Daily Macro Economy News on July 5

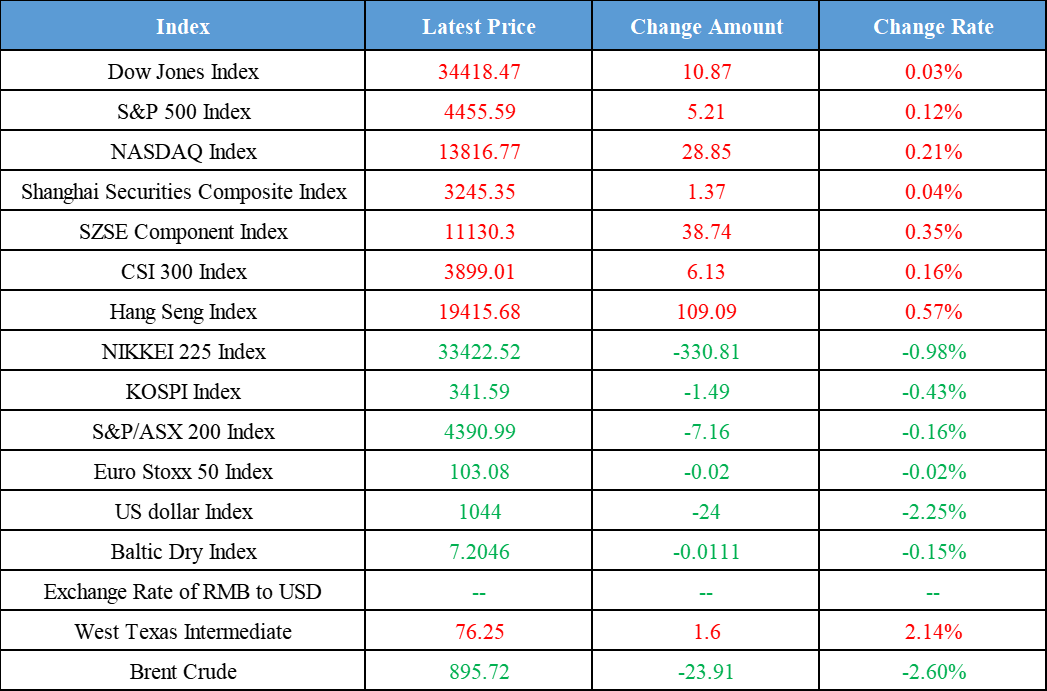

Latest Global Major Index

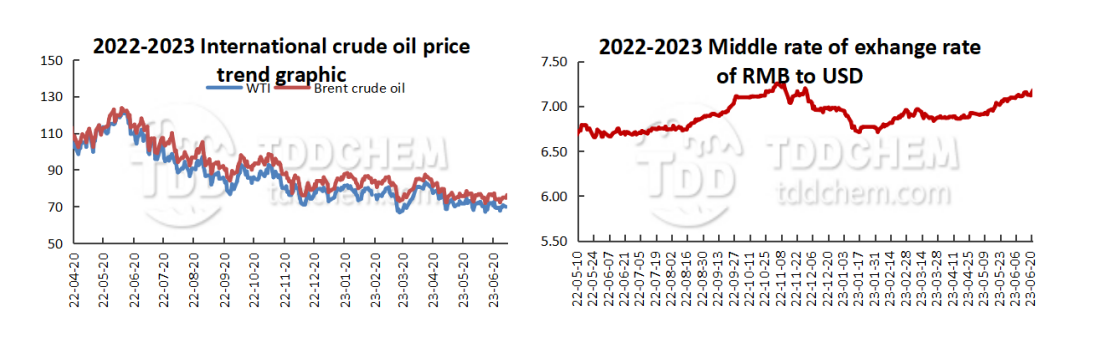

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. The accumulated power generation capacity of Jinsha River Wudongde Hydropower Station exceeds 100 billion kWh

2. Huaneng Hydropower: The first half of the year completed 37.095 billion kWh of power generation, a decrease of 25.44% compared with the same period last year

3. CPCA: The estimated new energy passenger car manufacturers’ wholesale sales in June will reach 740,000 units, with BYD, Tesla, and AION ranked as the first three

4. Sources close to the SAFE: China's bank settlement and bank payments on behalf of foreign customers in June showed a small surplus

International News

1. ING Bank: Germany's export slump will become the new normal

2. Commerzbank: The Australian Fed's "hawkish pause" will limit the Australian dollar's decline

3. European gas prices fall on higher Norwegian supply and renewable energy output

4. Russian media: Putin says more than 80% of Russia-China trade in rubles and yuan

Domestic News

1. The accumulated power generation capacity of Jinsha River Wudongde Hydropower Station exceeds 100 billion kWh

Recently, the accumulated power generation of Wudongde Hydropower Station of Jinsha River, which is a hydropower station ranked seventh in the world and the fourth in China, has exceeded 100 billion kWh. It is equivalent to saving about 30.15 million tons of standard coal and reducing about 82.8 million tons of carbon dioxide, making an important contribution to the realization of China’s carbon peaking and carbon neutrality goals. Wudongde Hydropower Station is located at the junction of Luquan County, Yunnan Province and Huidong County, Sichuan Province, sits by the Canyon reach of Jinsha River, is the major project of "West-East Electricity Transmission Project". The power station has installed a total of 12 hydroelectric generating units with a single capacity of 850,000 kilowatts, with a total installed capacity of 10.2 million kilowatts and a designed multi-year average power generation capacity of 38.91 billion kilowatt hours, and with great benefit to power generation. (Xinhua News Agency)

2. Huaneng Hydropower: The first half of the year completed 37.095 billion kWh of power generation, a decrease of 25.44% compared with the same period last year

Huaneng Hydropower announced that the company completed 37.095 billion kWh of power generation in the first half of 2023, a decrease of 25.44% year-on-year, and 36.809 billion kWh of online power, a decrease of 25.48% year-on-year. The main reasons for the decrease in power generation in the first half of 2023 are as follow: First, due to the lack of water in the 2022 flood season, resulting in a 6.137 billion kWh decrease in the cascade of hydropower storage in early 2023. The second is that the water in the Lancang River basin in the first half of 2023 is about 25 percent drier than the previous year.

3. CPCA: The estimated new energy passenger car manufacturers’ wholesale sales in June will reach 740,000 units, with BYD, Tesla, and AION ranked as the first three

The China Passenger Car Association (CPCA) estimates that the new energy passenger car manufacturers' wholesale sales for June are 740,000, showing a month-on-month increase of 10% and a year-on-year increase of 30%. It is expected that from January to June, the national passenger car manufacturers’ new energy wholesale will reach 3.53 million units, an increase of 44% year-on-year. BYD, Tesla, and AION ranked as the top three in wholesale sales.

4. Sources close to the SAFE: China's bank settlement and bank payments on behalf of foreign customers in June showed a small surplus

The sources close to the State Administration of Foreign Exchange (SAFE) were informed that China's June bank settlement and bank payments on behalf of foreign customers showed a small surplus, and are significantly higher than the level in May, the continuation of the surplus pattern since the second quarter, provide strong support to the foreign exchange market supply and demand to maintain a basic balance.

International News

1. ING Bank: Germany's export slump will become the new normal

Carsten Brzeski, the head of global macroeconomics at the ING Bank, said Germany's exports fell 0.1% in May from a year earlier after the country's exports plunged in March and rebounded slightly in April, a series of data showing that the country's export slump is not an exception, but a new norm. Brzeski said that in the short term, weak export orders, the expected slowdown in the US economy and high inflation will also affect exports. If there is a window, then it will be from Central and Eastern Europe, the two regions account for more than 11% of German exports.

2. Commerzbank: The Australian Fed's "hawkish pause" will limit the Australian dollar's decline

The Australian Federal Reserve suspended interest rate hikes today, the Australian dollar reacted negatively to the decision. Economists at Commerzbank said that although the Australian Federal Reserve suspended interest rate hikes, but it seems to be quite strong in its statement. The central bank said that further tightening of monetary policy may be necessary. However, this will largely depend on future data releases. So all in all, this is a hawkish pause. This could limit the AUD's decline against the USD as the Fed has also paused its rate hike circular and it is far from a fait accompli for the Fed to restart it in July.

3. European gas prices fall on higher Norwegian supply and renewable energy output

Gas prices in the UK and the Netherlands fell in the early trading index on Tuesday as the market expects supply to be boosted by the impending end of repairs to some Norwegian infrastructure and strong renewable energy production to dampen demand for gas for electricity. Renewable energy generation from wind and solar plants in Europe is expected to be higher than normal, analysts said. Also, the fall in gas prices was supported by easing concerns over Norwegian production, which surged 11 million cubic meters per day yesterday. Fundamentally, the outlook for natural gas remains bearish, with high inventories and strong renewable energy production expected to persist. To be sure, the market does not seem to want to start an uptrend.

4. Russian media: Putin says more than 80% of Russia-China trade in rubles and yuan

Russian President Vladimir Putin said on July 4th at the Leadership Summit of the Shanghai Cooperation Organization (SCO) that more than 80 percent of the trade between Russia and China is conducted in rubles and yuan, according to the latest news from Sputnik.

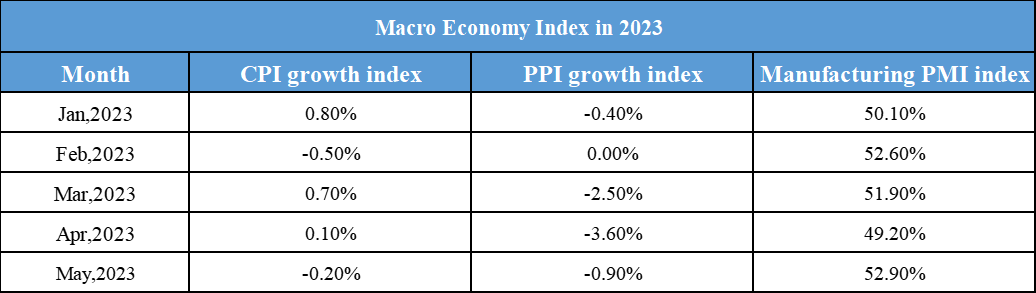

Domestic Macro Economy Index