Daily Macro Economy News on July 6

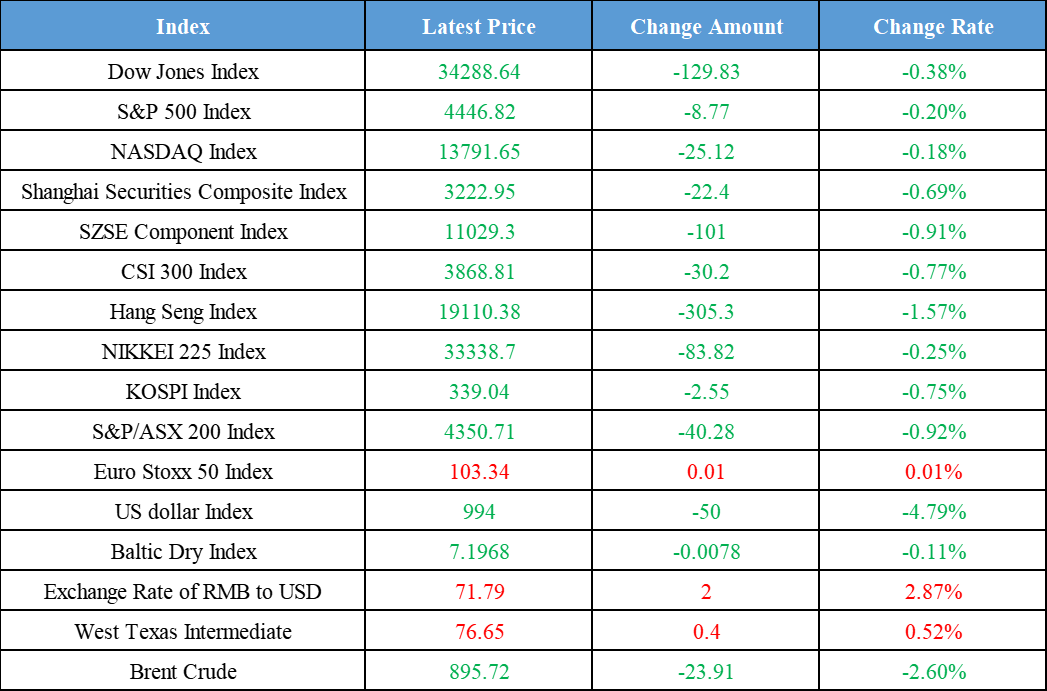

Latest Global Major Index

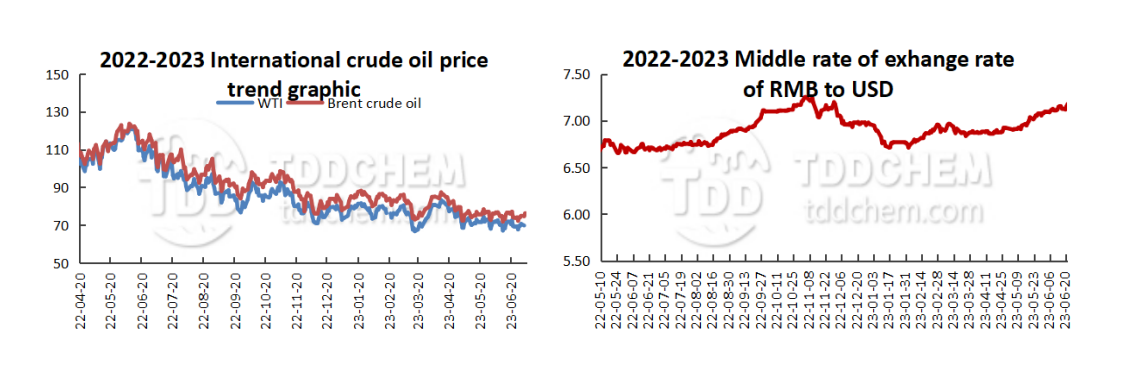

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. CPCA: The preliminary statistics of June passenger car market retail sales reached 1.896 million units, down 2% year-on-year

2. The world's largest offshore oil spill emergency disposal experimental system started construction

3. Multiple factors boosted the RMB exchange rate to rebound continuously, whether the short-term RMB exchange rate turn trend still needs to be confirmed

4. China Silicon Industry: Polysilicon prices stabilized this week

International News

1. SVOLT Energy Technology’s first module factory-- PACK factory, started construction in Thailand

2. ECB Survey: Consumer inflation expectations continue to decline

3. Commerzbank: The euro showed an unusual mean reversion trend against the dollar in the first half of the year

4. Eurozone May PPI data fell faster than expected

Domestic News

1. CPCA: The preliminary statistics of June passenger car market retail sales reached 1.896 million units, down 2% year-on-year

According to the preliminary statistics of the China Passenger Car Association (CPCA), from June 1st to 30th, the passenger car market retailed 1.896 million units, down 2% year-on-year and up 9% YoY. The total retailed 9.528 million units so far this year, up 3% YoY. The national passenger car manufacturers wholesaled 2.230 million units, up 2% YoY and up 11% YoY. The total wholesaled 11.062 million units so far this year, up 9% YoY.

2. The world's largest offshore oil spill emergency disposal experimental system started construction

On July 5th, the Tianjin marine oil spill emergency disposal experimental system of China Waterborne Transport Research Institute (WTI) began construction, and it will be completed by 2025. The experimental system will have 210 meters long, 25 meters wide, with a maximum pool depth of 7 meters comprehensive experimental pool, is currently the world's largest and only full-size oil spill emergency disposal equipment test facilities under four levels of sea conditions, will make up for the lack of professional oil spill. It will fill the scientific research blank of the professional oil spill disposal laboratory in China. (CCTV News)

3. Multiple factors boosted the RMB exchange rate to rebound continuously, whether the short-term RMB exchange rate turn trend still needs to be confirmed

The mid-price of the RMB exchange rate in the interbank foreign exchange market was 7.1968 yuan per US dollar, up 78 basis points in a single day, as announced by the China Foreign Exchange Trade Center. Boosted by multiple positive factors, the RMB mid-rate appreciated for three consecutive trading days. Does the rebound of the RMB exchange rate mean that the trend has turned? In this regard, the analysis believes that the RMB exchange rate will be stable in the second half of the year, and the short-term RMB exchange rate depreciation rate has slowed down but there is no sign of a turning trend. As for the subsequent trend of the RMB, most market participants believe that although the RMB exchange rate is still under pressure, the exchange rate is not expected to get out of control. (Beike Finance)

4. China Silicon Industry: Polysilicon prices stabilized this week

According to data released by the China Silicon Industry, the price range for domestic N-type material this week was 7.2-8.0 million yuan/ton, with an average transaction price of 74,200 yuan/ton, up 0.68% week-on-week. The price range for monocrystalline dense material was 6.00-7.4 million yuan/ton, with an average transaction price of 65,700 yuan/ton, which remains flat week-on-week. The overall silicon market stabilized this week, and N-type silicon material rebounded.

International News

1. SVOLT Energy Technology’s first module factory-- PACK factory, started construction in Thailand

According to SVOLT Energy Technology’s official message, on July 5th Thailand local time, SVOLT Energy Technology held a ceremony in Ratchasima City, Chonburi Province, Thailand to announce the official start of construction of Thailand's Module Pack factory. According to the plan, SVOLT Energy Technology's module PACK factory is a transformation and upgrade of the local leased factory in Thailand, with an expected capacity of 60,000 sets of module packs per year. The factory is expected to complete construction by the end of 2023.

2. ECB Survey: Consumer inflation expectations continue to decline

The results of the ECB's consumer survey show that consumer expectations for eurozone inflation continued to fall in May, continuing the trend of a sharp decline in the previous month. This will give them less pressure on the ECB officials. Consumer expectations for inflation in the eurozone over the next 12 months fell to 3.9% from 4.1% in April. However, inflation expectations for the next three years were maintained at 2.5%, still above the ECB's 2% target. Previous data showed that the overall CPI rise in the euro area slowed, mainly thanks to the decline in energy costs. Meanwhile, the current focus of policymakers is the core inflation rate accelerated again. German central bank president Joachim Nagel said earlier on Wednesday that while the ECB has not reached the end of its tightening path, "it is not yet possible to answer the question of how much further interest rate hikes are needed".

3. Commerzbank: The euro showed an unusual mean reversion trend against the dollar in the first half of the year

Economists at Commerzbank said the euro showed an unusual mean reversion trend against the dollar in the first half of the year. To prevent anyone from taking this as a future trading rule, the economist warned that the performance of the euro against the dollar in the first half of the year does not mean it will follow a similar pattern in the next six months. If (eurozone) inflation eases again, it is no longer so clear how the ECB should act. Should they lower rates or keep them on hold for a while? If they do cut rates, how soon will that happen? The (interest rate) differential between the eurozone and the US could become more persistent and could provide a more durable impetus for the euro against the dollar. At that point, the mean reversion trend would be over.

4. Eurozone May PPI data fell faster than expected

Eurozone PPI recorded a -1.9% monthly and -1.5% annual rate in May, both falling faster than expected. The energy sector led the decline with a 5.0% YoY decline. The PPI data is expected to be unlikely to change expectations that the ECB will raise interest rates by a further 25 bps in July, following a 25 bps hike in June.

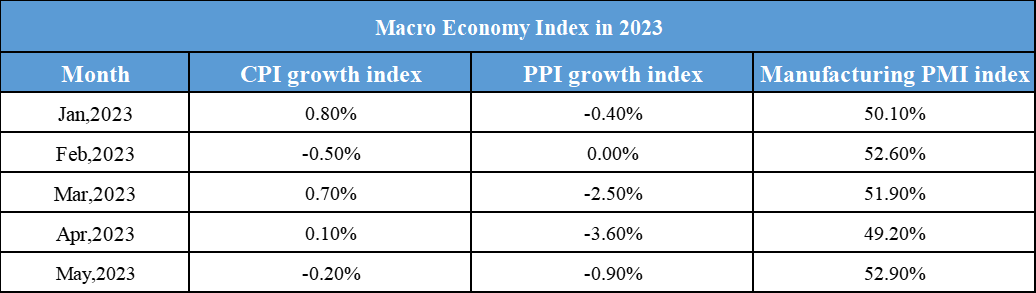

Domestic Macro Economy Index