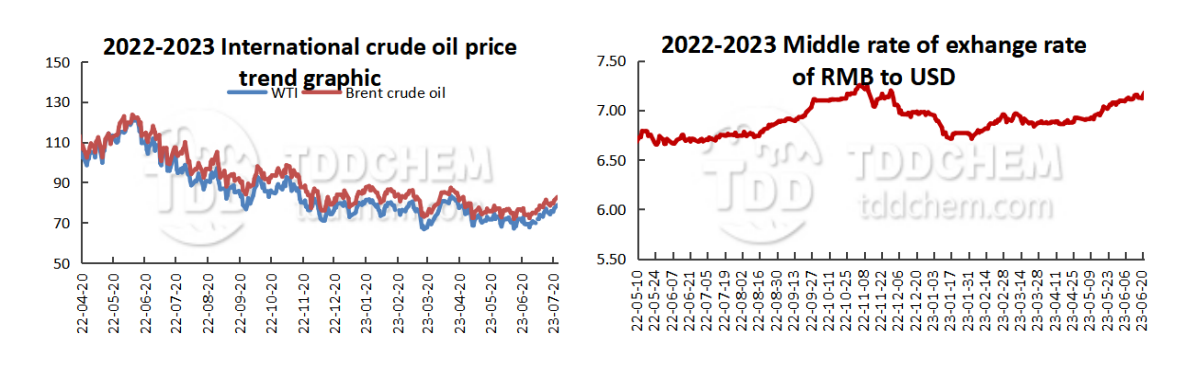

International Crude Price Trend and Exchange Rate of RMB to USD Trend

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

Domestic News

1. China Academy of Social Sciences Institute of Finance report: Macro Leverage Ratio Rises 2.1% in Q2

2. Sinomine Resource Group: the company’s Hifuma copper mine and Kahishi copper mine in Zambia are under development and have produced copper concentrate products

3. Guodian Nanjing Automation Co., Ltd helps State Grid Henan Province to operate the first new generation of autonomous controllable, and highly reliable Substations successfully

4. Industry boom degree repair superimposed on the company's operational improvement "three barrels of oil" performance and ROE ushered in a rise

International News

1. Japan's METI plans to build a new supercomputer to help Japanese companies develop generative AI

2. Agencies comment on UK PMI data: manufacturing slump intensifies but inflationary pressures cool further

3. Warning signs of rapid recession in major Eurozone economies

4. Cyrus de la Rubia, Chief Economist at Commerzbank Hamburg, commented on the German manufacturing PMI for July

Domestic News

1. China Academy of Social Sciences Institute of Finance report: Macro Leverage Ratio Rises 2.1% in Q2

The macro leverage ratio rose by 2.1% in the second quarter of 2023, to 283.9% from 281.8% at the end of the first quarter. By sector, the leverage ratio of the residential sector rose by 0.2%, from 63.3% at the end of the first quarter to 63.5%. The leverage ratio of the non-financial corporate sector rose by 0.8%, from 167.0% at the end of the first quarter to 167.8%, and the leverage ratio of the government sector rose by 1.1%, from 51.5% at the end of the first quarter to 52.6%.

2. Sinomine Resource Group: the company’s Hifuma copper mine and Kahishi copper mine in Zambia are under development and have produced copper concentrate products

Sinomine Resource Group announced at an interactive platform that the Hifuma copper mine and Kahishi copper mine in Zambia, which belongs to themselves, are in development. It has produced copper concentrate products, and is under the business model of providing company's mineral rights, and sharing develop revenues with third-party.

3. Guodian Nanjing Automation Co., Ltd helps State Grid Henan Province to operate the first new generation of autonomous controllable, and highly reliable Substations successfully

Recently, the No.1 main transformer of 220kV Ruya Substation in Shangqiu City, Henan Province was successfully charged and operated, marking the successful commissioning of the first new-generation autonomous controllable and highly reliable substation of State Grid of Henan Province, and Nanjing Guodian Nanzi Automation Co., Ltd, a subsidiary company of Guodian Nanjing Automation Co., Ltd, provides the station with autonomous controllable secondary system and complete set of solutions for the equipment.

4. Industry boom degree repair superimposed on the company's operational improvement "three barrels of oil" performance and ROE ushered in a rise

Everbright Securities released a research report that in 2023, crude oil prices are still running at a high level, the refining industry went back to prosperity, natural gas market reform boost the profitability of upstream gas production end. The "three barrels", which are (CNPC, Sinopec, and CNOOC), actively reduce costs and increase efficiency, boost the performance of anti-volatility. The performance of the "three barrels" is rising steadily, and is expected to reach a new level in the long term. From 2020 to 2022, the oil price is rising year by year, driving the chemical central enterprises ROE to rise. But in the Q1 of 2023, the downward trend of the oil price, along with the strong performance of the “three barrels”, the ROE is also maintained at a high level, the performance of the "three barrels" will effectively drive the long-term improvement of ROE, and investment value are still sufficient in the medium and long term.

International News

1. Japan's METI plans to build a new supercomputer to help Japanese companies develop generative AI

Nikkei News unleashed news on July 24th, the Japan Ministry of Economy Trade and Industry (METI) will import a cutting-edge supercomputer through its affiliated laboratory to support the development of generative AI technology of its own. According to the news, the National Institute of Advanced Industrial Science and Technology (AIST) will develop a supercomputer as early as next year, which will be 2.5 times the computing power of all existing machines. Under the supervision of the METI, the AIST will provide this supercomputer to domestic generative AI development companies through cloud services.

2. Agencies comment on UK PMI data: manufacturing slump intensifies but inflationary pressures cool further

The UK economy came to a near standstill in July and combined with bleak forward-looking indicators, it has reignited fears of a recession. Today's data showed a worrisome intensification of the manufacturing downturn, with rising interest rates and higher living costs appearing to have a greater impact on households, while at the same time, manufacturers are cutting output in response to a severe downturn in orders from both domestic and export markets. Forward-looking indicators, such as order inflows, the level of work in hand, and future business expectations, all point to a further weakening of economic growth in the coming months, increasing the risk of a decline in GDP in the third quarter. One benefit of the deteriorating growth and demand outlook is that inflationary pressures have cooled further. Manufacturing prices are falling at a faster pace, and inflation in services continues to slow. Although continued upward pressure on wages means that price growth in the services sector remains elevated, survey data suggest that consumer price inflation will fall further (and significantly) in the coming months.

3. Warning signs of rapid recession in major Eurozone economies

The private sector economies of Germany and France contracted at the start of the third quarter, with continued weakness in the manufacturing sector exacerbating the spillover effects on the services sector. Dragged down by the manufacturing sector, Germany's composite PMI has been below 50 for more than a year and is now close to the level it was at during the 2020 outbreak, and services growth slowed for the second consecutive month. French manufacturing and services also contracted again. The poor PMI data from the eurozone's two largest economies were a warning for the region as a whole, with the overall eurozone PMI data also showing further contraction in the private sector. Globally, PMI data released earlier showed a contraction in Australia and a steady expansion in Japan. Markets expect the UK and US private sectors are expected to show solid growth in July.

4. Cyrus de la Rubia, Chief Economist at Commerzbank Hamburg, commented on the German manufacturing PMI for July

It was a poor start to the third quarter for the German economy, with the preliminary PMI falling into tight territory. The manufacturing sector continues to lead the downturn, while the slowdown in service sector growth that began last month has continued into July. It is increasingly likely that the economy will fall into recession in the second half of the year. Over the past few months, we have seen an alarming decline in both new orders and backlogs of work, the fastest rate of decline since the initial new crown epidemic in early 2020. This does not bode well for the rest of the year. Manufacturers are reacting to the drop in activity and new orders by starting to lay off workers for the first time since January 2021. This comes at the same time that hiring in the service sector has slowed significantly. Unemployment is on the rise, so what we've seen over the past few months is likely to continue.

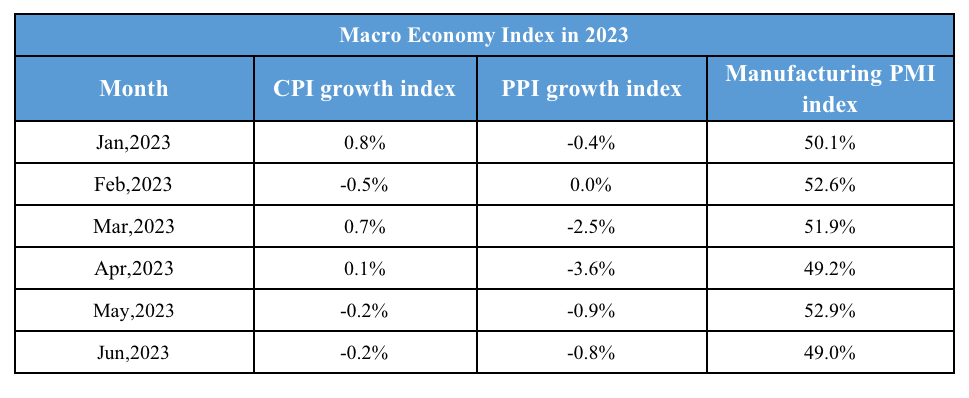

Domestic Macro Economy Index