Daily Macro Economy News on July 7

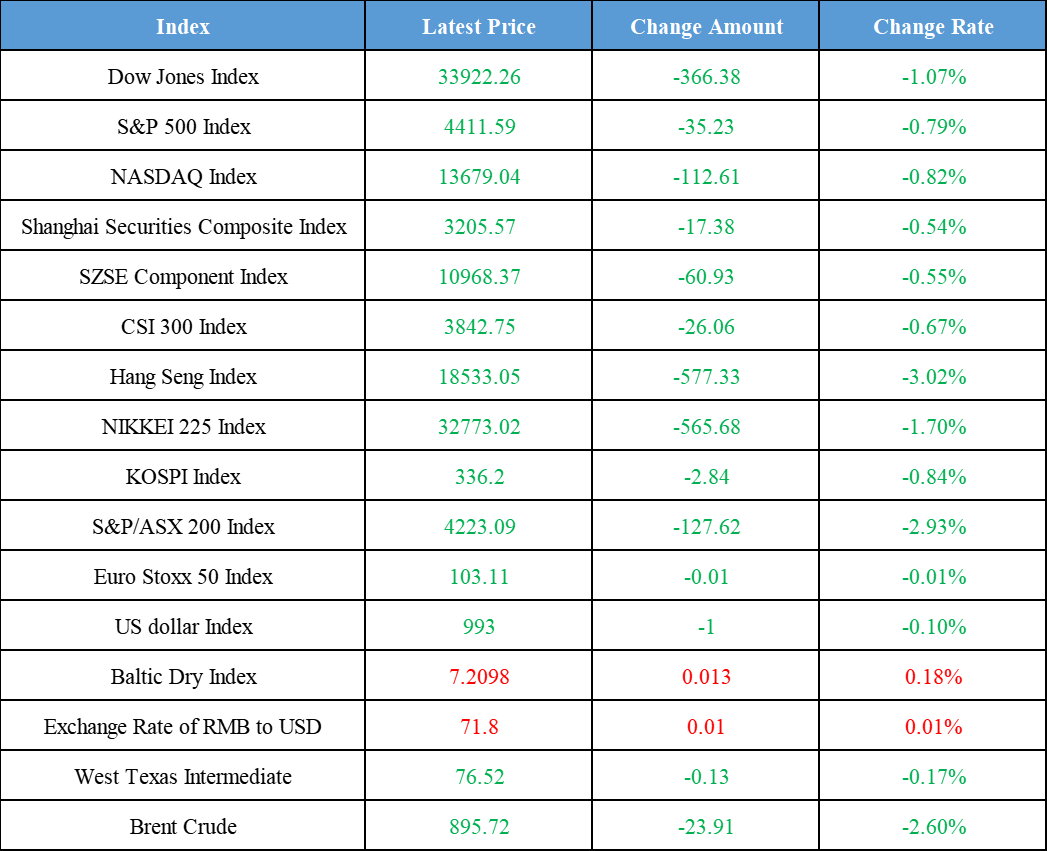

Latest Global Major Index

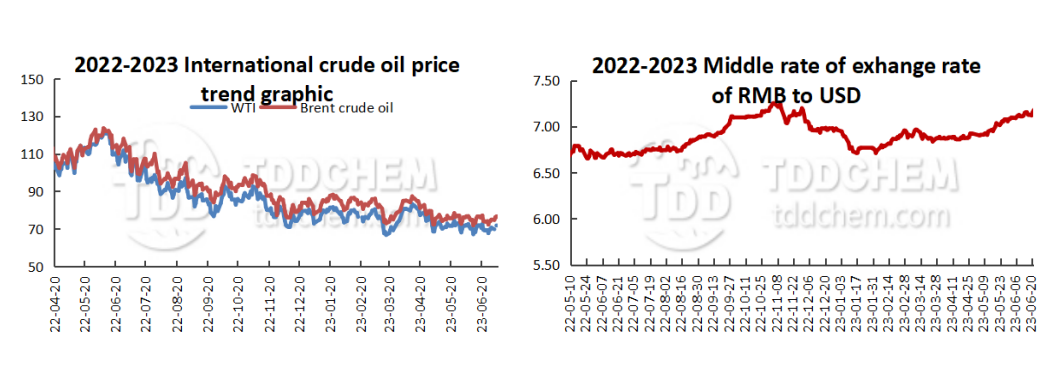

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. MOC: China's service trade in January to May deficit of 409.1 billion yuan

2. Wang Xinbo, the general manager of COSCO Shipping Technology Co., Ltd: Without carbon emission reduction measures, the capacity of large vessels will drop by 73% by 2030

3. China's mobile Internet of Things terminal users more than 2 billion

4. MIIT: Strengthen the support of funds, technology, talent, data, and other elements to promote the development of industrial Internet innovation

International News

1. Eurozone retail sales stagnate in May

2. World Gold Association: Gold performance will tend to be stable if a mild US recession becomes a reality

3. UK firms may raise prices at the slowest pace in 16 months

4. Japan considers buying high-priced gas from Qatar as Fumio Kishida to visit Qatar soon

Domestic News

1. MOC: China's service trade in January to May deficit of 409.1 billion yuan

The Ministry of Commerce (MOC) held a regular press conference today. Press spokeswoman Shu JueTing said at the meeting, from January to May, China's service trade in general remain a positive growth trend. The total import and export of services reached 260.54 billion yuan, an increase of 10.2%. Among them, the exports were 109.82 billion yuan, down 4.7%, and the imports were 150.73 billion yuan, up 24.2%. trade in services deficit 409.1 billion yuan. (Securities Times)

2. Wang Xinbo, the general manager of COSCO Shipping Technology Co., Ltd: Without carbon emission reduction measures, the capacity of large vessels will drop by 73% by 2030

Wang Xinbo, the general manager of COSCO Shipping Technology Co., Ltd, said in the forum of "AI without Boundary - Global Smart Chain" in 2023WAIC: According to the estimation, if there is no technical transformation or management transformation carried out at the current operation level, the capacity of large vessels will drop 73% by 2030 because they do not meet the requirements of carbon emission reduction. For the European routes alone, the carbon tax expenditure of China's vessels may reach 3.817 billion yuan by 2026.

3. China's mobile Internet of Things terminal users more than 2 billion

The reporter learned from the 2023 Global Digital Economy Conference being held in Beijing, as of the end of May this year, China has built a total of 2,844,000 5G base stations, mobile IoT terminal users are more than 2.05 billion, the first in the world's major economies to achieve "things" connection number more than "people" connections, and the cornerstone of digital economy development is increasingly consolidated. (Resource: Xinhua News Agency)

4. MIIT: Strengthen the support of funds, technology, talent, data, and other elements to promote the development of industrial Internet innovation

The relevant person in charge of the Ministry of Industry and Information Technology (MIIT) pointed out that China's industrial Internet is currently moving towards a critical stage of scale development, the MIIT will accelerate the high-quality development of the industrial Internet guidance, strengthen policy linkages, strengthen the support of funds, technology, talent, data, and other elements. Encourage infrastructure enterprises, internet platform enterprises, industrial enterprises, and other types of market players to work together to play a good digital transformation group game. Provide guidance to small and medium-sized enterprises to focus on industrial infrastructure and other niche areas of fine work, and speed up the cultivation of a number of industrial Internet fields of specialized and special new enterprises. (Securities Times)

International News

1. Eurozone retail sales stagnate in May

Eurozone retail sales were flat for the second consecutive month in May, with weaker-than-expected data as high inflation and concerns about a slowdown in the economy against a backdrop of high-interest rates continued to weigh on household spending. Data released showed that sales in the eurozone fell 2.9% year-on-year in May, indicating a continued decline in retail spending. Sales of food, beverages, and tobacco, which are particularly affected by high inflation, fell 0.5% this month, on top of a 0.3% decline in April. In addition, retail sales in the EU countries also vary, with Germany up 0.4%, Spain up 0.2%, France and Poland down 0.7% and 3.7%, respectively.

2. World Gold Association: Gold performance will tend to be stable if a mild US recession becomes a reality

On July 6th, the World Gold Association released its "2023 Gold Market Mid-Year Outlook," saying it expects the range-bound oscillation in bond yields and the weakness of the US dollar will continue to provide a boost to gold prices, following the growth in gold earnings maintained in the first half of the year. Gold investment demand will be stronger if economic conditions deteriorate, although a soft landing or further tightening of monetary policy is likely to make gold less attractive. The World Gold Council says that gold, which performed strongly in the first half of the year, is likely to level off in the second half of the year if the expected mild recession in the US economy becomes a reality. In this case, a weak dollar and stable interest rates would provide a boost to gold, although downward pressure from cooling inflation would put pressure on gold.

3. UK firms may raise prices at the slowest pace in 16 months

British companies are expected to raise prices at the slowest pace in 16 months, suggesting inflationary pressures are easing. A survey by the Bank of England showed that the expected price increase over the next 12 months fell to 4.9% in June from 5.1% in May. This is the lowest growth rate expected since the Russia-Ukraine conflict last February which led to a spike in energy prices. The average for the past three months was 5.3%, also the lowest level since the beginning of last year.

4. Japan considers buying high-priced gas from Qatar as Fumio Kishida to visit Qatar soon

Japanese gas buyers are in talks with Qatar over a new supply contract due to energy security concerns. Several Japanese companies are in the middle of negotiations to buy liquefied natural gas for decades, according to people familiar with the matter. But in the view of the Japanese companies, the current Qatari offer is too high, a key issue that could ultimately lead to a breakdown in negotiations. Japanese LNG importers have not signed contracts with Qatar since 2014 as they struggle to move to more flexible exporters, and Qatar's contracts are among the strictest in the industry, not allowing easy resale or transfer to other countries if the buyer does not need the goods. Japanese Prime Minister Fumio Kishida is scheduled to visit Qatar this month, it would be the first time that the Japanese prime minister has visited the country in 10 years. Japan's LNG partnership with Qatar began to deteriorate two years ago. Japan's largest LNG importer, Jera, did not renew its contract with the country to supply 5.5 million tons a year when it expires in 2021, which represents almost half of the deal between the two countries.

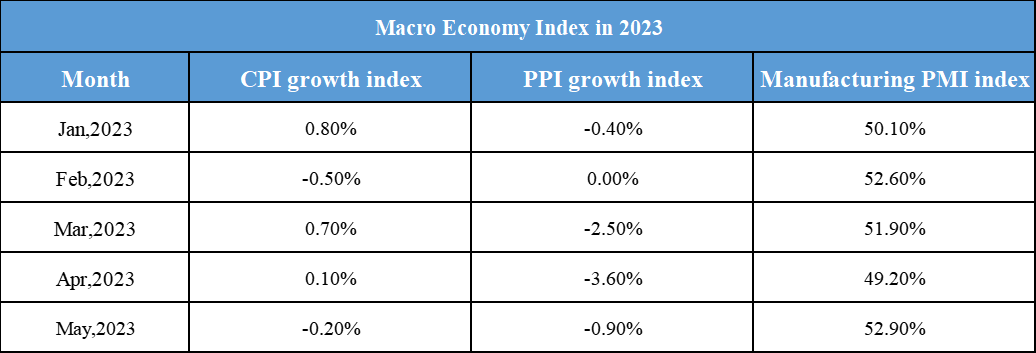

Domestic Macro Economy Index