Daily Macro Economy News on June 29

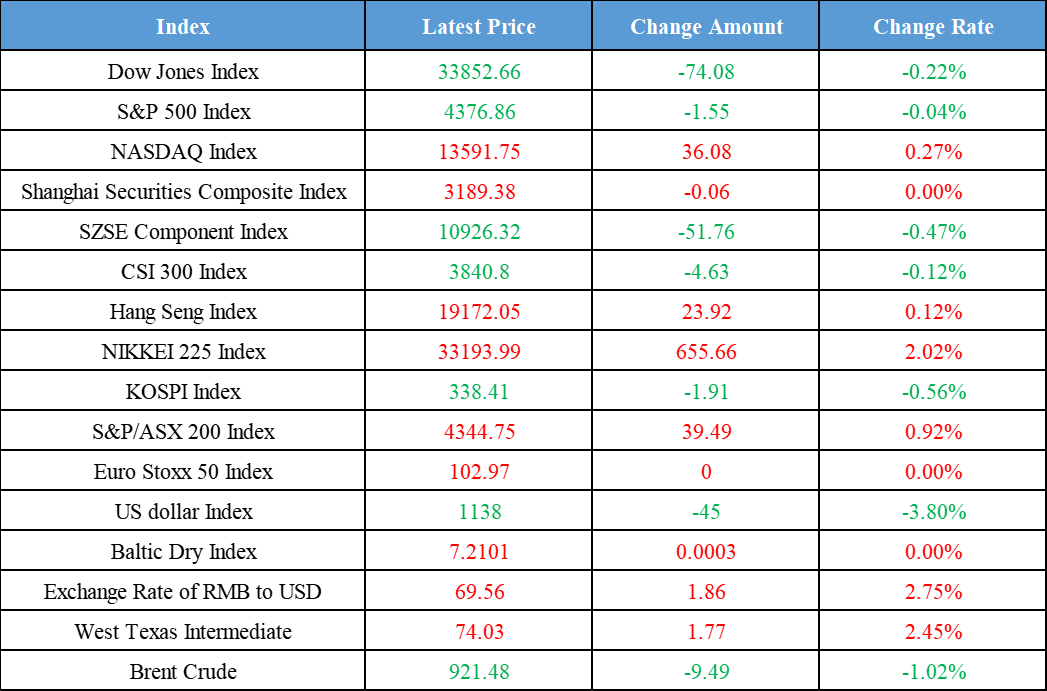

Latest Global Major Index

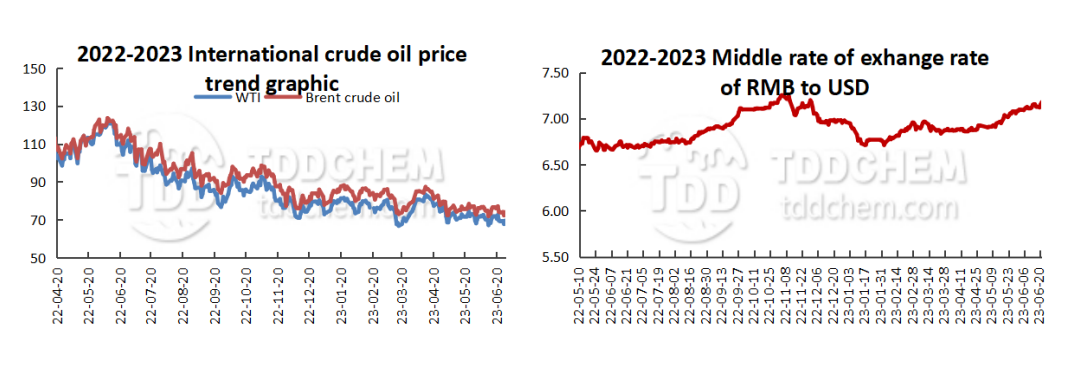

International Crude Price Trend and Exchange Rate of RMB to USD Trend

Domestic News

1. CPCA: June 1st-25th, the passenger car market retailed 1.354 million units, down 1% over the same period last year

2. Beijing: The proportion of renewable energy consumption will reach about 25% by 2030

3. The scale of capital trusts invested in real estate in the first quarter was 1.13 trillion yuan, down 28% year-on-year

4. The world's first 16 MW offshore wind turbine completed lifting in Fujian offshore wind farm

International News

1. Commerzbank: If the inflation data support the ECB's stance, the euro could see a rise

2. Italian Prime Minister Giorgia Meloni criticizes ECB's interest rate hikes

3. Swedbank: Sweden's central bank will raise rates by 25 basis points, accelerating the speed of shrinking balance sheet by half

4. Mitsubishi UFJ Financial Group: US economic data was stronger than expected, which may push the Fed to continue raising interest rates

Domestic News

1. CPCA: June 1st-25th, the passenger car market retailed 1.354 million units, down 1% over the same period last year

According to China Passenger Car Association(CPCA), from June 1st to 25th, the passenger car market retailed 1.354 million units, down 1% from the same period last year and showing a month-on-month increase of 9%. 50 million units of new energy vehicles were retailed from June 1st to 25th, up 13% from the same period last year and up 15% from the same period last month. 2.291 million units have been retailed so far this year, up 35% from the same period last year.

2. Beijing: The proportion of renewable energy consumption will reach about 25% by 2030

Beijing issued a notice of renewable energy alternative action program (2023-2025), which mentioned that by 2030, the proportion of the renewable energy consumption will reach about 25%. It has achieved significant results in renewable energy development and urban planning and construction of a high degree of integration and renewable energy alternative action. Power supply has accelerated decarbonization, new energy system construction has been vigorously promoted, the characteristic renewable energy high-quality development pattern that is suitable for Beijing city has basically formed.

3. The scale of capital trusts invested in real estate in the first quarter was 1.13 trillion yuan, down 28% year-on-year

The traditional trust business was challenged, and the scale and proportion of investment in industrial and commercial enterprises, basic industries, and real estate declined further. As of the end of the first quarter, the size of capital trusts invested in industrial and commercial enterprises was 3.9 trillion yuan, down 0.09 trillion yuan, a decrease of 2.22%, and a month-on-month decrease of 0.28%. Meanwhile, the size of capital trusts invested in basic industries was 1.56 trillion yuan, down 0.08 trillion yuan, a decrease of 5.03%, and a month-on-month decrease of 1.97%. In addition, the size of capital trusts invested in real estate was 1.13 trillion yuan, down 0.44 trillion yuan, a decrease of 28.21%, and a month-on-month decrease of 7.88%.

4. The world's first 16 MW offshore wind turbine completed lifting in Fujian offshore wind farm

According to China Three Gorges Group, on June 28th, the world's first 16 MW offshore wind turbine was successfully lifted and installed at Three Gorges Group's Fujian offshore wind farm, and will soon be put into commercial operation. This marks an important breakthrough in China's offshore wind power in terms of high-end equipment manufacturing capability and deep offshore wind power construction capability, reaching an international leading level. According to the introduction, this installation of the world's first mega-capacity 16 MW offshore wind turbine will become the world's largest offshore wind turbine that has been put into operation after the construction and operation.

International News

1. Commerzbank: If the inflation data support the ECB's stance, the euro could see a rise

Commerzbank said that if the upcoming euro zone inflation data support the restrictive policy of the European Central Bank, the euro may rise. Commerzbank foreign exchange analyst Antje Praefcke said in a report that if the data scheduled for release on Friday exceeds expectations, the euro has the potential to rise further. The high inflation rate means the ECB may take more measures as the market believes in the ECB's determination in fighting inflation. Commerzbank expects the euro to be around 1.10 against the dollar by the end of this quarter.

2. Italian Prime Minister Giorgia Meloni criticizes ECB's interest rate hikes

Italian Prime Minister Giorgia Meloni on Wednesday criticized the European Central Bank's (ECB) repeated interest rate hikes, saying they are "too simplistic" and do more harm than good. The ECB raised interest rates this month to the highest level in 2022 and said it will almost certainly raise rates for the ninth consecutive time in July because it expects inflation to remain above its 2 percent target by the end of 2025. Meloni said decisively fighting inflation is the right thing to do, but to the public, the ECB's simple approach of raising rates does not seem to be the right path.

3. Swedbank: Sweden's central bank will raise rates by 25 basis points, accelerating the speed of shrinking balance sheet by half

The Riksbank will announce its monetary policy decision on Thursday. The analysts at Swedbank expect that the bank to raise its policy rate by 25 basis points to 3.75 percent and hint at another rate hike this fall. Swedbank also expects the Riksbank will increase the rate of Treasury bond sales by 50 percent, from SEK 3.5 billion to SEK 5.25 billion per month. "However, with an economy of high inflation, a resilient economic performance and a weak krona, mean that the risks favor a greater degree of tightening." The potential inflation rate remains high, the weak Swedish krona could add to the (tightening) burden in the short term and the Riksbank could lag behind other central banks that continue to raise rates before the next policy meeting in September, the Swedbank said.

4. Mitsubishi UFJ Financial Group: US economic data was stronger than expected, which may push the Fed to continue raising interest rates

The US dollar index DXY rose slightly, extending yesterday's uptrend. Following the release of the stronger-than-expected US economic data, including durable goods orders, new resident sales and the US Conference Board consumer confidence index. Lee Hardman, the senior foreign exchange analyst at Mitsubishi UFJ Financial Group, said the data showed resilience and should allow the Fed to continue raising interest rates in the near term amid the negative impact of rising interest rates and a tightening credit environment. The unexpected strength of these data shows the strongest resilience since early April, making the Fed implement at least one of the two additional rate hikes in July," he said.

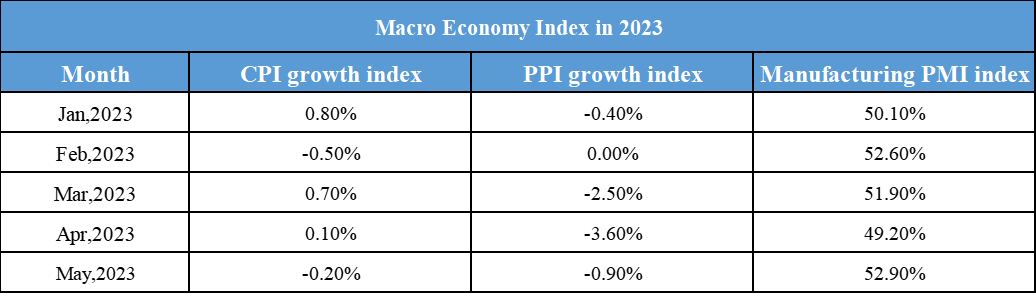

Domestic Macro Economy Index