Daily Macro Economy News on July 12

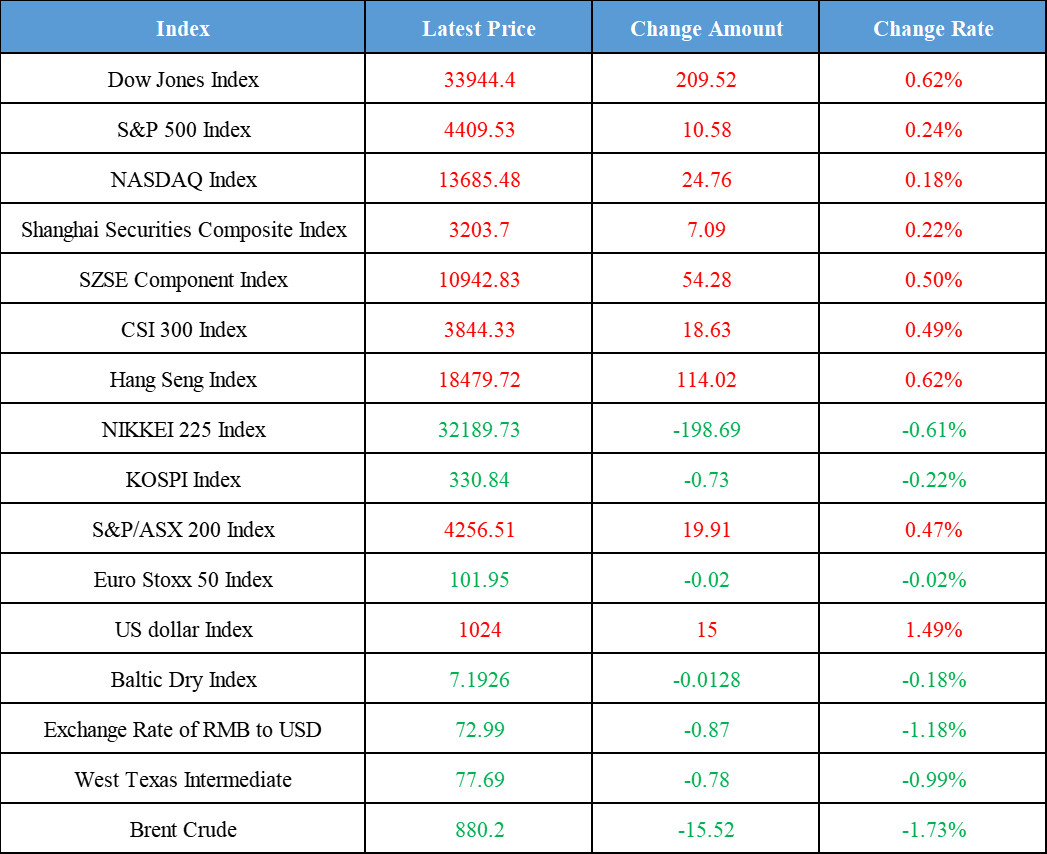

Latest Global Major Index

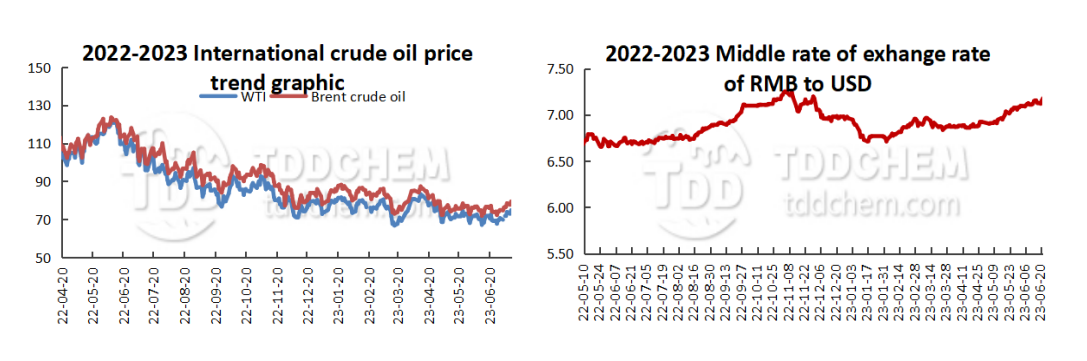

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. SASAC: Supporting central enterprises to collaborate with the upstream, midstream, and downstream enterprises of the global industry chain to jointly develop international standards

2. ACREI issued a notice to openly solicit clues of rare earth violations for a fee

3. Chinese Chemistry: The company's business in Russia has now entered a high-end fields of oil and gas, fine chemicals, petrochemicals, etc

4. HKSAR Government adjusts terms of petrol filling station (PFS) leases to facilitate the transition to electric and new energy vehicles

International News

1. Inflationary pressures on the UK jobs market are expected to ease as health crisis eases

2. The potential oversupply of natural gas in Europe may lead to further price falls

3. UK 2-year mortgage rates hit nearly 15-year high as families face a cost-of-living crisis

4. London Metal Exchange (LME) announced several metal inventory data

Domestic News

1. SASAC: Supporting central enterprises to collaborate with the upstream, midstream, and downstream enterprises of the global industry chain to jointly develop international standards

On July 11th, the State Administration for Market Regulation held a press conference on enterprise standardization construction, which is the policy interpretation conference for the Standard Innovative Enterprise Gradient Cultivation Management Methods (for trial implementation). Wang Xiaoliang, the deputy director of the Technology and Innovation Bureau of the State-owned Assets Supervision and Administration Commission of the State Council (SASAC), said at the conference that, as a next step, SASAC will support the central enterprises to collaborate with the upstream, midstream and downstream enterprises of the global industrial chain to jointly formulate international standards, participate in depth in the activities of the international professional standards organizations, and develop the independent internationalized group standards organizations, so as to further enhance the influence and the right to speak in international standardization.

2. ACREI issued a notice to openly solicit clues of rare earth violations for a fee

On July 11th, the Association of China Rare Earth Industry (ACREI) official account posted a notice to the whole society to openly paid the collection of illegal mining, illegal smelting and separation, illegal processing, smuggling of rare earths and over the total number of planned index production of illegal clues. Once the clues are verified, ACREI will provide certain cash rewards to the clues providers, keep the provider strictly confidential, and at the same time will analyze and summarize the reported information, and report to the relevant departments in time to promote the solution.

3. Chinese Chemistry: The company's business in Russia has now entered a high-end fields of oil and gas, fine chemicals, petrochemicals, etc

Chinese Chemistry said on an investor interactive platform that Russia is extremely rich in oil, gas, and mineral resources, and has become the company's main market overseas. The company's business in Russia started from the fertilizer, soda ash, and other chemical engineering fields, and has now entered the high-end fields of oil and gas, fine chemicals, petrochemicals, and others.

4. HKSAR Government adjusts terms of petrol filling station (PFS) leases to facilitate the transition to electric and new energy vehicles

The HKSAR Government issued a press release stating that the Chief Executive in Council approved on July 11th, the adjustment of the terms of the land leases of petrol filling stations (PFS) to facilitate Hong Kong's transition to the use of electric and new energy vehicles. The major changes to the lease conditions include: providing suitable incentives for existing petrol filling station (PFS) operators to install electric vehicle (EV) charging facilities. Shortening the term of new PFS leases from 21 years to 12 years. providing conditional short-term renewals of expired or soon-to-expire PFS leases if fast charging stations are provided in the PFS, and allowing the government to impose a cap on the charging price of electric commercial vehicles (ECVs).

International News

1. Inflationary pressures on the UK jobs market are expected to ease as health crisis eases

For the first time this year, the number of people who are unable to enter the UK job market due to long-term illness has fallen, further indicating that the UK economy is emerging from an "inactivity crisis". Although National Health Service waiting lists remain at record highs, the Office for National Statistics said on Tuesday that the number of people with long-term illness conditions fell by 30,000 from March to May compared with the peak in April. The data suggest that inflationary pressures from the labor market may ease in the coming months. While wages are still growing faster than the Bank of England’s target, the unemployment rate has risen as more people enter the labor market, suggesting that upward pressure on wages may have peaked. Charlie McCurdy, an economist at a British think tank-Resolution Foundation, said, "A further decline in economic inactivity would be good news as the job market returns to its pre-epidemic state."

2. The potential oversupply of natural gas in Europe may lead to further price falls

The potential oversupply in the European gas market is a key issue as winter approaches, suggesting that prices will fall further. With utilized gas in European storage facilities currently over 79%, which is well above seasonal averages, and with fuel usage slow recovery after last year's sharp cuts, the market is struggling to cope with the oversupply. If Europe meets its gas storage targets by September, as some analysts have suggested, there could be an oversupply of gas in October ahead of winter. Winter natural gas futures contracts have shown more resilience than recent prices, leading to discounted futures prices for colder months. The December contract, often used as an indicator of winter prices, has stabilized above €50, which is about €10 above the five-year average. However, if the oversupply becomes a reality, gas prices are likely to fall further.

3. UK 2-year mortgage rates hit nearly 15-year high as families face a cost-of-living crisis

The average interest rate on a 2-year fixed home loan in the UK rose to 6.66 percent on Tuesday, the highest level since August 2008, while the average 5-year rate rose to 6.17 percent, edging closer to a 14-year high set in October last year. British households are facing huge cost pressures triggered by interest rate rises and the worst cost of living crisis in a generation. Millions of homeowners have seen the value of their homes fall this year, with some analysts predicting double-digit falls in house prices. At the same time, lenders have raised the cost of loans, eliminated deals from the market, and tightened lending standards, making it harder for first-time buyers to enter the real estate market. Nonetheless, a model that correlates house prices with interest rates suggests that the U.K. housing market is still overvalued.

4. London Metal Exchange (LME) announced several metal inventory data

London Metal Exchange (LME): Aluminum stocks decreased by 2,350 tons, copper stocks decreased by 2,350 tons, nickel stocks decreased by 66 tons, lead stocks increased by 1,450 tons, tin stocks increased by 90 tons and zinc stocks decreased by 575 tons.

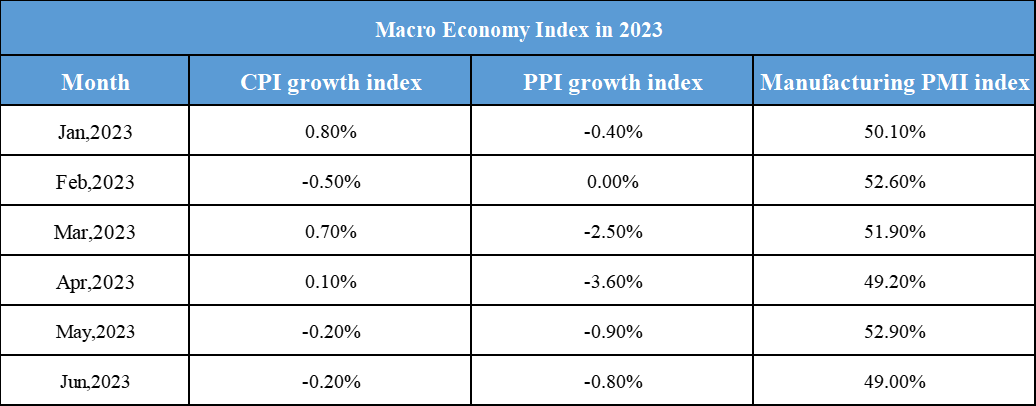

Domestic Macro Economy Index